|

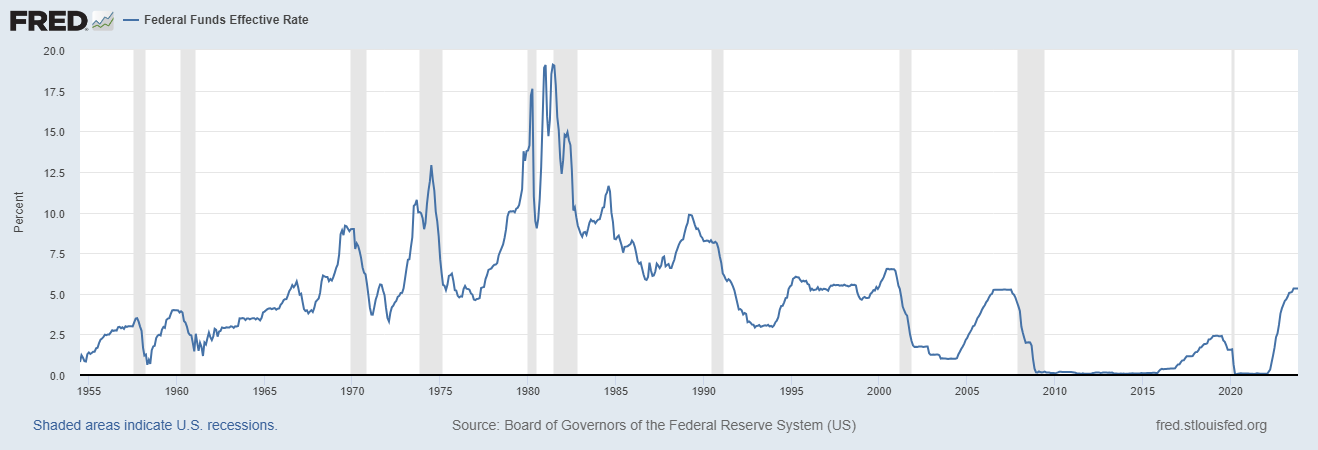

History Of Federal Open Market Committee Actions

This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the sale of treasury securities. The Federal Open Market Committee meets every two months during the fiscal year. At scheduled meetings, the FOMC meets and makes any changes it sees as necessary, notably to the federal funds rate and the discount rate. The committee may also take actions with a less firm target, such as an increasing liquidity by the sale of a set amount of Treasury bonds, or affecting the price of currencies both foreign and domestic by selling dollar reserves (such as during the Mexican peso bailout in 1994). Jerome Powell is the current chairperson of the Federal Reserve and the FOMC. Famous actions Operation Twist (1961) The Federal Open Market Committee action known as Operation Twist (named for the twist dance craze of the time) began in 1961. The intent was to flatten the yield curve in order to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Federal Funds Rate History And Recessions

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states *Federal republic, a federation which is a republic *Federalism, a political philosophy *Federalist, a political belief or member of a political grouping * Federalization, implementation of federalism Particular governments *Government of Argentina *Government of Australia *Federal government of Brazil *Government of Canada *Cabinet of Germany *Federal government of Iraq *Government of India *Federal government of Mexico *Federal government of Nigeria *Government of Pakistan *Government of the Philippines *Government of Russia *Government of South Africa *Federal government of the United States **United States federal law **United States federal courts *Federal gove ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Franco Modigliani

Franco Modigliani (; ; 18 June 1918 – 25 September 2003) was an Italian-American economist and the recipient of the 1985 Nobel Memorial Prize in Economics. He was a professor at University of Illinois at Urbana–Champaign, Carnegie Mellon University, and MIT Sloan School of Management. Early life and education Modigliani was born on 18 June 1918 in Rome to the Jewish family of a pediatrician father and a voluntary social worker mother."Franco Modigliani" by Daniel B. Klein and Ryan Daza, inThe Ideological Migration of the Economics Laureates, '' Econ Journal Watch'', 10(3), September 2013, pp. 472–293 He entered university at the age of seventeen, enrolling in the faculty of Law at the Sapienza University of Rome.Parisi, Daniela (2005) "Five Italian Articles Written by the Young Franco Modigliani (1937–1938)", ''Rivista Internazional di Scienze Sociali'', 113(4), pp. 555–557 (in language) In his second year at Sapienza, his submission to a nationwide contest in econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Open Market Operation

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the open market or enter into a repurchase agreement or secured lending transaction with a commercial bank. The latter option, often preferred by central banks, involves them making fixed period deposits at commercial banks with the security of eligible assets as collateral. Central banks regularly use OMOs as one of their tools for implementing monetary policy. A frequent aim of open market operations is — aside from supplying commercial banks with liquidity and sometimes taking surplus liquidity from commercial banks — to influence the short-term interest rate. Open market operations have become less prominent in this respect since the 2008 financial crisis, however, as many central banks have changed their monetary policy implementation to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Federal Open Market Committee

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System (the Fed) that is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treasury securities). This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks were authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC. The FOMC is the principal organ of United States national monetary policy. The Committee sets monetary policy by specifying the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

System Open Market Account

The System Open Market Account (SOMA) is a securities portfolio managed by the Federal Reserve Bank of New York, that holds the assets it has purchased through open market operations (OMOs) in the course of carrying out monetary policy. Through SOMA transactions, the Federal Reserve System influences interest rates and the amount of reserves in the US banking system. Income from SOMA assets also provides funding for the Federal Reserve's activities, which are not funded by Congress. The Federal Open Market Committee (FOMC) instructs the Reserve Bank of New York as to how it should use the SOMA to support monetary policy. Purpose SOMA's primary purpose is to assist the New York Fed in carrying out open market operations (OMOs) and foreign exchange interventions (the U.S. Treasury, in consultation with the Federal Reserve System, is responsible for setting U.S. exchange rate policy). The U.S. monetary authorities—the Treasury and the Fed—may intervene in the foreign exchange mark ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Mortgage-backed Security

A mortgage-backed security (MBS) is a type of asset-backed security (an " instrument") which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateral ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Government-sponsored Enterprise

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of Credit (finance), credit to targeted sectors of the economy, to make those segments of the capital market more efficient and transparent, and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors: agriculture, Home mortgage, home finance and Education loan, education. Well known GSEs are the Federal National Mortgage Association, known as Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac. Congress created the first GSE in 1916 with the creation of the Farm Credit System. It initiated GSEs in the home finance segment of the economy with the creation of the Federal Home Loan Banks in 1932; and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Fed Funds

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions. Transactions in the federal funds market enable depository institutions with reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. These loans are usually made for one day only, that is, "overnight". The interest rate at which these transactions occur is called the federal funds rate. Federal funds are not collateralized; like eurodollars, they are an unsecured interbank loan. Federal funds transactions by regulated financial institutions neither increase nor decrease total reserves in the banking system as a whole, instead, they redistribute reserves. Before 2008, this meant that otherwise idle funds could yield a return. (Since 2008, the Fed has paid i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chair of the Federal Reserve, chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s, with measures known as the ''Volcker shock''. He previously served as the List of presidents of the Federal Reserve Bank of New York, president of the Federal Reserve Bank of New York from 1975 to 1979. President Jimmy Carter nominated him to succeed G. William Miller as Fed chairman and President Ronald Reagan renominated him once. Volcker did not seek a third term at the Fed and was succeeded by Alan Greenspan. After his retirement from the Board, he chaired the Economic Recovery Advisory Board under President Barack Obama from 2009 to 2011 during the subprime mortgage crisis. Early life and education Volcker was born ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Central Bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and, in some cases, to enforce policies on financial consumer protection, and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence. Central banks in most developed nations are usually set up to be institutionally independent from political interference, even though governments typically have governance rights over them, legislative bodies exercise scrutiny, and central banks frequently do show resp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

The Brookings Institution

The Brookings Institution, often stylized as Brookings, is an American think tank that conducts research and education in the social sciences, primarily in economics (and tax policy), metropolitan policy, governance, foreign policy, global economy, and economic development. Brookings states that its staff "represent diverse points of view" and describes itself as nonpartisan. Media outlets have variously described Brookings as centrist, liberal, and center-left. The University of Pennsylvania's ''Global Go To Think Tank Index Report'' has named Brookings "Think Tank of the Year" and "Top Think Tank in the World" every year since 2008. History 20th century Brookings was founded in 1916 as the Institute for Government Research (IGR), with the mission of becoming "the first private organization devoted to analyzing public policy issues at the national level." The organization was founded on March 13, 1916, and began operations on October 1, 1916. Its stated mission is to "pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |