|

LTCM

Long-Term Capital Management L.P. (LTCM) was a highly-leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York. LTCM was founded in 1994 by John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM's board of directors included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial dynamics.''A financial History of the United States Volume II: 1970–2001'', Jerry W. Markham, Chapter 5: "Bank Consolidation", M. E. Sharpe, Inc., 2002 LTCM was initially successful, with annualized returns (after fees) of around 21% in its first year, 43% in its second year and 41% in its third year. However, in 1998 it lost $4.6 billion in less than four months due to a combination of high leverage and exposure to the 1997 Asian fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long-Term Capital Management (logo)

Long-Term Capital Management L.P. (LTCM) was a highly-leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York. LTCM was founded in 1994 by John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM's board of directors included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial dynamics.''A financial History of the United States Volume II: 1970–2001'', Jerry W. Markham, Chapter 5: "Bank Consolidation", M. E. Sharpe, Inc., 2002 LTCM was initially successful, with annualized returns (after fees) of around 21% in its first year, 43% in its second year and 41% in its third year. However, in 1998 it lost $4.6 billion in less than four months due to a combination of high leverage and exposure to the 1997 Asian financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Meriwether

John William Meriwether (born August 10, 1947) is an American hedge fund executive. Education Meriwether earned an undergraduate degree from Northwestern University and an MBA degree from the University of Chicago Booth School of Business. Salomon Brothers After graduation, Meriwether moved to New York City, where he worked as a bond trader at Salomon Brothers. At Salomon, Meriwether rose to become the head of the domestic fixed income arbitrage group in the early 1980s and vice-chairman of the company in 1988. In 1991, Salomon was caught in a Treasury securities trading scandal perpetrated by a Meriwether subordinate, Paul Mozer. Meriwether was assessed $50,000 in civil penalties. LTCM Meriwether founded the Long-Term Capital Management hedge fund in Greenwich, Connecticut in 1994. Long-Term Capital Management collapsed in 1998. The books '' When Genius Failed: The Rise and Fall of Long-Term Capital Management'' and ''Inventing Money: The Story of Long-Term Capital Manageme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greg Hawkins

Gregory Dale Hawkins was a trader and principal in the hedge fund Long-Term Capital Management that after four spectacularly successful years lost most of its clients' money in 1998 when the Russian government defaulted on its debt payments on August 17, 1998, triggering a devaluation of the Russian ruble. Long-Term Capital had $4.6 billion in portfolio losses in a few months and only avoided outright bankruptcy because the U.S. central bank prompted a consortium of large global investment banks and counter-parties of LTCM to provide an equity bailout. LTCM shutdown in early 2000. Hawkins lives in New Rochelle in Westchester County, New York. Early life Hawkins earned an S.B. in economics from MIT in 1976 and a Ph.D. in management from the MIT Sloan School of Management in 1982. Career On 27 February 2008, Hawkins was put in control of Risk Oversight of Real Estate and Mortgage Exposure for Citibank. See also *1998 Russian financial crisis *Long-Term Capital Management Lo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Myron Scholes

Myron Samuel Scholes ( ; born July 1, 1941) is a Canadian- American financial economist. Scholes is the Frank E. Buck Professor of Finance, Emeritus, at the Stanford Graduate School of Business, Nobel Laureate in Economic Sciences, and co-originator of the Black–Scholes options pricing model. Scholes is currently the chairman of the Board of Economic Advisers of Stamos Capital Partners. Previously he served as the chairman of Platinum Grove Asset Management and on the Dimensional Fund Advisors board of directors, American Century Mutual Fund board of directors and the Cutwater Advisory Board. He was a principal and limited partner at Long-Term Capital Management and a managing director at Salomon Brothers. Other positions Scholes held include the Edward Eagle Brown Professor of Finance at the University of Chicago, senior research fellow at the Hoover Institution, director of the Center for Research in Security Prices, and professor of finance at MIT's Sloan School of Managem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

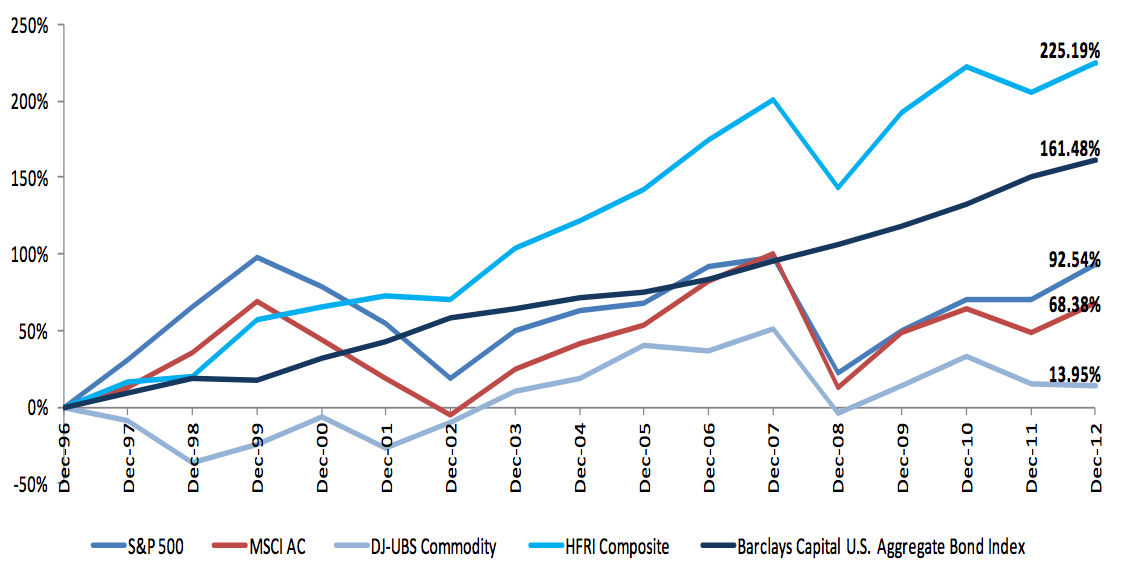

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black–Scholes Model

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a ''unique'' price given the risk of the security and its expected return (instead replacing the security's expected return with the risk-neutral rate). The equation and model are named after economists Fischer Black and Myron Scholes; Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited. The main principle behind the model is to hedge the option by buying and selling the underlying asset in a specific way to eliminate risk. This type of hedging is called "continuously revised delta hedging" and is the basis of more complicated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. First nominated to the Federal Reserve by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor. Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a "rock star". Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts. Many have argued that the "easy-money" poli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David W

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, Dav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stanford University

Stanford University, officially Leland Stanford Junior University, is a Private university, private research university in Stanford, California. The campus occupies , among the largest in the United States, and enrolls over 17,000 students. Stanford is considered among the most prestigious universities in the world. Stanford was founded in 1885 by Leland Stanford, Leland and Jane Stanford in memory of their only child, Leland Stanford Jr., who had died of typhoid fever at age 15 the previous year. Leland Stanford was a List of United States senators from California, U.S. senator and former List of governors of California, governor of California who made his fortune as a Big Four (Central Pacific Railroad), railroad tycoon. The school admitted its first students on October 1, 1891, as a Mixed-sex education, coeducational and non-denominational institution. Stanford University struggled financially after the death of Leland Stanford in 1893 and again after much of the campus was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recapitalization

Recapitalization is a type of corporate reorganization involving substantial change in a company's capital structure. Recapitalization may be motivated by a number of reasons. Usually, the large part of equity is replaced with debt or vice versa. In more complicated transactions, mezzanine financing and other hybrid securities are involved. Leveraged recapitalization One example of recapitalization is a leveraged recapitalization in which the company issues bonds to raise money and then buys back its own shares. Usually, current shareholders retain control. The reasons for such a recapitalization include: * Desire of current shareholders to partially exit the investment * Providing support of falling share price * Disciplining the company that has excessive cash * Protection from a hostile takeover * Rebalancing positions within a holding company * Help to improve the stock of the company during a time of poor economic conditions Leveraged buyout Another example is a leveraged b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of higher learning in the United States and one of the most prestigious and highly ranked universities in the world. The university is composed of ten academic faculties plus Harvard Radcliffe Institute. The Faculty of Arts and Sciences offers study in a wide range of undergraduate and graduate academic disciplines, and other faculties offer only graduate degrees, including professional degrees. Harvard has three main campuses: the Cambridge campus centered on Harvard Yard; an adjoining campus immediately across Charles River in the Allston neighborhood of Boston; and the medical campus in Boston's Longwood Medical Area. Harvard's endowment is valued at $50.9 billion, making it the wealthiest academic institution in the world. Endo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |