United States Housing Market Correction on:

[Wikipedia]

[Google]

[Amazon]

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five ma ...

housing prices experienced a major market correction

A market correction is a rapid change in the nominal price of a commodity, after a barrier to free trade has been removed and the free market establishes a new equilibrium price. It may also refer to several of these single-commodity corrections ...

after the housing bubble

A housing bubble (or a housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. Firs ...

that peaked in early 2006. Prices of real estate then adjusted downwards in late 2006, causing a loss of market liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between th ...

and subprime defaults.

A real estate bubble

A real-estate bubble or property bubble (or housing bubble for residential markets) is a type of economic bubble that occurs periodically in local or global real-estate markets, and typically follow a land boom. A land boom is the rapid increas ...

is a type of economic bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be ...

that occurs periodically in local, regional, national or global real estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more genera ...

markets. A housing bubble

A housing bubble (or a housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. Firs ...

is characterized by rapid and sustained increases in the price

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in t ...

of real property

In English common law, real property, real estate, immovable property or, solely in the US and Canada, realty, is land which is the property of some person and all structures (also called improvements or fixtures) integrated with or affixe ...

, such as housing

Housing, or more generally, living spaces, refers to the construction and housing authority, assigned usage of houses or buildings individually or collectively, for the purpose of Shelter (building), shelter. Housing ensures that members of so ...

' usually due to some combination of over-confidence and emotion, fraud, the synthetic offloading of risk using mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment ba ...

, the ability to repackage conforming debt via government-sponsored enterprise

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy, to make those segments of th ...

s, public and central bank policy availability of credit, and speculation. Housing bubbles tend to distort valuations upward relative to historic, sustainable, and statistical norms as described by economists Karl Case

Karl Edwin "Chip" Case (November 5, 1946 – July 15, 2016) was Professor of Economics Emeritus at Wellesley College in Wellesley, Massachusetts, United States, where he held the Coman and Hepburn Chair in Economics and taught for 34 years.

and Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for ...

in their book, ''Irrational Exuberance

"Irrational exuberance" is the phrase used by the then-Federal Reserve Board chairman, Alan Greenspan, in a speech given at the American Enterprise Institute during the dot-com bubble of the 1990s. The phrase was interpreted as a warning that the ...

''. As early as 2003 Shiller questioned whether or not there was, "a bubble in the housing market" that might in the near future correct.

Timeline

Market correction predictions

Based on the historic trends in valuations of U.S. housing, many economists and business writers predicted a market correction, ranging from a few percentage points, to 50% or more from peak values in some markets, and, although this cooling did not affect all areas of the United States, some warned that the correction could and would be "nasty" and "severe". Chief economistMark Zandi

Mark M. Zandi is an Iranian-American economist who is the chief economist of Moody's Analytics, where he directs economic research.

Zandi's research interests encompass macroeconomics, financial markets and public policy. He analyzes the economi ...

of the research firm Moody's Economy.com predicted a crash of double-digit depreciation in some U.S. cities by 2007–2009.

Dean Baker

Dean Baker (born July 13, 1958) is an American macroeconomist who co-founded the Center for Economic and Policy Research (CEPR) with Mark Weisbrot. Baker has been credited as one of the first economists to have identified the 2007–08 United St ...

of the Center for Economic and Policy Research

The Center for Economic and Policy Research (CEPR) is a progressive American think tank that specializes in economic policy. Based in Washington, D.C. CEPR was co-founded by economists Dean Baker and Mark Weisbrot in 1999.

Considered a left- ...

was the first economist to identify the housing bubble, in a report in the summer of 2002.

Investor Peter Schiff

Peter David Schiff (; born March 23, 1963) is an American stock broker, financial commentator, and radio personality. He is CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer based in Westport, Connecticut. He is also ...

acquired fame in a series of TV appearances where he opposed a multitude of financial experts and claimed that a bust was to come."

The housing bubble was partly subsidized by government-sponsored entities like Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the N ...

and Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.

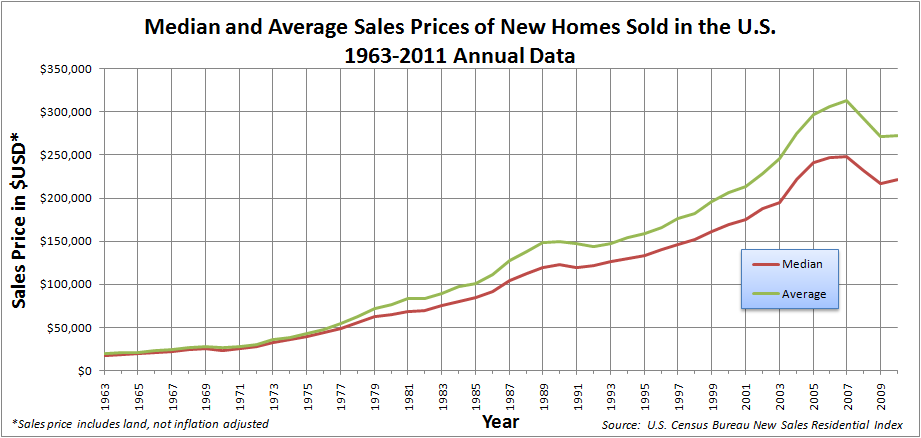

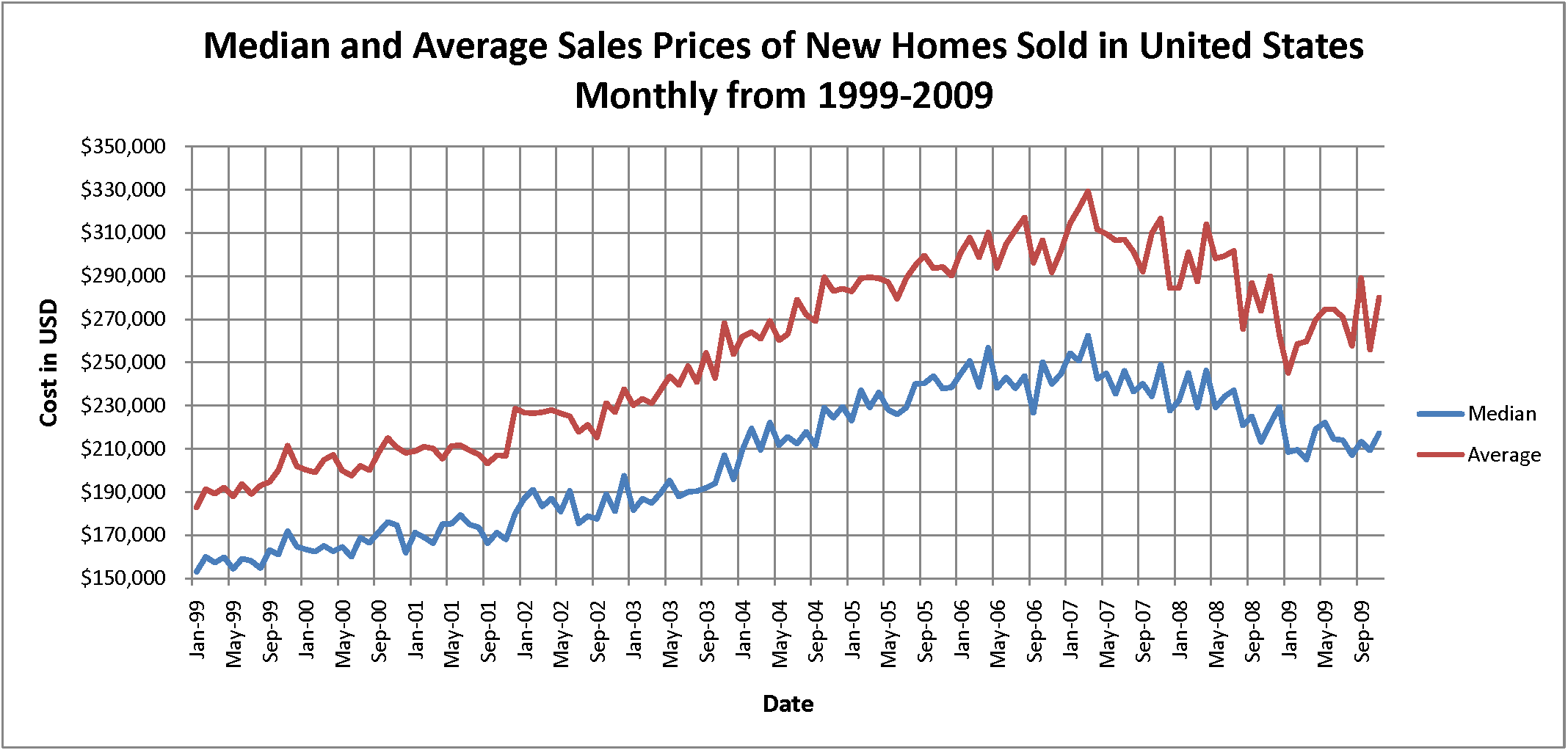

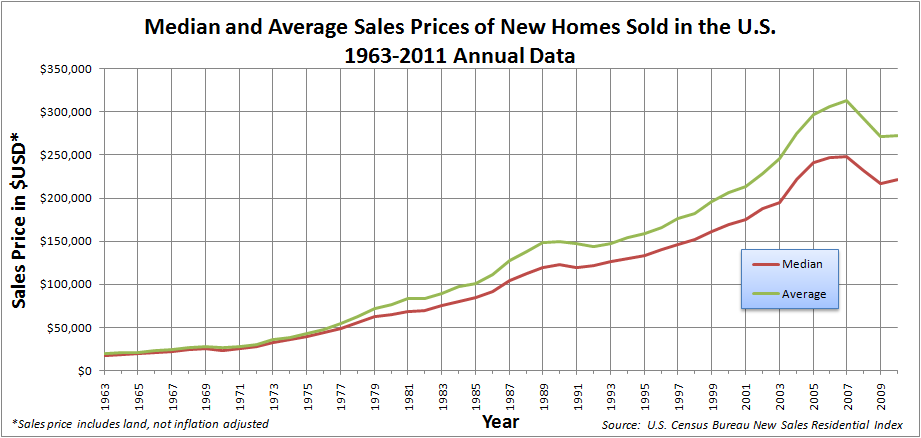

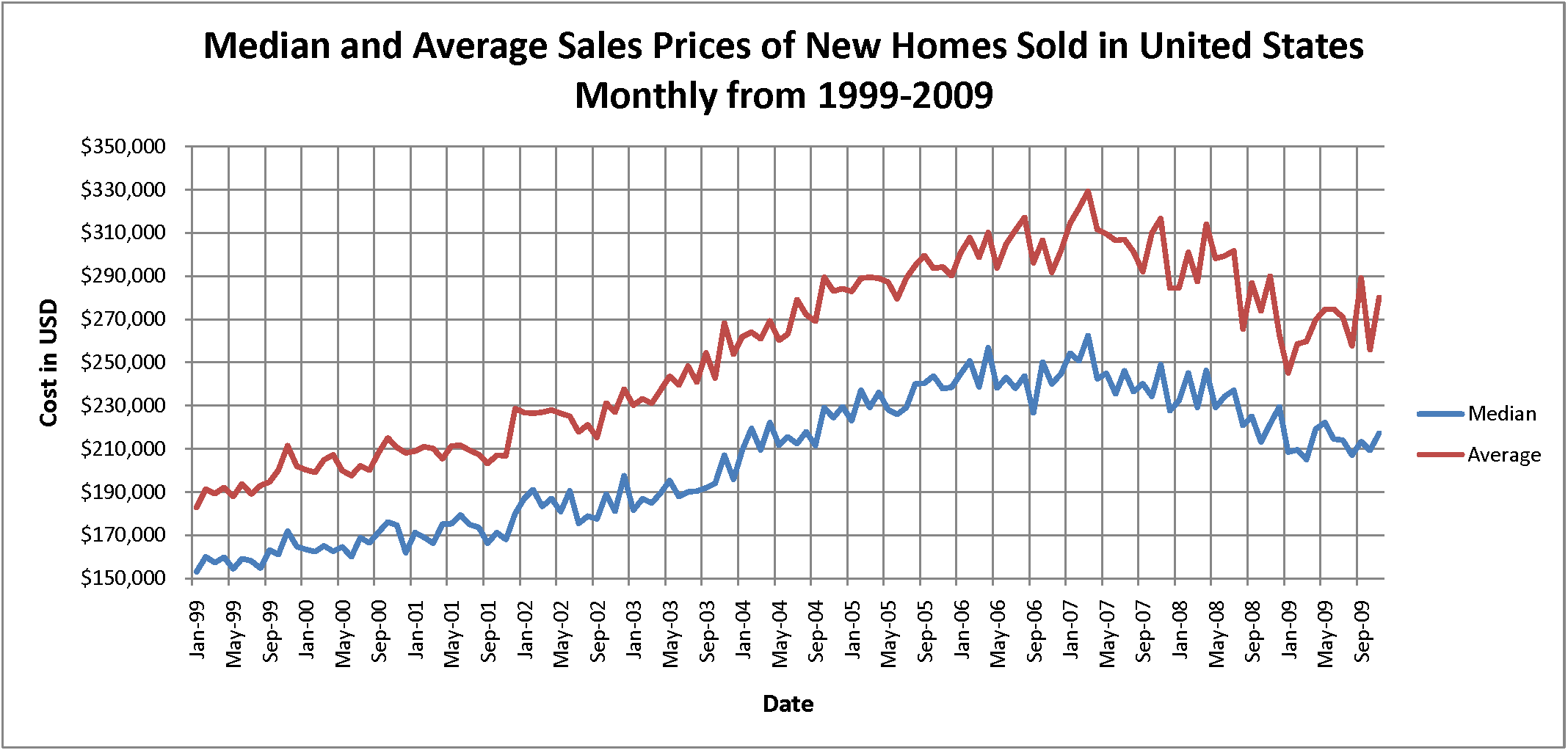

The booming housing market halted abruptly in many parts of the United States in the late summer of 2005, and as of summer 2006, several markets faced ballooning inventories, falling prices, and sharply reduced sales volumes. In August 2006, ''Barron's'' magazine warned, "a housing crisis approaches", and noted that the median price of new homes had dropped almost 3% since January 2006, that new-home inventories hit a record in April and remained near all-time highs, that existing-home inventories were 39% higher than they were just one year earlier, and that sales were down more than 10%, and predicted that "the national median price of housing will probably fall by close to 30% in the next three years ... simple reversion to the mean."

In

In 2005, economist

In 2005, economist

"“No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models"

/ref> In January 2006, financial analyst

The White House Council of Economic Advisers lowered its forecast for U.S. economic growth in 2008 from 3.1 per cent to 2.7 per cent and forecast higher unemployment, reflecting the turmoil in the credit and residential real-estate markets. The Bush Administration economic advisers also revised their unemployment outlook and predicted the unemployment rate could rise slightly above 5 per cent, up from the prevailing unemployment rate of 4.6 per cent.

The appreciation of home values far exceeded the income growth of many of these homebuyers, pushing them to leverage themselves beyond their means. They borrowed even more money in order to purchase homes whose cost was much greater than their ability to meet their mortgage obligations. Many of these homebuyers took out adjustable-rate mortgages during the period of low interest rates in order to purchase the home of their dreams. Initially, they were able to meet their mortgage obligations thanks to the low "teaser" rates being charged in the early years of the mortgage.

As the

The White House Council of Economic Advisers lowered its forecast for U.S. economic growth in 2008 from 3.1 per cent to 2.7 per cent and forecast higher unemployment, reflecting the turmoil in the credit and residential real-estate markets. The Bush Administration economic advisers also revised their unemployment outlook and predicted the unemployment rate could rise slightly above 5 per cent, up from the prevailing unemployment rate of 4.6 per cent.

The appreciation of home values far exceeded the income growth of many of these homebuyers, pushing them to leverage themselves beyond their means. They borrowed even more money in order to purchase homes whose cost was much greater than their ability to meet their mortgage obligations. Many of these homebuyers took out adjustable-rate mortgages during the period of low interest rates in order to purchase the home of their dreams. Initially, they were able to meet their mortgage obligations thanks to the low "teaser" rates being charged in the early years of the mortgage.

As the

The 30-year mortgage rates increased by more than a half a percentage point to 6.74 percent during May–June 2007, affecting borrowers with the best credit just as a crackdown in subprime lending standards limits the pool of qualified buyers. The national median home price is poised for its first annual decline since the Great Depression, and the NAR reported that supply of unsold homes is at a record 4.2 million.

Goldman Sachs and

The 30-year mortgage rates increased by more than a half a percentage point to 6.74 percent during May–June 2007, affecting borrowers with the best credit just as a crackdown in subprime lending standards limits the pool of qualified buyers. The national median home price is poised for its first annual decline since the Great Depression, and the NAR reported that supply of unsold homes is at a record 4.2 million.

Goldman Sachs and

Boston

Boston (), officially the City of Boston, is the capital city, state capital and List of municipalities in Massachusetts, most populous city of the Commonwealth (U.S. state), Commonwealth of Massachusetts, as well as the cultural and financ ...

, year-over-year prices dropped, sales fell, inventory increased, foreclosures were up, and the correction in Massachusetts

Massachusetts (Massachusett language, Massachusett: ''Muhsachuweesut assachusett writing systems, məhswatʃəwiːsət'' English: , ), officially the Commonwealth of Massachusetts, is the most populous U.S. state, state in the New England ...

was called a "hard landing" in 2005.

The previously booming Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005:

housing markets in Washington, D.C.

)

, image_skyline =

, image_caption = Clockwise from top left: the Washington Monument and Lincoln Memorial on the National Mall, United States Capitol, Logan Circle, Jefferson Memorial, White House, Adams Morgan, ...

, San Diego, California

San Diego ( , ; ) is a city on the Pacific Ocean coast of Southern California located immediately adjacent to the Mexico–United States border. With a 2020 population of 1,386,932, it is the List of United States cities by population, eigh ...

, Phoenix, Arizona

Phoenix ( ; nv, Hoozdo; es, Fénix or , yuf-x-wal, Banyà:nyuwá) is the capital and most populous city of the U.S. state of Arizona, with 1,608,139 residents as of 2020. It is the fifth-most populous city in the United States, and the o ...

, and other cities stalled as well in 2005.

'' Fortune'' magazine in May 2006 labeled many previously strong housing markets as "Dead Zones";This article classified several U.S. real-estate regions as "Dead Zones", "Danger Zones", and "Safe Havens."

other areas were classified as "Danger Zones" and "Safe Havens". '' Fortune'' in August 2005 also dispelled "four myths about the future of home prices".

The Arizona Regional Multiple Listing Service (ARMLS) showed that in summer 2006, the for-sale housing inventory in Phoenix had grown to over 50,000 homes, of which nearly half were vacant (see graphic). Plot of Phoenix inventory:

Several home builders revised their forecasts sharply downward during the summer of 2006, ''e.g.'', D.R. Horton cut its yearly earnings forecast by one-third in July 2006, the value of luxury home builder Toll Brothers

Toll Brothers is a company which designs, builds, markets, sells, and arranges financing for residential and commercial properties in the United States. In 2020, the company was the fifth largest home builder in the United States, based on home ...

' stock fell 50% between August 2005 and August 2006, and the Dow Jones U.S. Home Construction Index was down over 40% as of mid-August 2006.

CEO Robert Toll of Toll Brothers

Toll Brothers is a company which designs, builds, markets, sells, and arranges financing for residential and commercial properties in the United States. In 2020, the company was the fifth largest home builder in the United States, based on home ...

explained, "builders that built speculative homes are trying to move them by offering large incentives and discounts; and some buyers are canceling contracts for homes already being built". Homebuilder Kara Homes announced on 13 September 2006 the "two most profitable quarters in the history of our company", yet the company filed for bankruptcy protection less than one month later on 6 October. Six months later on 10 April 2007, Kara Homes sold unfinished developments, causing prospective buyers from the previous year to lose deposits, some of whom put down more than $100,000.

As the housing market began to soften from winter 2005 through summer 2006, NAR chief economist David Lereah predicted a "soft landing" for the market. However, based on unprecedented rises in inventory and a sharply slowing market throughout 2006, Leslie Appleton-Young, the chief economist of the California Association of Realtors, said that she was not comfortable with the mild term "soft landing" to describe what was actually happening in California's real estate market.

The ''Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikke ...

'' warned of the impact on the U.S. economy

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita ...

of the "hard edge" in the "soft landing" scenario, saying "A slowdown in these red-hot markets is inevitable. It may be gentle, but it is impossible to rule out a collapse of sentiment and of prices. ... If housing wealth stops rising ... the effect on the world's economy could be depressing indeed".

"It would be difficult to characterize the position of home builders as other than in a hard landing", said Robert I. Toll, CEO of Toll Brothers.

Angelo Mozilo, CEO of Countrywide Financial

Countrywide is one of the UK's largest integrated property services group including residential property surveying, a collaboration of estate agents, and corporate services. It employs circa 8,500 personnel nationwide, working across 650+ est ...

, said "I've never seen a soft-landing in 53 years, so we have a ways to go before this levels out. I have to prepare the company for the worst that can happen." Following these reports, Lereah admitted that "he expects home prices to come down 5% nationally", and said that some cities in Florida

Florida is a state located in the Southeastern region of the United States. Florida is bordered to the west by the Gulf of Mexico, to the northwest by Alabama, to the north by Georgia, to the east by the Bahamas and Atlantic Ocean, a ...

and California

California is a state in the Western United States, located along the Pacific Coast. With nearly 39.2million residents across a total area of approximately , it is the most populous U.S. state and the 3rd largest by area. It is also the ...

could have "hard landings."

The World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

lowered the global economic growth rate due to a housing slowdown in the United States, but it did not believe that the U.S. housing malaise would further spread to the rest of the world. The Fed

Fed, The Fed or FED may refer to:

People

* Andrey A. Fedorov (1908–1987), Soviet Russian biologist, author abbreviation

* Feds, a slang term for a police officer in several countries

* John Fedorowicz (born 1958), American International Grand ...

chairman Benjamin Bernanke said in October 2006 that there was currently a "substantial correction" going on in the housing market and that the decline of residential housing construction was one of the "major drags that is causing the economy to slow"; he predicted that the correcting market would decrease U.S. economic growth by about one percent in the second half of 2006 and remain a drag on expansion into 2007.

National home sales and prices both fell dramatically again in March 2007 according to NAR data, with sales down 13% to 482,000 from the peak of 554,000 in March 2006 and the national median price falling nearly 6% to $217,000 from the peak of $230,200 in July 2006. The plunge in existing-home sales was the steepest since 1989. The new home market also suffered. The biggest year over year drop in median home prices since 1970 occurred in April 2007. Median prices for new homes fell 10.9 percent according to the U.S. Department of Commerce

The United States Department of Commerce is an executive department of the U.S. federal government concerned with creating the conditions for economic growth and opportunity. Among its tasks are gathering economic and demographic data for busi ...

.

Others speculated on the negative impact of the retirement of the Baby Boom

A baby boom is a period marked by a significant increase of birth rate. This demographic phenomenon is usually ascribed within certain geographical bounds of defined national and cultural populations. People born during these periods are often ...

generation and the relative cost to rent on the declining housing market. In many parts of the United States, it was significantly cheaper to rent the same property than to purchase it; the national median mortgage payment is $1,687 per month, nearly twice the median rent payment of $868 per month.

Predictions of housing bubble bursting

In 2005, economist

In 2005, economist Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for ...

gave talks warning about a housing bubble to the Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all natio ...

and the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cre ...

. He was ignored, and later called it an incidence of Groupthink

Groupthink is a psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome. Cohesiveness, or the desire for cohesivenes ...

. That same year, his second edition of ''Irrational Exuberance

"Irrational exuberance" is the phrase used by the then-Federal Reserve Board chairman, Alan Greenspan, in a speech given at the American Enterprise Institute during the dot-com bubble of the 1990s. The phrase was interpreted as a warning that the ...

'' warned that the housing bubble might lead to a worldwide recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

. Also in 2005, economist Fred Harrison commented: "The next property market tipping point is due at end of 2007 or early 2008... The only way prices can be brought back to affordable levels is a slump or recession.”Bezemer, Dirk J, 16 June 2009"“No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models"

/ref> In January 2006, financial analyst

Gary Shilling

use both this parameter and , birth_date to display the person's date of birth, date of death, and age at death) -->

, death_place =

, death_cause =

, body_discovered =

, resting_place =

, resting_place_coordinates = ...

wrote an article entitled: “The Housing Bubble Will Probably Burst”. In May 2006, JPMorgan

JPMorgan Chase & Co. is an American Multinational corporation, multinational Investment banking, investment bank and financial services holding company headquartered in City of New York, New York City and Delaware General Corporation Law, inco ...

's Christopher Flanagan, director of global structured finance

Structured finance is a sector of finance - specifically financial law - that manages leverage and risk. Strategies may involve legal and corporate restructuring, off balance sheet accounting, or the use of financial instruments.

Securitizatio ...

research, warned clients of a coming housing downturn. In August 2006, economist Nouriel Roubini

Nouriel Roubini (born March 9 1958) is a Turkish-born Iranian-American economist. He is Professor Emeritus (2021–present) and was Professor of Economics (1995–2021) at the Stern School of Business, New York University, and also chairman of Ro ...

similarly warned that the housing sector was in "free fall" and would derail the rest of the economy, causing a recession in 2007. Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, and a full professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and th ...

, winner of the 2001 Nobel Prize in economics

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel ( sv, Sveriges riksbanks pris i ekonomisk vetenskap till Alfred Nobels minne), is an economics award administered ...

, also said that the U.S. might enter a recession as house prices declined.

Major downturn and subprime mortgage collapse, 2007

The White House Council of Economic Advisers lowered its forecast for U.S. economic growth in 2008 from 3.1 per cent to 2.7 per cent and forecast higher unemployment, reflecting the turmoil in the credit and residential real-estate markets. The Bush Administration economic advisers also revised their unemployment outlook and predicted the unemployment rate could rise slightly above 5 per cent, up from the prevailing unemployment rate of 4.6 per cent.

The appreciation of home values far exceeded the income growth of many of these homebuyers, pushing them to leverage themselves beyond their means. They borrowed even more money in order to purchase homes whose cost was much greater than their ability to meet their mortgage obligations. Many of these homebuyers took out adjustable-rate mortgages during the period of low interest rates in order to purchase the home of their dreams. Initially, they were able to meet their mortgage obligations thanks to the low "teaser" rates being charged in the early years of the mortgage.

As the

The White House Council of Economic Advisers lowered its forecast for U.S. economic growth in 2008 from 3.1 per cent to 2.7 per cent and forecast higher unemployment, reflecting the turmoil in the credit and residential real-estate markets. The Bush Administration economic advisers also revised their unemployment outlook and predicted the unemployment rate could rise slightly above 5 per cent, up from the prevailing unemployment rate of 4.6 per cent.

The appreciation of home values far exceeded the income growth of many of these homebuyers, pushing them to leverage themselves beyond their means. They borrowed even more money in order to purchase homes whose cost was much greater than their ability to meet their mortgage obligations. Many of these homebuyers took out adjustable-rate mortgages during the period of low interest rates in order to purchase the home of their dreams. Initially, they were able to meet their mortgage obligations thanks to the low "teaser" rates being charged in the early years of the mortgage.

As the Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

applied its monetary contraction policy in 2005, many homeowners were stunned when their adjustable-rate mortgages began to reset to much higher rates in mid-2007 and their monthly payments jumped far above their ability to meet the monthly mortgage payments. Some homeowners began defaulting on their mortgages in mid-2007, and the cracks in the U.S. housing foundation became apparent.

Subprime mortgage industry collapse

In March 2007, the United States'subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subpr ...

mortgage industry collapsed due to higher-than-expected home foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mort ...

rates, with more than 25 subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale. The stock of the country's largest subprime lender, New Century Financial

New Century Financial Corporation was a real estate investment trust that originated mortgage loans in the United States through its operating subsidiaries, New Century Mortgage Corporation and Home123 Corporation.

It was founded in 1995. In 200 ...

, plunged 84% amid Justice Department

A justice ministry, ministry of justice, or department of justice is a ministry or other government agency in charge of the administration of justice. The ministry or department is often headed by a minister of justice (minister for justice in a ...

investigations, before ultimately filing for Chapter 11

Chapter 11 of the United States Bankruptcy Code ( Title 11 of the United States Code) permits reorganization under the bankruptcy laws of the United States. Such reorganization, known as Chapter 11 bankruptcy, is available to every business, whet ...

bankruptcy on 2 April 2007 with liabilities exceeding $100 million.

The manager of the world's largest bond fund PIMCO

PIMCO (Pacific Investment Management Company, LLC) is an American investment management firm focusing on active fixed income management worldwide. PIMCO manages investments in many asset classes such as fixed income, equities, commodities, ass ...

, warned in June 2007 that the subprime mortgage crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the coll ...

was not an isolated event and would eventually take a toll on the economy and impact the impaired prices of homes. Bill Gross, "a most reputable financial guru", sarcastically and ominously criticized the credit ratings

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulti ...

of the mortgage-based CDOs now facing collapse: AAA? You were wooed Mr.Financial analysts predicted that the subprime mortgage collapse would result in earnings reductions for largeMoody's Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides internation ...and Mr. Poor's, by the makeup, those six-inch hooker heels, and a "tramp stamp Tattoos on the lower back became popular in the first decade of the 21st century, and gained a reputation for their erotic appeal. The tattoos were sometimes accentuated by low-rise jeans or crop tops. Their popularity was in part due to the in ...." Many of these good looking girls are not high-class assets worth 100 cents on the dollar. ... And sorry Ben, but derivatives are a two-edged sword. Yes, they diversify risk and direct it away from the banking system into the eventual hands of unknown buyers, but they multiply leverage like the Andromeda strain. When interest rates go up, the Petri dish turns from a benign experiment in financial engineering to a destructive virus because the cost of that leverage ultimately reduces the price of assets. Houses anyone? ... AAAs? e point is that there are hundreds of billions of dollars of this toxic waste and whether or not they're in CDOs orBear Stearns The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The c ...hedge funds matters only to the extent of the timing of the unwind. e subprime crisis is not an isolated event and it won't be contained by a few days of headlines in ''The New York Times ''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...'' ... The flaw lies in the homes that were financed with cheap and in some cases gratuitous money in 2004, 2005, and 2006. Because while the Bear hedge funds are now primarily history, those millions and millions of homes are not. They're not going anywhere ... except for their mortgages that is. Mortgage payments are going up, up, and up ... and so are delinquencies and defaults. A recent research piece by Bank of America estimates that approximately $500 billion of adjustable rate mortgages are scheduled to reset skyward in 2007 by an average of over 200 basis points. 2008 holds even more surprises with nearly $700 billion ARMS subject to reset, nearly ¾ of which are subprimes ... This problem—aided and abetted by Wall Street—ultimately resides in America's heartland, with millions and millions of overpriced homes and asset-backed collateral with a different address—Main Street.

Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for ...

investment banks trading in mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment ba ...

, especially Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The c ...

, Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, a ...

, Goldman Sachs, Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment banki ...

, and Morgan Stanley

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in more than 41 countries and more than 75,000 employees, the f ...

. The solvency of two troubled hedge fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as ...

s managed by Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The c ...

was imperliled in June 2007 after Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment banki ...

sold off assets seized from the funds and three other banks closed out their positions with them. The Bear Stearns funds once had over $20 billion of assets, but lost billions of dollars on securities backed by subprime mortgages.

H&R Block

H&R Block, Inc., or H&R Block, is an American tax preparation company operating in Canada, the United States, and Australia. The company was founded in 1955 by brothers Henry W. Bloch and Richard Bloch.

As of 2018, H&R Block operates approxima ...

reported a quarterly loss of $677 million on discontinued operations, which included subprime lender Option One

Option or Options may refer to:

Computing

*Option key, a key on Apple computer keyboards

*Option type, a polymorphic data type in programming languages

*Command-line option, an optional parameter to a command

*OPTIONS, an HTTP request method

...

, as well as writedowns, loss provisions on mortgage loans and the lower prices available for mortgages in the secondary market for mortgages. The units net asset value fell 21% to $1.1 billion as of April 30, 2007. The head of the mortgage industry consulting firm Wakefield Co. warned, "This is going to be a meltdown of unparalleled proportions. Billions will be lost." Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The c ...

pledged up to US$3.2 billion in loans on 22 June 2007 to bail out one of its hedge funds that was collapsing because of bad bets on subprime mortgages.

Peter Schiff

Peter David Schiff (; born March 23, 1963) is an American stock broker, financial commentator, and radio personality. He is CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer based in Westport, Connecticut. He is also ...

, president of Euro Pacific Capital, argued that if the bonds in the Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The c ...

funds were auctioned on the open market, much weaker values would be plainly revealed. Schiff added, "This would force other hedge funds to similarly mark down the value of their holdings. Is it any wonder that Wall street is pulling out the stops to avoid such a catastrophe? ... Their true weakness will finally reveal the abyss into which the housing market is about to plummet."

A ''New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' report connected the hedge fund crisis with lax lending standards: "The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes."

In the wake of the mortgage industry meltdown, Senator Chris Dodd

Christopher John Dodd (born May 27, 1944) is an American lobbyist, lawyer, and Democratic Party politician who served as a United States senator from Connecticut from 1981 to 2011. Dodd is the longest-serving senator in Connecticut's history. ...

, Chairman of the Banking Committee held hearings in March 2007 and asked executives from the top five subprime mortgage companies to testify and explain their lending practices. Dodd said, "Predatory lending practices endangered the home ownership for millions of people". Moreover, Democratic senators such as Senator Charles Schumer

Charles Ellis Schumer ( ; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021. A member of the Democratic Party, Schumer is in his fourth Senate term, having held his seat since 1999, and ...

of New York were proposing a federal government bailout of subprime borrowers in order to save homeowners from losing their residences. Opponents of such proposal asserted that government bailout of subprime borrowers was not in the best interests of the U.S. economy because it would set a bad precedent, create a moral hazard, and worsen the speculation problem in the housing market.

Lou Ranieri of Salomon Brothers

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street duri ...

, inventor of the mortgage-backed securities market in the 1970s, warned of the future impact of mortgage defaults: "This is the leading edge of the storm. ... If you think this is bad, imagine what it's going to be like in the middle of the crisis." In his opinion, more than $100 billion of home loans are likely to default when the problems in the subprime industry appear in the prime mortgage markets. Fed Chairman Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

praised the rise of the subprime mortgage industry and the tools used to assess credit-worthiness in an April 2005 speech: Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country ... With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. ... Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s.Because of these remarks, along with his encouragement for the use of adjustable-rate mortgages, Greenspan was criticized for his role in the rise of the housing bubble and the subsequent problems in the mortgage industry.

Alt-A mortgage problems

Subprime andAlt-A An Alt-A mortgage, short for Alternative A-paper, is a type of U.S. mortgage that, for various reasons, is considered riskier than A-paper, or "prime", and less risky than "subprime," the riskiest category. For these reasons, as well as in some c ...

loans account for about 21 percent of loans outstanding and 39 percent of mortgages made in 2006.

In April 2007, financial problems similar to the subprime mortgages began to appear with Alt-A loans made to homeowners who were thought to be less risky. American Home Mortgage said that it would earn less and pay out a smaller dividend to its shareholders because it was being asked to buy back and write down the value of Alt-A loans made to borrowers with decent credit; causing company stocks to tumble 15.2 percent. The delinquency rate for Alt-A mortgages has been rising in 2007.

In June 2007, Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is co ...

warned that U.S. homeowners with good credit are increasingly falling behind on mortgage payments, an indication that lenders have been offering higher risk loans outside the subprime market; they said that rising late payments and defaults on Alt-A mortgages made in 2006 are "disconcerting" and delinquent borrowers appear to be "finding it increasingly difficult to refinance" or catch up on their payments. Late payments of at least 90 days and defaults on 2006 Alt-A mortgages have increased to 4.21 percent, up from 1.59 percent for 2005 mortgages and 0.81 percent for 2004, indicating that "subprime carnage is now spreading to near prime mortgages".

COVID-19 impact

TheCOVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identified ...

raised the spectre of a U.S. housing market collapse due to "“The confluence of high unemployment and the end of the forbearance measures."

Regional weakness in the spring housing market in San Francisco

San Francisco (; Spanish language, Spanish for "Francis of Assisi, Saint Francis"), officially the City and County of San Francisco, is the commercial, financial, and cultural center of Northern California. The city proper is the List of Ca ...

was attributed to the pandemic, as shelter-in-place orders went into effect, and at a time the market would usually be rising.

Foreclosure rates increase

Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The c ...

, respectively the world's largest securities firm and largest underwriter of mortgage-backed securities in 2006, said in June 2007 that rising foreclosures reduced their earnings and the loss of billions from bad investments in the subprime market imperiled the solvency of several hedge fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as ...

s. Mark Kiesel, executive vice president of a California-based Pacific Investment Management Co. said, It's a blood bath. ... We're talking about a two- to three-year downturn that will take a whole host of characters with it, from job creation to consumer confidence. Eventually it will take the stock market and corporate profit.According to Donald Burnette of Brightgreen Homeloans in Florida (one of the states hit hardest by the bursting housing bubble) the corresponding loss in equity from the drop in housing values caused new problems. "It is keeping even borrowers with good credit and solid resources from refinancing to much better terms. Even with tighter lending restrictions and the disappearance of subprime programs, there are many borrowers who would indeed qualify as "A" borrowers who can't refinance as they no longer have the equity in their homes that they had in 2005 or 2006. They will have to wait for the market to recover to refinance to the terms they deserve, and that could be years, or even a decade." It is foreseen, especially in

California

California is a state in the Western United States, located along the Pacific Coast. With nearly 39.2million residents across a total area of approximately , it is the most populous U.S. state and the 3rd largest by area. It is also the ...

, that this recovery process could take until 2014 or later.

A 2012 report from the University of Michigan

, mottoeng = "Arts, Knowledge, Truth"

, former_names = Catholepistemiad, or University of Michigania (1817–1821)

, budget = $10.3 billion (2021)

, endowment = $17 billion (2021)As o ...

analyzed data from the Panel Study of Income Dynamics (PSID), which surveyed roughly 9,000 representative households in 2009 and 2011. The data seemed to indicate that, while conditions were still difficult, in some ways the crisis was easing: Over the period studied, the percentage of families behind on mortgage payments fell from 2.2 to 1.9; homeowners who thought it was "very likely or somewhat likely" that they would fall behind on payments fell from 6% to 4.6% of families. On the other hand, family's financial liquidity had decreased: "As of 2009, 18.5% of families had no liquid assets, and by 2011 this had grown to 23.4% of families."

See also

*Economic crisis of 2008

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

* Creative Real Estate Investing

* Deed in lieu of foreclosure

A deed in lieu of foreclosure is a deed instrument in which a mortgagor (i.e. the borrower) conveys all interest in a real property to the mortgagee (i.e. the lender) to satisfy a loan that is in default and avoid foreclosure proceedings.

The dee ...

* Foreclosure consultant

* List of entities involved in 2007-2008 financial crises

* dot-com bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet.

Between 1995 and its peak in March 2000, the Nasdaq Comp ...

General:

* Real estate pricing

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property (usually market value). Real estate transactions often require appraisals because they occur infrequently and every prop ...

* Real estate appraisal

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property (usually market value). Real estate transactions often require appraisals because they occur infrequently and every pr ...

* Real estate economics

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand. The closely related field of housing economics is narrower in scope, con ...

* Real estate trends

A real estate trend is any consistent pattern or change in the general direction of the real estate industry which, over the course of time, causes a statistically noticeable change. This phenomenon can be a result of the economy, a change in mortg ...

International property bubbles:

* Chinese property bubble

* British property bubble

The affordability of housing in the UK reflects the ability to rent or buy property. There are various ways to determine or estimate housing affordability. One commonly used metric is the median housing affordability ratio; this compares the medi ...

* Irish property bubble

The Irish property bubble was the speculative excess element of a long-term price increase of real estate in the Republic of Ireland from the early 2000s to 2007, a period known as the later part of the Celtic Tiger. In 2006, the prices peaked ...

* Japanese asset price bubble

The was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration o ...

* Spanish property bubble

The Spanish property bubble is the collapsed overshooting part of a long-term price increase of Spanish real estate prices. This long-term price increase has happened in various stages from 1985 up to 2008. The housing bubble can be clearly divi ...

Further reading

*References and notes

Note: Sources that are blank here can be found here. This is a problem that is not yet fixed. {{DEFAULTSORT:United States Housing Market Correction 2000s economic history 2000s in the United States