|

American Opportunity Tax Credit

The American Opportunity Tax Credit is a partially refundable tax credit first detailed in Section 1004 of the American Recovery and Reinvestment Act of 2009. The act specifies: # Provisions were originally specific to tax years 2009 and 2010, later extended, and finally made permanent by the Bipartisan Budget Act of 2015, for the first 4 years of post-secondary education. # Increases the Hope credit to 100 percent qualified tuition, fees and course materials paid by the taxpayer during the taxable year not to exceed $2,000, plus 25 percent of the next $2,000 in qualified tuition, fees and course materials. The total credit does not exceed $2,500. # 40% of the credit is refundable. # This tax credit is subject to a phase-out for taxpayers with adjusted gross income in excess of $80,000 ($160,000 for married couples filing jointly). The act directs several Treasury studies: # Coordination with non-tax student financial assistance; # Coordinate the credit allowed under the Federal P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Oklahoma

The University of Oklahoma (OU) is a Public university, public research university in Norman, Oklahoma. Founded in 1890, it had existed in Oklahoma Territory near Indian Territory for 17 years before the two Territories became the state of Oklahoma. In Fall 2022, the university had 29,705 students enrolled, most at its main campus in Norman. Employing nearly 3,000 faculty members, the school offers 152 Bachelor's degree, baccalaureate programs, 160 Master's degree, master's programs, 75 doctorate programs, and 20 majors at the first professional level. The university is Carnegie Classification of Institutions of Higher Education, classified among "R1: Doctoral Universities – Very high research activity". According to the National Science Foundation, OU spent $283 million on research and development in 2018, ranking it 82nd in the nation. Its Norman campus has two prominent museums, the Fred Jones Jr. Museum of Art, specializing in French Impressionism and Native Americans in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Financial Aid In The United States

Student financial aid in the United States is funding that is available exclusively to students attending a post-secondary educational institution in the United States. This funding is used to assist in covering the many costs incurred in the pursuit of post-secondary education. Financial aid is available from federal and state governments, educational institutions, and private organizations. It can be awarded in the form of grants, loans, work-study, and scholarships. In order to apply for federal financial aid, students must first complete the Free Application for Federal Student Aid (FAFSA). The financial aid process has been criticized for its part in enrollment management, whereby students are awarded money not based on merit or need, but on what the maximum the student families will pay. Types of financial aid Grants In the United States, grants come from a wide range of government departments, colleges, universities or public and private trusts. Grant eligibility is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Taxes In The United States

Personal may refer to: Aspects of persons' respective individualities * Privacy * Personality * Personal, personal advertisement, variety of classified advertisement used to find romance or friendship Companies * Personal, Inc., a Washington, D.C.-based tech startup * The Personal, a Canadian-based group car insurance and home insurance company * Telecom Personal, a mobile phone company in Argentina and Paraguay Music * ''Personal'' (album), the debut album by R&B group Men of Vizion * ''Personal'', the first album from singer-songwriter Quique González, and the title song * "Personal" (Aya Ueto song), a 2003 song by Aya Ueto from ''Message'' * "Personal" (Hrvy song), a song from ''Talk to Ya'' * "Personal" (The Vamps song), a song from ''Night & Day'' *"Personal", a song by Kehlani from ''SweetSexySavage'' Books * ''Personal'' (novel), a 2014 novel by Lee Child See also * The Personals (other) * Person * Personality psychology * Personalization * Human scal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student And Family Tax Simplification Act (H

The Student and Family Tax Simplification Act () is a bill that would amend the Internal Revenue Code to consolidate several different education tax incentives into an expanded American Opportunity Tax Credit. The American Opportunity Tax Credit, under this legislation, would provide a maximum credit of $2,500. The bill was introduced into the United States House of Representatives during the 113th United States Congress. Provisions of the bill ''This summary is based largely on the summary provided by the Congressional Research Service, a public domain source.'' The Student and Family Tax Simplification Act would amend the Internal Revenue Code to provide for an American Opportunity Tax Credit, in lieu of the current Hope Scholarship and Lifetime Learning tax credits and the tax deduction for qualified tuition and related expenses, that provides for each eligible student (i.e., a student who meets certain requirements of the Higher Education Act of 1965 and who is carrying at l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NARA

The National Archives and Records Administration (NARA) is an " independent federal agency of the United States government within the executive branch", charged with the preservation and documentation of government and historical records. It is also tasked with increasing public access to those documents which make up the National Archive. NARA is officially responsible for maintaining and publishing the legally authentic and authoritative copies of acts of Congress, presidential directives, and federal regulations. NARA also transmits votes of the Electoral College to Congress. It also examines Electoral College and Constitutional amendment ratification documents for prima facie legal sufficiency and an authenticating signature. The National Archives, and its publicly exhibited Charters of Freedom, which include the original United States Declaration of Independence, United States Constitution, United States Bill of Rights, and many other historical documents, is headquart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whitehouse

Whitehouse may refer to: People * Charles S. Whitehouse (1921-2001), American diplomat * Cornelius Whitehouse (1796–1883), English engineer and inventor * E. Sheldon Whitehouse (1883-1965), American diplomat * Elliott Whitehouse (born 1993), English footballer * Eula Whitehouse (1892–1974), American botanist * Frederick William Whitehouse (1900–1973), Australian geologist * Jimmy Whitehouse (footballer, born 1924) (1924-2005), English footballer * Mary Whitehouse (1910–2001), British Christian morality campaigner * Morris H. Whitehouse (1878–1944), American architect * Paul Whitehouse (born 1958), Welsh comedian and actor * Paul Whitehouse (police officer) (born 1944) * Sheldon Whitehouse (born 1955), American politician from the state of Rhode Island * Wildman Whitehouse (1816–1890), English surgeon and chief electrician for the transatlantic telegraph cable Places ;in the United Kingdom * Whitehouse, Aberdeenshire, location of the Whitehouse railway stati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

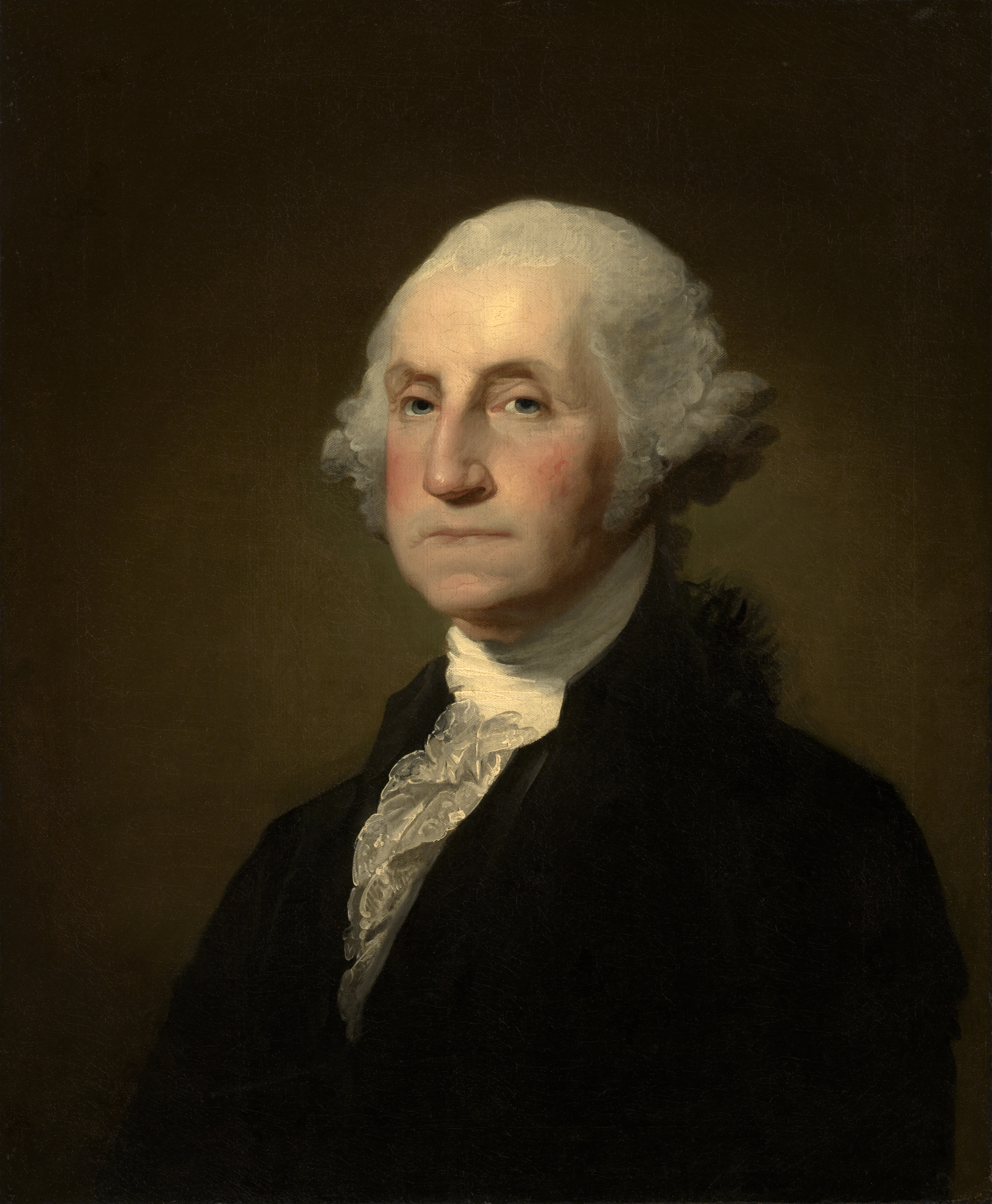

President Of The United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces. The power of the presidency has grown substantially since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasingly strong role in American political life since the beginning of the 20th century, with a notable expansion during the presidency of Franklin D. Roosevelt. In contemporary times, the president is also looked upon as one of the world's most powerful political figures as the leader of the only remaining global superpower. As the leader of the nation with the largest economy by nominal GDP, the president possesses significant domestic and international hard and soft power. Article II of the Constitution establ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benjamin Banneker Academic High School

Benjamin Banneker Academic High School is a magnet high school located in Washington, D.C., that was originally built to serve as a neighborhood Junior High School. The school's name commemorates Benjamin Banneker, an African-American scientist, surveyor, almanac author and farmer. In 1980, the school was converted to a magnet high school for academics. The school is colloquially referred to by students and faculty as "Banneker". Banneker was formerly located across the street from Howard University, but in 2021 a new campus opened at former Shaw Middle School site in Shaw. The former Banneker building will then become the site of Shaw Middle School following renovations. The school draws students from all parts of the city. Any student interested in applying must follow an entrance procedure, involving a multiple choice test, a written essay, an interview, recommendation(s), and a report of the applicant's standardized test scores and grades from previous years. The school's cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |