|

RBL Bank

RBL Bank, formerly known as Ratnakar Bank Limited, is an Indian private sector bank founded in 1943 and headquartered in Mumbai. It offers services across five verticals: corporate banking, commercial banking, branch banking and retail liabilities, retail assets, and treasury and financial markets operations. History On 6 August 1943, Ratnakar Bank was founded as a regional bank in Maharashtra with two branches in Kolhapur and Sangli by Babgonda Bhujgonda Patil from Sangli and Gangappa Siddappa Chougule from Kolhapur. It mainly served small and medium enterprises (SMEs) and business merchants in the Kolhapur-Sangli belt. The bank was incorporated in Kolhapur district on 14 June 1943 as Ratnakar Bank Limited. In 1959, the bank was categorized as a scheduled commercial bank as per the Reserve Bank of India Act, 1934. During this decade, it was referred to as an NH4 Bank. In 1970, it received a banking license from the Reserve Bank of India (RBI). In July 2010, Vishwavir Ahu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pune, Maharashtra

Pune ( ; , ISO 15919, ISO: ), previously spelled in English as Poona (List of renamed Indian cities and states#Maharashtra, the official name until 1978), is a city in the state of Maharashtra in the Deccan Plateau, Deccan plateau in Western India. It is the administrative headquarters of the Pune district, and of Pune division. In terms of the total amount of land under its jurisdiction, Pune is the largest city in Maharashtra, with a geographical area of 516.18 sq km, though List of cities in India by population, by population it comes in a distant second to Mumbai. According to the 2011 Census of India, Pune has 7.2 million residents in the metropolitan region, making it the List of metropolitan areas in India, seventh-most populous metropolitan area in India. The city of Pune is part of Pune Metropolitan Region. Pune is one of the largest IT hubs in India. It is also one of the most important Automotive industry in India, automobile and Manufacturing in India, manufacturin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

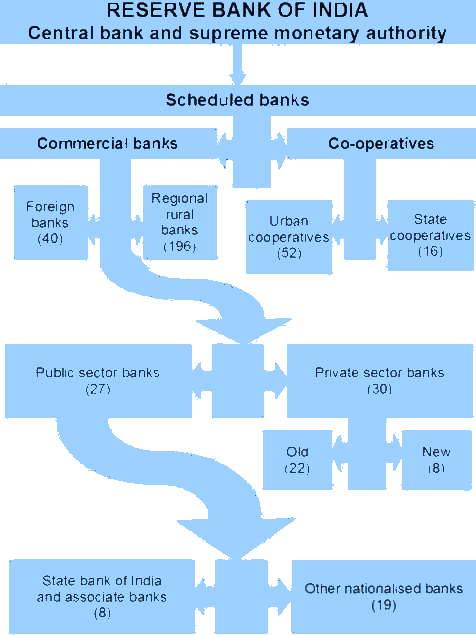

Scheduled Banks (India)

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934. Reserve Bank of India (RBI) in turn includes only those banks in this Schedule which satisfy all the criteria laid down vide section 42(6)(a) of the said Act. Banks not under this Schedule are called Non-Scheduled Banks Facilities Every Scheduled bank enjoys two types of principal facilities: it becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of clearing house. Types of banks There are two main categories of scheduled banks in India, namely: * Scheduled Commercial banks * Scheduled Co-operative banks Scheduled commercial Banks are further divided into six types, as below: # Scheduled Public Sector Banks # Scheduled Private Sector Banks # Scheduled Small Finance Banks # Regional Rural Banks # Foreign Banks # Payment banks (currently five banks Airtel Payments Bank, Fino Payments Bank, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Asian Banker

The Asian Banker is a company that provides information for the financial services industry in the form of publications, online materials such as e-newsletters, research, and conventions, and other industry gatherings. It is regarded as one of the Asian region's leading consultancies in financial services research, benchmarking and intelligence. History The Asian Banker was founded in Singapore in 1996 by Emmanuel Daniel. Publications The company's original product was ''The Asian Banker Journal'', a quarterly publication of 40 pages that was launched in January 1997. Throughout 1997 and 1998, it provided on-the-ground coverage of the 1997 Asian financial crisis, anchored by Daniel's journalistic skills and award-winning articles—Daniel won the prestigious Citibank Excellence in Journalism Award for the Asian region in February 1999 for his work in determining the impact of the Internet on banking. The magazine covers a wide range of industry topics, such as opinion editori ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euromoney

''Euromoney'' is an English-language monthly magazine focused on business and finance. First published in 1969, it is the flagship production of Euromoney Institutional Investor plc. History and profile ''Euromoney'' was first published in 1969 by Sir Patrick Sergeant. It is part of Euromoney Institutional Investor, an international business-to-business media group focused primarily on the international finance industry. The group became a public company in 1986, and is listed on the London Stock Exchange as Euromoney Institutional Investor PLC. The headquarters of the magazine is in London. Sergeant continued to manage the business until 1985 and remains as co-president of the company. Daily Mail and General Trust plc is the largest shareholder in the company. DMGT's principal shareholder, Jonathan Harmsworth, 4th Viscount Rothermere, is co-president of Euromoney Institutional Investor. ''Euromoney'' covers global banking, macroeconomics and capital markets, including de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance consists of financial services targeting individuals and small businesses (SMEs) who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings account, savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance product and services in MFI include: # Savings # Microcredit # Microinsurance # Microleasing and # Fund transfer/remittance. Microfinance services are designed to reach excluded customers, usually low income population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Peck Christen, Robert; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euronet Worldwide

Euronet Worldwide is an American provider of global electronic payment services with headquarters in Leawood, Kansas. It offers automated teller machines (ATM), point of sale (POS) services, credit/debit card services, currency exchange and other electronic financial services and payments software. Among others, it provides the prepaid subsidiaries Transact, PaySpot, epay, Movilcarga, TeleRecarga and ATX. As of 2019, Euronet services 50,000 ATMs and 330,000 EFT point-of-sale terminals across 170 countries. History The company was founded in 1994 by brothers-in-law Dan Henry and Mike Brown and headquartered in Leawood, Kansas. In 1998, Euronet purchased ARKSYS, a computer software company that specialized in electronic payment and transaction delivery systems. On January 23, 2002, Euronet Worldwide announced the formation of a joint venture with Hong Kong-based First Mobile Group Holdings Limited. In April 2014, Walmart started offering a store-to-store money transfer servic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baring Private Equity Asia

Baring Private Equity Asia (BPEA) was an Asian investment firm headquartered in Hong Kong. It was founded in 1997 as an affiliate of Barings Bank before becoming an independent firm in 2000. In 2022, it was acquired by EQT AB to act as its Asian investment platform. It was subsequently renamed to BPEA EQT and then EQT Private Capital Asia. History BPEA was founded in 1997 as a subsidiary of Baring Private Equity Partners which was an affiliate of Barings Bank. In addition to BPEA, the affiliates of Baring Private Equity Partners include Baring Vostok Capital Partners, Baring Private Equity Partners India and GP Investments. Jean Salata and two other senior colleagues from the investment arm of American International Group, AIG were set to run it with the ING Group providing $300 million in seed money. However, the two colleagues pulled out and ING downsized its commitment to $25 million due to the collapse of Barings Bank and the Asian financial crisis. However, des ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CDC Group

British International Investment plc, (formerly CDC Group plc, Commonwealth Development Corporation, and Colonial Development Corporation) is the development finance institution of the UK government. The Foreign, Commonwealth and Development Office is responsible for the organisation, and is the sole shareholder. It has an investment portfolio valued around US$7.1 billion (year-end 2020) and since 2011 is focused on the emerging markets of South Asia and Africa via its direct investment and cooperation with important global stakeholders such as Standard Chartered. History Formation The original Colonial Development Corporation was established as a statutory corporation in 1948 by Clement Attlee's post-war Labour government, to assist British colonies in the development of agriculture. Following the independence of many colonies, it was renamed the Commonwealth Development Corporation in 1963 and was permitted to invest outside the Commonwealth in 1969. As part of the (c. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automatic Teller Machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of other names, including automatic teller machines (ATMs) in the United States (sometimes RAS syndrome, redundantly as "ATM machine"). In Canada, the term automated banking machine (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM rather than ABM. In British English, the terms cashpoint, cash machine and hole in the wall are also used. ATMs that are Independent ATM deployer, not operated by a financial institution are known as "White-label ABMs, white-label" ATMs. Using an ATM, customers can access their bank deposit or credit accounts in order to make ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RuPay

RuPay (portmanteau of Rupee and Payment) is an Indian multinational financial services and payment service system, conceived and owned by the National Payments Corporation of India (NPCI). It was launched in 2012, to fulfil the Reserve Bank of India's (RBI) vision of establishing a domestic, open and multilateral system of payments. RuPay facilitates electronic payments at almost all Indian banks and financial institutions. NPCI has partnered with Discover Financial and JCB to help the RuPay network gain international acceptance. As of November 2020, around 753 million RuPay cards have been issued by nearly 1,158 banks. All merchant discount rate (MDR) charges were eliminated for transactions done using Rupay debit cards from 1 January 2020. All Indian companies with an annual turnover exceeding are required to offer RuPay debit card and Unified Payments Interface as a payment option to their customers. Background In 2009, RBI asked the Indian Banks' Association to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Common Mobility Card

National Common Mobility Card (NCMC) is an open-loop, inter-operable transport card conceived by the Ministry of Housing and Urban Affairs under Prime Minister of India, Prime Minister Narendra Modi's ‘One Nation, One Card' vision. It was launched on 4 March 2019. The transport card enables the user to pay for travel, toll tax, retail shopping and withdraw money. It is enabled through the RuPay card mechanism. The NCMC card is issuable as a prepaid, debit, or credit RuPay card from partnered banks such as the State Bank of India, Canara Bank, Bank of India, Punjab National Bank, and others. History In late 2010, the Government of India envisioned a scheme wherein seamless access could be granted to public transport networks. The system, which later came to be known as Interoperable Fare Management System (IFMS), aimed to let passengers pay across different public transport platforms using one system. This was created as an effort to bring together the public transport system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unified Payments Interface

Unified Payments Interface, commonly known as UPI is an Indian instant payment system as well as protocol developed by the National Payments Corporation of India (NPCI) in 2016. The interface facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions. It is used on mobile devices to instantly transfer funds between two bank accounts using only a unique UPI ID. It runs as an open source application programming interface (API) on top of the Immediate Payment Service (IMPS), and is regulated by the Reserve Bank of India (RBI). Major Indian banks started making their UPI-enabled apps available to customers in August 2016 and the system is today supported by almost all Indian banks. As of 2025, the platform had over 500 million active users in India. In May 2025, 18.67 billion UPI transactions worth ₹ 25.14 trillion (approx. 293 billion USD) were processed by the UPI system, equivalent to almost 7,000 transactions on average every second. The widespre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |