homoscedasticity on:

[Wikipedia]

[Google]

[Amazon]

In

In

Residuals can be tested for homoscedasticity using the Breusch–Pagan test, which performs an auxiliary regression of the squared residuals on the independent variables. From this auxiliary regression, the explained sum of squares is retained, divided by two, and then becomes the test statistic for a chi-squared distribution with the degrees of freedom equal to the number of independent variables. The null hypothesis of this chi-squared test is homoscedasticity, and the alternative hypothesis would indicate heteroscedasticity. Since the Breusch–Pagan test is sensitive to departures from normality or small sample sizes, the Koenker–Bassett or 'generalized Breusch–Pagan' test is commonly used instead. From the auxiliary regression, it retains the R-squared value which is then multiplied by the sample size, and then becomes the test statistic for a chi-squared distribution (and uses the same degrees of freedom). Although it is not necessary for the Koenker–Bassett test, the Breusch–Pagan test requires that the squared residuals also be divided by the residual sum of squares divided by the sample size. Testing for groupwise heteroscedasticity can be done with the Goldfeld–Quandt test.

Due to the standard use of

Residuals can be tested for homoscedasticity using the Breusch–Pagan test, which performs an auxiliary regression of the squared residuals on the independent variables. From this auxiliary regression, the explained sum of squares is retained, divided by two, and then becomes the test statistic for a chi-squared distribution with the degrees of freedom equal to the number of independent variables. The null hypothesis of this chi-squared test is homoscedasticity, and the alternative hypothesis would indicate heteroscedasticity. Since the Breusch–Pagan test is sensitive to departures from normality or small sample sizes, the Koenker–Bassett or 'generalized Breusch–Pagan' test is commonly used instead. From the auxiliary regression, it retains the R-squared value which is then multiplied by the sample size, and then becomes the test statistic for a chi-squared distribution (and uses the same degrees of freedom). Although it is not necessary for the Koenker–Bassett test, the Breusch–Pagan test requires that the squared residuals also be divided by the residual sum of squares divided by the sample size. Testing for groupwise heteroscedasticity can be done with the Goldfeld–Quandt test.

Due to the standard use of

In

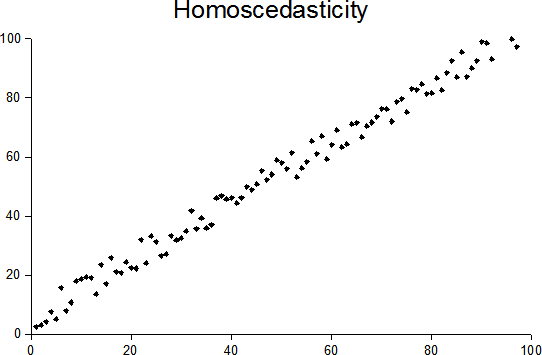

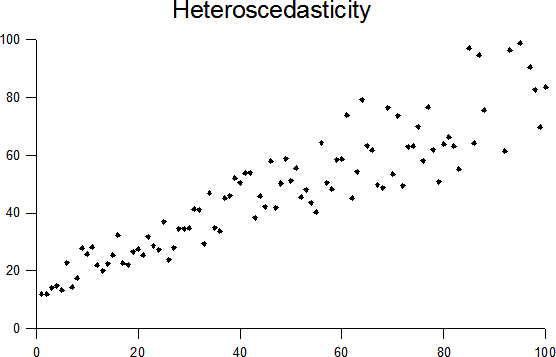

In statistics

Statistics (from German language, German: ', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a s ...

, a sequence

In mathematics, a sequence is an enumerated collection of objects in which repetitions are allowed and order matters. Like a set, it contains members (also called ''elements'', or ''terms''). The number of elements (possibly infinite) is cal ...

of random variable

A random variable (also called random quantity, aleatory variable, or stochastic variable) is a Mathematics, mathematical formalization of a quantity or object which depends on randomness, random events. The term 'random variable' in its mathema ...

s is homoscedastic () if all its random variables have the same finite variance

In probability theory and statistics, variance is the expected value of the squared deviation from the mean of a random variable. The standard deviation (SD) is obtained as the square root of the variance. Variance is a measure of dispersion ...

; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings ''homoskedasticity'' and ''heteroskedasticity'' are also frequently used. “Skedasticity” comes from the Ancient Greek word “skedánnymi”, meaning “to scatter”.

Assuming a variable is homoscedastic when in reality it is heteroscedastic () results in unbiased

Bias is a disproportionate weight ''in favor of'' or ''against'' an idea or thing, usually in a way that is inaccurate, closed-minded, prejudicial, or unfair. Biases can be innate or learned. People may develop biases for or against an individ ...

but inefficient point estimates and in biased estimates of standard error

The standard error (SE) of a statistic (usually an estimator of a parameter, like the average or mean) is the standard deviation of its sampling distribution or an estimate of that standard deviation. In other words, it is the standard deviati ...

s, and may result in overestimating the goodness of fit

The goodness of fit of a statistical model describes how well it fits a set of observations. Measures of goodness of fit typically summarize the discrepancy between observed values and the values expected under the model in question. Such measur ...

as measured by the Pearson coefficient.

The existence of heteroscedasticity is a major concern in regression analysis and the analysis of variance

Analysis of variance (ANOVA) is a family of statistical methods used to compare the Mean, means of two or more groups by analyzing variance. Specifically, ANOVA compares the amount of variation ''between'' the group means to the amount of variati ...

, as it invalidates statistical tests of significance that assume that the modelling errors all have the same variance. While the ordinary least squares

In statistics, ordinary least squares (OLS) is a type of linear least squares method for choosing the unknown parameters in a linear regression

In statistics, linear regression is a statistical model, model that estimates the relationship ...

estimator is still unbiased in the presence of heteroscedasticity, it is inefficient and inference based on the assumption of homoskedasticity is misleading. In that case, generalized least squares

In statistics, generalized least squares (GLS) is a method used to estimate the unknown parameters in a Linear regression, linear regression model. It is used when there is a non-zero amount of correlation between the Residual (statistics), resi ...

(GLS) was frequently used in the past. Nowadays, standard practice in econometrics is to include Heteroskedasticity-consistent standard errors

The topic of heteroskedasticity-consistent (HC) standard errors arises in statistics and econometrics in the context of linear regression and time series analysis. These are also known as heteroskedasticity-robust standard errors (or simply robust ...

instead of using GLS, as GLS can exhibit strong bias in small samples if the actual skedastic function is unknown.

Because heteroscedasticity concerns expectations of the second moment of the errors, its presence is referred to as misspecification of the second order.

The econometrician

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8� ...

Robert Engle

Robert Fry Engle III (born November 10, 1942) is an American economist and statistician. He won the 2003 Nobel Memorial Prize in Economic Sciences, sharing the award with Clive Granger, "for methods of analyzing economic time series with time-va ...

was awarded the 2003 Nobel Memorial Prize for Economics

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences adminis ...

for his studies on regression analysis in the presence of heteroscedasticity, which led to his formulation of the autoregressive conditional heteroscedasticity

In econometrics, the autoregressive conditional heteroskedasticity (ARCH) model is a statistical model for time series data that describes the variance of the current error term or innovation as a function of the actual sizes of the previous tim ...

(ARCH) modeling technique.

Definition

Consider thelinear regression

In statistics, linear regression is a statistical model, model that estimates the relationship between a Scalar (mathematics), scalar response (dependent variable) and one or more explanatory variables (regressor or independent variable). A mode ...

equation where the dependent random variable equals the deterministic variable times coefficient plus a random disturbance term that has mean zero. The disturbances are homoscedastic if the variance of is a constant ; otherwise, they are heteroscedastic. In particular, the disturbances are heteroscedastic if the variance of depends on or on the value of . One way they might be heteroscedastic is if (an example of a scedastic function

In probability theory and statistics, a conditional variance is the variance of a random variable given the value(s) of one or more other variables.

Particularly in econometrics, the conditional variance is also known as the scedastic function or s ...

), so the variance is proportional to the value of .

More generally, if the variance-covariance matrix of disturbance across has a nonconstant diagonal, the disturbance is heteroscedastic. The matrices below are covariances when there are just three observations across time. The disturbance in matrix A is homoscedastic; this is the simple case where OLS is the best linear unbiased estimator. The disturbances in matrices B and C are heteroscedastic. In matrix B, the variance is time-varying, increasing steadily across time; in matrix C, the variance depends on the value of . The disturbance in matrix D is homoscedastic because the diagonal variances are constant, even though the off-diagonal covariances are non-zero and ordinary least squares is inefficient for a different reason: serial correlation.

:

Examples

Heteroscedasticity often occurs when there is a large difference among the sizes of the observations. A classic example of heteroscedasticity is that of income versus expenditure on meals. A wealthy person may eat inexpensive food sometimes and expensive food at other times. A poor person will almost always eat inexpensive food. Therefore, people with higher incomes exhibit greater variability in expenditures on food. At a rocket launch, an observer measures the distance traveled by the rocket once per second. In the first couple of seconds, the measurements may be accurate to the nearest centimeter. After five minutes, the accuracy of the measurements may be good only to 100 m, because of the increased distance, atmospheric distortion, and a variety of other factors. So the measurements of distance may exhibit heteroscedasticity.Consequences

One of the assumptions of the classical linear regression model is that there is no heteroscedasticity. Breaking this assumption means that theGauss–Markov theorem

In statistics, the Gauss–Markov theorem (or simply Gauss theorem for some authors) states that the ordinary least squares (OLS) estimator has the lowest sampling variance within the class of linear unbiased estimators, if the errors in ...

does not apply, meaning that OLS estimators are not the Best Linear Unbiased Estimators (BLUE) and their variance is not the lowest of all other unbiased estimators.

Heteroscedasticity does ''not'' cause ordinary least squares coefficient estimates to be biased, although it can cause ordinary least squares estimates of the variance (and, thus, standard errors) of the coefficients to be biased, possibly above or below the true of population variance. Thus, regression analysis using heteroscedastic data will still provide an unbiased estimate for the relationship between the predictor variable and the outcome, but standard errors and therefore inferences obtained from data analysis are suspect. Biased standard errors lead to biased inference, so results of hypothesis tests are possibly wrong. For example, if OLS is performed on a heteroscedastic data set, yielding biased standard error estimation, a researcher might fail to reject a null hypothesis at a given significance level, when that null hypothesis was actually uncharacteristic of the actual population (making a type II error

Type I error, or a false positive, is the erroneous rejection of a true null hypothesis in statistical hypothesis testing. A type II error, or a false negative, is the erroneous failure in bringing about appropriate rejection of a false null hy ...

).

Under certain assumptions, the OLS estimator has a normal asymptotic distribution when properly normalized and centered (even when the data does not come from a normal distribution

In probability theory and statistics, a normal distribution or Gaussian distribution is a type of continuous probability distribution for a real-valued random variable. The general form of its probability density function is

f(x) = \frac ...

). This result is used to justify using a normal distribution, or a chi square distribution (depending on how the test statistic

Test statistic is a quantity derived from the sample for statistical hypothesis testing.Berger, R. L.; Casella, G. (2001). ''Statistical Inference'', Duxbury Press, Second Edition (p.374) A hypothesis test is typically specified in terms of a tes ...

is calculated), when conducting a hypothesis test. This holds even under heteroscedasticity. More precisely, the OLS estimator in the presence of heteroscedasticity is asymptotically normal, when properly normalized and centered, with a variance-covariance matrix

Matrix (: matrices or matrixes) or MATRIX may refer to:

Science and mathematics

* Matrix (mathematics), a rectangular array of numbers, symbols or expressions

* Matrix (logic), part of a formula in prenex normal form

* Matrix (biology), the m ...

that differs from the case of homoscedasticity. In 1980, White proposed a consistent estimator

In statistics, a consistent estimator or asymptotically consistent estimator is an estimator—a rule for computing estimates of a parameter ''θ''0—having the property that as the number of data points used increases indefinitely, the result ...

for the variance-covariance matrix of the asymptotic distribution of the OLS estimator. This validates the use of hypothesis testing using OLS estimators and White's variance-covariance estimator under heteroscedasticity.

Heteroscedasticity is also a major practical issue encountered in ANOVA

Analysis of variance (ANOVA) is a family of statistical methods used to compare the means of two or more groups by analyzing variance. Specifically, ANOVA compares the amount of variation ''between'' the group means to the amount of variation ''w ...

problems.

The F test can still be used in some circumstances.

However, it has been said that students in econometrics

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8 ...

should not overreact to heteroscedasticity. One author wrote, "unequal error variance is worth correcting only when the problem is severe." In addition, another word of caution was in the form, "heteroscedasticity has never been a reason to throw out an otherwise good model." With the advent of heteroscedasticity-consistent standard errors allowing for inference without specifying the conditional second moment of error term, testing conditional homoscedasticity is not as important as in the past.

For any non-linear model (for instance Logit

In statistics, the logit ( ) function is the quantile function associated with the standard logistic distribution. It has many uses in data analysis and machine learning, especially in Data transformation (statistics), data transformations.

Ma ...

and Probit

In probability theory and statistics, the probit function is the quantile function associated with the standard normal distribution. It has applications in data analysis and machine learning, in particular exploratory statistical graphics and ...

models), however, heteroscedasticity has more severe consequences: the maximum likelihood estimates (MLE) of the parameters will usually be biased, as well as inconsistent (unless the likelihood function is modified to correctly take into account the precise form of heteroscedasticity or the distribution is a member of the linear exponential family and the conditional expectation function is correctly specified). Yet, in the context of binary choice models (Logit

In statistics, the logit ( ) function is the quantile function associated with the standard logistic distribution. It has many uses in data analysis and machine learning, especially in Data transformation (statistics), data transformations.

Ma ...

or Probit

In probability theory and statistics, the probit function is the quantile function associated with the standard normal distribution. It has applications in data analysis and machine learning, in particular exploratory statistical graphics and ...

), heteroscedasticity will only result in a positive scaling effect on the asymptotic mean of the misspecified MLE (i.e. the model that ignores heteroscedasticity). As a result, the predictions which are based on the misspecified MLE will remain correct. In addition, the misspecified Probit and Logit MLE will be asymptotically normally distributed which allows performing the usual significance tests (with the appropriate variance-covariance matrix). However, regarding the general hypothesis testing, as pointed out by Greene, "simply computing a robust covariance matrix for an otherwise inconsistent estimator does not give it redemption. Consequently, the virtue of a robust covariance matrix in this setting is unclear."

Correction

There are several common corrections for heteroscedasticity. They are: * A stabilizing transformation of the data, e.g. logarithmized data. Non-logarithmized series that are growing exponentially often appear to have increasing variability as the series rises over time. The variability in percentage terms may, however, be rather stable. * Use a different specification for the model (different ''X'' variables, or perhaps non-linear transformations of the ''X'' variables). * Apply aweighted least squares

Weighted least squares (WLS), also known as weighted linear regression, is a generalization of ordinary least squares and linear regression in which knowledge of the unequal variance of observations (''heteroscedasticity'') is incorporated into ...

estimation method, in which OLS is applied to transformed or weighted values of ''X'' and ''Y''. The weights vary over observations, usually depending on the changing error variances. In one variation the weights are directly related to the magnitude of the dependent variable, and this corresponds to least squares percentage regression.

* Heteroscedasticity-consistent standard errors (HCSE), while still biased, improve upon OLS estimates. HCSE is a consistent estimator of standard errors in regression models with heteroscedasticity. This method corrects for heteroscedasticity without altering the values of the coefficients. This method may be superior to regular OLS because if heteroscedasticity is present it corrects for it, however, if the data is homoscedastic, the standard errors are equivalent to conventional standard errors estimated by OLS. Several modifications of the White method of computing heteroscedasticity-consistent standard errors have been proposed as corrections with superior finite sample properties.

* Wild bootstrapping can be used as a Resampling method that respects the differences in the conditional variance of the error term. An alternative is resampling observations instead of errors. Note resampling errors without respect for the affiliated values of the observation enforces homoskedasticity and thus yields incorrect inference.

* Use MINQUE

In statistics, the theory of minimum norm quadratic unbiased estimation (MINQUE) was developed by C. R. Rao. MINQUE is a theory alongside other estimation methods in estimation theory, such as the method of moments or maximum likelihood estimatio ...

or even the customary estimators (for independent samples with observations each), whose efficiency losses are not substantial when the number of observations per sample is large (), especially for small number of independent samples.

Testing

heteroskedasticity-consistent Standard Errors

The topic of heteroskedasticity-consistent (HC) standard errors arises in statistics and econometrics in the context of linear regression and time series analysis. These are also known as heteroskedasticity-robust standard errors (or simply robust ...

and the problem of Pre-test, econometricians nowadays rarely use tests for conditional heteroskedasticity.

List of tests

Although tests for heteroscedasticity between groups can formally be considered as a special case of testing within regression models, some tests have structures specific to this case. ; Tests in regression * Goldfeld–Quandt test * Park test * Glejser test * Harrison–McCabe test * Breusch–Pagan test * White test * Cook–Weisberg test ; Tests for grouped data * F-test of equality of variances * Cochran's C test * Hartley's test * Bartlett's test *Levene's test

In statistics, Levene's test is an inferential statistic used to assess the equality of variances for a variable calculated for two or more groups. This test is used because some common statistical procedures assume that variances of the population ...

* Brown–Forsythe test

Generalisations

Homoscedastic distributions

Two or morenormal distribution

In probability theory and statistics, a normal distribution or Gaussian distribution is a type of continuous probability distribution for a real-valued random variable. The general form of its probability density function is

f(x) = \frac ...

s, are both homoscedastic and lack serial correlation

Autocorrelation, sometimes known as serial correlation in the discrete time case, measures the correlation of a signal with a delayed copy of itself. Essentially, it quantifies the similarity between observations of a random variable at differe ...

if they share the same diagonals in their covariance

In probability theory and statistics, covariance is a measure of the joint variability of two random variables.

The sign of the covariance, therefore, shows the tendency in the linear relationship between the variables. If greater values of one ...

matrix, and their non-diagonal entries are zero. Homoscedastic distributions are especially useful to derive statistical pattern recognition

Pattern recognition is the task of assigning a class to an observation based on patterns extracted from data. While similar, pattern recognition (PR) is not to be confused with pattern machines (PM) which may possess PR capabilities but their p ...

and machine learning

Machine learning (ML) is a field of study in artificial intelligence concerned with the development and study of Computational statistics, statistical algorithms that can learn from data and generalise to unseen data, and thus perform Task ( ...

algorithms. One popular example of an algorithm that assumes homoscedasticity is Fisher's linear discriminant analysis

Linear discriminant analysis (LDA), normal discriminant analysis (NDA), canonical variates analysis (CVA), or discriminant function analysis is a generalization of Fisher's linear discriminant, a method used in statistics and other fields, to fi ...

.

The concept of homoscedasticity can be applied to distributions on spheres.

Multivariate data

The study of homescedasticity and heteroscedasticity has been generalized to the multivariate case, which deals with the covariances of vector observations instead of the variance of scalar observations. One version of this is to use covariance matrices as the multivariate measure of dispersion. Several authors have considered tests in this context, for both regression and grouped-data situations. Bartlett's test for heteroscedasticity between grouped data, used most commonly in the univariate case, has also been extended for the multivariate case, but a tractable solution only exists for 2 groups. Approximations exist for more than two groups, and they are both called Box's M test.See also

*Heterogeneity

Homogeneity and heterogeneity are concepts relating to the uniformity of a substance, process or image. A homogeneous feature is uniform in composition or character (i.e., color, shape, size, weight, height, distribution, texture, language, i ...

* Spherical error

* Heteroskedasticity-consistent standard errors

The topic of heteroskedasticity-consistent (HC) standard errors arises in statistics and econometrics in the context of linear regression and time series analysis. These are also known as heteroskedasticity-robust standard errors (or simply robust ...

References

Further reading

Most statistics textbooks will include at least some material on homoscedasticity and heteroscedasticity. Some examples are: * * * * * *External links

* by Mark Thoma {{statistics Statistical deviation and dispersion Regression analysis ja:ARCHモデル#分散不均一性