|

SSE Composite Index

The SSE Composite Index also known as SSE Index is a stock market index of all stocks ( A shares and B shares) that are traded at the Shanghai Stock Exchange. There are also SSE 180, SSE 50 and SSE Mega-Cap Indexes for top 180, 50 and 20 companies respectively, and the CSI 300 Index, which includes shares traded at the Shanghai Stock Exchange and the Shenzhen Stock Exchange. Weighting and calculation SSE Indices are all calculated using a Paasche weighted composite price index formula. This means that the index is based on a base period on a specific base day for its calculation. The base day for SSE Composite Index is December 19, 1990, and the base period is the total market capitalization of all stocks of that day. The Base Value is 100. The index was launched on July 15, 1991. * The formula is: Current index = Current total market cap of constituents × Base Value / Base Period total market cap of constituents Total market capitalization = Σ (price × shares issued) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shanghai Stock Exchange

The Shanghai Stock Exchange (, SSE) is a stock exchange based in the city of Shanghai, China. It is one of the three stock exchanges operating independently in mainland China, the others being the Beijing Stock Exchange and the Shenzhen Stock Exchange. The Shanghai Stock Exchange is the world's third-largest stock market by market capitalization, exceeding $6 trillion in July 2024. It is also Asia's biggest stock exchange. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors and often affected by the decisions of the central government due to capital account controls exercised by the Chinese mainland authorities. In 1891, Shanghai founded China's first exchange system. The current stock exchange was re-established on November 26, 1990, and was in operation on December 19 of the same year. It is a non-profit organization directly administered by the China Securities Regulatory Commission (CSRC). History The formati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1,000,000,000,000

This list contains selected positive numbers in increasing order, including counts of things, dimensionless quantities and probabilities. Each number is given a name in the short scale, which is used in English-speaking countries, as well as a name in the long scale, which is used in some of the countries that do not have English as their national language. Smaller than (one googolth) * ''Physics:'' The probability of a human spontaneously teleporting due to quantum effects is approximately 10−4.5×1029. * ''Mathematics – random selections:'' Approximately is a rough first estimate of the probability that a typing "monkey", or an English-illiterate typing robot, when placed in front of a typewriter, will type out William Shakespeare's play ''Hamlet'' as its first set of inputs, on the precondition it typed the needed number of characters. However, demanding correct punctuation, capitalization, and spacing, the probability falls to around 10−360,783. * ''Compu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSE 50 Index

SSE 50 Index is the stock index of Shanghai Stock Exchange, representing the top 50 companies by "float-adjusted" capitalization and other criteria. In order to qualify as a constituent of SSE 50 Index, it must be a constituent of SSE 180 Index, thus SSE 50 is a subindex of SSE 180 Index. SSE 50 Index is also a subset of SSE Composite Index, which included all stock. SSE 50 was regarded as a blue-chip index of the exchange. Constituents , the index constituents are: References {{Asian Stock market indices Shanghai Stock Exchange Chinese stock market indices Lists of companies of China ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSE 180 Index

SSE 180 Index is the stock index of Shanghai Stock Exchange, representing the top 180 companies by "float-adjusted" capitalization and other criteria. SSE 180 is a sub-index of SSE Composite Index, the latter included all shares of the exchange. Constituents Related indexes Both SSE 50 Index and SSE MidCap Index () were the subindex of SSE 180 Index. They did not intersect each other. By a different selection criteria than SSE 50, is also the sub-index of SSE 180. It consists of the top 20 companies with a cap of 6 from each kind of industries. The subindex may intersect with SSE 50 Index. SSE Mega-Cap started to publish in 2009. References See also * SSE Composite Index The SSE Composite Index also known as SSE Index is a stock market index of all stocks ( A shares and B shares) that are traded at the Shanghai Stock Exchange. There are also SSE 180, SSE 50 and SSE Mega-Cap Indexes for top 180, 50 and 20 comp ... {{Asian Stock market indices Shanghai Stock Exchan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Index

In finance, a stock index, or stock market index, is an Index (economics), index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors may be able to invest in a stock market index by buying an index fund, which is structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called ''tracking error''. Types of indices by coverage Stock market indices may be classified and segmented by the set of underlying stocks included in the index, sometimes referred to as the "coverage". The underlying stocks are typically grouped together based on their underlying economics or underlying investor demand that the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

A-share (mainland China)

A-shares (), also known as domestic shares (), are shares that are denominated in renminbi and traded in the Shanghai and Shenzhen stock exchanges, as well as the National Equities Exchange and Quotations. These are in contrast to B-shares that are denominated in foreign currency and traded in Shanghai and Shenzhen, as well as H share H shares () refer to the shares of companies incorporated in mainland China that are traded on the Hong Kong Stock Exchange. Many companies float their shares simultaneously on the Hong Kong market and one of the two mainland Chinese stock excha ...s, that are denominated in Hong Kong dollars and traded in the Stock Exchange of Hong Kong. A-shares are generally owned by domestic investors. As of 2023, foreign investors own only 3-5% of China's A-shares equity and bond market. In 2018 MSCI began including Chinese A-shares in its MSCI Emerging Markets Index. See also * Chip * Red chip * P chip * S chip * N share * L share * G share * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

B-share (mainland China)

B shares (, officially Domestically Listed Foreign Investment Shares) on the Shanghai and Shenzhen stock exchanges refers to those that are traded in foreign currencies. Shares that are traded on the two mainland Chinese stock exchanges in Renminbi, the currency in mainland China, are called A shares. History B shares were limited to foreign investment until 19 February 2001, when the China Securities Regulatory Commission began permitting the exchange of B shares via the secondary market to domestic citizens. This was widely seen as a landmark event to the integration of Chinese stock markets. Currency The face values of B shares are set in Renminbi. In Shanghai, B shares are traded in US dollars, whereas in Shenzhen they are traded in Hong Kong dollars. See also * Chip * A share * H share * Red chip * P chip * S chip * N share * L share * G share G shares () refers to shares traded in the stock exchanges of mainland China that belong to companies that have accomplished stoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CSI 300 Index

The CSI 300 () is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. It has two sub-indexes: the CSI 100 Index and the CSI 200 Index. Over the years, it has been deemed the Chinese counterpart of the S&P 500 The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ... index and a better gauge of the Chinese stock market than the more traditional SSE Composite Index. The index is compiled by the China Securities Index Company, Ltd. It has been calculated since April 8, 2005. Its value is normalized relative to a base of 1000 on December 31, 2004. It is considered to be a blue chip index for Mainland China stock exchanges. As of January 25, 2024, the index is on a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shenzhen Stock Exchange

The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Exchange and the Shanghai Stock Exchange. It is situated in the Futian district of Shenzhen. The SZSE is the List of stock exchanges, world's 6th largest stock exchange with a market capitalization exceeding US$4.4 trillion in July 2024. History On 1 December 1990, Shenzhen Stock Exchange was founded. As an idea adapted from the capitalist countries, it was politically controversial in China. In support of the stock exchange, Deng Xiaoping rhetorically asked, "Are securities and the stock markets good or bad? Do they entail dangers? Are they peculiar to capitalism? Can socialism make use of them?" Deng contended that China must try them out and reserve judgment, because if securities and the stock market went well, they could be expanded, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalization-weighted Index

A capitalization-weighted (or cap-weighted) index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value (the share price multiplied by the number of outstanding shares), in a capitalization-weighted index. In other types of indices, different ratios are used. For example, the NYSE Amex Composite Index (XAX) is composed of all of the securities traded on the exchange including stocks and American depositary receipts (ADRs). The weighting of each component shifts with changes to each securities' price and the number of shares outstanding. The index moves in line with changes in price of the component. Stock market indices are a type of economic index. Free-float wei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE Component Index

The SZSE Component Index is an index of 500 stocks that are traded at the Shenzhen Stock Exchange (SZSE). It is the main stock market index of SZSE. Constituents The full list of all constituent stocks can be found aSZSE Related indices * SZSE 300 Index - top 300 companies ** SZSE 100 Index - top 100 companies ** SZSE 200 Index 101st to 300th companies * SZSE 1000 Index - top 1000 companies ** SZSE 700 Index 301st to 1000th companies * SZSE Composite Index - index for all shares from all companies of the exchange See also * CSI 300 Index major index of mainland Chinese stock markets * SSE Composite Index major index of Shanghai Stock Exchange * Hang Seng Index The Hang Seng Index (HSI) is a market-Capitalization-weighted index, capitalisation-weighted stock market index in Hong Kong adjusted for free float. It tracks and records daily changes in the largest stock listings on the Hong Kong Stock Exch ... major index of Hong Kong Stock Exchange of Hong Kong S.A. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

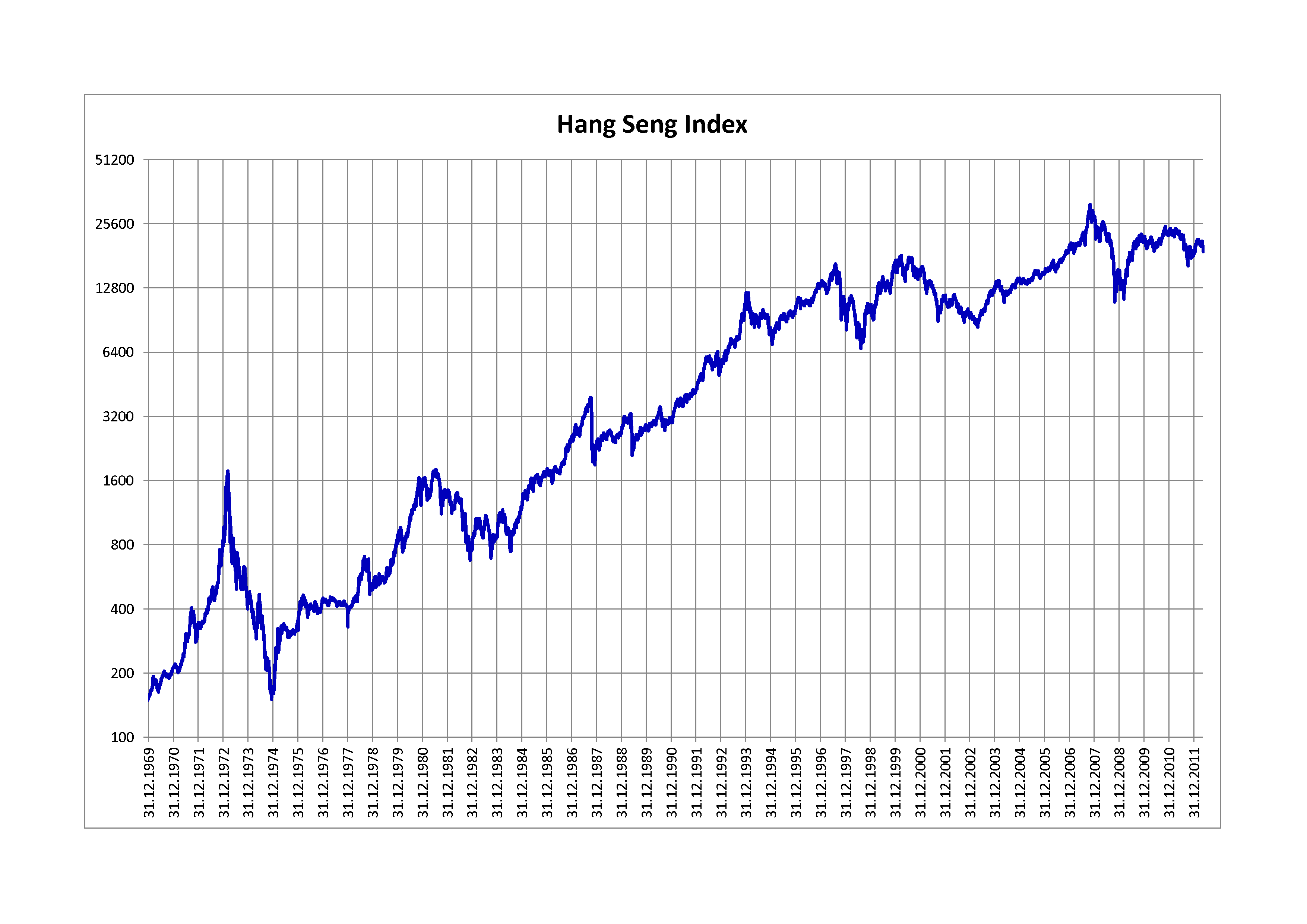

Hang Seng Index

The Hang Seng Index (HSI) is a market-Capitalization-weighted index, capitalisation-weighted stock market index in Hong Kong adjusted for free float. It tracks and records daily changes in the largest stock listings on the Hong Kong Stock Exchange and serves as the primary indicator of overall market performance in Hong Kong. These 82 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange. HSI was publicized on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as ''Hang Seng China Enterprises Index'', ''Hang Seng China AH Index Series'', ''Hang Seng China H-Financials Index'', ''Hang Seng Composite Index Series'', ''Hang Seng Ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |