|

Revenue-based Financing

Revenue-based financing or royalty-based financing (RBF) is a type of financial capital provided to small or growing businesses in which investors inject capital into a business in return for a fixed percentage of ongoing gross revenues, with payment increases and decreases based on business revenues, typically measured as either daily revenue or monthly revenue. This funding model is similar to a merchant cash advance, which is a lump-sum payment to a business in exchange for a percentage of future credit card sales or daily debit card sales. Like RBF, merchant cash advances do not require collateral or equity and are typically repaid within a short period of time, often within a few months to a year. Usually the returns to the investor continue until the initial capital amount, plus a multiple (also known as a cap) is repaid. Generally, RBF investors expect the loan to be repaid within 3 to 5 years of the initial investment. Overview RBF is often described as sitting between a ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based, ''e.g.'', retail, corporate, investment banking, etc. In other words, financial capital is internal retained earnings generated by the entity or funds provided by lenders (and investors) to businesses in order to purchase real capital equipment or services for producing new goods and/or services. In contrast, real capital (or economic capital) comprises physical goods that assist in the production of other goods and services, e.g. shovels for gravediggers, sewing machines for tailors, or machinery and tooling for factories. IFRS concepts of capital maintenance ''Financial capital'' generally refers to saved-up financial wealth, especially that used in or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct-to-consumer

Direct-to-consumer (DTC) or business-to-consumer (B2C) is the business model of selling products directly to customers and thereby bypassing any third-party retailers, wholesalers, or any other middlemen. Direct-to-consumer sales are usually transacted online, but direct-to-consumer brands may also operate physical retail spaces as a complement to their main e-commerce platform in a clicks-and-mortar business model. History Direct-to-consumer became immensely popular during the dot-com bubble of the late 1990s when it was mainly used to refer to online retailers who sold products and services to consumers through the Internet.Business-to-Consumer (Direct-to-consumer) May 20, 2019 This business model originated before modern |

Commercial Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Capital

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Margin

Gross margin is the difference between revenue and cost of goods sold (COGS), divided by revenue. Gross margin is expressed as a percentage. Generally, it is calculated as the selling price of an item, less the cost of goods sold (e. g. production or acquisition costs, not including indirect fixed costs like office expenses, rent, or administrative costs), then divided by the same selling price. "Gross margin" is often used interchangeably with "gross profit", however the terms are different: "gross ''profit''" is technically an absolute monetary amount and "gross ''margin''" is technically a percentage or ratio. Gross margin is a kind of profit margin, specifically a form of profit divided by net revenue, e. g., gross (profit) margin, operating (profit) margin, net (profit) margin, etc. Purpose The purpose of margins is "to determine the value of incremental sales, and to guide pricing and promotion decision."Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees A fee is the price one pays as remuneration for rights or services. Fees usually allow for overhead (business), overhead, wages, costs, and Profit (accounting), markup. Traditionally, professionals in the United Kingdom (and previously the Repu .... This definition is based on International Accounting Standard, IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profit (accounting), Profits or net income generally imply total revenue minus total expenses in a given period. In accountancy, accounting, in the balance statement, revenue is a subsection of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mountain States

The Mountain states (also known as the Mountain West or the Interior West) form one of the nine geographic divisions of the United States that are officially recognized by the United States Census Bureau. It is a subregion of the Western United States. The Mountain states are considered to include: Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah and Wyoming. Sometimes West River, South Dakota is also included. The words "Mountain states" generally refer to the U.S. States which encompass the U.S. Rocky Mountains. These are oriented north-south through portions of the states of Montana, Idaho, Wyoming, Colorado, Utah, and New Mexico. Arizona and Nevada, as well as other parts of Utah and New Mexico, have other smaller mountain ranges and scattered mountains located in them as well. Sometimes, the Trans-Pecos area of West Texas is considered part of the region. The land area of the eight states together is some 855,767 square miles (2,216,426 square kilometers). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment’s rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The internal rate of return on an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Assets

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such as precious metals, collectibles (art, wine, antiques, cars, coins, musical instruments, or stamps) and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, exchange funds, carbon credits, venture capital, film production, financial derivatives, cryptocurrencies, non-fungible tokens, and tax receivable agreements. Investments in real estate, forestry and shipping are also often termed "alternative" despite the ancient use of such real assets to enhance and preserve wealth. Alternative investments are to be contrasted with traditional investments. Research As the definition of alternative investments is broad, data and research vary widely across the investment classes. For example, art a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

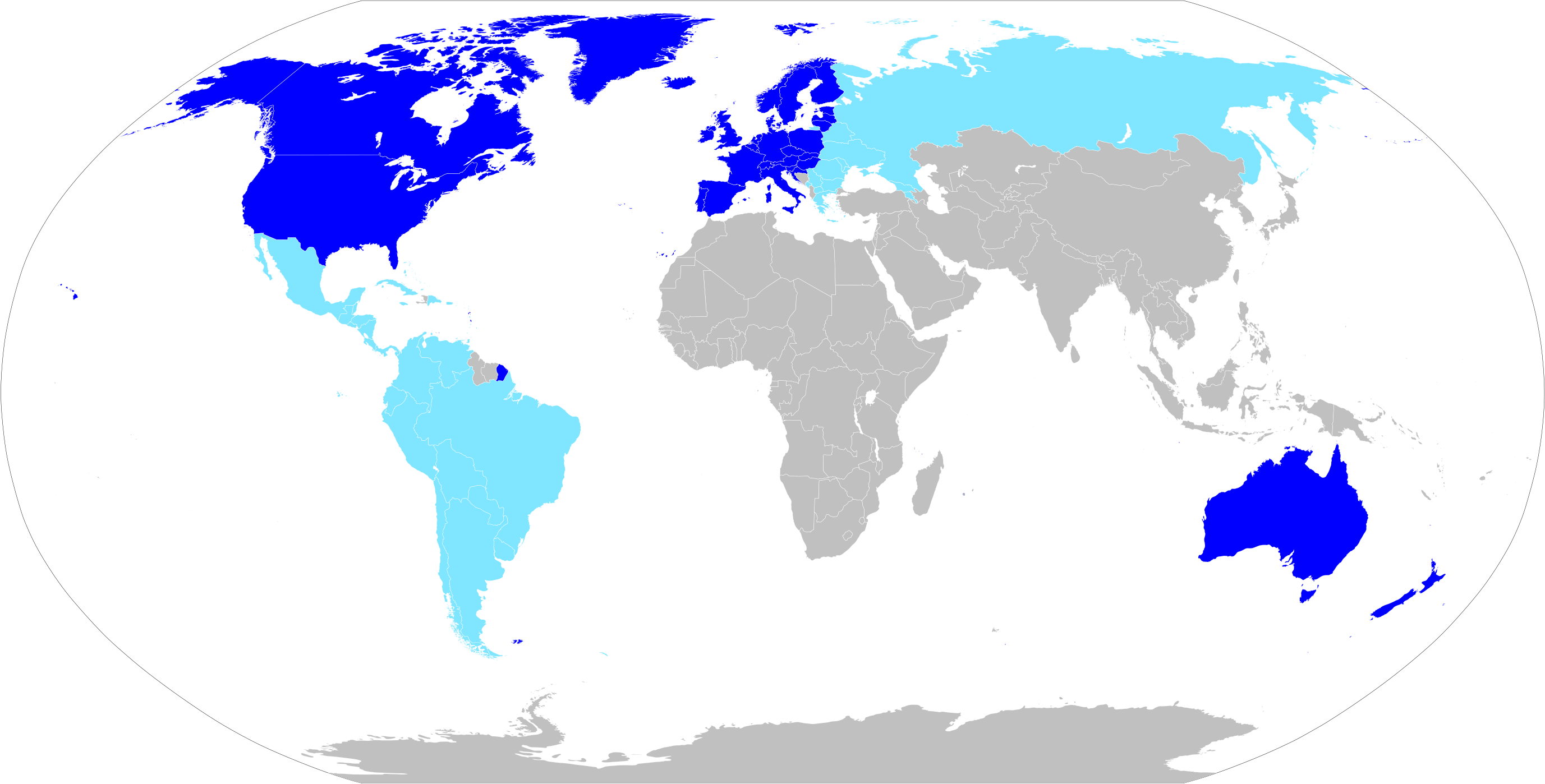

Western World

The Western world, also known as the West, primarily refers to the various nations and state (polity), states in the regions of Europe, North America, and Oceania.Western Civilization Our Tradition; James Kurth; accessed 30 August 2011 The Western world is also known as the Occident (from the Latin word ''occidēns'' "setting down, sunset, west") in contrast to the Eastern world known as the Orient (from the Latin word ''oriēns'' "origin, sunrise, east"). Following the Discovery of America in 1492, the West came to be known as the "world of business" and trade; and might also mean the Northern half of the North–South divide, the countries of the ''Global North'' (often equated with capitalist Developed country, developed countries). [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SaaS

Software as a service (SaaS ) is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted. SaaS is also known as "on-demand software" and Web-based/Web-hosted software. SaaS is considered to be part of cloud computing, along with infrastructure as a service (IaaS), platform as a service (PaaS), desktop as a service (DaaS), managed software as a service (MSaaS), mobile backend as a service (MBaaS), data center as a service (DCaaS), integration platform as a service (iPaaS), and information technology management as a service (ITMaaS). SaaS apps are typically accessed by users of a web browser (a thin client). SaaS became a common delivery model for many business applications, including office software, messaging software, payroll processing software, DBMS software, management software, CAD software, development software, gamification, virtualization, accounting, collaboration, customer relationship management (CRM), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

..jpg)