|

Arrow–Debreu Security

In financial economics, a state-price security, also called an Arrow–Debreu security (from its origins in the Arrow–Debreu model), a pure security, or a primitive security is a contract that agrees to pay one unit of a numeraire (a currency or a commodity) if a particular state occurs at a particular time in the future and pays zero numeraire in all the other states. The price of this security is the state price of this particular state of the world. The state price vector is the vector of state prices for all states. See . An Arrow security is an instrument with a fixed payout of one unit in a specified state and no payout in other states. It is a type of hypothetical asset used in the Arrow market structure model. In contrast to the Arrow-Debreu market structure model, an Arrow market is a market in which the individual agents engage in trading assets at every time period t. In an Arrow-Debreu model, trading occurs only once at the beginning of time. An Arrow Security ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade".William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus:Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing and corporate finance; the first being the perspective of providers of Financial capital, capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama and Miller (1972), ''The Theory of Finance'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings. * In a normative context, utility refers to a goal or objective that we wish to maximize, i.e., an objective function. This kind of utility bears a closer resemblance to the original utilitarian concept, developed by moral philosophers such as Jeremy Bentham and John Stuart Mill. * In a descriptive context, the term refers to an ''apparent'' objective function; such a function is revealed by a person's behavior, and specifically by their preferences over lotteries, which can be any quantified choice. The relationship between these two kinds of utility functions has been a source of controversy among both economists and ethicists, with most maintaining that the two are distinct but generally related. Utility function Consider a set of alternatives among which a person has a preference ordering. A utility fu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. Modern portfolio theory initiated by Harry Markowitz in 1952 under his thesis titled "Portfolio Selection" is the discipline and study which pertains to managing market and financial risk. In modern portfolio theory, the variance (or standard deviation In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean ( ...) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorith ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Pricing

In financial economics, asset pricing refers to a formal treatment and development of two interrelated Price, pricing principles, outlined below, together with the resultant models. There have been many models developed for different situations, but correspondingly, these stem from either General equilibrium theory, general equilibrium asset pricing or Rational pricing, rational asset pricing, the latter corresponding to risk neutral pricing. Investment theory, which is near synonymous, encompasses the body of knowledge used to support the decision-making process of choosing investments, and the asset pricing models are then applied in determining the Required rate of return, asset-specific required rate of return on the investment in question, and for hedging. General equilibrium asset pricing Under general equilibrium theory prices are determined through Market price, market pricing by supply and demand. See, e.g., Tim Bollerslev (2019)"Risk and Return in Equilibrium: The C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Discount Factor

The concept of the stochastic discount factor (SDF) is used in financial economics and mathematical finance. The name derives from the price of an asset being computable by "discounting" the future cash flow \tilde_i by the stochastic factor \tilde, and then taking the expectation. This definition is of fundamental importance in asset pricing. If there are ''n'' assets with initial prices p_1, \ldots, p_n at the beginning of a period and payoffs \tilde_1, \ldots, \tilde_n at the end of the period (all ''x''s are random (stochastic) variables), then SDF is any random variable \tilde satisfying :E(\tilde\tilde_i) = p_i, \text i=1,\ldots,n. The stochastic discount factor is sometimes referred to as the pricing kernel as, if the expectation E(\tilde\,\tilde_i) is written as an integral, then \tilde can be interpreted as the kernel function in an integral transform. Other names sometimes used for the SDF are the "marginal rate of substitution" (the ratio of utility of states, when ut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incomplete Markets

In economics, incomplete markets are markets in which there does not exist an Arrow–Debreu security for every possible state of nature. In contrast with complete markets, this shortage of securities will likely restrict individuals from transferring the desired level of wealth among states. An Arrow security purchased or sold at date ''t'' is a contract promising to deliver one unit of income in one of the possible contingencies which can occur at date ''t'' + 1. If at each date-event there exists a complete set of such contracts, one for each contingency that can occur at the following date, individuals will trade these contracts in order to insure against future risks, targeting a desirable and budget feasible level of consumption in each state (i.e. consumption smoothing). In most set ups when these contracts are not available, optimal risk sharing between agents will not be possible. For this scenario, agents (homeowners, workers, firms, investors, etc.) will lack the instru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complete Market

In economics, a complete market (aka Arrow-Debreu market or complete system of markets) is a market with two conditions: # Negligible transaction costs and therefore also perfect information, # Every asset in every possible state of the world has a price. In such a market, the complete set of possible bets on future states of the world can be constructed with existing assets without friction. Here, goods are state-contingent; that is, a good includes the time and state of the world in which it is consumed. For instance, an umbrella tomorrow if it rains is a distinct good from an umbrella tomorrow if it is clear. The study of complete markets is central to state-preference theory. The theory can be traced to the work of Kenneth Arrow (1964), Gérard Debreu Gérard Debreu (; 4 July 1921 – 31 December 2004) was a French-born economist and mathematician. Best known as a professor of economics at the University of California, Berkeley, where he began work in 1962, he won the 198 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Pricing

In financial economics, asset pricing refers to a formal treatment and development of two interrelated Price, pricing principles, outlined below, together with the resultant models. There have been many models developed for different situations, but correspondingly, these stem from either General equilibrium theory, general equilibrium asset pricing or Rational pricing, rational asset pricing, the latter corresponding to risk neutral pricing. Investment theory, which is near synonymous, encompasses the body of knowledge used to support the decision-making process of choosing investments, and the asset pricing models are then applied in determining the Required rate of return, asset-specific required rate of return on the investment in question, and for hedging. General equilibrium asset pricing Under general equilibrium theory prices are determined through Market price, market pricing by supply and demand. See, e.g., Tim Bollerslev (2019)"Risk and Return in Equilibrium: The C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Price Density

State most commonly refers to: * State (polity), a centralized political organization that regulates law and society within a territory **Sovereign state, a sovereign polity in international law, commonly referred to as a country **Nation state, a state where the majority identify with a single nation (with shared culture or ethnic group) ** Constituent state, a political subdivision of a state ** Federated state, constituent states part of a federation *** U.S. state * State of nature, a concept within philosophy that describes the way humans acted before forming societies or civilizations State may also refer to: Arts, entertainment, and media Literature * '' State Magazine'', a monthly magazine published by the U.S. Department of State * ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States * '' Our State'', a monthly magazine published in North Carolina and formerly called ''The State'' * The State (Larry Niven), a fictional future governme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Integration (mathematics)

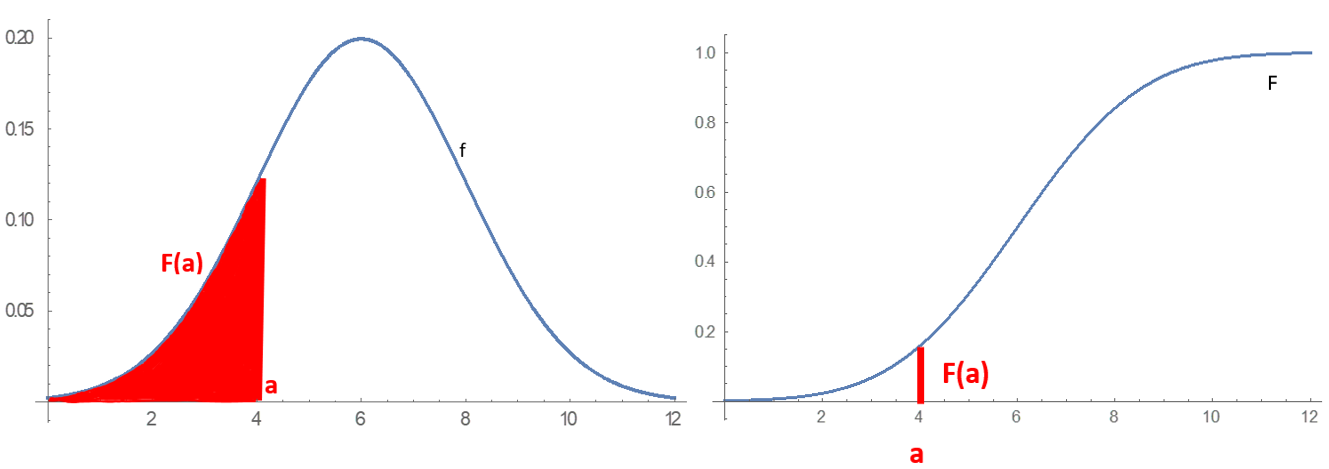

In mathematics, an integral is the continuous analog of a sum, which is used to calculate areas, volumes, and their generalizations. Integration, the process of computing an integral, is one of the two fundamental operations of calculus,Integral calculus is a very well established mathematical discipline for which there are many sources. See and , for example. the other being differentiation. Integration was initially used to solve problems in mathematics and physics, such as finding the area under a curve, or determining displacement from velocity. Usage of integration expanded to a wide variety of scientific fields thereafter. A definite integral computes the signed area of the region in the plane that is bounded by the graph of a given function between two points in the real line. Conventionally, areas above the horizontal axis of the plane are positive while areas below are negative. Integrals also refer to the concept of an ''antiderivative'', a function whose deri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Continuous Random Variable

In probability theory and statistics, a probability distribution is a function that gives the probabilities of occurrence of possible events for an experiment. It is a mathematical description of a random phenomenon in terms of its sample space and the probabilities of events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A probability distribution is a mathematical description of the probabilities of events, subsets of the sample space. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rational Expectations

Rational expectations is an economic theory that seeks to infer the macroeconomic consequences of individuals' decisions based on all available knowledge. It assumes that individuals' actions are based on the best available economic theory and information. History The concept of rational expectations was first introduced by John F. Muth in his paper "Rational Expectations and the Theory of Price Movements" published in 1961. Robert Lucas and Thomas Sargent further developed the theory in the 1970s and 1980s which became seminal works on the topic and were widely used in microeconomics. Significant Findings Muth’s work introduces the concept of rational expectations and discusses its implications for economic theory. He argues that individuals are rational and use all available information to make unbiased, informed predictions about the future. This means that individuals do not make systematic errors in their predictions and that their predictions are not biased by past er ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |