|

Silverite

The Silverites were members of a political movement in the United States in the late-19th century that advocated that silver should continue to be a monetary standard along with gold, as authorized under the Coinage Act of 1792. The Silverite coalition's famous slogan was "16 to 1" – that is, the ratio of sixteen ounces of silver equal in value to one ounce of gold, a ratio similar to that established in the Coinage Act of 1834. Silverites belonged to a number of political parties, including the Silver Party, Populist Party, Democratic Party, and the Silver Republican Party. The Silverites advocated free coinage of silver. They wanted to replace the strict gold standard with silver, thereby allowing inflation of the money supply. Many Silverites were in the West, where silver was mined. Advocates predicted that if silver were used as the standard of money, they would be able to pay off all of their debt. The debt amount would stay the same but they would have more silver ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silverites

The Silverites were members of a political movement in the United States in the late-19th century that advocated that silver should continue to be a monetary standard A monetary system is a system where a government manages money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks. Commodity money system A commodity mone ... along with Gold standard, gold, as authorized under the Coinage Act of 1792. The Silverite coalition's famous slogan was "16 to 1" – that is, the ratio of sixteen ounces of silver equal in value to one ounce of gold, a ratio similar to that established in the Coinage Act of 1834. Silverites belonged to a number of political parties, including the Silver Party, Populist Party (United States), Populist Party, Democratic Party (United States), Democratic Party, and the Silver Republican Party. The Silverites advocated free coinage of silver. They wanted to replace th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1896 United States Presidential Election

Presidential elections were held in the United States on November 3, 1896. Former Governor William McKinley, the Republican nominee, defeated former Representative William Jennings Bryan, the Democratic nominee. The 1896 campaign, which took place during an economic depression known as the Panic of 1893, was a political realignment that ended the old Third Party System and began the Fourth Party System. Incumbent Democratic President Grover Cleveland did not seek election to a second consecutive term (which would have been his third overall), leaving the Democratic nomination open. An attorney and former congressman, Bryan galvanized support with his Cross of Gold speech, which called for reform of the monetary system and attacked business leaders as the cause of ongoing economic depression. The 1896 Democratic National Convention repudiated the Cleveland administration and nominated Bryan on the fifth presidential ballot. Bryan then won the nomination of the Populist Pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Populist Party (United States)

The People's Party, usually known as the Populist Party or simply the Populists, was an agrarian populist political party in the United States in the late 19th century. The Populist Party emerged in the early 1890s as an important force in the Southern and Western United States, but declined rapidly after the 1896 United States presidential election in which most of its natural constituency was absorbed by the Bryan wing of the Democratic Party. A rump faction of the party continued to operate into the first decade of the 20th century, but never matched the popularity of the party in the early 1890s. The Populist Party's roots lay in the Farmers' Alliance, an agrarian movement that promoted economic action during the Gilded Age, as well as the Greenback Party, an earlier third party that had advocated fiat money. The success of Farmers' Alliance candidates in the 1890 elections, along with the conservatism of both major parties, encouraged Farmers' Alliance leaders to estab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Jennings Bryan

William Jennings Bryan (March 19, 1860 – July 26, 1925) was an American lawyer, orator, and politician. He was a dominant force in the History of the Democratic Party (United States), Democratic Party, running three times as the party's nominee for President of the United States in the 1896 United States presidential election, 1896, 1900 United States presidential election, 1900, and 1908 United States presidential election, 1908 elections. He served in the United States House of Representatives, House of Representatives from 1891 to 1895 and as the United States Secretary of State, Secretary of State under Woodrow Wilson from 1913 to 1915. Because of his faith in the wisdom of the common people, Bryan was often called "the Great Commoner", and because of his rhetorical power and early fame as the youngest presidential candidate, "the Boy Orator". Born and raised in Illinois, Bryan moved to Nebraska in the 1880s. He won election to the House of Representatives in the 18 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bimetallism

