|

March 2021 United Kingdom Budget

The March 2021 United Kingdom budget, officially known as Protecting the Jobs and Livelihoods of the British People was a Budget of the United Kingdom, budget delivered by Rishi Sunak, the Chancellor of the Exchequer in March 2021. It was expected to be delivered in Autumn 2020, but was postponed because of the COVID-19 pandemic in the United Kingdom, COVID-19 pandemic. It succeeds the 2020 United Kingdom budget, budget held in March 2020, and the July 2020 United Kingdom summer statement, summer statement and September 2020 United Kingdom Winter Economy Plan, Winter Economy Plan held in summer and autumn 2020, respectively. The budget is the second under Premiership of Boris Johnson, Boris Johnson's government, also the second to be delivered by Sunak and the second since Britain's Brexit, withdrawal from the European Union. The budget was the first for government expenditure in the United Kingdom to exceed £1 trillion. It was confirmed on the previous day that the British gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of MPs Elected In The 2019 United Kingdom General Election

In the United Kingdom's (UK) 2019 general election, 650 Members of Parliament (MPs) were elected to the House of Commons – one for each parliamentary constituency. The UK Parliament comprises the elected House of Commons, the House of Lords and the Sovereign. The new Parliament first met on 17 December 2019. After the swearing-in of members and the election of Speaker, the State Opening of Parliament took place on 19 December. The 2021 State Opening of Parliament began the second session on 11 May 2021. The 2022 State Opening of Parliament began the third session on 10 May 2022. House of Commons composition The Conservative Party gained a majority of seats in the election. The Scottish National Party increased their number of seats and the Social Democratic and Labour Party and the Alliance Party returned to the House of Commons for the first time since their defeats in the 2017 and 2015 general elections respectively. The Labour Party, Plaid Cymru and Democratic Un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Messenger RNA

In molecular biology, messenger ribonucleic acid (mRNA) is a single-stranded molecule of RNA that corresponds to the genetic sequence of a gene, and is read by a ribosome in the process of synthesizing a protein. mRNA is created during the process of transcription, where an enzyme (RNA polymerase) converts the gene into primary transcript mRNA (also known as pre-mRNA). This pre-mRNA usually still contains introns, regions that will not go on to code for the final amino acid sequence. These are removed in the process of RNA splicing, leaving only exons, regions that will encode the protein. This exon sequence constitutes mature mRNA. Mature mRNA is then read by the ribosome, and, utilising amino acids carried by transfer RNA (tRNA), the ribosome creates the protein. This process is known as translation. All of these processes form part of the central dogma of molecular biology, which describes the flow of genetic information in a biological system. As in DNA, genetic inf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Break

Tax break also known as tax preferences, tax concession, and tax relief, are a method of reduction to the tax liability of taxpayers. Government usually applies them to stimulate the economy and increase the solvency of the population. By this fiscal policy act, government favourable behaving of population sample or general behaving. By announcing a new tax break state budget possibly deprecate some of their revenues from collecting taxes. On the other hand, a new tax break stimulates the economy of subjects in the state, which could possibly strengthen the increase of outcomes that will be taxed. Every tax break must go through the Legislative system to be accepted by authorized institutions to become valid. Most of the countries pledge this position to the Ministry of finance, which approves new tax breaks as tax law. Whether for validation is needed an agreement with other constitutional officials depends on state legislative. However, in the same manner, could the tax break be a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom tim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

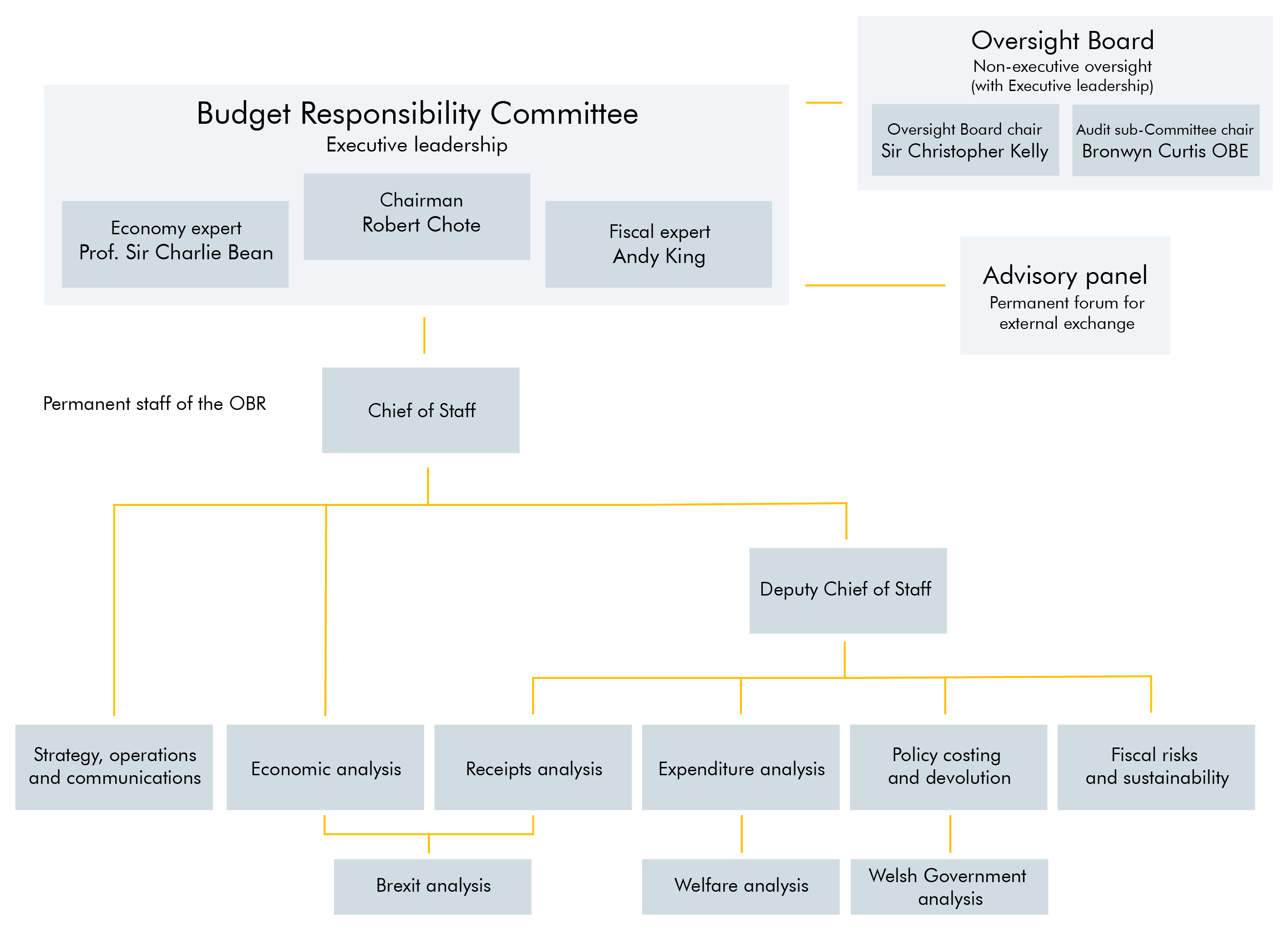

Office For Budget Responsibility

The Office for Budget Responsibility (OBR) is a non-departmental public body funded by the UK Treasury, that the UK government established to provide independent economic forecasts and independent analysis of the public finances. It was formally created in May 2010 following the general election (although it had previously been constituted in shadow form by the Conservative party opposition in December 2009) and was placed on a statutory footing by the Budget Responsibility and National Audit Act 2011. It is one of a growing number of official independent fiscal watchdogs around the world. Richard Hughes, former Director of Fiscal Policy at HM Treasury, has been head since October 2020. Functions The UK government created the OBR in 2010 with the goal of offering independent and authoritative analysis of the UK's public finances. To that end it produces two 5-year-ahead forecasts for the economy and the public finances each year, alongside the Budget and Spring Statements. In it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax In The United Kingdom

Capital gains tax in the United Kingdom is a tax levied on capital gains, the profit realised on the sale of a non-inventory asset by an individual or trust in the United Kingdom. The most common capital gains are realised from the sale of shares, bonds, precious metals, real estate, and property, so the tax principally targets business owners, investors and employee share scheme participants. In the UK, gains made by companies fall under the scope of corporation tax rather than capital gains tax. In 2017–18, total capital gains tax receipts were £8.3 billion from 265,000 individuals and £0.6 billion from trusts, on total gains of £58.9 billion. The current operation of the capital gains tax system is a recognised issue. The Conservative government consulted on the issue in 2020. Beginnings The capital gains tax (CGT) system was introduced by Labour Chancellor James Callaghan in 1965. Prior to this, capital gains were not taxed. Channon observed that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax In The United Kingdom

In the United Kingdom, Inheritance Tax is a transfer tax. It was introduced with effect from 18 March 1986, replacing Capital Transfer Tax. History Prior to the introduction of Estate Duty by the Finance Act 1894, there was a complex system of different taxes relating to the inheritance of property, that applied to either realty (land) or personalty (other personal property): # From 1694, Probate Duty, introduced as a stamp duty on wills entered in probate in 1694, applying to personalty. # From 1780, Legacy Duty, an inheritance duty paid by the receiver of personalty, graduated according to consanguinity # From 1853, Succession Duty, a duty introduced by the Succession Duty Act 1853 applying to realty settlements, taking effect on the death of the settlor # From 1881, Account Duty applied as an anti-avoidance duty on lifetime gifts made to avoid paying Legacy Duty # From 1885, Corporation Duty applied to the annual value of certain property vested in corporate and unincorp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Duty In The United Kingdom

Stamp duty in the United Kingdom is a form of tax charged on legal instruments (written documents), and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no longer require a physical stamp. History of UK stamp duties Stamp duty was first introduced in England on 28 June 1694, during the reign of William III and Mary II, under "An act for granting to their Majesties several duties upon vellum, parchment and paper, for four years, towards carrying on the war against France". Dagnall, H. (1994) ''Creating a Good Impression: three hundred years of The Stamp Office and stamp duties.'' London: HMSO, p. 3. In the 1702/03 financial year 3,932,933 stamps were embossed in England for a total value of £91,206.10s.4d. Stamp duty was so successful that it continues to this day through a series of Stamp Acts. Similar duties have been levied in the Netherlands, France and elsewhere. During the 18th a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom Corporation Tax

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

Value-added Tax In The United Kingdom

In the United Kingdom, the value added tax (VAT) was introduced in 1973, replacing Purchase Tax, and is the third-largest source of government revenue, after income tax and National Insurance. It is administered and collected by HM Revenue and Customs, primarily through the Value Added Tax Act 1994. VAT is levied on most goods and services provided by registered businesses in the UK and some goods and services imported from outside the UK. The default VAT rate is the standard rate, 20% since 4 January 2011. Some goods and services are subject to VAT at a reduced rate of 5% (such as domestic fuel) or 0% (such as most food and children's clothing). Others are exempt from VAT or outside the system altogether. VAT is an indirect tax because the tax is paid to the government by the seller (the business) rather than the person who ultimately bears the economic burden of the tax (the consumer). Opponents of VAT claim it is a regressive tax because the poorest people spend a higher pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |