Tax Policy and Economic Inequality in the United States on:

[Wikipedia]

[Google]

[Amazon]

Tax policy and economic inequality in the United States discusses how tax policy affects the distribution of income and wealth in the United States. Income inequality can be measured before- and after-tax; this article focuses on the after-tax aspects. Income tax rates applied to various income levels and tax expenditures (i.e., deductions, exemptions, and preferential rates that modify the outcome of the rate structure) primarily drive how market results are redistributed to impact the after-tax inequality. After-tax inequality has risen in the United States markedly since 1980, following a more egalitarian period following World War II.

Tax policy is the mechanism through which market results are redistributed, affecting after-tax inequality. The provisions of the

Tax policy is the mechanism through which market results are redistributed, affecting after-tax inequality. The provisions of the

Timothy Noah , tnr.com, January 13, 2012 unjust, a danger to democracy/social stability,

By PAUL KRUGMAN. 3 November 2011 and a sign of national decline."The Broken Contract", By George Packer, ''

/ref> The top marginal income tax rate had been 91% since 1946 and had not been below 70% since 1936. The "

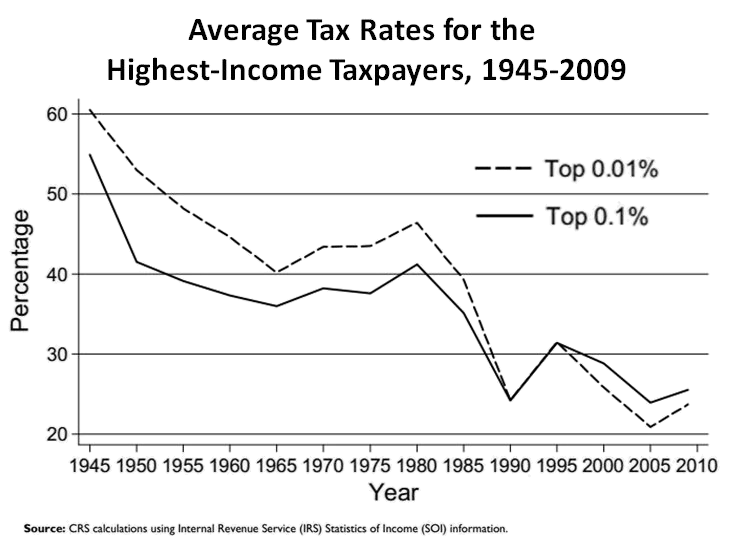

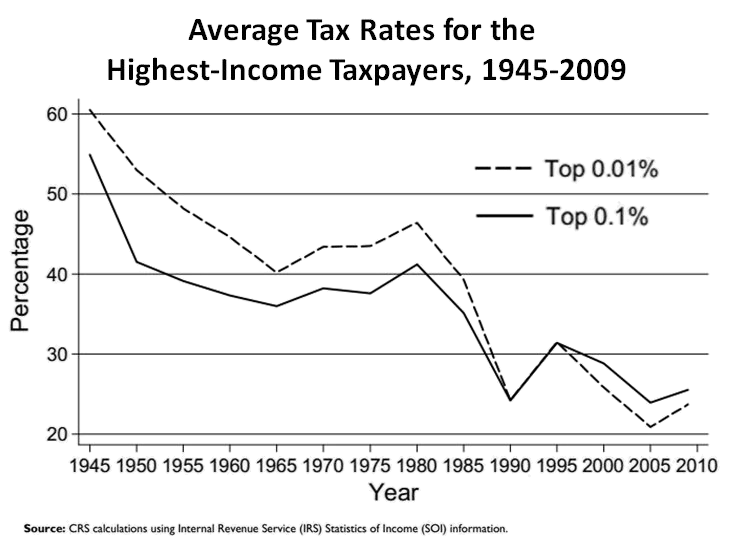

Ronald Reagan made very large reductions in the nominal marginal income tax rates with his Tax Reform Act of 1986, which did not make a similarly large reduction in the effective tax rate on marginal incomes. Noah writes in his ten part series entitled "The Great Divergence," that "in 1979, the effective tax rate on the top 0.01 percent was 42.9 percent, according to the Congressional Budget Office, but by Reagan's last year in office it was 32.2%." This effective rate held steadily until the first few years of the Clinton presidency when it increased to a peak high of 41%. However, it fell back down to the low 30s by his second term in the White House. This percentage reduction in the effective marginal income tax rate for the wealthiest Americans, 9%, is not a very large decrease in their tax burden, according to Noah, especially in comparison to the 20% drop in nominal rates from 1980 to 1981 and the 15% drop in nominal rates from 1986 to 1987. In addition to this small reduction on the income taxes of the wealthiest taxpayers in America, Noah discovered that the effective income tax burden for the bottom 20% of wage earners was 8% in 1979 and dropped to 6.4% under the Clinton Administration. This effective rate further dropped under the George W. Bush Administration. Under Bush, the rate decreased from 6.4% to 4.3%. Reductions in the effective income tax burden on the poor coinciding with modest reductions in the effective income tax rate on the wealthiest 0.01% of tax payers could not have been the driving cause of increased income inequality that began in the 1980s. These figures are similar to an analysis of effective federal tax rates from 1979-2005 by the

Ronald Reagan made very large reductions in the nominal marginal income tax rates with his Tax Reform Act of 1986, which did not make a similarly large reduction in the effective tax rate on marginal incomes. Noah writes in his ten part series entitled "The Great Divergence," that "in 1979, the effective tax rate on the top 0.01 percent was 42.9 percent, according to the Congressional Budget Office, but by Reagan's last year in office it was 32.2%." This effective rate held steadily until the first few years of the Clinton presidency when it increased to a peak high of 41%. However, it fell back down to the low 30s by his second term in the White House. This percentage reduction in the effective marginal income tax rate for the wealthiest Americans, 9%, is not a very large decrease in their tax burden, according to Noah, especially in comparison to the 20% drop in nominal rates from 1980 to 1981 and the 15% drop in nominal rates from 1986 to 1987. In addition to this small reduction on the income taxes of the wealthiest taxpayers in America, Noah discovered that the effective income tax burden for the bottom 20% of wage earners was 8% in 1979 and dropped to 6.4% under the Clinton Administration. This effective rate further dropped under the George W. Bush Administration. Under Bush, the rate decreased from 6.4% to 4.3%. Reductions in the effective income tax burden on the poor coinciding with modest reductions in the effective income tax rate on the wealthiest 0.01% of tax payers could not have been the driving cause of increased income inequality that began in the 1980s. These figures are similar to an analysis of effective federal tax rates from 1979-2005 by the

Capital gains are profits from investments in capital assets such as bonds, stocks, and real estate. These gains are taxed, for individuals, as ordinary income when held for less than one year which means that they have the same marginal tax rate as the marginal income tax rate of their recipient. This is known as the capital gains tax rate on a short-term capital gains. Accordingly, the capital gains tax rate for short-term capital gains paid by an individual is equal to the marginal income tax rate of that individual. The tax rate then decreases once the capital gain becomes a long-term capital gain, or is held for 1 year or more.

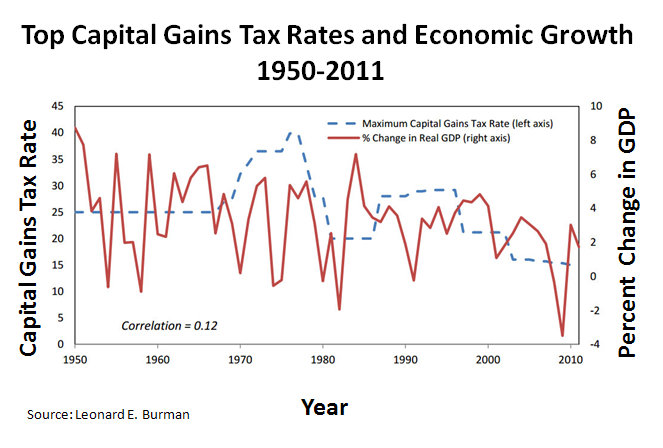

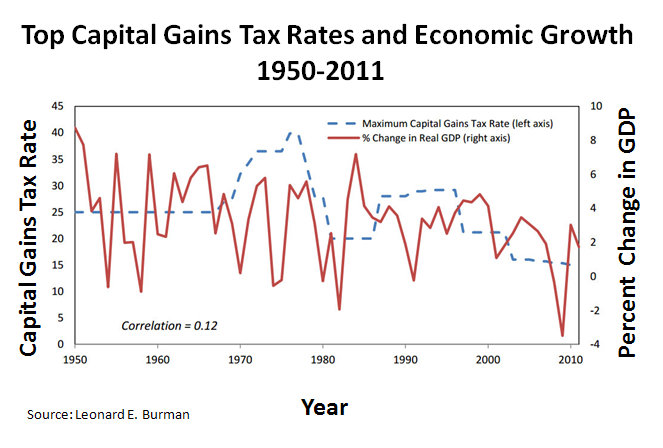

In 1964, the effective capital gains tax rate was 25%. This means that the actual tax percentage of all capital gains realized in the U.S. in 1964 was 25% as opposed to the nominal capital gains tax rate, or the percentage that would have been collected by the government prior to deductions and evasions. This effective rate held constant until a small rise in 1968 up to 26.9% and then began steadily increasing until it peaked at 39.875% in 1978. This top rate then fell to 28% in 1979 and further dropped to 20% in 1982. This top capital gains rate held until 1986 when the Tax Reform Act of 1986 re-raised it to 28% and 33% for all individuals subject to phase-outs. The Tax Reform Act of 1986 shifted capital gains to income for the first time thus establishing equal short-term capital gains taxes and marginal income tax rates. The top rate of 28%, not taking into account taxpayers under the stipulations of a phase-out, remained until 1997, despite increases in marginal income tax rates, when it was lowered to 28%. Starting in May 1997, however, long-term capital gains were divided into multiple subgroups based on the duration of time investors held them. Each new subgroup had a different tax rate. This effectively reduced the top capital gains tax rate on a long-term capital good held for over 1 year from 28% to 20%. These multiple subgroups were reorganized into less than one year, one to five years, and five years or more and were in place from 1998 to 2003. In 2003, the divisions reverted to the less than one year and more than one year categories until 2011 when then reverted to the three divisions first implemented in 1998. This rate, 20%, remained until 2003 when it was further reduced to 15%. The 15% long-term capital gains tax rate was then changed back to its 1997 rate of 20% in 2011. Capital gains taxes for the bottom two and top two income tax brackets have changed significantly since the late 1980s. The short-term and long-term capital gains tax rates for the bottom two tax rates, 15% and 28%, respectively, were equal to those tax payers' marginal income tax rates from 1988 until 1997. In 1997, the capital gains tax rates for the bottom two income tax brackets were reduced to 10% and 20% for the 15% and 28% income tax brackets, respectively. These rates remained until 2001. President Bush made additional changes to the capital gains tax rates for the bottom two income tax brackets in 2001, which were lowered from 15% and 28% to 10% and 15%, respectively, by lowering the tax on long-term capital gains held for more than five years from 10% to 8%. He also reduced the tax on short-term capital gains from 28% to 15% for the 15% tax bracket as well as lowered the tax on long-term capital goods from 20% to 10%. In 2003, the capital gains tax on long-term capital goods decreased from 10% to 5% for both of the bottom two tax brackets (10% and 15%). In 2008, these same rates were dropped to 0% but were restored to the 2003 rates in 2011 under President Obama via the extension of the Bush Tax Cuts.

Overall, capital gains tax rates decreased significantly for both the bottom two and the top two income tax brackets. The top two income tax brackets have had a net decrease in their long-term capital gains tax rates of 13% since 1988, while the lowest two income tax brackets' long-term capital gains tax rates have changed by 10% and 13%, respectively, in that time. The difference between income and long-term capital gains taxes for the top two income tax brackets (5% in 1988 and 18% and 20%, respectively, in 2011), however, is larger than the difference between the income and long-term capital gains tax rates for the bottom two income tax brackets (0% in 1988 and 5% and 10%, respectively, in 2011). As of the 2013 tax year, all investment income for high earning households will be subject to a 3.8% surtax bringing the top capital gains rate to 23.8%.

Capital gains are profits from investments in capital assets such as bonds, stocks, and real estate. These gains are taxed, for individuals, as ordinary income when held for less than one year which means that they have the same marginal tax rate as the marginal income tax rate of their recipient. This is known as the capital gains tax rate on a short-term capital gains. Accordingly, the capital gains tax rate for short-term capital gains paid by an individual is equal to the marginal income tax rate of that individual. The tax rate then decreases once the capital gain becomes a long-term capital gain, or is held for 1 year or more.

In 1964, the effective capital gains tax rate was 25%. This means that the actual tax percentage of all capital gains realized in the U.S. in 1964 was 25% as opposed to the nominal capital gains tax rate, or the percentage that would have been collected by the government prior to deductions and evasions. This effective rate held constant until a small rise in 1968 up to 26.9% and then began steadily increasing until it peaked at 39.875% in 1978. This top rate then fell to 28% in 1979 and further dropped to 20% in 1982. This top capital gains rate held until 1986 when the Tax Reform Act of 1986 re-raised it to 28% and 33% for all individuals subject to phase-outs. The Tax Reform Act of 1986 shifted capital gains to income for the first time thus establishing equal short-term capital gains taxes and marginal income tax rates. The top rate of 28%, not taking into account taxpayers under the stipulations of a phase-out, remained until 1997, despite increases in marginal income tax rates, when it was lowered to 28%. Starting in May 1997, however, long-term capital gains were divided into multiple subgroups based on the duration of time investors held them. Each new subgroup had a different tax rate. This effectively reduced the top capital gains tax rate on a long-term capital good held for over 1 year from 28% to 20%. These multiple subgroups were reorganized into less than one year, one to five years, and five years or more and were in place from 1998 to 2003. In 2003, the divisions reverted to the less than one year and more than one year categories until 2011 when then reverted to the three divisions first implemented in 1998. This rate, 20%, remained until 2003 when it was further reduced to 15%. The 15% long-term capital gains tax rate was then changed back to its 1997 rate of 20% in 2011. Capital gains taxes for the bottom two and top two income tax brackets have changed significantly since the late 1980s. The short-term and long-term capital gains tax rates for the bottom two tax rates, 15% and 28%, respectively, were equal to those tax payers' marginal income tax rates from 1988 until 1997. In 1997, the capital gains tax rates for the bottom two income tax brackets were reduced to 10% and 20% for the 15% and 28% income tax brackets, respectively. These rates remained until 2001. President Bush made additional changes to the capital gains tax rates for the bottom two income tax brackets in 2001, which were lowered from 15% and 28% to 10% and 15%, respectively, by lowering the tax on long-term capital gains held for more than five years from 10% to 8%. He also reduced the tax on short-term capital gains from 28% to 15% for the 15% tax bracket as well as lowered the tax on long-term capital goods from 20% to 10%. In 2003, the capital gains tax on long-term capital goods decreased from 10% to 5% for both of the bottom two tax brackets (10% and 15%). In 2008, these same rates were dropped to 0% but were restored to the 2003 rates in 2011 under President Obama via the extension of the Bush Tax Cuts.

Overall, capital gains tax rates decreased significantly for both the bottom two and the top two income tax brackets. The top two income tax brackets have had a net decrease in their long-term capital gains tax rates of 13% since 1988, while the lowest two income tax brackets' long-term capital gains tax rates have changed by 10% and 13%, respectively, in that time. The difference between income and long-term capital gains taxes for the top two income tax brackets (5% in 1988 and 18% and 20%, respectively, in 2011), however, is larger than the difference between the income and long-term capital gains tax rates for the bottom two income tax brackets (0% in 1988 and 5% and 10%, respectively, in 2011). As of the 2013 tax year, all investment income for high earning households will be subject to a 3.8% surtax bringing the top capital gains rate to 23.8%.

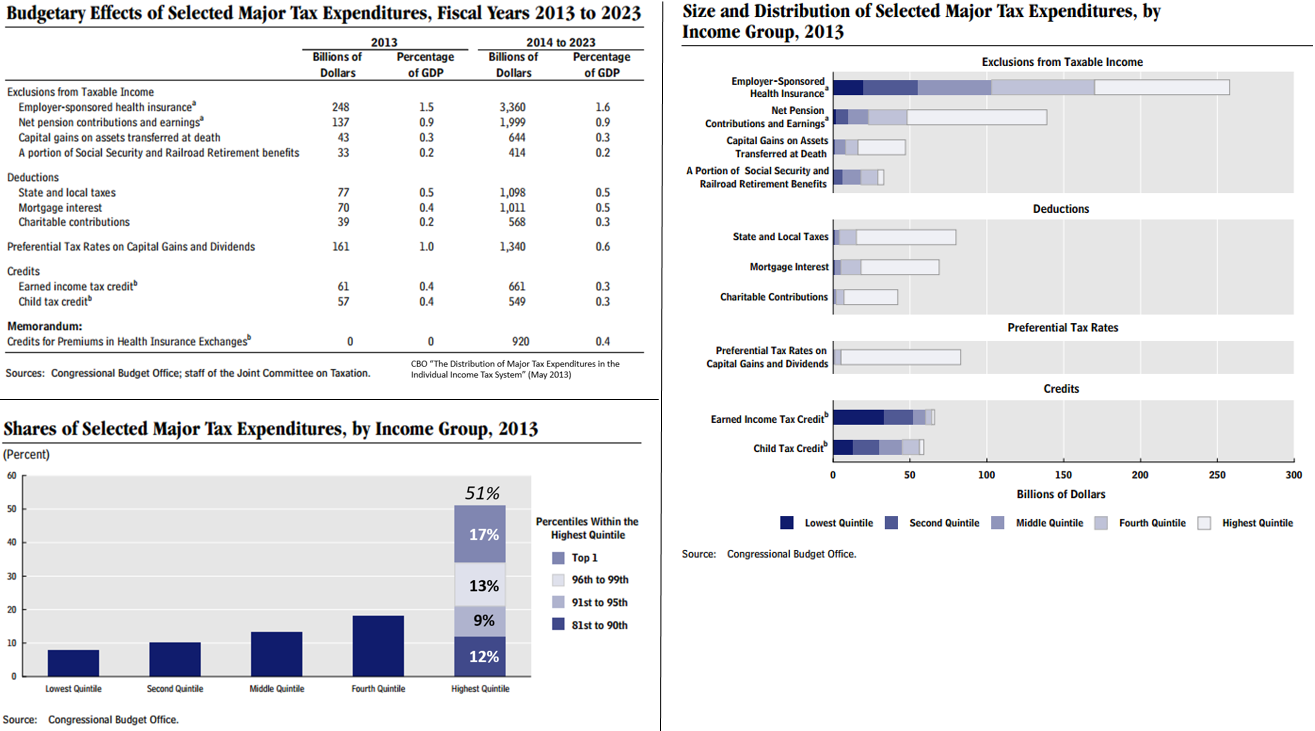

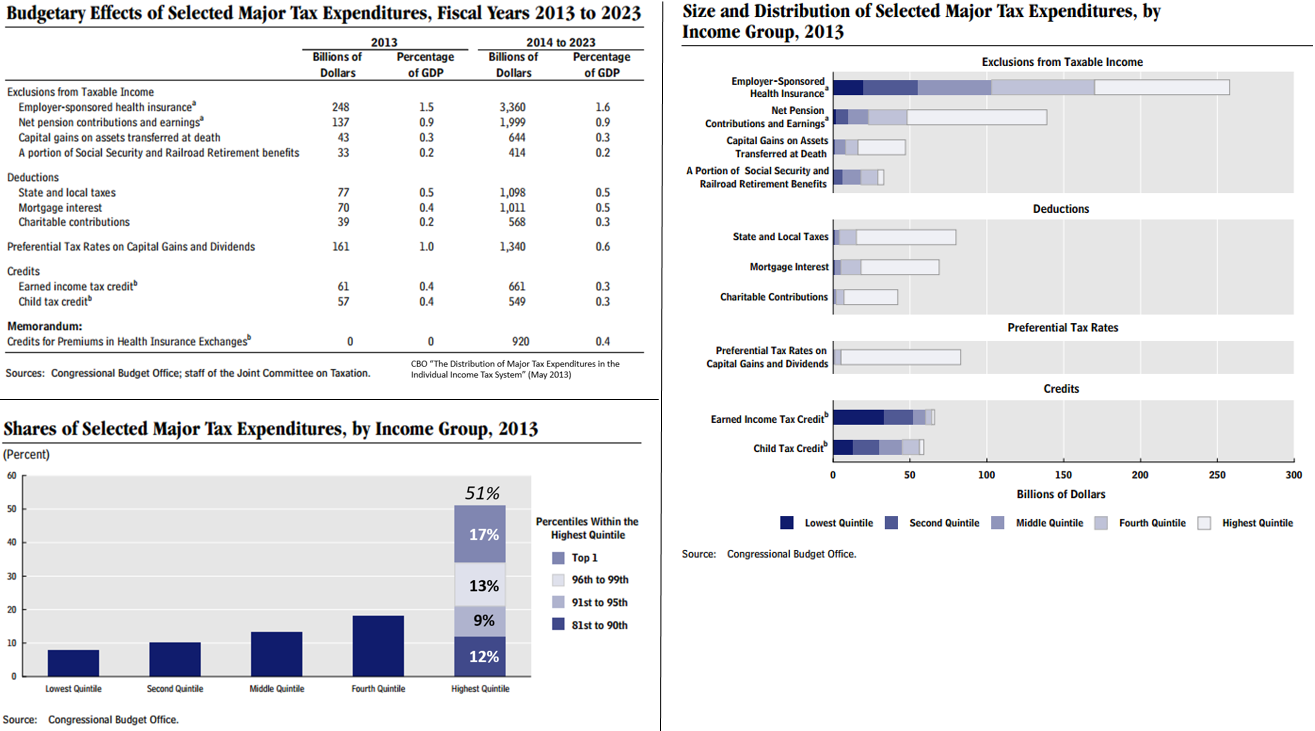

The term "tax expenditures" refers to income exclusions, deductions, preferential rates, and credits that reduce revenues for any given level of tax rates in the individual, payroll, and corporate income tax systems. Like conventional spending, they contribute to the federal budget deficit. They also influence choices about working, saving, and investing, and affect the distribution of income. The amount of reduced federal revenues are significant, estimated by CBO at nearly 8% GDP or about $1.5 trillion in 2017, for scale roughly half the revenue collected by the government and nearly three times as large as the budget deficit. Since eliminating a tax expenditure changes economic behavior, the amount of additional revenue that would be generated is somewhat less than the estimated size of the tax expenditure.

CBO reported that the following were among the largest individual (non-corporate) tax expenditures in 2013:

*The exclusion from workers' taxable income of employers' contributions for health care, health insurance premiums, and premiums for long-term care insurance ($248B);

*The exclusion of contributions to and the earnings of pension funds such as 401k plans ($137B);

*Preferential tax rates on dividends and long-term capital gains ($161B); and

*The deductions for state and local taxes ($77B), mortgage interest ($70B) and charitable contributions ($39B).

In 2013, CBO estimated that more than half of the combined benefits of 10 major tax expenditures would apply to households in the top 20% income group, and that 17% of the benefit would go to the top 1% households. The top 20% of income earners pay about 70% of federal income taxes, excluding payroll taxes. For scale, 50% of the $1.5 trillion in tax expenditures in 2016 was $750 billion, while the U.S. budget deficit was approximately $600 billion. In other words, eliminating the tax expenditures for the top 20% might balance the budget over the short-term, depending on economic feedback effects.

The term "tax expenditures" refers to income exclusions, deductions, preferential rates, and credits that reduce revenues for any given level of tax rates in the individual, payroll, and corporate income tax systems. Like conventional spending, they contribute to the federal budget deficit. They also influence choices about working, saving, and investing, and affect the distribution of income. The amount of reduced federal revenues are significant, estimated by CBO at nearly 8% GDP or about $1.5 trillion in 2017, for scale roughly half the revenue collected by the government and nearly three times as large as the budget deficit. Since eliminating a tax expenditure changes economic behavior, the amount of additional revenue that would be generated is somewhat less than the estimated size of the tax expenditure.

CBO reported that the following were among the largest individual (non-corporate) tax expenditures in 2013:

*The exclusion from workers' taxable income of employers' contributions for health care, health insurance premiums, and premiums for long-term care insurance ($248B);

*The exclusion of contributions to and the earnings of pension funds such as 401k plans ($137B);

*Preferential tax rates on dividends and long-term capital gains ($161B); and

*The deductions for state and local taxes ($77B), mortgage interest ($70B) and charitable contributions ($39B).

In 2013, CBO estimated that more than half of the combined benefits of 10 major tax expenditures would apply to households in the top 20% income group, and that 17% of the benefit would go to the top 1% households. The top 20% of income earners pay about 70% of federal income taxes, excluding payroll taxes. For scale, 50% of the $1.5 trillion in tax expenditures in 2016 was $750 billion, while the U.S. budget deficit was approximately $600 billion. In other words, eliminating the tax expenditures for the top 20% might balance the budget over the short-term, depending on economic feedback effects.

The United States tax code includes deductions and penalties with regard to

The United States tax code includes deductions and penalties with regard to

/ref>

/ref> This indicates that more progressive income tax policies (e.g., higher income taxes on the wealthy and a higher earned-income tax credit) would reduce after-tax income inequality. In their World Inequality Report published in December 2017, Piketty, Saez and coauthors revealed that in "Russia and the United States, the rise in wealth inequality has been extreme, whereas in Europe it has been more moderate." They reported that the tax system in the United States, along with "massive educational inequalities", have grown "less progressive despite a surge in top labor compensation since the 1980s, and in top capital incomes in the 2000s." The "top 1% income share was close to 10% in the S and Europein 1980, it rose only slightly to 12% in 2016 in Western Europe

/ref> SenatorNYT-Schumer and Sanders: Limit Corporate Stock Buybacks-February 3, 2019

/ref>

Income Inequality in the United States: Hearing Before the Joint Economic Committee, Congress of the United States, One Hundred Thirteenth Congress, Second Session, January 16, 2014

Overview

Tax policy is the mechanism through which market results are redistributed, affecting after-tax inequality. The provisions of the

Tax policy is the mechanism through which market results are redistributed, affecting after-tax inequality. The provisions of the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 ...

regarding income taxes

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

and estate taxes have undergone significant changes under both Republican

Republican can refer to:

Political ideology

* An advocate of a republic, a type of government that is not a monarchy or dictatorship, and is usually associated with the rule of law.

** Republicanism, the ideology in support of republics or agains ...

and Democratic administrations and Congresses since 1964. Since the Johnson Administration, the top marginal income tax rates have been reduced from 91% for the wealthiest Americans in 1963, to a low of 35% under George W Bush

George may refer to:

People

* George (given name)

* George (surname)

* George (singer), American-Canadian singer George Nozuka, known by the mononym George

* George Washington, First President of the United States

* George W. Bush, 43rd President ...

, rising recently to 39.6% (or in some cases 43.4%) in 2013 under the Obama Administration

Barack Obama's tenure as the 44th president of the United States began with his first inauguration on January 20, 2009, and ended on January 20, 2017. A Democrat from Illinois, Obama took office following a decisive victory over Republican ...

. In addition to the standard rate of 39.6% for individual income exceeding $400,000, there is a 3.8% surcharge on investment income over $200,000 as part of the Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Presid ...

Capital gains taxes have also decreased over the last several years, and have experienced a more punctuated evolution than income taxes as significant and frequent changes to these rates occurred from 1981 to 2011. Both estate and inheritance taxes have been steadily declining since the 1990s. Economic inequality in the United States

Income inequality in the United States is the extent to which income is distributed in differing amounts among the American population. It has fluctuated considerably since measurements began around 1915, moving in an arc between peaks in t ...

has been steadily increasing since the 1980s as well and economists such as Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was th ...

, Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, and a full professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the Joh ...

, and Peter Orszag

Peter Richard Orszag (born December 16, 1968) is the CEO of Financial Advisory at Lazard. Before June 2019, he was the firm's Head of North American M&A and Global Co-Head of Healthcare.

Orszag previously served as a Vice Chairman of Corporate ...

, politicians like Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the U ...

and Paul Ryan

Paul Davis Ryan (born January 29, 1970) is an American former politician who served as the List of Speakers of the United States House of Representatives, 54th speaker of the United States House of Representatives from 2015 to 2019. A member o ...

, and media entities have engaged in debates and accusations over the role of tax policy changes in perpetuating economic inequality.

Tax expenditures (i.e., deductions, exemptions, and preferential tax rates) represent a major driver of inequality, as the top 20% get roughly 50% of the benefit from them, with the top 1% getting 17% of the benefit. For example, a 2011 Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a c ...

report stated, "Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality." CBO estimated tax expenditures would be $1.5 trillion in fiscal year 2017, approximately 8% GDP; for scale, the budget deficit historically has averaged around 3% GDP.

Scholarly and popular literature exists on this topic with numerous works on both sides of the debate. The work of Emmanuel Saez

Emmanuel Saez (born November 26, 1972) is a French, naturalized American economist who is Professor of Economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of th ...

, for example, has concerned the role of American tax policy in aggregating wealth into the richest households in recent years while Thomas Sowell

Thomas Sowell (; born June 30, 1930) is an American author, economist, political commentator and academic who is a senior fellow at the Hoover Institution. With widely published commentary and books—and as a guest on TV and radio—he becam ...

and Gary Becker

Gary Stanley Becker (; December 2, 1930 – May 3, 2014) was an American economist who received the 1992 Nobel Memorial Prize in Economic Sciences. He was a professor of economics and sociology at the University of Chicago, and was a leader of ...

maintain that education, globalization, and market forces are the root causes of income and overall economic inequality. The Revenue Act of 1964 and the "Bush Tax Cuts" coincide with the rising economic inequality

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income (the amount of money people are paid) and wealth inequality measured using the distribution of wealth (the amount of we ...

in the United States both by socioeconomic class and race.Massey, Douglas S. "The New Geography of Inequality in Urban America." Race, Poverty, and Domestic Policy. New Haven: Yale UP, 2004. 173-87. Print

Changes in economic inequality

Income inequality

Economists and related experts have described America's growing income inequality as "deeply worrying",White House: Here's Why You Have To Care About InequalityTimothy Noah , tnr.com, January 13, 2012 unjust, a danger to democracy/social stability,

Winner-Take-All Politics (book)

''Winner-Take-All Politics: How Washington Made the Rich Richer—and Turned Its Back on the Middle Class'' is a 2010 book by political scientists Jacob S. Hacker and Paul Pierson. In it the authors argue that contrary to conventional wisdom, ...

by Jacob S. Hacker

Jacob Stewart Hacker (born 1971) is an American professor and political scientist. He is the director of the Institution for Social and Policy Studies and a professor of political science at Yale University. Hacker has written works on social poli ...

and Paul Pierson

Paul Pierson (born 1959) is an American professor of political science specializing in comparative politics and holder of the John Gross Endowed Chair of Political Science at the University of California, Berkeley. From 2007-2010 he served at UC ...

p. 75Oligarchy, American StyleBy PAUL KRUGMAN. 3 November 2011 and a sign of national decline."The Broken Contract", By George Packer, ''

Foreign Affairs

''Foreign Affairs'' is an American magazine of international relations and U.S. foreign policy published by the Council on Foreign Relations, a nonprofit, nonpartisan, membership organization and think tank specializing in U.S. foreign policy and ...

'', November/December 2011 Yale professor Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center fo ...

, who was among three Americans who won the Nobel prize for economics in 2013, said after receiving the award, "The most important problem that we are facing now today, I think, is rising inequality in the United States and elsewhere in the world."

Inequality in land and income ownership is negatively correlated with subsequent economic growth. A strong demand for redistribution may occur in societies where a large section of the population does not have access to the productive resources of the economy. Voters may internalize such issues. High unemployment rates have a significant negative effect when interacting with increases in inequality. Increasing inequality harms growth in countries with high levels of urbanization. High and persistent unemployment also has a negative effect on subsequent long-run economic growth. Unemployment may seriously harm growth because it is a waste of resources, generates redistributive pressures and distortions, depreciates existing human capital and deters its accumulation, drives people to poverty, results in liquidity constraints that limit labor mobility, and because it erodes individual self-esteem and promotes social dislocation, unrest and conflict. Policies to control unemployment and reduce its inequality-associated effects can strengthen long-run growth.

Gini coefficient

The Gini Coefficient, a statistical measurement of the inequality present in a nation's income distribution developed by Italian statistician and sociologist Corrado Gini, for the United States has increased over the last few decades. The closer the Gini Coefficient is to one, the closer its income distribution is to absolute inequality. In 2007, the United Nations approximated the United States' Gini Coefficient at 41% while the CIA Factbook placed the coefficient at 45%. The United States' Gini Coefficient was below 40% in 1964 and slightly declined through the 1970s. However, around 1981, the Gini Coefficient began to increase and rose steadily through the 2000s.Wealth distribution

Wealth

Wealth is the abundance of Value (economics), valuable financial assets or property, physical possessions which can be converted into a form that can be used for financial transaction, transactions. This includes the core meaning as held in the ...

, in economic terms, is defined as the value of an individual's or household's total assets minus his or its total liabilities. The components of wealth include assets, both monetary and non-monetary, and income. Wealth is accrued over time by savings and investment. Levels of savings and investment are determined by an individual's or a household's consumption, the market real interest rate, and income. Individuals and households with higher incomes are more capable of saving and investing because they can set aside more of their disposable income to it while still optimizing their consumption functions. It is more difficult for lower-income individuals and households to save and invest because they need to use a higher percentage of their income for fixed and variable costs thus leaving them with a more limited amount of disposable income to optimize their consumption. Accordingly, a natural wealth gap exists in any market as some workers earn higher wages and thus are able to divert more income towards savings and investment which build wealth.

The wealth gap in the United States is large and the large majority of net worth and financial wealth is concentrated in a relatively very small percentage of the population. Sociologist and University of California-Santa Cruz professor G. William Domhoff writes that "numerous studies show that the wealth distribution has been extremely concentrated throughout American history" and that "most Americans (high income or low income, female or male, young or old, Republican or Democrat) have no idea just how concentrated the wealth distribution actually is." In 2007, the top 1% of households owned 34.6% of all privately held wealth and the next 19% possessed 50.5% of all privately held wealth. Taken together, 20% of Americans controlled 85.1% of all privately held wealth in the country.Domhoff, G. William. Who Rules America?: Power, Politics, and Social Change. Boston: McGraw-Hill Higher Education, 2010. Print.Stiglitz, Joseph E. "Of the 1%, by the 1%, for the 1%." Vanity Fair May 2011. Web. 20 Nov. 2011. Congressional Budget Office

The Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress.

Inspired by California's Legislative Analyst's Office that manages ...

, the real, or inflation-adjusted, after-tax earnings of the wealthiest one percent of Americans grew by 275% from 1979 to 2007. Simultaneously, the real, after-tax earnings of the bottom twenty percent of wage earnings in the United States grew 18%. The difference in the growth of real income of the top 1% and the bottom 20% of Americans was 257%. The average increase in real, after-tax income for all U.S. households during this time period was 62% which is slightly below the real, after-tax income growth rate of 65% experienced by the top 20% of wage earners, not accounting for the top 1%.} Data aggregated and analyzed by Robert B. Reich

Robert Bernard Reich (; born June 24, 1946) is an American professor, author, lawyer, and political commentator. He worked in the administrations of Presidents Gerald Ford and Jimmy Carter, and served as Secretary of Labor from 1993 to 1997 i ...

, Thomas Piketty

Thomas Piketty (; born 7 May 1971) is a French economist who is Professor of Economics at the School for Advanced Studies in the Social Sciences, Associate Chair at the Paris School of Economics and Centennial Professor of Economics in the Int ...

, and Emmanuel Saez

Emmanuel Saez (born November 26, 1972) is a French, naturalized American economist who is Professor of Economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of th ...

and released in a New York Times article written by Bill Marsh shows that real wages for production and non-supervisory workers, which account for 82% of the U.S. workforce, increased by 100% from 1947 to 1979 but then increased by only 8% from 1979–2009. Their data also shows that the bottom fifth experienced a 122% growth rate in wages from 1947 to 1979 but then experienced a negative growth rate of 4% in their real wages from 1979–2009. The real wages of the top fifth rose by 99% and then 55% during the same periods, respectively. Average real hourly wages have also increased by a significantly larger rate for the top 20% than they have for the bottom 20%. Real family income for the bottom 20% increased by 7.4% from 1979 to 2009 while it increased by 49% for the top 20% and increased by 22.7% for the second top fifth of American families. As of 2007, the United Nations estimated the ratio of average income for the top 10% to the bottom 10% of Americans, via the Gini Coefficient, as 15.9:1. The ratio of average income for the top 20% to the bottom 20% in the same year and using the same index was 8.4:1. According to these UN statistics, the United States has the third highest disparity between the average income of the top 10% and 20% to the bottom 10% and bottom 20% of the population, respectively, of the OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate e ...

(Organization for Economic Co-operation and Development) countries. Only Chile and Mexico have larger average income disparities between the top 10% and bottom 10% of the population with 26:1 and 23:1, respectively. Consequently, the United States has the fourth highest Gini Coefficient of the OECD countries at 40.8% which is lower than Chile's (52%), Mexico's (51%), and just lower than Turkey's (42%).

Tax structure

A 2011Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a c ...

report stated, "Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality. Taxes were less progressive in 2006 than in 1996, and consequently, tax policy also contributed to the increase in income inequality between 1996 and 2006. But overall income inequality would likely have increased even in the absence of tax policy changes." Since 1964, the U.S. income tax, including the capital gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

...

tax, has become less progressive (although recent changes have made the federal tax code the most progressive since 1979). The estate tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

, a highly progressive tax, has also been reduced over the last decades.

A progressive tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progre ...

code is believed to mitigate the effects of recessions by taking a smaller percentage of income from lower-income consumers than from other consumers in the economy so they can spend more of their disposable income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major c ...

on consumption

Consumption may refer to:

*Resource consumption

*Tuberculosis, an infectious disease, historically

* Consumption (ecology), receipt of energy by consuming other organisms

* Consumption (economics), the purchasing of newly produced goods for curren ...

and thus restore equilibrium.Böhm, Volker. "Demand Theory." The New Palgrave: A Dictionary of Economics,. Ed. Hans Haller. Vol. 1. Palgrave MacMillan, 1987. 785-92. Print. This is known as an automatic stabilizer as it does not need Congressional action such as legislation. It also mitigates inflation by taking more money from the wealthiest consumers so their large level of consumption does not create demand-driven inflation.

One argument against the view that tax policy increases income inequality is analysis of the overall share of wealth controlled by the top 1%.

Income tax

TheRevenue Act of 1964 The United States Revenue Act of 1964 (), also known as the Tax Reduction Act, was a tax cut act proposed by President John F. Kennedy, passed by the 88th United States Congress, and signed into law by President Lyndon B. Johnson. The act became law ...

was the first bill of the Post-World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposin ...

era to reduce marginal income tax rates. This reform, which was proposed under John F. Kennedy

John Fitzgerald Kennedy (May 29, 1917 – November 22, 1963), often referred to by his initials JFK and the nickname Jack, was an American politician who served as the 35th president of the United States from 1961 until his assassination ...

but passed under Lyndon Johnson

Lyndon Baines Johnson (; August 27, 1908January 22, 1973), often referred to by his initials LBJ, was an American politician who served as the 36th president of the United States from 1963 to 1969. He had previously served as the 37th vice ...

, reduced the top marginal income (annual income of $2.9 million+ adjusted for inflation) tax rate from 91% (for tax year 1963) to 77% (for tax year 1964) and 70% (for tax year 1965) for annual incomes of $1.4 million+. It was the first tax legislation to reduce the top end of the marginal income tax rate distribution since 1924. Tax Foundation.org, "Federal Individual Income Tax Rates History: Inflation Adjusted (Real 2011 Dollars) Using Average Annual CPI During Tax Year"./ref> The top marginal income tax rate had been 91% since 1946 and had not been below 70% since 1936. The "

Bush Tax Cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

* Economic Growth and Tax Relief Reconciliation Act o ...

," which are the popularly known names of the Economic Growth and Tax Relief Reconciliation Act of 2001

The Economic Growth and Tax Relief Reconciliation Act of 2001 was a major piece of tax legislation passed by the 107th United States Congress and signed by President George W. Bush. It is also known by its abbreviation EGTRRA (often pronounced ...

and the Jobs and Growth Tax Relief Reconciliation Act of 2003

The Jobs and Growth Tax Relief Reconciliation Act of 2003 ("JGTRRA", , ), was passed by the United States Congress on May 23, 2003 and signed into law by President George W. Bush on May 28, 2003. Nearly all of the cuts (individual rates, capital ...

passed during President George W. Bush

George Walker Bush (born July 6, 1946) is an American politician who served as the 43rd president of the United States from 2001 to 2009. A member of the Republican Party, Bush family, and son of the 41st president George H. W. Bush, he ...

's first term, reduced the top marginal income tax rate from 38.6% (annual income at $382,967+ adjusted for inflation) to 35%. These rates were continued under the Obama Administration and will extend through 2013. The number of income tax brackets declined during this time period as well but several years, particularly after 1992, saw an increase in the number of income tax brackets. In 1964, there were 26 income tax brackets. The number of brackets was reduced to 16 by 1981 and then collapsed into 13 brackets after passage of the Economic Recovery Tax Act of 1981

The Economic Recovery Tax Act of 1981 (ERTA), or Kemp–Roth Tax Cut, was an Act that introduced a major tax cut, which was designed to encourage economic growth. The federal law enacted by the 97th US Congress and signed into law by US Preside ...

. Five years later, the 13 income tax brackets were collapsed into five under the Reagan Administration. By the end of the G. H. W. Bush administration in 1992, the number of income tax brackets had reached an all-time low of three but President Bill Clinton

William Jefferson Clinton ( né Blythe III; born August 19, 1946) is an American politician who served as the 42nd president of the United States from 1993 to 2001. He previously served as governor of Arkansas from 1979 to 1981 and agai ...

oversaw a reconfiguration of the brackets that increased the number to five in 1993. The current number of income tax brackets, as of 2011, is six which is the number of brackets configured under President George W. Bush.

The NYT reported in July 2018 that: "The top-earning 1 percent of households — those earning more than $607,000 a year — will pay a combined $111 billion less this year in federal taxes than they would have if the laws had remained unchanged since 2000. That's an enormous windfall. It's more, in total dollars, than the tax cut received over the same period by the entire bottom 60 percent of earners." This represents the tax cuts for the top 1% from the Bush tax cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

* Economic Growth and Tax Relief Reconciliation Act o ...

and Trump tax cuts

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

, partially offset by the tax increases on the top 1% by Obama.

Effective tax rates

Ronald Reagan made very large reductions in the nominal marginal income tax rates with his Tax Reform Act of 1986, which did not make a similarly large reduction in the effective tax rate on marginal incomes. Noah writes in his ten part series entitled "The Great Divergence," that "in 1979, the effective tax rate on the top 0.01 percent was 42.9 percent, according to the Congressional Budget Office, but by Reagan's last year in office it was 32.2%." This effective rate held steadily until the first few years of the Clinton presidency when it increased to a peak high of 41%. However, it fell back down to the low 30s by his second term in the White House. This percentage reduction in the effective marginal income tax rate for the wealthiest Americans, 9%, is not a very large decrease in their tax burden, according to Noah, especially in comparison to the 20% drop in nominal rates from 1980 to 1981 and the 15% drop in nominal rates from 1986 to 1987. In addition to this small reduction on the income taxes of the wealthiest taxpayers in America, Noah discovered that the effective income tax burden for the bottom 20% of wage earners was 8% in 1979 and dropped to 6.4% under the Clinton Administration. This effective rate further dropped under the George W. Bush Administration. Under Bush, the rate decreased from 6.4% to 4.3%. Reductions in the effective income tax burden on the poor coinciding with modest reductions in the effective income tax rate on the wealthiest 0.01% of tax payers could not have been the driving cause of increased income inequality that began in the 1980s. These figures are similar to an analysis of effective federal tax rates from 1979-2005 by the

Ronald Reagan made very large reductions in the nominal marginal income tax rates with his Tax Reform Act of 1986, which did not make a similarly large reduction in the effective tax rate on marginal incomes. Noah writes in his ten part series entitled "The Great Divergence," that "in 1979, the effective tax rate on the top 0.01 percent was 42.9 percent, according to the Congressional Budget Office, but by Reagan's last year in office it was 32.2%." This effective rate held steadily until the first few years of the Clinton presidency when it increased to a peak high of 41%. However, it fell back down to the low 30s by his second term in the White House. This percentage reduction in the effective marginal income tax rate for the wealthiest Americans, 9%, is not a very large decrease in their tax burden, according to Noah, especially in comparison to the 20% drop in nominal rates from 1980 to 1981 and the 15% drop in nominal rates from 1986 to 1987. In addition to this small reduction on the income taxes of the wealthiest taxpayers in America, Noah discovered that the effective income tax burden for the bottom 20% of wage earners was 8% in 1979 and dropped to 6.4% under the Clinton Administration. This effective rate further dropped under the George W. Bush Administration. Under Bush, the rate decreased from 6.4% to 4.3%. Reductions in the effective income tax burden on the poor coinciding with modest reductions in the effective income tax rate on the wealthiest 0.01% of tax payers could not have been the driving cause of increased income inequality that began in the 1980s. These figures are similar to an analysis of effective federal tax rates from 1979-2005 by the Congressional Budget Office

The Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress.

Inspired by California's Legislative Analyst's Office that manages ...

. The figures show a decrease in the total effective tax rate from 37.0% in 1979 to 29% in 1989. The effective individual income tax rate dropped from 21.8% to 19.9% in 1989. However, by 2010, the top 1 percent of all households an average federal tax rate of 29.4 percent, with 2013 rates to be significantly higher.

Capital gains tax

Capital gains are profits from investments in capital assets such as bonds, stocks, and real estate. These gains are taxed, for individuals, as ordinary income when held for less than one year which means that they have the same marginal tax rate as the marginal income tax rate of their recipient. This is known as the capital gains tax rate on a short-term capital gains. Accordingly, the capital gains tax rate for short-term capital gains paid by an individual is equal to the marginal income tax rate of that individual. The tax rate then decreases once the capital gain becomes a long-term capital gain, or is held for 1 year or more.

In 1964, the effective capital gains tax rate was 25%. This means that the actual tax percentage of all capital gains realized in the U.S. in 1964 was 25% as opposed to the nominal capital gains tax rate, or the percentage that would have been collected by the government prior to deductions and evasions. This effective rate held constant until a small rise in 1968 up to 26.9% and then began steadily increasing until it peaked at 39.875% in 1978. This top rate then fell to 28% in 1979 and further dropped to 20% in 1982. This top capital gains rate held until 1986 when the Tax Reform Act of 1986 re-raised it to 28% and 33% for all individuals subject to phase-outs. The Tax Reform Act of 1986 shifted capital gains to income for the first time thus establishing equal short-term capital gains taxes and marginal income tax rates. The top rate of 28%, not taking into account taxpayers under the stipulations of a phase-out, remained until 1997, despite increases in marginal income tax rates, when it was lowered to 28%. Starting in May 1997, however, long-term capital gains were divided into multiple subgroups based on the duration of time investors held them. Each new subgroup had a different tax rate. This effectively reduced the top capital gains tax rate on a long-term capital good held for over 1 year from 28% to 20%. These multiple subgroups were reorganized into less than one year, one to five years, and five years or more and were in place from 1998 to 2003. In 2003, the divisions reverted to the less than one year and more than one year categories until 2011 when then reverted to the three divisions first implemented in 1998. This rate, 20%, remained until 2003 when it was further reduced to 15%. The 15% long-term capital gains tax rate was then changed back to its 1997 rate of 20% in 2011. Capital gains taxes for the bottom two and top two income tax brackets have changed significantly since the late 1980s. The short-term and long-term capital gains tax rates for the bottom two tax rates, 15% and 28%, respectively, were equal to those tax payers' marginal income tax rates from 1988 until 1997. In 1997, the capital gains tax rates for the bottom two income tax brackets were reduced to 10% and 20% for the 15% and 28% income tax brackets, respectively. These rates remained until 2001. President Bush made additional changes to the capital gains tax rates for the bottom two income tax brackets in 2001, which were lowered from 15% and 28% to 10% and 15%, respectively, by lowering the tax on long-term capital gains held for more than five years from 10% to 8%. He also reduced the tax on short-term capital gains from 28% to 15% for the 15% tax bracket as well as lowered the tax on long-term capital goods from 20% to 10%. In 2003, the capital gains tax on long-term capital goods decreased from 10% to 5% for both of the bottom two tax brackets (10% and 15%). In 2008, these same rates were dropped to 0% but were restored to the 2003 rates in 2011 under President Obama via the extension of the Bush Tax Cuts.

Overall, capital gains tax rates decreased significantly for both the bottom two and the top two income tax brackets. The top two income tax brackets have had a net decrease in their long-term capital gains tax rates of 13% since 1988, while the lowest two income tax brackets' long-term capital gains tax rates have changed by 10% and 13%, respectively, in that time. The difference between income and long-term capital gains taxes for the top two income tax brackets (5% in 1988 and 18% and 20%, respectively, in 2011), however, is larger than the difference between the income and long-term capital gains tax rates for the bottom two income tax brackets (0% in 1988 and 5% and 10%, respectively, in 2011). As of the 2013 tax year, all investment income for high earning households will be subject to a 3.8% surtax bringing the top capital gains rate to 23.8%.

Capital gains are profits from investments in capital assets such as bonds, stocks, and real estate. These gains are taxed, for individuals, as ordinary income when held for less than one year which means that they have the same marginal tax rate as the marginal income tax rate of their recipient. This is known as the capital gains tax rate on a short-term capital gains. Accordingly, the capital gains tax rate for short-term capital gains paid by an individual is equal to the marginal income tax rate of that individual. The tax rate then decreases once the capital gain becomes a long-term capital gain, or is held for 1 year or more.

In 1964, the effective capital gains tax rate was 25%. This means that the actual tax percentage of all capital gains realized in the U.S. in 1964 was 25% as opposed to the nominal capital gains tax rate, or the percentage that would have been collected by the government prior to deductions and evasions. This effective rate held constant until a small rise in 1968 up to 26.9% and then began steadily increasing until it peaked at 39.875% in 1978. This top rate then fell to 28% in 1979 and further dropped to 20% in 1982. This top capital gains rate held until 1986 when the Tax Reform Act of 1986 re-raised it to 28% and 33% for all individuals subject to phase-outs. The Tax Reform Act of 1986 shifted capital gains to income for the first time thus establishing equal short-term capital gains taxes and marginal income tax rates. The top rate of 28%, not taking into account taxpayers under the stipulations of a phase-out, remained until 1997, despite increases in marginal income tax rates, when it was lowered to 28%. Starting in May 1997, however, long-term capital gains were divided into multiple subgroups based on the duration of time investors held them. Each new subgroup had a different tax rate. This effectively reduced the top capital gains tax rate on a long-term capital good held for over 1 year from 28% to 20%. These multiple subgroups were reorganized into less than one year, one to five years, and five years or more and were in place from 1998 to 2003. In 2003, the divisions reverted to the less than one year and more than one year categories until 2011 when then reverted to the three divisions first implemented in 1998. This rate, 20%, remained until 2003 when it was further reduced to 15%. The 15% long-term capital gains tax rate was then changed back to its 1997 rate of 20% in 2011. Capital gains taxes for the bottom two and top two income tax brackets have changed significantly since the late 1980s. The short-term and long-term capital gains tax rates for the bottom two tax rates, 15% and 28%, respectively, were equal to those tax payers' marginal income tax rates from 1988 until 1997. In 1997, the capital gains tax rates for the bottom two income tax brackets were reduced to 10% and 20% for the 15% and 28% income tax brackets, respectively. These rates remained until 2001. President Bush made additional changes to the capital gains tax rates for the bottom two income tax brackets in 2001, which were lowered from 15% and 28% to 10% and 15%, respectively, by lowering the tax on long-term capital gains held for more than five years from 10% to 8%. He also reduced the tax on short-term capital gains from 28% to 15% for the 15% tax bracket as well as lowered the tax on long-term capital goods from 20% to 10%. In 2003, the capital gains tax on long-term capital goods decreased from 10% to 5% for both of the bottom two tax brackets (10% and 15%). In 2008, these same rates were dropped to 0% but were restored to the 2003 rates in 2011 under President Obama via the extension of the Bush Tax Cuts.

Overall, capital gains tax rates decreased significantly for both the bottom two and the top two income tax brackets. The top two income tax brackets have had a net decrease in their long-term capital gains tax rates of 13% since 1988, while the lowest two income tax brackets' long-term capital gains tax rates have changed by 10% and 13%, respectively, in that time. The difference between income and long-term capital gains taxes for the top two income tax brackets (5% in 1988 and 18% and 20%, respectively, in 2011), however, is larger than the difference between the income and long-term capital gains tax rates for the bottom two income tax brackets (0% in 1988 and 5% and 10%, respectively, in 2011). As of the 2013 tax year, all investment income for high earning households will be subject to a 3.8% surtax bringing the top capital gains rate to 23.8%.

Gift tax

The inheritance tax, which is also known as the "gift tax", has been altered in the Post-World War II era as well. First established in 1932 as a means to raise tax revenue from the wealthiest Americans, the inheritance tax was put at a nominal rate of 25% points lower than the estate tax which meant its effective rate was 18.7%. Its exemption, up to $50,000, was the same as the estate tax exemption. Under current law, individuals can give gifts of up to $13,000 without incurring a tax and couples can poll their gift together to give a gift of up to $26,000 a year without incurring a tax. The lifetime gift tax exemption is $5 million which is the same amount as the estate tax exemption. These two exemptions are directly tied to each other as the amount exempted from one reduces the amount that can be exempted from the other at a 1:1 ratio. The inheritance/gift tax generally affects a very small percentage of the population as most citizens do not inherit anything from their deceased relatives in any given year. In 2000, the Federal Reserve Bank of Cleveland published a report that found that 1.6% of Americans received an inheritance of $100,000 or more and an additional 1.1% received an inheritance worth $50,000 to $100,000 while 91.9% of Americans did not receive an inheritance. A 2010 report conducted by Citizens for Tax Justice found that only 0.6% of the population would pass on an inheritance in the event of death in that fiscal year. Accordingly, data shows that inheritance taxes are a tax almost exclusively on the wealthy. In 1986, Congress enacted legislation to prevent trust funds of wealthy individuals from skipping a generation before taxes had to be paid on the inheritance.Estate tax

Estate taxes, while affecting more taxpayers than inheritance taxes, do not affect many Americans and are also considered to be a tax aimed at the wealthy. In 2007, all of the state governments combined collected $22 billion in tax receipts from estate taxes and these taxes affected less than 5% of the population including less than 1% of citizens in every state. In 2004, the average tax burden of the federal estate tax was 0% for the bottom 80% of the population by household. The average tax burden of the estate tax for the top 20% was $1,362. The table below gives a general impression of the spread of estate taxes by income. A certain dollar amount of every estate can be exempted from tax, however. For example, if the government allows an exemption of up to $2 million on an estate then the tax on a $4 million estate would only be paid on $2 million worth of that estate, not all $4 million. This reduces the effective estate tax rate. In 2001, the "exclusion" amount on estates was $675,000 and the top tax rate was 55%. The exclusion amount steadily increased to $3.5 million by 2009 while the tax rate dropped to 45% when it was temporarily repealed in 2010. The estate tax was reinstated in 2011 with a further increased cap of $5 million for individuals and $10 million for couples filing jointly and a reduced rate of 35%. The "step-up basis" of estate tax law allows a recipient of an estate or portion of an estate to have a tax basis in the property equal to the market value of the property. This enables recipients of an estate to sell it at market value without having paid any tax on it. According to the Congressional Budget Office, this exemption costs the federal government $715 billion a year.Sales tax

Sales taxes are taxes placed on the sale or lease of goods and services in the United States. While no national generalsales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

exists, the federal government levies several national selective sales taxes. States also may levy selective sales taxes on the sale or lease of particular goods or services. States may also delegate to local governments the authority to impose additional general or selective sales taxes.

Tax expenditures

The term "tax expenditures" refers to income exclusions, deductions, preferential rates, and credits that reduce revenues for any given level of tax rates in the individual, payroll, and corporate income tax systems. Like conventional spending, they contribute to the federal budget deficit. They also influence choices about working, saving, and investing, and affect the distribution of income. The amount of reduced federal revenues are significant, estimated by CBO at nearly 8% GDP or about $1.5 trillion in 2017, for scale roughly half the revenue collected by the government and nearly three times as large as the budget deficit. Since eliminating a tax expenditure changes economic behavior, the amount of additional revenue that would be generated is somewhat less than the estimated size of the tax expenditure.

CBO reported that the following were among the largest individual (non-corporate) tax expenditures in 2013:

*The exclusion from workers' taxable income of employers' contributions for health care, health insurance premiums, and premiums for long-term care insurance ($248B);

*The exclusion of contributions to and the earnings of pension funds such as 401k plans ($137B);

*Preferential tax rates on dividends and long-term capital gains ($161B); and

*The deductions for state and local taxes ($77B), mortgage interest ($70B) and charitable contributions ($39B).

In 2013, CBO estimated that more than half of the combined benefits of 10 major tax expenditures would apply to households in the top 20% income group, and that 17% of the benefit would go to the top 1% households. The top 20% of income earners pay about 70% of federal income taxes, excluding payroll taxes. For scale, 50% of the $1.5 trillion in tax expenditures in 2016 was $750 billion, while the U.S. budget deficit was approximately $600 billion. In other words, eliminating the tax expenditures for the top 20% might balance the budget over the short-term, depending on economic feedback effects.

The term "tax expenditures" refers to income exclusions, deductions, preferential rates, and credits that reduce revenues for any given level of tax rates in the individual, payroll, and corporate income tax systems. Like conventional spending, they contribute to the federal budget deficit. They also influence choices about working, saving, and investing, and affect the distribution of income. The amount of reduced federal revenues are significant, estimated by CBO at nearly 8% GDP or about $1.5 trillion in 2017, for scale roughly half the revenue collected by the government and nearly three times as large as the budget deficit. Since eliminating a tax expenditure changes economic behavior, the amount of additional revenue that would be generated is somewhat less than the estimated size of the tax expenditure.

CBO reported that the following were among the largest individual (non-corporate) tax expenditures in 2013:

*The exclusion from workers' taxable income of employers' contributions for health care, health insurance premiums, and premiums for long-term care insurance ($248B);

*The exclusion of contributions to and the earnings of pension funds such as 401k plans ($137B);

*Preferential tax rates on dividends and long-term capital gains ($161B); and

*The deductions for state and local taxes ($77B), mortgage interest ($70B) and charitable contributions ($39B).

In 2013, CBO estimated that more than half of the combined benefits of 10 major tax expenditures would apply to households in the top 20% income group, and that 17% of the benefit would go to the top 1% households. The top 20% of income earners pay about 70% of federal income taxes, excluding payroll taxes. For scale, 50% of the $1.5 trillion in tax expenditures in 2016 was $750 billion, while the U.S. budget deficit was approximately $600 billion. In other words, eliminating the tax expenditures for the top 20% might balance the budget over the short-term, depending on economic feedback effects.

Credits and exemptions

Education

EconomistGary Becker

Gary Stanley Becker (; December 2, 1930 – May 3, 2014) was an American economist who received the 1992 Nobel Memorial Prize in Economic Sciences. He was a professor of economics and sociology at the University of Chicago, and was a leader of ...

has described educational attainment as the root of economic mobility

Economic mobility is the ability of an individual, family or some other group to improve (or lower) their economic status—usually measured in income. Economic mobility is often measured by movement between income quintiles. Economic mobility ...

. The United States offers several tax incentive

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments.

Tax incentives can have both positive and negative impacts on an economy. Among the posit ...

s for education, such as the American Opportunity Tax Credit and Hope credit

The Hope credit, provided by (b), was available to taxpayers who have incurred expenses related to the first two years of post-secondary education. For this credit to be claimed by a taxpayer, the student must attend school on at least a part-ti ...

along with tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

s for scholarship

A scholarship is a form of financial aid awarded to students for further education. Generally, scholarships are awarded based on a set of criteria such as academic merit, diversity and inclusion, athletic skill, and financial need.

Scholarsh ...

s and grants

Grant or Grants may refer to:

Places

*Grant County (disambiguation)

Australia

* Grant, Queensland, a locality in the Barcaldine Region, Queensland, Australia

United Kingdom

*Castle Grant

United States

* Grant, Alabama

*Grant, Inyo County, C ...

. Those who do not qualify for such aid can obtain a low-interest student loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest r ...

, which may be subsidized

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the ter ...

based on financial need, and tuition

Tuition payments, usually known as tuition in American English and as tuition fees in Commonwealth English, are fees charged by education institutions for instruction or other services. Besides public spending (by governments and other public bo ...

can often be deducted from the federal income tax

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allow ...

. Such loans were created with the goal of encouraging greater social mobility

Social mobility is the movement of individuals, families, households or other categories of people within or between social strata in a society. It is a change in social status relative to one's current social location within a given society ...

and equality of opportunity

Equal opportunity is a state of fairness in which individuals are treated similarly, unhampered by artificial barriers, prejudices, or preferences, except when particular distinctions can be explicitly justified. The intent is that the important ...

.

According to Becker, the rise in returns on investments in human capital is beneficial and desirable to society because it increases productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proces ...

and standards of living

Standard of living is the level of income, comforts and services available, generally applied to a society or location, rather than to an individual. Standard of living is relevant because it is considered to contribute to an individual's quality ...

. However, the cost for college tuition has increased significantly faster than inflation, leading the United States to have one of the most expensive higher education systems in the world. It has been suggested that tax policy could be used to help reduce these costs, by taxing the endowment income of universities and linking the endowment tax to tuition rates. The United States spends about 7.3% of GDP ($1.1 trillion in 2011 - public and private, all levels) annually on education, with 70% funded publicly through varying levels of federal, state, and local taxation.

Healthcare

The United States tax code includes deductions and penalties with regard to

The United States tax code includes deductions and penalties with regard to health insurance

Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among ma ...

coverage. The number of uninsured in the United States, many of whom are the working poor

The working poor are working people whose incomes fall below a given poverty line due to low-income jobs and low familial household income. These are people who spend at least 27 weeks in a year working or looking for employment, but remain und ...

or unemployed

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the referen ...

, are one of the primary concerns raised by advocates of health care reform

Health care reform is for the most part governmental policy that affects health care delivery in a given place. Health care reform typically attempts to:

* Broaden the population that receives health care coverage through either public sector insur ...

. The costs of treating the uninsured must often be absorbed by providers as charity care

In the United States, charity care is health care provided for free or at reduced prices to low income patients. The percentage of doctors providing charity care dropped from 76% in 1996–97 to 68% in 2004–2005. Potential reasons for the decl ...

, passed on to the insured via cost shifting and higher health insurance premiums, or paid by taxpayers through higher taxes. The federal income tax offers employers a deduction for amounts contributed health care plans.

In 2014, the Patient Protection and Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Presi ...

encourages states to expand Medicaid

Medicaid in the United States is a federal and state program that helps with healthcare costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and pers ...

for low income households, funded by additional federal taxes. Some of the taxes specifically target wealthier households. Income from self-employment and wages of single individuals in excess of $200,000 annually will be subject to an additional tax of 0.9%. The threshold amount is $250,000 for a married couple filing jointly (threshold applies to joint compensation of the two spouses), or $125,000 for a married person filing separately. In addition, a Medicare tax of 3.8% will apply to unearned income, specifically the lesser of net investment income or the amount by which adjusted gross income exceeds $200,000 ($250,000 for a married couple filing jointly; $125,000 for a married person filing separately.)

In March 2018, the CBO reported that the ACA had reduced income inequality in 2014, saying that the law led the lowest and second quintiles (the bottom 40%) to receive an average of an additional $690 and $560 respectively while causing households in the top 1% to pay an additional $21,000 due mostly to the net investment income tax and the additional Medicare tax. The law placed relatively little burden on households in the top quintile (top 20%) outside of the top 1%.CBO-The Distribution of Household Income, 2014-March 19, 2018/ref>

Compression and divergence in tax code changes

Princeton economics professor, Nobel laureate, and John Bates Clarke Award winnerPaul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was th ...

argues that politics not economic conditions have made income inequality in the United States "unique" and to a degree that "other advanced countries have not seen." According to Krugman, government action can either compress or widen income inequality through tax policy and other redistributive or transfer policies. Krugman illustrates this point by describing "The Great Compression" and "The Great Divergence." He states that the end of the Great Depression to the end of World War II, from 1939–1946, saw a rapid narrowing of the spread of the income distribution in America which effectively created the middle class. Krugman calls this economic time period "The Great Compression" because the income distribution was compressed. He attributes this phenomenon to intrinsically equalizing economic policy such as increased tax rates on the wealthy, higher corporate tax rates, a pro-union organizing environment, minimum wage, Social Security, unemployment insurance, and "extensive government controls on the economy that were used in a way that tended to equalize incomes." This "artificial y created middle class endured due to the creation of middle class institutions, norms, and expectations that promoted income equality. Krugman believes this period ends in 1980, which he points out as being "interesting" because it was when "Reagan came to the White House." From 1980 to the present, Krugman believes income inequality was uniquely shaped by the political environment and not the global economic environment. For example, the U.S. and Canada both had approximately 30% of its workers in unions during the 1960s. However, by 2010, around 25% of Canadian workers were still unionized while 11% of American workers were unionized. Krugman blames Reagan for this rapid decline in unionization because he "declared open season on unions" while the global market clearly made room for unions as Canada's high union rate proves. Contrary to the arguments made by Chicago economists such as Gary Becker, Krugman points out that while the wealth gap between the college educated and non-college educated continues to grow, the largest rise in income inequality is between the well-educated-college graduates and college graduates, and not between college graduates and non-college graduates. The average high school teacher, according to Krugman, has a post-graduate degree which is a comparable level of education to a hedge fund manager whose income is several times that of the average high school teacher. In 2006, the "highest paid hedge fund manager in the United States made an amount equal to the salaries of all 80,000 New York City school teachers for the next three years." Accordingly, Krugman believes that education and a shifting global market are not the sole causes of increased income inequalities since the 1980s but rather that politics and the implementation of conservative ideology has aggregated wealth to the rich. Some of these political policies include the Reagan tax cuts in 1981 and 1986.

Nobel laureate Joseph Stiglitz