venture capital on:

[Wikipedia]

[Google]

[Amazon]

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky  The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the

The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S.

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S.

Venture Capital Loses Its Vigor

"

. This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirements, which cannot be financed by cheaper alternatives such as debt. That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fast-growing

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to

report by the National Venture Capital Association

The same numbers for all of 2010 were $23.4 billion in 3,496 deals. According to a report by Dow Jones VentureSource, venture capital funding fell to $6.4 billion in the US in the first quarter of 2013, an 11.8% drop from the first quarter of 2012, and a 20.8% decline from 2011. Venture firms have added $4.2 billion into their funds this year, down from $6.3 billion in the first quarter of 2013, but up from $2.6 billion in the fourth quarter of 2012.

H1 2019 MENA Venture Investment Report

' by MAGNiTT, 238 startup investment deals have taken place in the region in the first half of 2019, totaling in $471 million in investments. Compared to 2018’s H1 report, this represents an increase of 66% in total funding and 28% in number of deals. According to the report, the UAE is the most active ecosystem in the region with 26% of the deals made in H1, followed by

Venture Capital's Role in Financing Innovation: What We Know and How Much We Still Need to Learn

" Journal of Economic Perspectives, 34 (3): 237-61.

start-ups

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend t ...

in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model

A business model describes how an organization creates, delivers, and captures value,''Business Model Generation'', Alexander Osterwalder, Yves Pigneur, Alan Smith, and 470 practitioners from 45 countries, self-published, 2010 in economic, soc ...

and they are usually from high technology

High technology (high tech), also known as advanced technology (advanced tech) or exotechnology, is technology that is at the cutting edge: the highest form of technology available. It can be defined as either the most complex or the newest tec ...

industries, such as information technology

Information technology (IT) is the use of computers to create, process, store, retrieve, and exchange all kinds of data . and information. IT forms part of information and communications technology (ICT). An information technology system ...

(IT), clean technology

Clean technology, in short cleantech, is any process, product, or service that reduces negative environmental impacts through significant energy efficiency improvements, the sustainable use of resources, or environmental protection activities. Cl ...

or biotechnology

Biotechnology is the integration of natural sciences and engineering sciences in order to achieve the application of organisms, cells, parts thereof and molecular analogues for products and services. The term ''biotechnology'' was first used b ...

.

The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the

The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the Series A round

A series A round (also known as series A financing or series A investment) is the name typically given to a company's first significant round of venture capital financing. The name refers to the class of preferred stock sold to investors in exc ...

. Venture capitalists provide this financing in the interest of generating a return

Return may refer to:

In business, economics, and finance

* Return on investment (ROI), the financial gain after an expense.

* Rate of return, the financial term for the profit or loss derived from an investment

* Tax return, a blank document o ...

through an eventual "exit" event, such as the company selling shares to the public for the first time in an initial public offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investme ...

(IPO), or disposal of shares happening via a merger, via a sale to another entity such as a financial buyer in the private equity secondary market or via a sale to a trading company such as a competitor.

In addition to angel investing

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or owner ...

, equity crowdfunding and other seed funding options, venture capital is attractive for new companies with limited operating history that are too small to raise capital in the public market

A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions, livestock, and other goods. In different parts of the world, a marketplace may be described as a '' souk'' (from the Arabic), ' ...

s and have not reached the point where they are able to secure a bank loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that ...

or complete a debt offering. In exchange for the high risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environme ...

that venture capitalists assume by investing in smaller and early-stage companies, venture capitalists usually get significant control over company decisions, in addition to a significant portion of the companies' ownership (and consequently value). Start-ups like Uber

Uber Technologies, Inc. (Uber), based in San Francisco, provides mobility as a service, ride-hailing (allowing users to book a car and driver to transport them in a way similar to a taxi), food delivery ( Uber Eats and Postmates), pack ...

, Airbnb, Flipkart, Xiaomi & Didi Chuxing are highly valued startups, commonly known as Unicorns

The unicorn is a legendary creature that has been described since antiquity as a beast with a single large, pointed, spiraling horn projecting from its forehead.

In European literature and art, the unicorn has for the last thousand years or ...

where venture capitalists contribute more than financing to these early-stage firms; they also often provide strategic advice to the firm's executives on its business model

A business model describes how an organization creates, delivers, and captures value,''Business Model Generation'', Alexander Osterwalder, Yves Pigneur, Alan Smith, and 470 practitioners from 45 countries, self-published, 2010 in economic, soc ...

and marketing strategies.

Venture capital is also a way in which the private and public sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, in ...

s can construct an institution that systematically creates business networks for the new firms and industries so that they can progress and develop. This institution helps identify promising new firms and provide them with finance, technical expertise, mentoring, talent acquisition, strategic partnership, marketing "know-how", and business model

A business model describes how an organization creates, delivers, and captures value,''Business Model Generation'', Alexander Osterwalder, Yves Pigneur, Alan Smith, and 470 practitioners from 45 countries, self-published, 2010 in economic, soc ...

s. Once integrated into the business network, these firms are more likely to succeed, as they become "nodes" in the search networks for designing and building products in their domain. However, venture capitalists' decisions are often biased, exhibiting for instance overconfidence and illusion of control, much like entrepreneurial decisions in general.

History

Origins of modern venture capital

BeforeWorld War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

(1939–1945) venture capital was primarily the domain of wealthy individuals and families. J.P. Morgan

JP may refer to:

Arts and media

* ''JP'' (album), 2001, by American singer Jesse Powell

* ''Jp'' (magazine), an American Jeep magazine

* ''Jönköpings-Posten'', a Swedish newspaper

* Judas Priest, an English heavy metal band

* ''Jurassic Park ...

, the Wallenbergs, the Vanderbilts, the Whitneys, the Rockefellers, and the Warburgs were notable investors in private companies. In 1938, Laurance S. Rockefeller

Laurance Spelman Rockefeller (May 26, 1910 – July 11, 2004) was an American businessman, financier, philanthropist, and conservationist. Rockefeller was the third son and fourth child of John D. Rockefeller Jr. and Abby Aldrich Rockefeller. As ...

helped finance the creation of both Eastern Air Lines

Eastern Air Lines, also colloquially known as Eastern, was a major United States airline from 1926 to 1991. Before its dissolution, it was headquartered at Miami International Airport in an unincorporated area of Miami-Dade County, Florida.

Ea ...

and Douglas Aircraft, and the Rockefeller family had vast holdings in a variety of companies. Eric M. Warburg founded E.M. Warburg & Co. in 1938, which would ultimately become Warburg Pincus, with investments in both leveraged buyouts and venture capital. The Wallenberg family

The Wallenberg family is a prominent Swedish family, Europe's most powerful business dynasty. Wallenbergs are noted as bankers, industrialists, politicians, bureaucrats, diplomats and military. The Wallenberg sphere's holdings employ about 60 ...

started Investor AB

Investor AB is a Swedish investment and ''de facto'' conglomerate holding company. It was founded in 1916 and is still controlled by the Wallenberg family through their Foundation Asset Management company FAM. The company owns a controlling s ...

in 1916 in Sweden and were early investors in several Swedish companies such as ABB, Atlas Copco, and Ericsson

(lit. "Telephone Stock Company of LM Ericsson"), commonly known as Ericsson, is a Sweden, Swedish multinational networking and telecommunications company headquartered in Stockholm. The company sells infrastructure, software, and services in ...

in the first half of the 20th century.

Only after 1945 did "true" venture capital investment firms begin to emerge, notably with the founding of American Research and Development Corporation (ARDC) and J.H. Whitney & Company in 1946.

Georges Doriot, the "father of venture capitalism", along with Ralph Flanders and Karl Compton (former president of MIT) founded ARDC in 1946 to encourage private-sector investment in businesses run by soldiers returning from World War II. ARDC became the first institutional private-equity investment firm to raise capital from sources other than wealthy families. Unlike most present-day venture capital firms, ARDC was a publicly-traded company. ARDC's most successful investment was its 1957 funding of Digital Equipment Corporation

Digital Equipment Corporation (DEC ), using the trademark Digital, was a major American company in the computer industry from the 1960s to the 1990s. The company was co-founded by Ken Olsen and Harlan Anderson in 1957. Olsen was president unti ...

(DEC), which would later be valued at more than $355 million after its initial public offering in 1968. This represented a return of over 1200 times its investment and an annualized rate of return of 101% to ARDC.

Former employees of ARDC went on to establish several prominent venture capital firms including Greylock Partners, founded in 1965 by Charlie Waite and Bill Elfers; Morgan, Holland Ventures, the predecessor of Flagship Ventures, founded in 1982 by James Morgan; Fidelity Ventures, now Volition Capital, founded in 1969 by Henry Hoagland; and Charles River Ventures, founded in 1970 by Richard Burnes. ARDC continued investing until 1971, when Doriot retired. In 1972 Doriot merged ARDC with Textron

Textron Inc. is an American industrial conglomerate based in Providence, Rhode Island. Textron's subsidiaries include Arctic Cat, Bell Textron, Textron Aviation (which itself includes the Beechcraft, and Cessna brands), and Lycoming Engine ...

after having invested in over 150 companies.

John Hay Whitney (1904–1982) and his partner Benno Schmidt (1913–1999) founded J.H. Whitney & Company in 1946. Whitney had been investing since the 1930s, founding Pioneer Pictures in 1933 and acquiring a 15% interest in Technicolor Corporation with his cousin Cornelius Vanderbilt Whitney. Florida Foods Corporation proved Whitney's most famous investment. The company developed an innovative method for delivering nutrition to American soldiers, later known as Minute Maid

Minute Maid is a product line of beverages, usually associated with lemonade or orange juice, but which now extends to soft drinks of different kinds, including Hi-C. Minute Maid is sold under the Cappy brand in Central Europe and under the ...

orange juice and was sold to The Coca-Cola Company

The Coca-Cola Company is an American multinational beverage corporation founded in 1892, best known as the producer of Coca-Cola. The Coca-Cola Company also manufactures, sells, and markets other non-alcoholic beverage concentrates and syrup ...

in 1960. J.H. Whitney & Company continued to make investments in leveraged buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money ( leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loa ...

transactions and raised $750 million for its sixth institutional private-equity fund in 2005.

Early venture capital and the growth of Silicon Valley

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S.

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S. Small Business Administration

The United States Small Business Administration (SBA) is an independent agency of the United States government that provides support to entrepreneurs and small businesses. The mission of the Small Business Administration is "to maintain and str ...

(SBA) to license private "Small Business Investment Companies" (SBICs) to help the financing and management of the small entrepreneurial businesses in the United States. The Small Business Investment Act of 1958 provided tax breaks that helped contribute to the rise of private-equity firms.

During the 1950s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction. It was a business that was growing very rapidly, and as the business grew, the transactions grew exponentially.

During the 1960s and 1970s, venture capital firms focused their investment activity primarily on starting and expanding companies. More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in 1962 by William Henry Draper III and Franklin P. Johnson, Jr. In 1965, Sutter Hill Ventures acquired the portfolio of Draper and Johnson as a founding action. Bill Draper and Paul Wythes were the founders, and Pitch Johnson formed Asset Management Company at that time.

It was also in the 1960s that the common form of private-equity fund, still in use today, emerged. Private-equity firms organized limited partnership

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited ...

s to hold investments in which the investment professionals served as general partner General partner is a person who joins with at least one other person to form a business. A general partner has responsibility for the actions of the business, can legally bind the business and is personally liable for all the partnership's debts an ...

and the investors, who were passive limited partners

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited ...

, put up the capital. The compensation structure, still in use today, also emerged with limited partners paying an annual management fee of 1.0–2.5% and a carried interest typically representing up to 20% of the profits of the partnership.

The growth of the venture capital industry was fueled by the emergence of the independent investment firms on Sand Hill Road

Sand Hill Road, often shortened to just "Sand Hill" or "SHR", is an arterial road in western Silicon Valley, California, running through Palo Alto, Menlo Park, and Woodside, notable for its concentration of venture capital companies. The road h ...

, beginning with Kleiner Perkins and Sequoia Capital in 1972. Located in Menlo Park, CA, Kleiner Perkins, Sequoia and later venture capital firms would have access to the many semiconductor

A semiconductor is a material which has an electrical conductivity value falling between that of a conductor, such as copper, and an insulator, such as glass. Its resistivity falls as its temperature rises; metals behave in the opposite way. ...

companies based in the Santa Clara Valley as well as early computer firms using their devices and programming and service companies.

Throughout the 1970s, a group of private-equity firms, focused primarily on venture capital investments, would be founded that would become the model for later leveraged buyout and venture capital investment firms. In 1973, with the number of new venture capital firms increasing, leading venture capitalists formed the National Venture Capital Association (NVCA). The NVCA was to serve as the industry trade group for the venture capital industry. Venture capital firms suffered a temporary downturn in 1974, when the stock market crashed and investors were naturally wary of this new kind of investment fund.

It was not until 1978 that venture capital experienced its first major fundraising year, as the industry raised approximately $750 million. With the passage of the Employee Retirement Income Security Act (ERISA) in 1974, corporate pension funds were prohibited from holding certain risky investments including many investments in privately held

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is ...

companies. In 1978, the US Labor Department relaxed certain restrictions of the ERISA, under the " prudent man rule", thus allowing corporate pension funds to invest in the asset class and providing a major source of capital available to venture capitalists.

1980s

The public successes of the venture capital industry in the 1970s and early 1980s (e.g.,Digital Equipment Corporation

Digital Equipment Corporation (DEC ), using the trademark Digital, was a major American company in the computer industry from the 1960s to the 1990s. The company was co-founded by Ken Olsen and Harlan Anderson in 1957. Olsen was president unti ...

, Apple Inc., Genentech) gave rise to a major proliferation of venture capital investment firms. From just a few dozen firms at the start of the decade, there were over 650 firms by the end of the 1980s, each searching for the next major "home run". The number of firms multiplied, and the capital managed by these firms increased from $3 billion to $31 billion over the course of the decade.POLLACK, ANDREW. Venture Capital Loses Its Vigor

"

New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

, October 8, 1989.

The growth of the industry was hampered by sharply declining returns, and certain venture firms began posting losses for the first time. In addition to the increased competition among firms, several other factors affected returns. The market for initial public offerings cooled in the mid-1980s before collapsing after the stock market crash in 1987, and foreign corporations, particularly from Japan and Korea

Korea ( ko, 한국, or , ) is a peninsular region in East Asia. Since 1945, it has been divided at or near the 38th parallel, with North Korea (Democratic People's Republic of Korea) comprising its northern half and South Korea (Republi ...

, flooded early-stage companies with capital.

In response to the changing conditions, corporations that had sponsored in-house venture investment arms, including General Electric

General Electric Company (GE) is an American multinational conglomerate founded in 1892, and incorporated in New York state and headquartered in Boston. The company operated in sectors including healthcare, aviation, power, renewable energ ...

and Paine Webber either sold off or closed these venture capital units. Additionally, venture capital units within Chemical Bank and Continental Illinois National Bank, among others, began shifting their focus from funding early stage companies toward investments in more mature companies. Even industry founders J.H. Whitney & Company and Warburg Pincus began to transition toward leveraged buyouts and growth capital investments.

Venture capital boom and the Internet Bubble

By the end of the 1980s, venture capital returns were relatively low, particularly in comparison with their emergingleveraged buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money ( leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loa ...

cousins, due in part to the competition for hot startups, excess supply of IPOs and the inexperience of many venture capital fund managers. Growth in the venture capital industry remained limited throughout the 1980s and the first half of the 1990s, increasing from $3 billion in 1983 to just over $4 billion more than a decade later in 1994.

The advent of the World Wide Web

The World Wide Web (WWW), commonly known as the Web, is an information system enabling documents and other web resources to be accessed over the Internet.

Documents and downloadable media are made available to the network through web se ...

in the early 1990s reinvigorated venture capital as investors saw companies with huge potential being formed. Netscape and Amazon (company) were founded in 1994, and Yahoo!

Yahoo! (, styled yahoo''!'' in its logo) is an American web services provider. It is headquartered in Sunnyvale, California and operated by the namesake company Yahoo! Inc. (2017–present), Yahoo Inc., which is 90% owned by investment funds ma ...

in 1995. All were funded by venture capital. Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a ''internetworking, network of networks'' that consists ...

IPOs—AOL in 1992; Netcom in 1994; UUNet, Spyglass and Netscape in 1995; Lycos, Excite, Yahoo!, CompuServe, Infoseek, C/NET, and E*Trade in 1996; and Amazon, ONSALE, Go2Net, N2K, NextLink, and SportsLine in 1997—generated enormous returns for their venture capital investors. These returns, and the performance of the companies post-IPO, caused a rush of money into venture capital, increasing the number of venture capital funds raised from about 40 in 1991 to more than 400 in 2000, and the amount of money committed to the sector from $1.5 billion in 1991 to more than $90 billion in 2000.

The bursting of the Dot-com bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet.

Between 1995 and its peak in March 2000, the Nasdaq Comp ...

in 2000 caused many venture capital firms to fail and financial results in the sector to decline.

Private equity crash

TheNasdaq

The Nasdaq Stock Market () (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second ...

crash and technology slump that started in March 2000 shook virtually the entire venture capital industry as valuations for startup technology companies collapsed. Over the next two years, many venture firms had been forced to write-off large proportions of their investments, and many funds were significantly "under water

The underwater environment is the region below the surface of, and immersed in, liquid water in a natural or artificial feature (called a body of water), such as an ocean, sea, lake, pond, reservoir, river, canal, or aquifer. Some characterist ...

" (the values of the fund's investments were below the amount of capital invested). Venture capital investors sought to reduce the size of commitments they had made to venture capital funds, and, in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the ...

. By mid-2003, the venture capital industry had shriveled to about half its 2001 capacity. Nevertheless, PricewaterhouseCoopers' MoneyTree Survey shows that total venture capital investments held steady at 2003 levels through the second quarter of 2005.

Although the post-boom years represent just a small fraction of the peak levels of venture investment reached in 2000, they still represent an increase over the levels of investment from 1980 through 1995. As a percentage of GDP, venture investment was 0.058% in 1994, peaked at 1.087% (nearly 19 times the 1994 level) in 2000 and ranged from 0.164% to 0.182% in 2003 and 2004. The revival of an Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a ''internetworking, network of networks'' that consists ...

-driven environment in 2004 through 2007 helped to revive the venture capital environment. However, as a percentage of the overall private-equity market, venture capital has still not reached its mid-1990s level, let alone its peak in 2000.

Venture capital funds, which were responsible for much of the fundraising volume in 2000 (the height of the dot-com bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet.

Between 1995 and its peak in March 2000, the Nasdaq Comp ...

), raised only $25.1 billion in 2006, a 2% decline from 2005 and a significant decline from its peak. The decline continued till their fortunes started to turn around in 2010 with $21.8 billion invested (not raised). The industry continued to show phenomenal growth and in 2020 hit $80 billion in fresh capital.

Financing

Obtaining venture capital is substantially different from raising debt or a loan. Lenders have a legal right to interest on a loan and repayment of the capital irrespective of the success or failure of a business. Venture capital is invested in exchange for an equity stake in the business. The return of the venture capitalist as a shareholder depends on the growth and profitability of the business. This return is generally earned when the venture capitalist "exits" by selling its shareholdings when the business is sold to another owner. Venture capitalists are typically very selective in deciding what to invest in, with a Stanford survey of venture capitalists revealing that 100 companies were considered for every company receiving financing. Ventures receiving financing must demonstrate an excellent management team, a large potential market, and most importantly high growth potential, as only such opportunities are likely capable of providing financial returns and a successful exit within the required time frame (typically 3–7 years) that venture capitalists expect. Because investments are illiquid and require the extended time frame to harvest, venture capitalists are expected to carry out detaileddue diligence

Due diligence is the investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

It can be a ...

prior to investment. Venture capitalists also are expected to nurture the companies in which they invest, in order to increase the likelihood of reaching an IPO stage when valuations

Valuation may refer to:

Economics

*Valuation (finance), the determination of the economic value of an asset or liability

**Real estate appraisal, sometimes called ''property valuation'' (especially in British English), the appraisal of land or bui ...

are favourable. Venture capitalists typically assist at four stages in the company's development:

* Idea generation;

* Start-up

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend t ...

;

* Ramp-up; and

* Exit

Because there are no public exchanges listing their securities, private companies meet venture capital firms and other private-equity investors in several ways, including warm referrals from the investors' trusted sources and other business contacts; investor conferences and symposia; and summits where companies pitch directly to investor groups in face-to-face meetings, including a variant known as "Speed Venturing", which is akin to speed-dating for capital, where the investor decides within 10 minutes whether he wants a follow-up meeting. In addition, some new private online networks are emerging to provide additional opportunities for meeting investors.Cash-strapped entrepreneurs get creative, BBC News. This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirements, which cannot be financed by cheaper alternatives such as debt. That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fast-growing

technology

Technology is the application of knowledge to reach practical goals in a specifiable and reproducible way. The word ''technology'' may also mean the product of such an endeavor. The use of technology is widely prevalent in medicine, scie ...

and life sciences

This list of life sciences comprises the branches of science that involve the scientific study of life – such as microorganisms, plants, and animals including human beings. This science is one of the two major branches of natural science, th ...

or biotechnology

Biotechnology is the integration of natural sciences and engineering sciences in order to achieve the application of organisms, cells, parts thereof and molecular analogues for products and services. The term ''biotechnology'' was first used b ...

fields.

If a company does have the qualities venture capitalists seek including a solid business plan, a good management team, investment and passion from the founders, a good potential to exit the investment before the end of their funding cycle, and target minimum returns in excess of 40% per year, it will find it easier to raise venture capital.

Financing stages

There are typically six stages ofventure round

A venture round is a type of funding round used for venture capital financing, by which startup companies obtain investment, generally from venture capitalists and other institutional investors. The availability of venture funding is among ...

financing offered in venture capital, that roughly correspond to these stages of a company's development.

* Seed funding: The earliest round of financing needed to prove a new idea, often provided by angel investors. Equity crowdfunding is also emerging as an option for seed funding.

* Start-up: Early stage firms that need funding for expenses associated with marketing and product development.

* Growth (Series A round

A series A round (also known as series A financing or series A investment) is the name typically given to a company's first significant round of venture capital financing. The name refers to the class of preferred stock sold to investors in exc ...

): Early sales and manufacturing funds. This is typically where VCs come in. Series A can be thought of as the first institutional round. Subsequent investment rounds are called Series B, Series C and so on. This is where most companies will have the most growth.

* Second round: Working capital for early stage companies that are selling product, but not yet turning a profit. This can also be called Series B round and so on.

* Expansion: Also called mezzanine financing, this is expansion money for a newly profitable company.

* Exit of venture capitalist: VCs can exit through secondary sale or an IPO or an acquisition. Early stage VCs may exit in later rounds when new investors (VCs or private-equity investors) buy the shares of existing investors. Sometimes a company very close to an IPO may allow some VCs to exit and instead new investors may come in hoping to profit from the IPO.

* Bridge financing is when a startup seeks funding in between full VC rounds. The objective is to raise a smaller amount of money to "bridge" the gap when current funds are expected to run out prior to planned future funding, intended to meet short-term working capital needs.

Between the first round and the fourth round, venture-backed companies may also seek to take venture debt.

Firms and funds

Venture capitalist

A venture capitalist or sometimes simply capitalist, is a person who makes capital investments in companies in exchange for an equity stake. The venture capitalist is often expected to bring managerial and technical expertise, as well as capital, to their investments. A venture capital fund refers to a pooled investment vehicle (in the United States, often an LP orLLC

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a ...

) that primarily invests the financial capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provid ...

of third-party investors in enterprises that are too risky for the standard capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of saver ...

s or bank loans

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

. These funds are typically managed by a venture capital firm, which often employs individuals with technology backgrounds (scientists, researchers), business training and/or deep industry experience.

A core skill within VC is the ability to identify novel or disruptive technologies that have the potential to generate high commercial returns at an early stage. By definition, VCs also take a role in managing entrepreneurial companies at an early stage, thus adding skills as well as capital, thereby differentiating VC from buy-out private equity, which typically invest in companies with proven revenue, and thereby potentially realizing much higher rates of returns. Inherent in realizing abnormally high rates of returns is the risk of losing all of one's investment in a given startup company. As a consequence, most venture capital investments are done in a pool format, where several investors combine their investments into one large fund that invests in many different startup companies. By investing in the pool format, the investors are spreading out their risk to many different investments instead of taking the chance of putting all of their money in one start up firm.

Structure

Venture capital firms are typically structured as partnerships, the general partners of which serve as the managers of the firm and will serve as investment advisors to the venture capital funds raised. Venture capital firms in the United States may also be structured aslimited liability companies

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability o ...

, in which case the firm's managers are known as managing members. Investors in venture capital funds are known as limited partners. This constituency comprises both high-net-worth individuals and institutions with large amounts of available capital, such as state and private pension fund

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.

Pension funds typically have large amounts of money to invest and are the major investors in listed and priva ...

s, university financial endowment

A financial endowment is a legal structure for managing, and in many cases indefinitely perpetuating, a pool of financial, real estate, or other investments for a specific purpose according to the will of its founders and donors. Endowments are o ...

s, foundations, insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge ...

companies, and pooled investment vehicles, called funds of funds

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A ...

.

Types

Venture capitalist firms differ in their motivations and approaches. There are multiple factors, and each firm is different. Venture capital funds are generally three in types: * 1. Angel investors * 2. Financial VCs * 3. Strategic VCs Some of the factors that influence VC decisions include: * Business situation: Some VCs tend to invest in new, disruptive ideas, or fledgling companies. Others prefer investing in established companies that need support to go public or grow. * Some invest solely in certain industries. * Some prefer operating locally while others will operate nationwide or even globally. * VC expectations can often vary. Some may want a quicker public sale of the company or expect fast growth. The amount of help a VC provides can vary from one firm to the next. There are also estimates on how big of an exit a VC will expect for your company (i.e. if the size of the VC fund is $20M, estimate that they'll at least want you to exit for the size of the fund.Roles

Within the venture capital industry, the general partners and other investment professionals of the venture capital firm are often referred to as "venture capitalists" or "VCs". Typical career backgrounds vary, but, broadly speaking, venture capitalists come from either an operational or a finance background. Venture capitalists with an operational background ( operating partner) tend to be former founders or executives of companies similar to those which the partnership finances or will have served as management consultants. Venture capitalists with finance backgrounds tend to haveinvestment banking

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with ...

or other corporate finance experience.

Although the titles are not entirely uniform from firm to firm, other positions at venture capital firms include:

Structure of the funds

Most venture capital funds have a fixed life of 10 years, with the possibility of a few years of extensions to allow for private companies still seeking liquidity. The investing cycle for most funds is generally three to five years, after which the focus is managing and making follow-on investments in an existing portfolio. This model was pioneered by successful funds inSilicon Valley

Silicon Valley is a region in Northern California that serves as a global center for high technology and innovation. Located in the southern part of the San Francisco Bay Area, it corresponds roughly to the geographical areas San Mateo Count ...

through the 1980s to invest in technological trends broadly but only during their period of ascendance, and to cut exposure to management and marketing risks of any individual firm or its product.

In such a fund, the investors have a fixed commitment to the fund that is initially unfunded and subsequently "called down" by the venture capital fund over time as the fund makes its investments. There are substantial penalties for a limited partner (or investor) that fails to participate in a capital call

A capital call (also known as a draw down or a capital commitment) is a legal right of an investment firm or an insurance firm to demand a portion of the money promised to it by an investor. A capital call fund would be the money that had been c ...

.

It can take anywhere from a month to several years for venture capitalists to raise money from limited partners for their fund. At the time when all of the money has been raised, the fund is said to be closed and the 10-year lifetime begins. Some funds have partial closes when one half (or some other amount) of the fund has been raised. The vintage year generally refers to the year in which the fund was closed and may serve as a means to stratify VC funds for comparison.

From an investor's point of view, funds can be: (1) traditional

A tradition is a belief or behavior (folk custom) passed down within a group or society with symbolic meaning or special significance with origins in the past. A component of cultural expressions and folklore, common examples include holidays ...

—where all the investors invest with equal terms; or (2) asymmetric

Asymmetric may refer to:

*Asymmetry in geometry, chemistry, and physics

Computing

* Asymmetric cryptography, in public-key cryptography

*Asymmetric digital subscriber line, Internet connectivity

* Asymmetric multiprocessing, in computer architect ...

—where different investors have different terms. Typically asymmetry is seen in cases where investors have opposing interests, such as the need to not have unrelated business taxable income in the case of public tax-exempt investors.

Investment Decision Process

The decision process to fund a company is elusive. One study report in theHarvard Business Review

''Harvard Business Review'' (''HBR'') is a general management magazine published by Harvard Business Publishing, a wholly owned subsidiary of Harvard University. ''HBR'' is published six times a year and is headquartered in Brighton, Ma ...

states that VCs rarely use standard financial analytics. First, VCs engage in a process known as "generating deal flow," where they reach out to their network to source potential investments. The study also reported that few VCs use any type of financial analytics when they assess deals; VCs are primarily concerned about the cash returned from the deal as a multiple of the cash invested. According to 95% of the VC firms surveyed, VCs cite the founder or founding team as the most important factor in their investment decision. Other factors are also considered, including intellectual property rights and the state of the economy. Some argue that the most important thing a VC looks for in a company is high-growth.

The funding decision process has spawned bias in the form of a large disparity between the funding men and minority groups, such as women and people of color. In 2021, female founders only received 2% of VC funding in the United States. Some research studies have found that VCs evaluate women differently and are less likely to fund female founders.

Compensation

Venture capitalists are compensated through a combination of management fees and carried interest (often referred to as a "two and 20" arrangement): Because a fund may run out of capital prior to the end of its life, larger venture capital firms usually have several overlapping funds at the same time; doing so lets the larger firm keep specialists in all stages of the development of firms almost constantly engaged. Smaller firms tend to thrive or fail with their initial industry contacts; by the time the fund cashes out, an entirely new generation of technologies and people is ascending, whom the general partners may not know well, and so it is prudent to reassess and shift industries or personnel rather than attempt to simply invest more in the industry or people the partners already know.Alternatives

Because of the strict requirements venture capitalists have for potential investments, many entrepreneurs seek seed funding from angel investors, who may be more willing to invest in highly speculative opportunities, or may have a prior relationship with the entrepreneur. Additionally, entrepreneurs may seek alternative financing, such asrevenue-based financing Revenue-based financing or royalty-based financing (RBF) is a type of financial capital provided to small or growing businesses in which investors inject capital into a business in return for a fixed percentage of ongoing gross revenues, with payme ...

, to avoid giving up equity ownership in the business. For entrepreneurs seeking more than just funding, startup studios can be an appealing alternative to venture capitalists, as they provide operational support and an experienced team.

Furthermore, many venture capital firms will only seriously evaluate an investment in a start-up company

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend ...

otherwise unknown to them if the company can prove at least some of its claims about the technology and/or market potential for its product or services. To achieve this, or even just to avoid the dilutive effects of receiving funding before such claims are proven, many start-ups seek to self-finance sweat equity until they reach a point where they can credibly approach outside capital providers such as venture capitalists or angel investors. This practice is called "bootstrapping

In general, bootstrapping usually refers to a self-starting process that is supposed to continue or grow without external input.

Etymology

Tall boots may have a tab, loop or handle at the top known as a bootstrap, allowing one to use fingers ...

".

Equity crowdfunding is emerging as an alternative to traditional venture capital. Traditional crowdfunding

Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet. Crowdfunding is a form of crowdsourcing and Alternative Finance, alternative finance. In 2015, over was rais ...

is an approach to raising the capital required for a new project or enterprise by appealing to large numbers of ordinary people for small donations. While such an approach has long precedents in the sphere of charity, it is receiving renewed attention from entrepreneurs, now that social media and online communities make it possible to reach out to a group of potentially interested supporters at very low cost. Some equity crowdfunding models are also being applied specifically for startup funding, such as those listed at Comparison of crowd funding services. One of the reasons to look for alternatives to venture capital is the problem of the traditional VC model. The traditional VCs are shifting their focus to later-stage investments, and return on investment

Return on investment (ROI) or return on costs (ROC) is a ratio between net income (over a period) and investment (costs resulting from an investment of some resources at a point in time). A high ROI means the investment's gains compare favourably ...

of many VC funds have been low or negative.

In Europe and India, Media for equity is a partial alternative to venture capital funding. Media for equity investors are able to supply start-ups with often significant advertising campaigns in return for equity. In Europe, an investment advisory firm offers young ventures the option to exchange equity for services investment; their aim is to guide ventures through the development stage to arrive at a significant funding, mergers and acquisition, or other exit strategy.

In industries where assets can be securitized

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling ...

effectively because they reliably generate future revenue streams or have a good potential for resale in case of foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mort ...

, businesses may more cheaply be able to raise debt to finance their growth. Good examples would include asset-intensive extractive industries such as mining, or manufacturing industries. Offshore funding is provided via specialist venture capital trusts, which seek to use securitization in structuring hybrid multi-market transactions via an SPV ( special purpose vehicle): a corporate entity that is designed solely for the purpose of the financing.

In addition to traditional venture capital and angel networks, groups have emerged, which allow groups of small investors or entrepreneurs themselves to compete in a privatized business plan competition where the group itself serves as the investor through a democratic process.

Law firms are also increasingly acting as an intermediary between clients seeking venture capital and the firms providing it.

Other forms include venture resources that seek to provide non-monetary support to launch a new venture.

Role in employment

Every year, there are nearly 2 million businesses created in the US, but only 600–800 get venture capital funding. According to the National Venture Capital Association, 11% of private sector jobs come from venture-backed companies and venture-backed revenue accounts for 21% of US GDP.Gender disparities

In 2020 female founded companies raised only 2.8% of capital investment from venture capital, the highest amount recorded. Babson College's Diana Report found that the number of women partners in VC firms decreased from 10% in 1999 to 6% in 2014. The report also found that 97% of VC-funded businesses had malechief executive

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especial ...

s, and that businesses with all-male teams were more than four times as likely to receive VC funding compared to teams with at least one woman.

Currently, about 3 percent of all venture capital is going to woman-led companies. More than 75% of VC firms in the US did not have any female venture capitalists at the time they were surveyed. It was found that a greater fraction of VC firms had never had a woman represent them on the board of one of their portfolio companies A portfolio company is a company or entity in which a venture capital firm, a startup studio, or a holding company invests. All companies currently backed by a private equity firm can be spoken of as the firm's portfolio.

A company may create ...

. In 2017 only 2.2% of all VC funding went to female founders.

For comparison, a UC Davis study focusing on large public companies in California found 49.5% with at least one female board seat. When the latter results were published, some ''San Jose Mercury News

''The Mercury News'' (formerly ''San Jose Mercury News'', often locally known as ''The Merc'') is a morning daily newspaper published in San Jose, California, in the San Francisco Bay Area. It is published by the Bay Area News Group, a subsidia ...

'' readers dismissed the possibility that sexism was a cause. In a follow-up ''Newsweek

''Newsweek'' is an American weekly online news magazine co-owned 50 percent each by Dev Pragad, its president and CEO, and Johnathan Davis, who has no operational role at ''Newsweek''. Founded as a weekly print magazine in 1933, it was widely ...

'' article, Nina Burleigh

Nina D. Burleigh is an American writer and investigative journalist, the daughter of author Robert Burleigh. She writes books, articles, essays and reviews. Burleigh is a supporter of secular liberalism, and is known for her interest in issues of ...

asked "Where were all these offended people when women like Heidi Roizen published accounts of having a venture capitalist stick her hand in his pants under a table while a deal was being discussed?"

Geographical differences

Venture capital, as an industry, originated in the United States, and American firms have traditionally been the largest participants in venture deals with the bulk of venture capital being deployed in American companies. However, increasingly, non-US venture investment is growing, and the number and size of non-US venture capitalists have been expanding. Venture capital has been used as a tool foreconomic development

In the economics study of the public sector, economic and social development is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals a ...

in a variety of developing regions. In many of these regions, with less developed financial sectors, venture capital plays a role in facilitating access to finance for small and medium enterprises (SMEs), which in most cases would not qualify for receiving bank loans.

In the year of 2008, while VC funding were still majorly dominated by U.S. money ($28.8 billion invested in over 2550 deals in 2008), compared to international fund investments ($13.4 billion invested elsewhere), there has been an average 5% growth in the venture capital deals outside the US, mainly in China and Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a subcontinent of Eurasia and it is located enti ...

. Geographical differences can be significant. For instance, in the UK, 4% of British investment goes to venture capital, compared to about 33% in the U.S.

VC funding has been shown to be positively related to a country's individualistic culture. According to economist Jeffrey Funk however more than 90% of US startups valued over $1 billion lost money between 2019–2020 and return on investment from VC barely exceed return from public stock markets over the last 25 years.

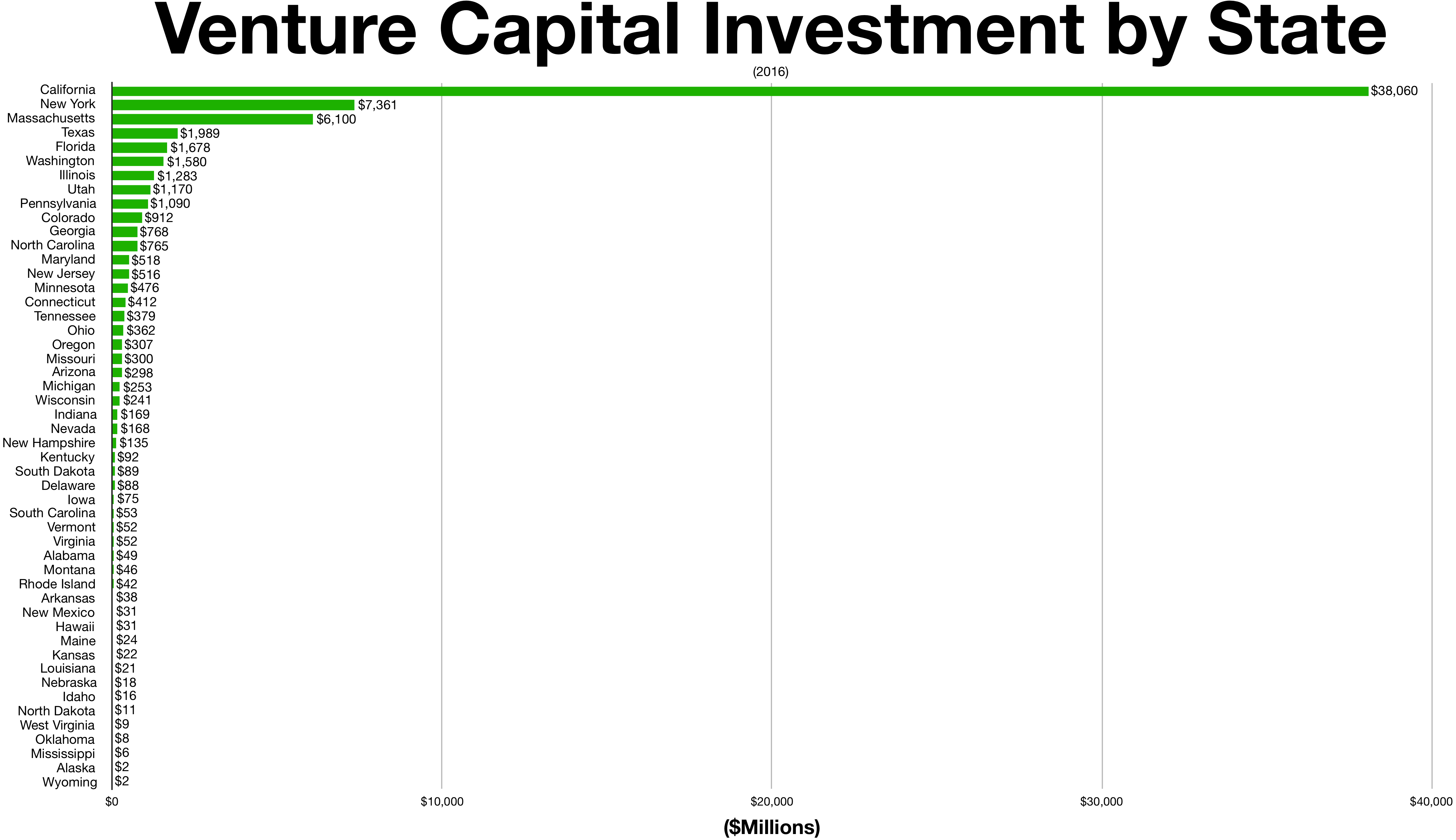

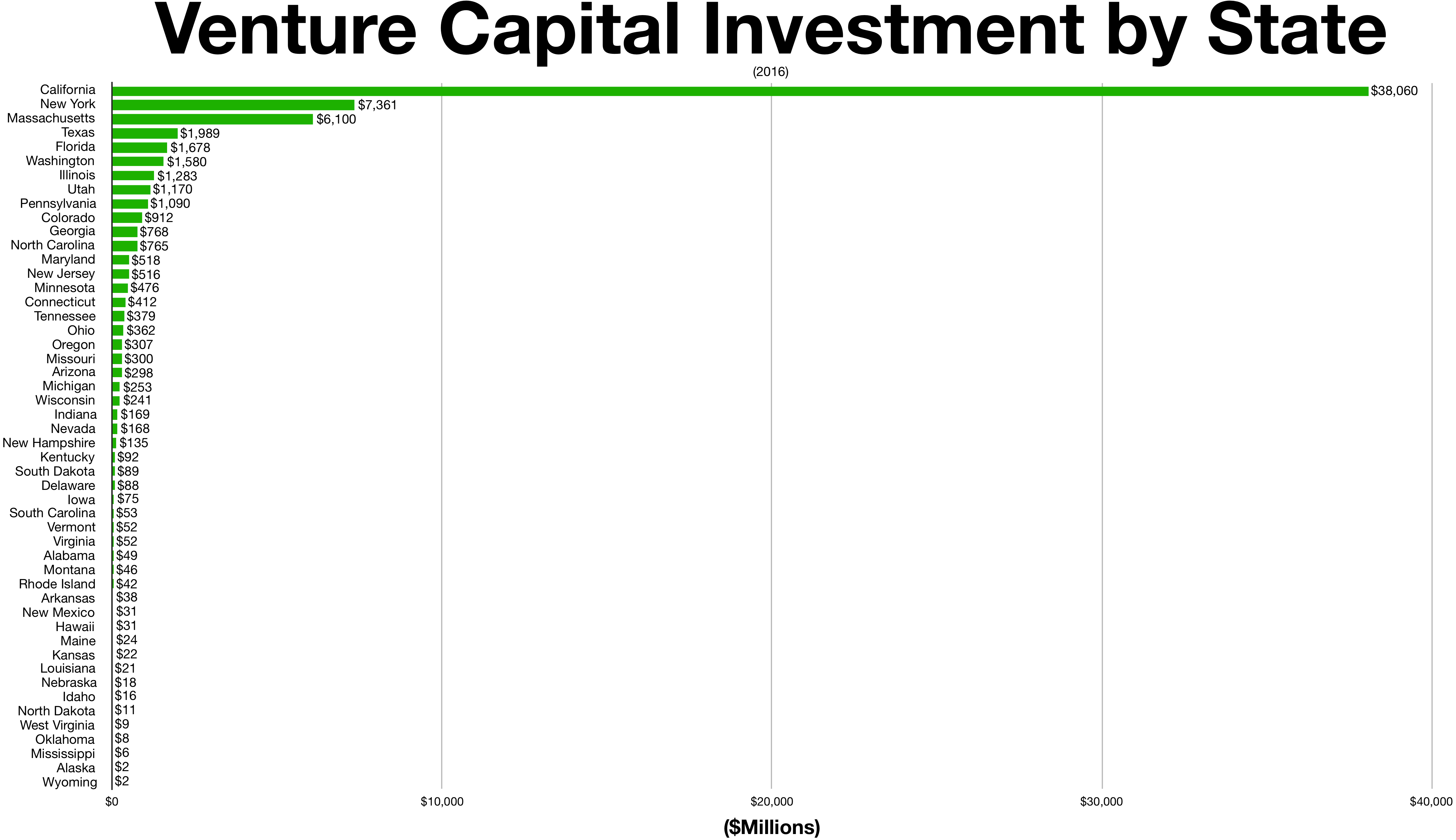

United States

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to report by the National Venture Capital Association

The same numbers for all of 2010 were $23.4 billion in 3,496 deals. According to a report by Dow Jones VentureSource, venture capital funding fell to $6.4 billion in the US in the first quarter of 2013, an 11.8% drop from the first quarter of 2012, and a 20.8% decline from 2011. Venture firms have added $4.2 billion into their funds this year, down from $6.3 billion in the first quarter of 2013, but up from $2.6 billion in the fourth quarter of 2012.

Australia and New Zealand

In Australia and New Zealand, there are more than one hundred active VC funds, syndicates, or angel investors making VC-style investments. The State of Startup Funding report found that in 2021, over AUD $10 billion AUD was invested into Australian and New Zealand startups across 682 deals. This represents a 3x increase from the $3.1 billion that was invested in 2020. Some notable Australian and New Zealand startup success stories include graphic design company Canva, financial services provider Airwallex, New Zealand payments provider Vend (acquired by Lightspeed), rent-to-buy company OwnHome, and direct-to-consumer propositions such asEucalyptus

''Eucalyptus'' () is a genus of over seven hundred species of Flowering plant, flowering trees, shrubs or Mallee (habit), mallees in the Myrtaceae, myrtle Family (biology), family, Myrtaceae. Along with several other genera in the Tribe (biology) ...

(a house of direct-to-consumer telehealth brands), and Lyka (a pet wellness company).

In 2022, the largest Australian funds are Blackbird Ventures, Square Peg Capital, and Airtree Ventures. These three funds have more than $1 billion AUD under management across multiple funds. These funds have funding from institutional capital, including AustralianSuper and Hostplus, family offices, and sophisticated individual high-net-wealth investors.

Outside of the 'Big 3', other notable institutional funds include AfterWork Ventures, Artesian, Folklore Ventures, Equity Venture Partners, Our Innovation Fund, Investible, Main Sequence Ventures (the VC arm of the CSIRO), and Tenacious Ventures.

As the number of capital providers in the Australian and New Zealand ecosystem has grown, funds have started to specialise and innovate to differentiate themselves. For example, Tenacious Ventures is a $35 million specialised agritech fund, while AfterWork Ventures is a 'community-powered fund' that has coalesced a group of 120 experienced operators from across Australia's startups and tech companies. Its community is invested in its fund, and lean into assist with sourcing and evaluating deal opportunities, as well as supporting companies post-investment.

Several Australian corporates have corporate VC arms, including NAB Ventures, Reinventure (associated with Westpac), IAG Firemark Ventures, and Telstra Ventures.

Bulgaria

The Bulgarian venture capital industry has been growing rapidly in the past decade. As of the beginning of 2021, there are 18 VC and growth equity firms on the local market, with the total funding available for technology startups exceeding €200M. According to BVCA – Bulgarian Private Equity and Venture Capital Association, 59 transactions of total value of €29.4 million took place in 2020. Most of the venture capital investments in Bulgaria are concentrated in the seed and Series A stages. Sofia-based LAUNCHub Ventures recently launched one of the biggest funds in the region, with a target size of €70 million.Mexico

The Venture Capital industry in Mexico is a fast-growing sector in the country that, with the support of institutions and private funds, is estimated to reach US$100 billion invested by 2018.Israel

In Israel, high-tech entrepreneurship and venture capital have flourished well beyond the country's relative size. As it has very little natural resources and, historically has been forced to build its economy on knowledge-based industries, its VC industry has rapidly developed, and nowadays has about 70 active venture capital funds, of which 14 international VCs with Israeli offices, and additional 220 international funds which actively invest in Israel. In addition, as of 2010, Israel led the world in venture capital invested per capita. Israel attracted $170 per person compared to $75 in the USA. About two thirds of the funds invested were from foreign sources, and the rest domestic. In 2013, Wix.com joined 62 other Israeli firms on the Nasdaq.Canada

Canadian technology companies have attracted interest from the global venture capital community partially as a result of generous tax incentive through the Scientific Research and Experimental Development (SR&ED) investment tax credit program. The basic incentive available to any Canadian corporation performing R&D is a refundable tax credit that is equal to 20% of "qualifying" R&D expenditures (labour, material, R&D contracts, and R&D equipment). An enhanced 35% refundable tax credit of available to certain (i.e. small) Canadian-controlled private corporations (CCPCs). Because the CCPC rules require a minimum of 50% Canadian ownership in the company performing R&D, foreign investors who would like to benefit from the larger 35% tax credit must accept minority position in the company, which might not be desirable. The SR&ED program does not restrict the export of any technology or intellectual property that may have been developed with the benefit of SR&ED tax incentives. Canada also has a fairly unusual form of venture capital generation in its labour-sponsored venture capital corporations (LSVCC). These funds, also known as Retail Venture Capital or Labour Sponsored Investment Funds (LSIF), are generally sponsored by labor unions and offer tax breaks from government to encourage retail investors to purchase the funds. Generally, these Retail Venture Capital funds only invest in companies where the majority of employees are in Canada. However, innovative structures have been developed to permit LSVCCs to direct in Canadian subsidiaries of corporations incorporated in jurisdictions outside of Canada.Switzerland

Many Swiss start-ups are university spin-offs, in particular from its federal institutes of technology inLausanne

Lausanne ( , , , ) ; it, Losanna; rm, Losanna. is the capital and largest city of the Swiss French speaking canton of Vaud. It is a hilly city situated on the shores of Lake Geneva, about halfway between the Jura Mountains and the Alps, and fac ...

and Zurich.

According to a study by the London School of Economics

, mottoeng = To understand the causes of things

, established =

, type = Public research university

, endowment = £240.8 million (2021)

, budget = £391.1 mill ...

analysing 130 ETH Zurich

(colloquially)

, former_name = eidgenössische polytechnische Schule

, image = ETHZ.JPG

, image_size =

, established =

, type = Public

, budget = CHF 1.896 billion (2021)

, rector = Günther Dissertori

, president = Joël Mesot

, a ...

spin-offs over 10 years, about 90% of these start-ups survived the first five critical years, resulting in an average annual IRR of more than 43%.

Switzerland's most active early-stage investors are The Zurich Cantonal Bank, investiere.ch, Swiss Founders Fund, as well as a number of angel investor clubs.

Europe

Leading early-stage venture capital investors in Europe include Mark Tluszcz of Mangrove Capital Partners and Danny Rimer ofIndex Ventures

Index Ventures is a Europe, European venture capital firm with dual headquarters in San Francisco and London, investing in technology-enabled companies with a focus on e-commerce, fintech, mobility, gaming, infrastructure/AI, and security. Sinc ...

, both of whom were named on ''Forbes'' Magazine's Midas List of the world's top dealmakers in technology venture capital in 2007. In 2020, the first Italian Venture capital Fund named Primo Space was launched by Primomiglio SGR. This fund first closed €58 million out a target €80 million and is focused on Space

Space is the boundless three-dimensional extent in which objects and events have relative position and direction. In classical physics, physical space is often conceived in three linear dimensions, although modern physicists usually con ...

investing.

Nordic countries

Recent years have seen a revival of the Nordic venture scene with more than €3 billion raised by VC funds in the Nordic region over the last five years. Over the past five years, a total of €2.7 billion has been invested into Nordic startups. Known Nordic early-stage venture capital funds include NorthZone (Sweden), Maki.vc (Finland) and ByFounders (Copenhagen).Poland

As of March 2019, there are 130 active VC firms inPoland

Poland, officially the Republic of Poland, , is a country in Central Europe. Poland is divided into Voivodeships of Poland, sixteen voivodeships and is the fifth most populous member state of the European Union (EU), with over 38 mill ...

which have invested locally in over 750 companies, an average of 9 companies per portfolio. Since 2016, new legal institutions have been established for entities implementing investments in enterprises in the seed or startup phase. In 2018, venture capital funds invested in Polish startups (0.033% of GDP). As of March 2019, total assets managed by VC companies operating in Poland are estimated at . The total value of investments of the Polish VC market is worth .

Asia

India

India, officially the Republic of India ( Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the ...

is catching up with the West in the field of venture capital and a number of venture capital funds have a presence in the country (IVCA). In 2006, the total amount of private equity and venture capital in India reached $7.5 billion across 299 deals. In the Indian market, venture capital consists of investing in equity, quasi-equity, or conditional loans in order to promote unlisted, high-risk, or high-tech firms driven by technically or professionally qualified entrepreneurs. It is also used to refer to investors "providing seed", "start-up and first-stage financing", or financing companies that have demonstrated extraordinary business potential. Venture capital refers to capital investment; equity and debt ;both of which carry indubitable risk. The anticipated risk is very high. The venture capital industry follows the concept of "high risk, high return", innovative entrepreneurship, knowledge-based ideas and human capital intensive enterprises have become common as venture capitalists invest in risky finance to encourage innovation.

China is also starting to develop a venture capital industry ( CVCA).

Vietnam

Vietnam or Viet Nam ( vi, Việt Nam, ), officially the Socialist Republic of Vietnam,., group="n" is a country in Southeast Asia, at the eastern edge of mainland Southeast Asia, with an area of and population of 96 million, making it ...

is experiencing its first foreign venture capitals, including IDG Venture Vietnam ($100 million) and DFJ Vinacapital ($35 million)

Singapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, borde ...

is widely recognized and featured as one of the hottest places to both start up and invest, mainly due to its healthy ecosystem, its strategic location and connectedness to foreign markets. With 100 deals valued at US$3.5 billion, Singapore saw a record value of PE and VC investments in 2016. The number of PE and VC investments increased substantially over the last 5 years: In 2015, Singapore recorded 81 investments with an aggregate value of US$2.2 billion while in 2014 and 2013, PE and VC deal values came to US$2.4 billion and US$0.9 billion respectively. With 53 percent, tech investments account for the majority of deal volume. Moreover, Singapore is home to two of South-East Asia's largest unicorns. Garena is reportedly the highest-valued unicorn in the region with a US$3.5 billion price tag, while Grab is the highest-funded, having raised a total of US$1.43 billion since its incorporation in 2012.

Start-ups and small businesses in Singapore receive support from policymakers and the local government fosters the role VCs play to support entrepreneurship in Singapore and the region. For instance, in 2016, Singapore's National Research Foundation (NRF) has given out grants up to around $30 million to four large local enterprises for investments in startups in the city-state. This first of its kind partnership NRF has entered into is designed to encourage these enterprises to source for new technologies and innovative business models.

Currently, the rules governing VC firms are being reviewed by the Monetary Authority of Singapore (MAS) to make it easier to set up funds and increase funding opportunities for start-ups. This mainly includes simplifying and shortening the authorization process for new venture capital managers and to study whether existing incentives that have attracted traditional asset managers here will be suitable for the VC sector. A public consultation on the proposals was held in January 2017 with changes expected to be introduced by July.

Middle East and North Africa

The Middle East and North Africa (MENA) venture capital industry is an early stage of development but growing. According toH1 2019 MENA Venture Investment Report

' by MAGNiTT, 238 startup investment deals have taken place in the region in the first half of 2019, totaling in $471 million in investments. Compared to 2018’s H1 report, this represents an increase of 66% in total funding and 28% in number of deals. According to the report, the UAE is the most active ecosystem in the region with 26% of the deals made in H1, followed by

Egypt

Egypt ( ar, مصر , ), officially the Arab Republic of Egypt, is a transcontinental country spanning the northeast corner of Africa and southwest corner of Asia via a land bridge formed by the Sinai Peninsula. It is bordered by the Med ...

at 21%, and Lebanon

Lebanon ( , ar, لُبْنَان, translit=lubnān, ), officially the Republic of Lebanon () or the Lebanese Republic, is a country in Western Asia. It is located between Syria to Lebanon–Syria border, the north and east and Israel to Blue ...

at 13%. In terms of deals by sector, fintech remains the most active industry with 17% of the deals made, followed by e-commerce at 12%, and delivery and transport at 8%.

The report also notes that a total of 130 institutions invested in MENA-based startups in H1 2019, 30% of which were headquartered outside the MENA, demonstrating international appetite for investments in the region. 15 startup exits have been recorded in H1 2019, with Careem’s $3.1 billion acquisition by Uber

Uber Technologies, Inc. (Uber), based in San Francisco, provides mobility as a service, ride-hailing (allowing users to book a car and driver to transport them in a way similar to a taxi), food delivery ( Uber Eats and Postmates), pack ...

being the first unicorn exit in the region. Other notable exits include Souq.com exit to Amazon

Amazon most often refers to:

* Amazons, a tribe of female warriors in Greek mythology

* Amazon rainforest, a rainforest covering most of the Amazon basin

* Amazon River, in South America

* Amazon (company), an American multinational technolog ...

in 2017 for $650 million.

Sub-Saharan Africa

The Southern African venture capital industry is developing. The South African Government and Revenue Service is following the international trend of using tax-efficient vehicles to propel economic growth and job creation through venture capital. Section 12 J of the ''Income Tax Act'' was updated to include venture capital. Companies are allowed to use a tax-efficient structure similar to VCTs in the UK. Despite the above structure, the government needs to adjust its regulation aroundintellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, cop ...

, exchange control and other legislation to ensure that Venture capital succeeds.

Currently, there are not many venture capital funds in operation and it is a small community; however, the number of venture funds are steadily increasing with new incentives slowly coming in from government. Funds are difficult to come by and due to the limited funding, companies are more likely to receive funding if they can demonstrate initial sales or traction and the potential for significant growth. The majority of the venture capital in Sub-Saharan Africa is centered on South Africa and Kenya.

Entrepreneurship is a key to growth. Governments will need to ensure business friendly regulatory environments in order to help foster innovation. In 2019, venture capital startup funding grew to 1.3 billion dollars, increasing rapidly. The causes are as of yet unclear, but education is certainly a factor.

Confidential information

Unlike public companies, information regarding an entrepreneur's business is typically confidential and proprietary. As part of thedue diligence

Due diligence is the investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

It can be a ...