|

Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows: Some banks also possess branches, with the whole system being headquartered at the Eccles Building in Washington, D.C. History The Federal Reserve Banks are the most recent institutions that the United States government has created to provide functions of a central bank. Prior institutions have included the First (1791–1811) and Second (1818–1824) Banks of the United States, the Independent Treasury (1846–1920) and the National Banking System (1863–1935). Several policy questions have arisen with these institutions, including the degree of influence by private interes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

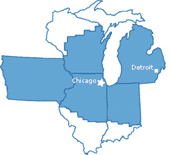

Federal Reserve Bank Of Chicago

The Federal Reserve Bank of Chicago (informally the Chicago Fed) is one of twelve regional Reserve Banks that, along with the Federal Reserve Board of Governors, make up the United States' central bank. The Chicago Reserve Bank serves the Seventh Federal Reserve District, which encompasses the northern portions of Illinois and Indiana, southern Wisconsin, the Lower Peninsula of Michigan, and the state of Iowa. In addition to participation in the formulation of monetary policy, each Reserve Bank supervises member banks and bank holding companies, provides financial services to depository institutions and the U.S. government, and monitors economic conditions in its District. Responsibilities As one of the Reserve Banks that make up the Federal Reserve System, the Chicago Fed is responsible for: * Helping to formulate national monetary policy. The Chicago Fed's CEO, Charles L. Evans, helps formulate monetary policy by taking part and voting in meetings of the Federal Open Market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U.S. Virgin Islands. Located at 33 Liberty Street in Lower Manhattan, it is by far the largest (by assets), the most active (by volume), and the most influential of the Reserve Banks. The Federal Reserve Bank of New York is solely responsible for implementing monetary policy on behalf of the Federal Open Market Committee and acts as the market agent of the entire Federal Reserve System (as it houses the Open Market Trading Desk and manages System Open Market Account). It is also the sole fiscal agent of the U.S. Department of the Treasury, the bearer of the Treasury's General Account, and the custodian of the world's largest gold storage reserve. Aside from these distinct f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Districts Map - Banks & Branches

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states * Federal republic, a federation which is a republic * Federalism, a political philosophy * Federalist, a political belief or member of a political grouping *Federalization, implementation of federalism Particular governments *Federal government of the United States **United States federal law **United States federal courts * Government of Argentina * Government of Australia *Government of Pakistan *Federal government of Brazil *Government of Canada *Government of India *Federal government of Mexico * Federal government of Nigeria * Government of Russia *Government of South Africa *Government of Philippines Other *''The Federalist Papers'', critical early arguments ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eccles Building

The Marriner S. Eccles Federal Reserve Board Building houses the main offices of the Board of Governors of the United States' Federal Reserve System. It is located at the intersection of 20th Street and Constitution Avenue in Washington, D.C. The building, designed in the Stripped Classicism style, was designed by Paul Philippe Cret and completed in 1937. President Franklin D. Roosevelt dedicated the building on October 20, 1937. The building was named after Marriner S. Eccles (1890–1977), Chairman of the Federal Reserve under President Roosevelt, by an Act of Congress on October 15, 1982. Previously it had been known as the Federal Reserve Building. Architectural competition From 1913 to 1937, the Federal Reserve Board met in the United States Treasury building on Pennsylvania Avenue in Washington, D.C., while employees were scattered across three locations throughout the city. In response to the Banking Act of 1935, which centralized control of the Federal Rese ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Tort Claims Act

The Federal Tort Claims Act (August 2, 1946, ch.646, Title IV, 28 U.S.C. Part VI, Chapter 171and ) ("FTCA") is a 1946 federal statute that permits private parties to sue the United States in a federal court for most torts committed by persons acting on behalf of the United States. Historically, citizens have not been able to sue their state—a doctrine referred to as sovereign immunity. The FTCA constitutes a limited waiver of sovereign immunity, permitting citizens to pursue some tort claims against the government. It was passed and enacted as a part of the Legislative Reorganization Act of 1946. Limitations Under the FTCA, " e United States sliable ... in the same manner and to the same extent as a private individual under like circumstances, but s notliable for interest prior to judgment or for punitive damages." . Federal courts have jurisdiction over such claims, but apply the law of the state "where the act or omission occurred". (b). Thus, both federal and state la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The Ninth Circuit

The United States Court of Appeals for the Ninth Circuit (in case citations, 9th Cir.) is the U.S. federal court of appeals that has appellate jurisdiction over the U.S. district courts in the following federal judicial districts: * District of Alaska * District of Arizona * Central District of California * Eastern District of California * Northern District of California * Southern District of California * District of Hawaii * District of Idaho * District of Montana * District of Nevada * District of Oregon * Eastern District of Washington * Western District of Washington The Ninth Circuit also has appellate jurisdiction over the territorial courts for the District of Guam and the District of the Northern Mariana Islands. Additionally, it sometimes handles appeals that originate from American Samoa, which has no district court and partially relies on the District of Hawaii for its federal cases.https://www.gao.gov/products/GAO-08-1124T GAO (U.S. Government Accountabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Board Of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the Chair and Vice Chair of the Board are two of seven members of the Board of Governors who are appointed by the President from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the preside ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and recognized as such in law for certain purposes. Early incorporated entities were established by charter (i.e. by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: by whether they can issue stock, or by whether they are formed to make a profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this article) or '' sole'' (a legal entity consisting of a single incorporated office occupied by a single natural person). One of the most att ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Monetary Commission

The National Monetary Commission was a U.S. congressional commission created by the Aldrich–Vreeland Act of 1908. After the Panic of 1907, the Commission studied the banking laws of the United States, and the leading countries of Europe. The chairman of the Commission, Senator Nelson Aldrich, a Republican leader in the Senate, personally led a team of experts to major European capitals. They were stunned to discover how much more efficient the European financial system appeared to be and how much more important than the dollar were the pound, the franc and the mark in international trade. The Commission's reports and recommendations became one of the principal bases in the enactment of the Federal Reserve Act of 1913 which created the modern Federal Reserve system. Background Following the panics of the late 1890s and early 1900s, the American people were aroused to the need for basic reforms. One of the most painful aspects of the economic crisis before World War I was the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

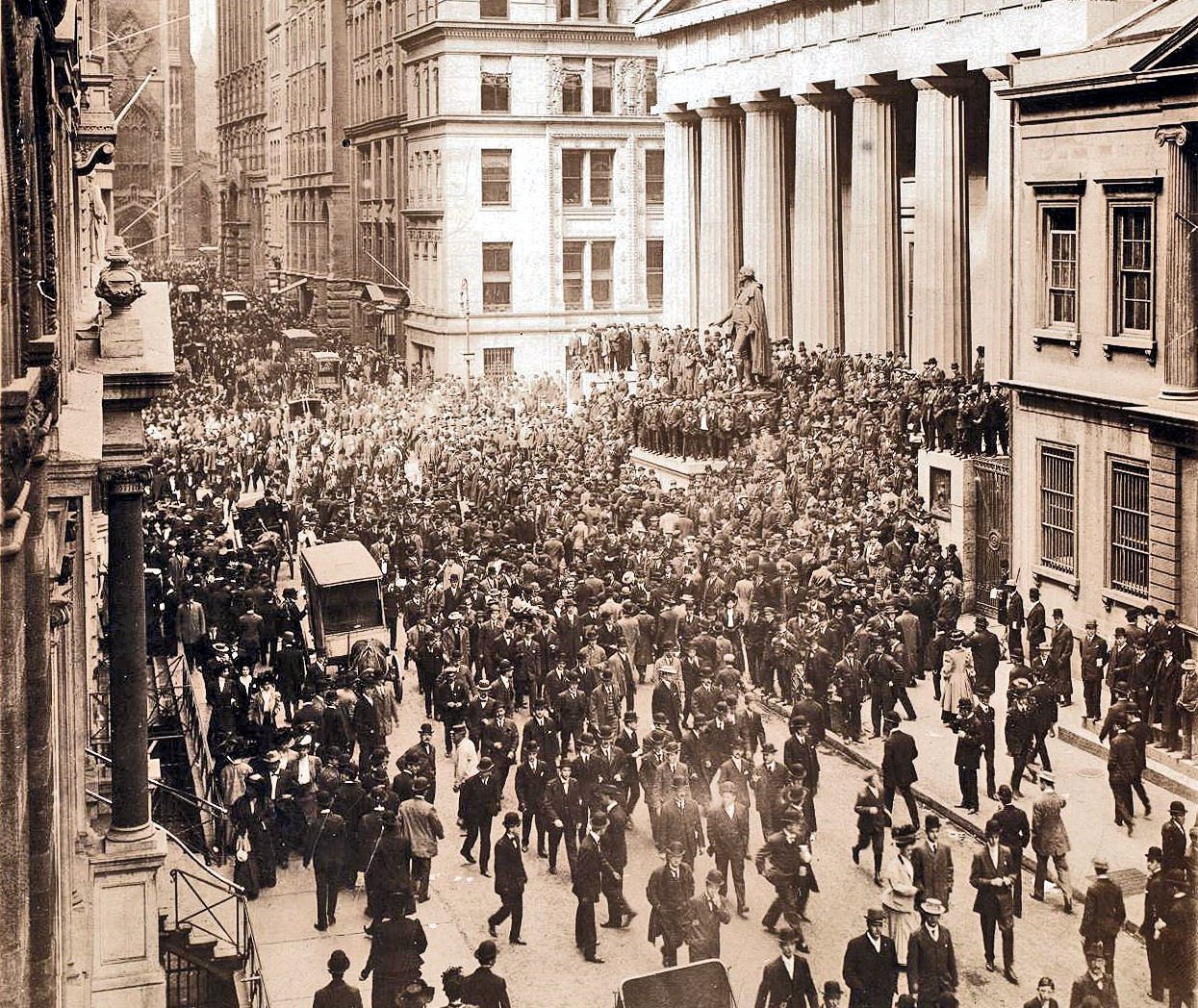

Panic Of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs on banks and on trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When that bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a week ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Act

The National Banking Acts of 1863 and 1864 were two United States federal banking acts that established a system of national banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S. Treasury securities and established the Office of the Comptroller of the Currency as part of the United States Department of the Treasury and a system of nationally chartered banks. The Act shaped today's national banking system and its support of a uniform U.S. banking policy. Background At the end of the Second Bank of the United States in 1836, the control of banking regimes devolved mostly to the states. Different states adopted policies including a total ban on banking (as in Wisconsin), a single state-chartered bank (as in Indiana and Illinois), limited chartering of banks (as in Ohio), and free entry (as in New York). While the relative success of New York's "free banking" laws led a number of states to also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent Treasury

The Independent Treasury was the system for managing the money supply of the United States federal government through the U.S. Treasury and its sub-treasuries, independently of the national banking and financial systems. It was created on August 6, 1846 by the 29th Congress, with the enactment of the Independent Treasury Act of 1846 (ch. 90, ). It was expanded with the creation of the national banking system in 1863. It functioned until the early 20th century, when the Federal Reserve System replaced it. During this time, the Treasury took over an ever-larger number of functions of a central bank and the U.S. Treasury Department came to be the major force in the U.S. money market. Background The Panic of 1819 unleashed a wave of popular resentment against the Second Bank of the United States (the "national bank"), which handled various fiscal duties for the U.S. government after its establishment in 1816. In addition to storing all government funds, the bank also made loans an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)