|

Revenue Act Of 1964

The United States Revenue Act of 1964 (), also known as the Tax Reduction Act, was a tax cut act proposed by President John F. Kennedy, passed by the 88th United States Congress, and signed into law by President Lyndon B. Johnson. The act became law on February 26, 1964. Kennedy proposed the bill on the advice of Keynesian economist Walter Heller, who believed that temporary deficit spending would boost economic growth. The act was initially blocked by conservatives like Senator Harry F. Byrd, but Lyndon Johnson was able to guide it through Congress after the assassination of Kennedy in November 1963. The act cut federal income taxes by approximately twenty percent across the board, and the top federal income tax rate fell from 91 percent to 70 percent. The act also reduced the corporate tax from 52 percent to 48 percent and created a minimum standard deduction. Summary of provisions The Office of Tax Analysis of the United States Department of the Treasury summarized the tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John F

John is a common English name and surname: * John (given name) * John (surname) John may also refer to: New Testament Works * Gospel of John, a title often shortened to John * First Epistle of John, often shortened to 1 John * Second Epistle of John, often shortened to 2 John * Third Epistle of John, often shortened to 3 John People * John the Baptist (died c. AD 30), regarded as a prophet and the forerunner of Jesus Christ * John the Apostle (lived c. AD 30), one of the twelve apostles of Jesus * John the Evangelist, assigned author of the Fourth Gospel, once identified with the Apostle * John of Patmos, also known as John the Divine or John the Revelator, the author of the Book of Revelation, once identified with the Apostle * John the Presbyter, a figure either identified with or distinguished from the Apostle, the Evangelist and John of Patmos Other people with the given name Religious figures * John, father of Andrew the Apostle and Saint Peter * Pop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

88th United States Congress

The 88th United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, D.C. from January 3, 1963, to January 3, 1965, during the last year of the administration of U.S. President John F. Kennedy, and the first of the administration of his successor, U.S. President Lyndon B. Johnson. The apportionment of seats in this House of Representatives was based on the Eighteenth Census of the United States in 1960, and the number of members was again 435 (it had temporarily been 437 in order to seat one member each from recently admitted states of Alaska and Hawaii). Both chambers maintained a Democratic majority - including a filibuster-proof supermajority in the Senate - and with President Kennedy, the Democrats maintained an overall federal government trifecta. Major events * November 22, 1963: Vice President Lyndon B. Johnso ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lyndon B

Lyndon may refer to: Places * Lyndon, Alberta, Canada * Lyndon, Rutland, East Midlands, England * Lyndon, Solihull, West Midlands, England United States * Lyndon, Illinois * Lyndon, Kansas * Lyndon, Kentucky * Lyndon, New York * Lyndon, Ohio * Lyndon, Pennsylvania * Lyndon, Vermont * Lyndon, Sheboygan County, Wisconsin, a town * Lyndon, Juneau County, Wisconsin, a town Other uses * Lyndon State College, a public college located in Lyndonville, Vermont People * Lyndon (name), given name and surname See also * Lyndon School (other) * Lyndon Township (other) * * Lydon (other) * Lynden (other) * Lindon (other) Lindon may refer to: Places ; Real *Lindon, Colorado * Lindon, Utah * Lindon, South Australia ; Fictional * Lindon (Middle-earth), a region of the extreme west of J.R.R. Tolkien's fictional Middle-earth Other uses *Lindon (name) See also *Linden ... * Linden (other) {{disambig, geo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walter Heller

Walter Wolfgang Heller (27 August 1915 – 15 June 1987) was a leading American economist of the 1960s, and an influential adviser to President John F. Kennedy as chairman of the Council of Economic Advisers, 1961–64. Life and career Heller was born in Buffalo, New York, to German immigrants, Gertrude (Warmburg) and Ernst Heller, a civil engineer. After attending Shorewood High School in Shorewood, Wisconsin, he entered Oberlin College in 1931, graduating with a B.A. degree in 1935. Heller received his masters and doctorate degrees in economics from the University of Wisconsin. As a Keynesian, he promoted cuts in the marginal federal income tax rates. This tax cut, which was passed by President Lyndon B. Johnson and Congress after Kennedy's death, was credited for boosting the U.S. economy. Heller developed the first "voluntary" wage-price guidelines. When the steel industry failed to follow them, it was publicly attacked by Kennedy and quickly complied. Heller was one o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harry F

Harry may refer to: TV shows * ''Harry'' (American TV series), a 1987 American comedy series starring Alan Arkin * ''Harry'' (British TV series), a 1993 BBC drama that ran for two seasons * ''Harry'' (talk show), a 2016 American daytime talk show hosted by Harry Connick Jr. People and fictional characters *Harry (given name), a list of people and fictional characters with the given name *Harry (surname), a list of people with the surname *Dirty Harry (musician) (born 1982), British rock singer who has also used the stage name Harry *Harry Potter (character), the main protagonist in a Harry Potter fictional series by J. K. Rowling Other uses *Harry (derogatory term), derogatory term used in Norway * ''Harry'' (album), a 1969 album by Harry Nilsson *The tunnel used in the Stalag Luft III escape ("The Great Escape") of World War II * ''Harry'' (newspaper), an underground newspaper in Baltimore, Maryland See also *Harrying (laying waste), may refer to the following historical event ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

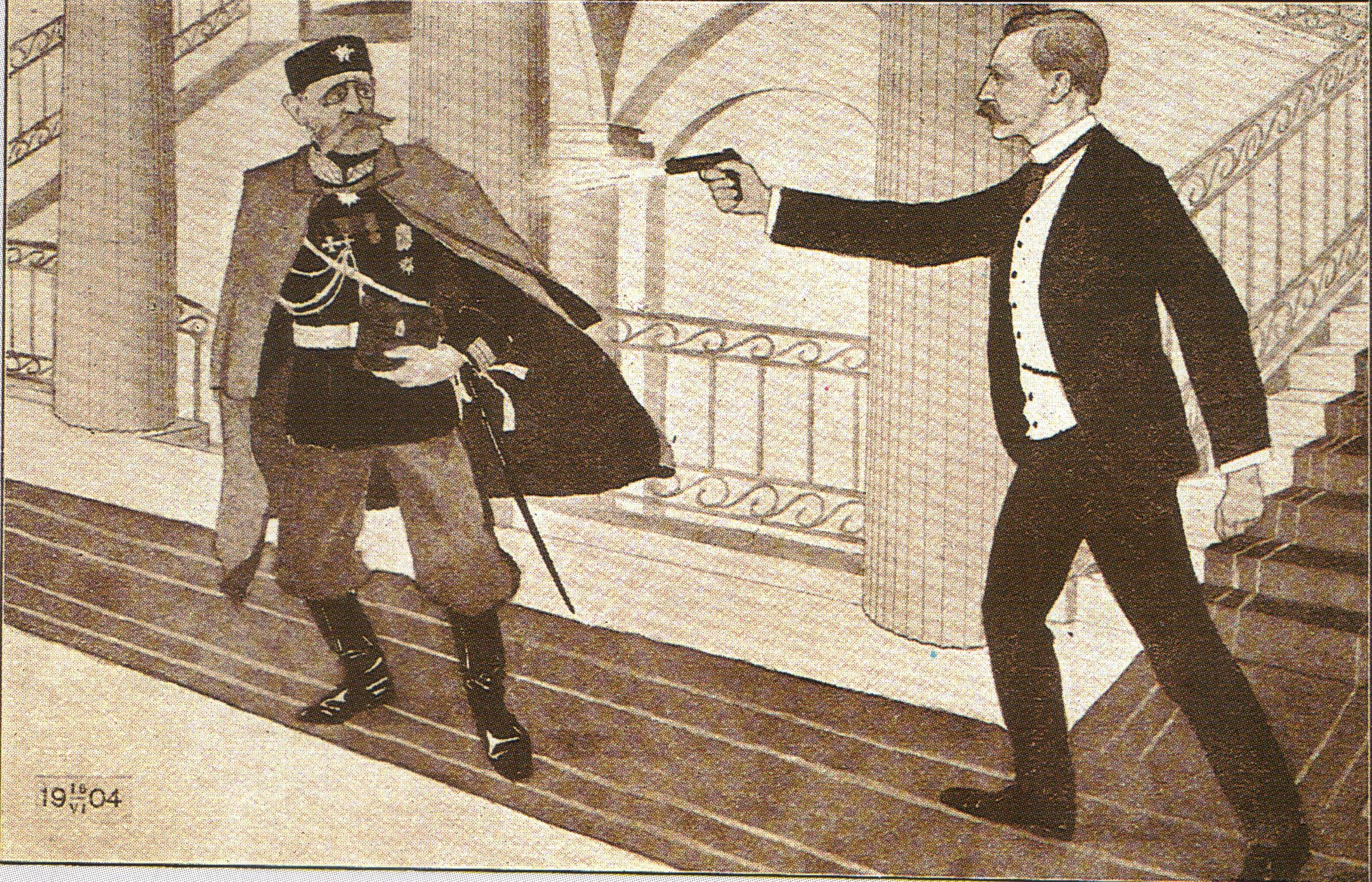

Assassination Of John F

Assassination is the murder of a prominent or important person, such as a head of state, head of government, politician, world leader, member of a royal family or CEO. The murder of a celebrity, activist, or artist, though they may not have a direct role in matters of the state, may also sometimes be considered an assassination. An assassination may be prompted by political and military motives, or done for financial gain, to avenge a grievance, from a desire to acquire fame or notoriety, or because of a military, security, insurgent or secret police group's command to carry out the assassination. Acts of assassination have been performed since ancient times. A person who carries out an assassination is called an assassin or hitman. Etymology The word ''assassin'' may be derived from '' asasiyyin'' (Arabic: أَسَاسِيِّين, ʾasāsiyyīn) from أَسَاس (ʾasās, "foundation, basis") + ـِيّ (-iyy), meaning "people who are faithful to the fou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Taxes In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" refe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corpor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Council Of Economic Advisers

The Council of Economic Advisers (CEA) is a United States agency within the Executive Office of the President established in 1946, which advises the President of the United States on economic policy. The CEA provides much of the empirical research for the White House and prepares the publicly-available annual Economic Report of the President. Activities Economic Report of the President The report is published by the CEA annually in February, no later than 10 days after the Budget of the US Government is submitted. The president typically writes a letter introducing the report, serving as an executive summary and used for press coverage. The report proceeds with several hundred pages of qualitative and quantitative research by reviewing the impact of economic activity in the previous year, outlining the economic goals for the coming year (based on the President's economic agenda), and making numerical projections of economic performance and outcomes. Public criticism usually ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)