|

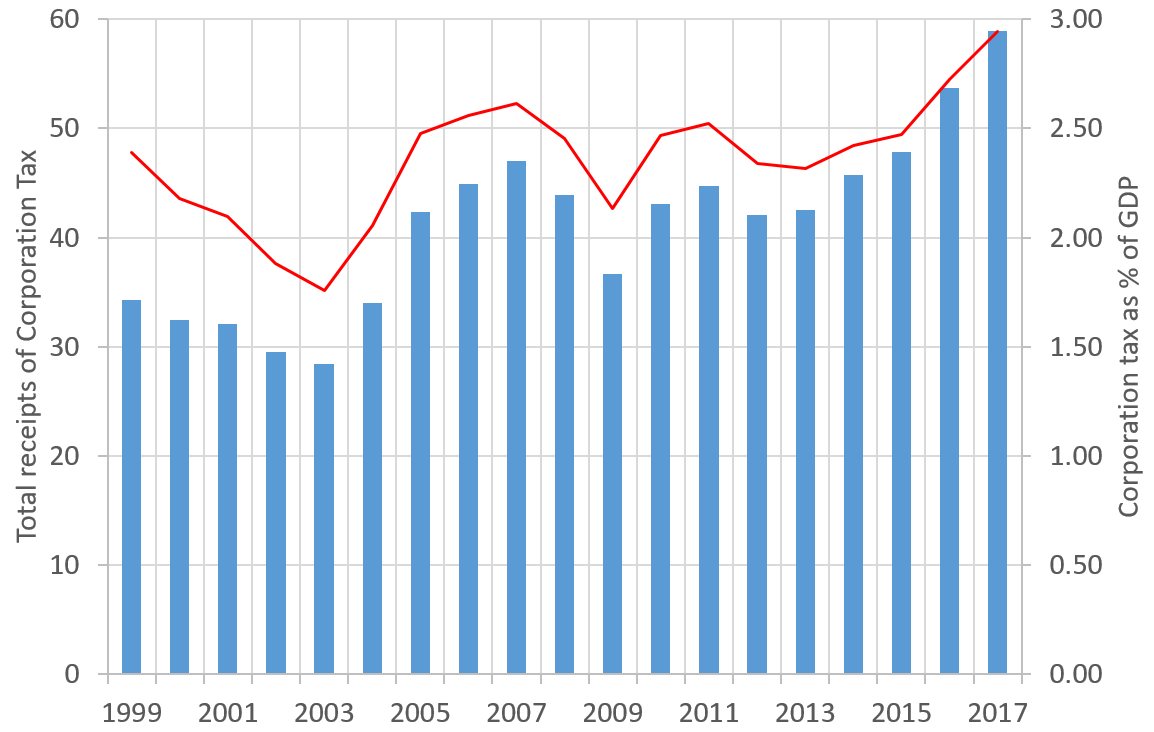

United Kingdom Corporation Tax

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

Pound Sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency that is still in use and that has been in continuous use since its inception. It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of mid-2021, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |