|

Carlyle Group

The Carlyle Group Inc. is an American multinational company with operations in private equity, alternative asset management and financial services. As of 2023, the company had $426 billion of assets under management. Carlyle specializes in private equity, real assets, and private credit. One of the world's largest investment firms, it ranked first among private equity firms by capital raised from 2010-2015, according to the PEI 300 index. In June 2024, it ranked sixth in Private Equity International's PEI 300 ranking among the world's largest private equity firms. Founded in 1987 in Washington, D.C., the company has nearly 2,200 employees in 28 offices on four continents . On May 3, 2012, Carlyle completed a million initial public offering and began trading on the NASDAQ stock exchange. History Founding and early history Carlyle was founded in 1987 as a boutique investment bank by five partners with backgrounds in finance and government: William E. Conway Jr., ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Finance

Structured finance is a sector of finance — specifically financial law — that manages Leverage (finance), leverage and Financial risk, risk. Strategies may involve legal and corporate restructuring, off balance sheet accounting, or the use of financial instruments. Securitization provides $15.6 trillion in financing and funded more than 50% of U.S. household debt last year. Through securitization and structured finance, more families, individuals, and businesses have access to essential credit, seamlessly and at a lower price. With more than 370 member institutions, the Structured Finance Association (SFA) is the leading trade association for the structured finance industry. SFA’s purpose is to help its members and public policymakers grow credit availability and the real economy in a responsible manner. ISDA conducted market surveys of its Primary Membership to provide a summary of the notional amount outstanding of interest rate, credit, and equity derivatives, until 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Boutique Investment Bank

A boutique investment bank is an investment bank that specializes in at least one aspect of investment banking, generally corporate finance, although some banks' strengths are retail in nature, such as Charles Schwab. Of those involved in corporate finance, capital raising, mergers and acquisitions and restructuring and reorganizations are their primary activities. Boutiques usually provide advisory and consulting services, but lack capacity to provide funding. After the Gramm–Leach–Bliley Act, investment banks have either had a retail deposit base (JPMorgan Chase, Citi, Bank of America) or have had funding from overseas owners or from Wealth Management arms ( UBS, Deutsche Bank, Morgan Stanley). Boutique banks on the other hand often turn to other banks to provide funding or deal directly with capital rich firms such as insurers to provide capital for deals. Boutique investment banks generally work on smaller deals involving middle-market companies, and usually assist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

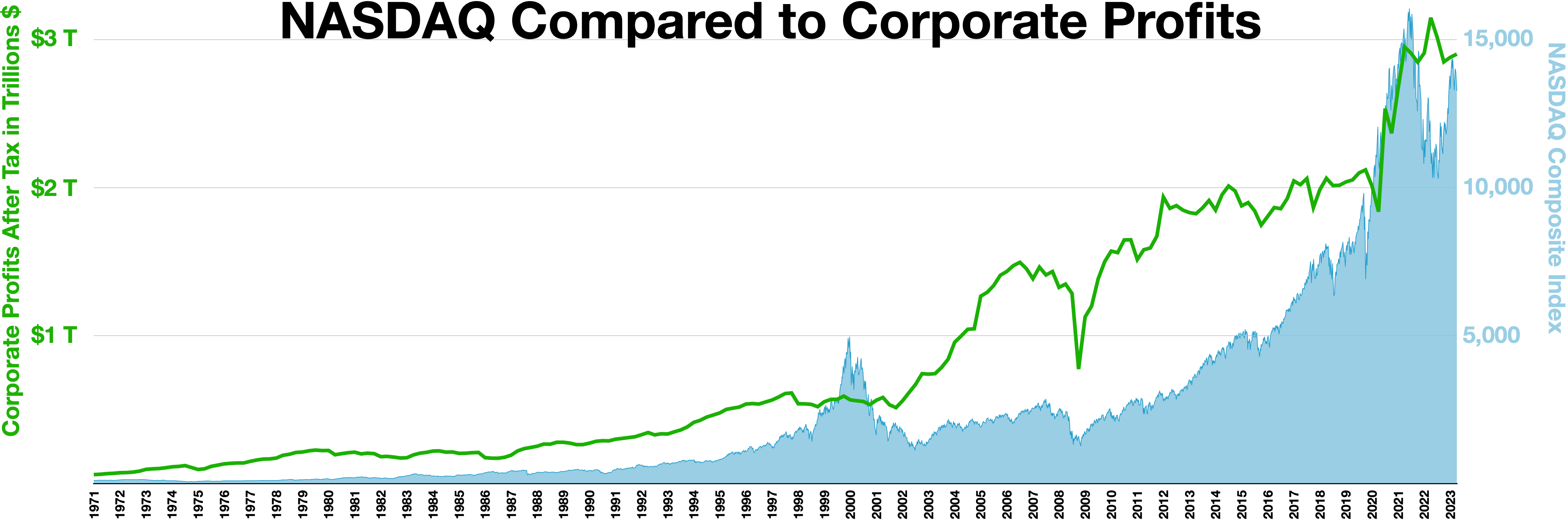

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity International

''Private Equity International'' (PEI) is a global insight, analysis and data provider for the private equity industry, with a core focus on the relationship between investors and fund managers: the LP- GP nexus. Launched in December 2001, the title's website and printed magazines cover the people, funds, capital providers and financial trends shaping the private equity industry with an integrated team of specialist journalists and researchers in London, Hong Kong and New York. As demand for private equity in institutional portfolios continues to grow around the world, PEI aims to deliver private equity-focused professionals a comprehensive offering of proprietary data, authoritative analysis and context around industry issues and best practice. It is known for its annual ranking of the industry's largest private equity groups, the PEI 300, which measures firms by capital raised ("dry powder" in industry terms) over a 5-year period. The first PEI ranking of private equity groups ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PEI 300

Below is a list of notable private equity firms. Largest private equity firms by PE capital raised Each year Private Equity International publishes the PEI 300, a ranking of the largest private-equity firms by how much capital they have raised for private-equity investment in the last five years. In the 2025 ranking, KKR regained the top spot from Blackstone Inc. who fell to third, behind EQT AB. List of investment banking private equity groups ^ Defunct banking institution Notable private equity firms Americas * 3G Capital * ABS Capital * Adams Street Partners * Advent International * AEA Investors * American Securities * Angelo, Gordon & Co. * Apollo Global Management * Ares Management * Arlington Capital Partners * Auldbrass Partners * Avenue Capital Group * Avista Capital Partners * Bain Capital * BDT & MSD Partners * Berkshire Partners * Blackstone Group * Blue Owl Capital * Blum Capital * Brentwood Associates * Bruckmann, Rosser, Sherr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Credit

Private credit is an asset defined by non-bank lending where the debt is not issued or traded on the public markets. "Private credit" can also be referred to as " direct lending" or " private lending". It is a subset of "alternative credit". Estimations of the global private credit industry's size vary; as of April 2024, the International Monetary Fund claims it is just over $2 trillion, while JPMorgan claims it to be $3.14 trillion. The private credit market has shifted away from banks in recent decades. In 1994, U.S. bank underwriting covered over 70 percent of middle market loans. By 2020, U.S. banks issued/held around 10 percent of middle market loans. The direct lending market expanded rapidly after the 2008 financial crisis, when the SEC tightened restrictions and capital requirements on public banks. As banks decreased their lending activity, nonbank lenders took their place to address the continued demand for debt financing from corporate borrowers. Private credit has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Assets

Real assets is an investment asset class that covers investments in physical assets such as real estate, energy, and infrastructure. Real assets have an inherent physical worth. Real assets differ from financial assets in that financial assets get their value from a contractual right and are typically intangible. Real assets are categorized into three categories: * Real Estate: REITs, commercial real estate, and residential * Natural Resources: Energy, Oil & gas, MLPs, timber, agriculture, solar, mining, and commodities *Infrastructure: Transportation (roads, airports, railroads), utilities, telecommunications infrastructure Real assets are appealing to investors for four reasons: high current income, inflation protection / equity appreciation, low correlation to equity markets, and favorable tax treatment. Background Investing in real assets has existed since the advent of property ownership. However, public investment only began in 1965, when the first publicly traded REIT ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services

Financial services are service (economics), economic services tied to finance provided by financial institutions. Financial services encompass a broad range of tertiary sector of the economy, service sector activities, especially as concerns financial management and consumer finance. The finance industry in its most common sense concerns commercial banks that provide market liquidity, derivative (finance), risk instruments, and broker, brokerage for large public company, public companies and multinational corporations at a macroeconomics, macroeconomic scale that impacts domestic politics and foreign relations. The extragovernmental power and scale of the finance industry remains an ongoing controversy in many industrialized Western economies, as seen in the American Occupy Wall Street civil protest movement of 2011. Styles of financial institution include credit union, bank, savings and loan association, trust company, building society, brokerage firm, payment processor, many ty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Management

Asset management is a systematic approach to the governance and realization of all value for which a group or entity is responsible. It may apply both to tangible assets (physical objects such as complex process or manufacturing plants, infrastructure, buildings or equipment) and to intangible assets (such as intellectual property, goodwill or financial assets). Asset management is a systematic process of developing, operating, maintaining, upgrading, and disposing of assets in the most cost-effective manner (including all costs, risks, and performance attributes). Theory of asset management primarily deals with the periodic matter of improving, maintaining or in other circumstances assuring the economic and capital value of an asset over time. The term is commonly used in engineering, the business world, and public infrastructure sectors to ensure a coordinated approach to the optimization of costs, risks, service/performance, and sustainability. The term has traditionally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |