|

Leveraged Buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money ( leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity. The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Buyout Diagram

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the comparatively small amount of money needed for borrowing into large amounts of profit. However, the technique also involves the high risk of not being able to pay back a large loan. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Leveraging enables gains to be multiplied.Brigham, Eugene F., ''Fundamentals of Financial Management'' (1995). On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malcom McLean

Malcolm Purcell McLean (November 14, 1913 – May 25, 2001; later known as Malcom McLean) was an American businessman. He was a transport entrepreneur who invented the modern intermodal shipping container, which revolutionized transport and international trade in the second half of the twentieth century. Containerization led to a significant reduction in the cost of freight transportation by eliminating the need for repeated handling of individual pieces of cargo, and also improved reliability, reduced cargo theft, and cut inventory costs by shortening transit time. Containerization is credited as being one of the main drivers of globalization. Early life McLean was born in Maxton, North Carolina in 1913. His first name was originally spelled Malcolm, though he used Malcom later in life. In 1935, when he finished high school at Winston-Salem, his family did not have enough money to send him to college, but there was enough for Malcolm to buy a used truck. The same year, McLean ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gerry Schwartz

Gerald W. Schwartz, OC (born 1941) is the founder, chairman and CEO of Onex Corporation. Schwartz has a net worth of US$1.5 billion, according to Forbes. Early life and career Schwartz was born in Winnipeg, Manitoba. He graduated from Kelvin High School in Winnipeg. He received his B.A. and LL.B. degrees from the University of Manitoba where he became an active brother of the Sigma Alpha Mu fraternity. He later received an MBA degree from Harvard University in 1970. In the 1970s, Schwartz worked at Bear Stearns, where he was mentored by Jerome Kohlberg, Jr., who later became a founding partner in Kohlberg Kravis Roberts. Schwartz left Bear Stearns by 1977, returning to Canada. Along with Izzy Asper, Schwartz co-founded CanWest Global Communications in 1977. In 1983, Schwartz founded Onex Corporation. Schwartz has been a director of Scotiabank since 1999. In 2021, Schwartz's net worth was estimated at US$1.5 billion, making him one of the wealthiest people in Canada. As of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saul Steinberg (business)

Saul Phillip Steinberg (August 13, 1939December 7, 2012) Note that this source, and the majority, spell his middle name ''Phillip'', while others spell it ''Philip''. was an American businessman and financier. He became a millionaire before his 30th birthday and a billionaire before his 40th birthday. He started a computer leasing company (Leasco), which he used in an audacious and successful takeover of the much larger Reliance Insurance Company in 1968. He was best known for his unsuccessful attempts to take over Chemical Bank in 1969 and Walt Disney Productions in 1984.Berkman, Johanna"Fall of the House of Steinberg"New York magazine, June 19, 2000 Early life Steinberg was born to a Jewish family on August 13, 1939, and grew up in Brooklyn, New York the son of Julius and Anne Cohen Steinberg. He had one brother, Robert Steinberg, and two sisters, Roni Sokoloff and Lynda Jurist.Eaton, Leslie."Sorry, Mother, But Get in Line For Your Money; Suit Says Steinberg Sons Failed to Re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nelson Peltz

Nelson Peltz (born June 24, 1942) is an American billionaire businessman and investor. He is a founding partner, together with Peter W. May and Edward P. Garden, of Trian Fund Management, an alternative investment management fund based in New York. He is non-executive chairman of Wendy's Company, Sysco, and The Madison Square Garden Company. He is a former director of H.J. Heinz Company, Mondelēz International, and Ingersoll Rand and a former CEO of Triangle Industries. Early life and education Peltz was born to a Jewish family in 1942 in Brooklyn, New York, the son of Claire (''née'' Wechsler; 1905–2007) and Maurice Herbert Peltz (1901–1977). He was the second of their two children, and grew up in the Cypress Hills section of Brooklyn, a sub-section of the East New York neighborhood. He attended Horace Mann School in the Bronx. Peltz attended the undergraduate program at the Wharton School of the University of Pennsylvania starting in 1960, where he joined the frate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Triarc

The Wendy's Company is an American holding company for the major fast food chain Wendy's. Its headquarters are in Dublin, Ohio. The company's principal subsidiary, Wendy's International, is the franchisor of Wendy's restaurants. Wendy's International Wendy's International, Inc. is the franchisor of Wendy's restaurants and the former parent company of Wendy's. It also owned Tim Hortons, Baja Fresh, and had a 70 percent stake in Cafe Express. The corporate headquarters is located in Dublin, Ohio, a suburb of Columbus. Wendy's International is owned by the Wendy's Company. The Tim Hortons chain was spun off by Wendy's into a separate company in September 2006. The Baja Fresh chain was sold in October 2006. On September 15, 2008, the purchase of Wendy's International Inc. by Triarc Companies, Inc. was approved by shareholders. On September 30, the merger was completed, with Triarc being renamed to Wendy's/Arby's Group, Inc, a change of leadership for both Arby's and Wendy's and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Victor Posner

Victor Posner (September 18, 1918 – February 11, 2002) was an American businessman. He was one of the highest-paid business executives of his generation. He was a pioneer of the leveraged buyout and became notorious for asset stripping. Career Of Russian-Jewish descent, he was born in Baltimore, Maryland, one of nine children of grocers Morris and Mary Posner. Though he left school at age 13, he claimed to have earned his first million dollars by the age of 21 by investing in real estate, although financial records do not confirm this. Taking advantage of the post- World War II demand for housing in America, in 1948, he developed land and built houses in the Baltimore area, and by 1952, was building more than 1,100 dwellings per year. In 1954, he moved to Miami Beach, Florida, where he continued to invest in real estate and publicly traded companies. He became the head of numerous companies over his career, including Security Management Corporation (owner of rental ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Berkshire Hathaway

Berkshire Hathaway Inc. () is an American Multinational corporation, multinational conglomerate (company), conglomerate holding company headquartered in Omaha, Nebraska, United States. Its main business and source of capital is insurance, from which it invests the float (the retained premiums) in a broad portfolio of subsidiaries, equity positions and other securities. The company has been overseen since 1965 by its chairman and CEO Warren Buffett and (since 1978) vice chairman Charlie Munger, who are known for their advocacy of value investing principles. Under their direction, the company's book value has grown at an average rate of 20%, compared to about 10% from the S&P 500 index with dividends included over the same period, while employing large amounts of capital and minimal debt. The company's insurance brands include auto insurer GEICO and reinsurance firm General Re. Its non-insurance subsidiaries operate in diverse sectors such as confectionery, retail, Rail transport, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net worth of over $100 billion as of November 2022, making him the Bloomberg Billionaires Index, world's sixth-wealthiest person. Buffett was born in Omaha, Nebraska. He developed an interest in business and investing in his youth, eventually entering the Wharton School of the University of Pennsylvania in 1947 before transferring to and graduating from the University of Nebraska–Lincoln, University of Nebraska at 19. He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing pioneered by Benjamin Graham. He attended New York Institute of Finance to focus his economics background and soon after began various business partnerships, including one with Graham. He created ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Publicly Traded

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange ( listed company), which facilitates the trade of shares, or not ( unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

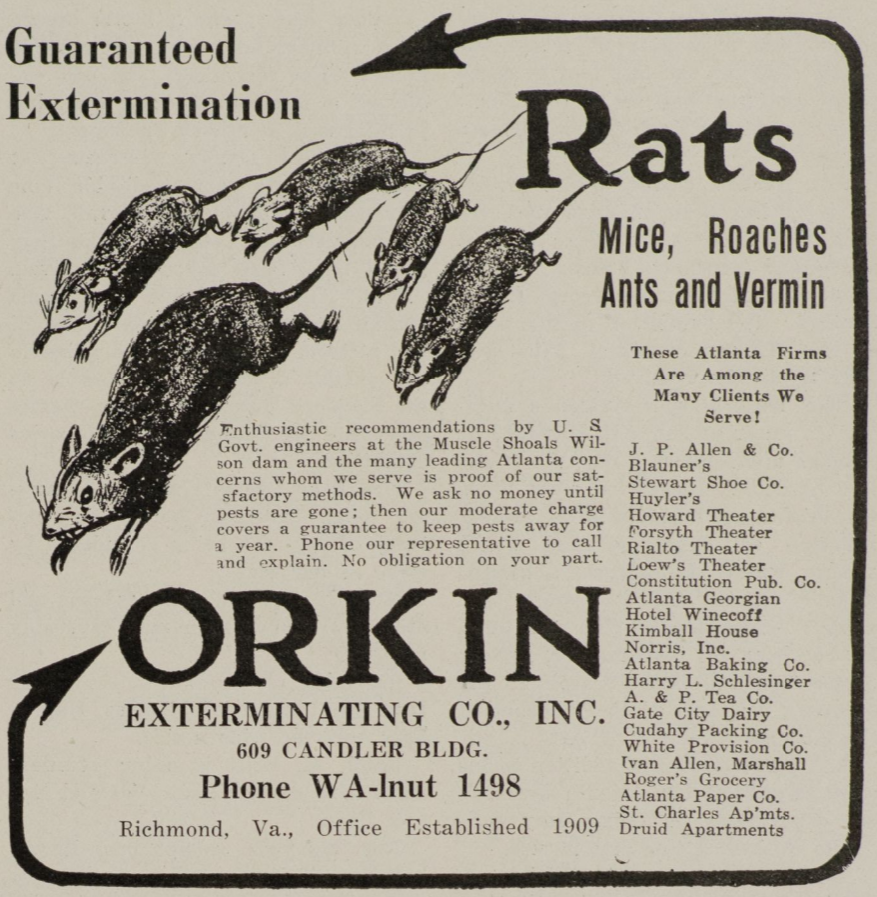

Orkin

Orkin is an American company that provides residential and commercial pest control services. The company was founded in 1901 and became a wholly owned subsidiary of Rollins Inc. in 1964. Orkin has held research collaborations with universities around the country and with organizations like the Centers for Disease Control and Prevention (CDC) dating back to 1990 for pest biology research and pest-related disease studies. It has been ranked on ''Training Magazine'''s Top 125 list for its training programs since 2002. History Otto the Rat Man Orkin was founded in Walnutport, Pennsylvania in 1901 by Otto Orkin, who began selling rat poison door-to-door at age 14. One of six children of a Latvian immigrant family, Otto was responsible since an early age for shooting and poisoning rats to keep them out of the family's food stores and away from their farm animals. Kirk, p.11 At age 12, Orkin began experimenting with different methods to poison rats in order to discover the most effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

How The Shipping Container Made The World Smaller And The World Economy Bigger

How may refer to: * How (greeting), a word used in some misrepresentations of Native American/First Nations speech * How, an interrogative word in English grammar Art and entertainment Literature * ''How'' (book), a 2007 book by Dov Seidman * ''HOW'' (magazine), a magazine for graphic designers * H.O.W. Journal, an American art and literary journal Music * "How", a song by The Cranberries from ''Everybody Else Is Doing It, So Why Can't We?'' * "How", a song by Maroon 5 from ''Hands All Over'' * "How", a song by Regina Spektor from ''What We Saw from the Cheap Seats'' * "How", a song by Daughter from ''Not to Disappear'' * "How?" (song), by John Lennon Other media * HOW (graffiti artist), Raoul Perre, New York graffiti muralist * ''How'' (TV series), a British children's television show * ''How'' (video game), a platform game People * How (surname) * HOW (graffiti artist), Raoul Perre, New York graffiti muralist Places * How, Cumbria, England * How, Wiscon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_in_1950.jpg)