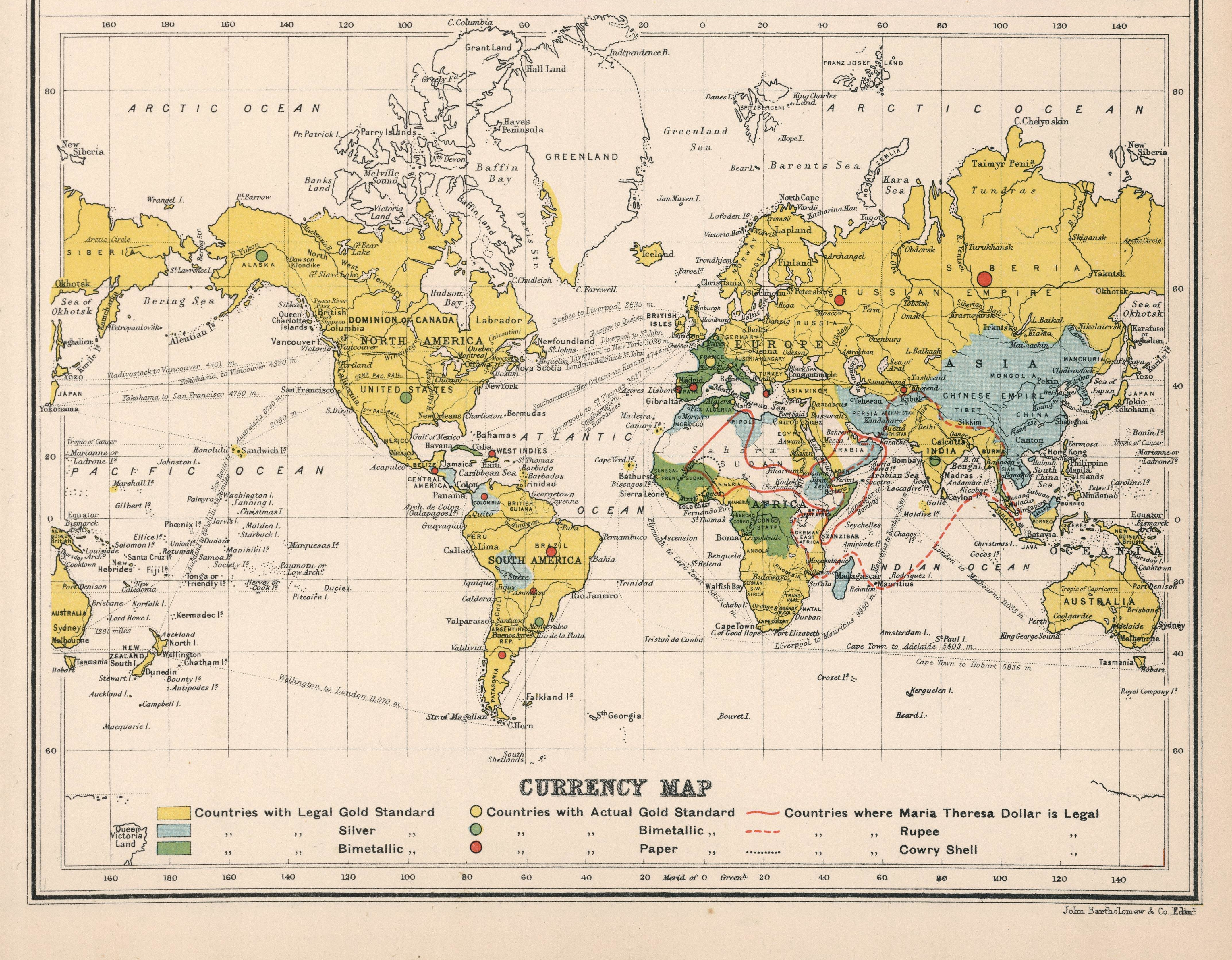

Bimetallism, also known as the bimetallic standard, is a monetary standard in which the value of the monetary unit is defined as equivalent to certain quantities of two metals, typically gold and silver, creating a fixed Exchange rate, rate of exchange between them. For scholarly purposes, "proper" bimetallism is sometimes distinguished as permitting that both gold and silver money are legal tender in unlimited amounts and that gold and silver may be taken to be coined by the Mint (facility), government mints in unlimited quantities. This distinguishes it from "limping standard" bimetallism, where both gold and silver are legal tender but only one is freely coined (e.g. the monies of France, Germany, and the United States after 1873), and from "trade" bimetallism, where both metals are freely coined but only one is legal tender and the other is used as "trade money" (e.g. most monies in western Europe from the 13th to 18th centuries). Economists also distinguish ''legal'' bimeta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bullionism

Bullionism is an economic theory that defines wealth by the amount of precious metals owned. Bullionism is an early and perhaps more primitive form of mercantilism. It was derived, during the 16th century, from the observation that the Kingdom of England, because of its large trade surplus, possessed large amounts of gold and silver—bullion—despite the fact that there was not any mining of precious metals in England. History Bullionism was born in what now is known as Spain. Following the Reconquista, the region fell victim to a deep economic slump. This prompted local scientists to look for ways to revive the region's economy. Some noted that England had accumulated vast reserves of gold and silver thanks to its trade surplus, and established a link between the possession of precious metals and the wealth of the country. Although the supporters of Bullionism did not write theoretical treatises on the subject (unlike the precursors of the classical school in the following c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Standard

A gold standard is a backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves. Historically, the silver standard and bimetallism have been more common than the gold standard. The shift to an international monetary system based on a gold standard reflected accident, network externalities, and path dependence. Great Britain accidentally adopted a ''de facto'' gold standard in 1717 when Isaac Newton, then-master of the Royal Mint, set the exchange rate of silver to gold too low, thus causing silver coins to go out of circulation. As Great Britain became the w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silver Standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following the discovery in the 16th century of large deposits of silver at the Cerro Rico in Potosí, Bolivia, an international silver standard came into existence in conjunction with the Spanish pieces of eight. These silver dollar coins were an international trading currency for nearly four hundred years. The move away from the silver to the gold standard began in the 18th century when Great Britain set the gold guinea’s price in silver higher than international prices, on the recommendation of Sir Isaac Newton, thus attracting gold and putting Great Britain on a de facto gold standard. Great Britain formalised the gold standard in 1821 and introduced it to its colonies afterwards. Imperial Germany’s move to the gold standard in 1873 trigger ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves ( intrinsic value) as well as their value in buying goods. This is in contrast to representative money, which has no intrinsic value but represents something of value such as gold or silver, for which it can be exchanged, and fiat money, which derives its value from having been established as money by government regulation. Examples of commodities that have been used as media of exchange include precious metals and stones, grain, animal parts (such as beaver pelts), tobacco, fuel, and others. Sometimes several types of commodity money were used together, with fixed relative values, in various commodity valuation or price system economies. Aspects Commodity money is to be distinguished from representative money, which is a certificate or token which can be exchanged for the underlying commodity, but only by a formal process ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from '' disinflation'', a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral . Some economists argue that prolonged deflationary periods are related to the underlying technological progress in an economy, because as productivity increases ( TFP), the cost of goods decreases. Deflation usually happens when supply is hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |