Corporation on:

[Wikipedia]

[Google]

[Amazon]

A corporation is an organization—usually a group of people or a company—authorized by the

A corporation is an organization—usually a group of people or a company—authorized by the

The word "corporation" derives from ''corpus'', the

The word "corporation" derives from ''corpus'', the

Dutch and English chartered companies, such as the

Dutch and English chartered companies, such as the  In England, the government created corporations under a

In England, the government created corporations under a  In the late 18th century,

In the late 18th century,

The British Bubble Act 1720s prohibition on establishing companies remained in force until its repeal in 1825. By this point, the

The British Bubble Act 1720s prohibition on establishing companies remained in force until its repeal in 1825. By this point, the

In 1892,

In 1892,

''The History of the Corporation''

(2003) * Cadman, John William. ''The Corporation in New Jersey: Business and Politics'' (1949) * Conard, Alfred F. ''Corporations in Perspective''. 1976. * Cooke, C.A., ''Corporation, Trust and Company: A Legal History'', (1950) * Davies, PL, and LCB Gower, ''Principles of Modern Company Law'' (6th ed., Sweet and Maxwell, 1997), chapters 2–4 * Davis, John P

(1904) * Davis, Joseph S

(1917) * Dignam, Alan and John Lowry (2020), ''Company Law'',

''The Legal Nature of the Corporation''

(1897), MCMaster.ca * Hallis, Frederick. ''Corporate Personality: A Study in Jurisprudence'' (1930) * Hessen, Robert. ''In Defense of the Corporation''. Hoover Institute. 1979. * Hunt, Bishop. ''The Development of the Business Corporation in England '' (1936) * Klein and Coffee. ''Business Organization and Finance: Legal and Economic Principles''. Foundation. 2002. * Kocaoglu, Kagan (Cahn Kojaolu

A Comparative Bibliography: Regulatory Competition on Corporate Law

* Kyd, S, ''A Treatise on the Law of Corporations'' (1793–1794) * Mahoney, PG, "Contract or Concession? An Essay on the History of Corporate Law" (2000) 34 Ga. Law Review 873 * Majumdar, Ramesh Chandra

(1920) * Means, Robert Charles. ''Underdevelopment and the Development of Law: Corporations and Corporation Law in Nineteenth-century Colombia'', (1980) * Micklethwait, John and Wooldridge, Adrian. ''The Company: A Short History of a Revolutionary Idea''. New York: Modern Library. 2003. * Owen, Thomas. ''The Corporation Under Russian Law: A Study in Tsarist Economic Policy'' (1991) * Rungta, Radhe Shyam. ''The Rise of the Business Corporation in India, 1851–1900'' (1970) * Scott, W. R

(1912) * Sobel, Robert. ''The Age of Giant Corporations: A Microeconomic History of American Business''. (1984) * Tooze, Adam, "Democracy and Its Discontents", ''

an Audio from a talk about the history of corporations and the English Law by Barrister Daniel Bennett

{{Authority control Companies Corporate law Legal entities Types of organization

A corporation is an organization—usually a group of people or a company—authorized by the

A corporation is an organization—usually a group of people or a company—authorized by the state

State may refer to:

Arts, entertainment, and media Literature

* ''State Magazine'', a monthly magazine published by the U.S. Department of State

* ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States

* ''Our S ...

to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

in legal context) and recognized as such in law

Law is a set of rules that are created and are enforceable by social or governmental institutions to regulate behavior,Robertson, ''Crimes against humanity'', 90. with its precise definition a matter of longstanding debate. It has been vario ...

for certain purposes. Early incorporated entities were established by charter (i.e. by an ''ad hoc

Ad hoc is a Latin phrase meaning literally 'to this'. In English, it typically signifies a solution for a specific purpose, problem, or task rather than a generalized solution adaptable to collateral instances. (Compare with '' a priori''.)

C ...

'' act granted by a monarch or passed by a parliament or legislature). Most jurisdiction

Jurisdiction (from Latin 'law' + 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, areas of jurisdiction apply to local, state, and federal levels.

J ...

s now allow the creation of new corporations through registration

Register or registration may refer to:

Arts entertainment, and media Music

* Register (music), the relative "height" or range of a note, melody, part, instrument, etc.

* ''Register'', a 2017 album by Travis Miller

* Registration (organ), th ...

. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: by whether they can issue stock, or by whether they are formed to make a profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this article) or '' sole'' (a legal entity consisting of a single incorporated office occupied by a single natural person

In jurisprudence, a natural person (also physical person in some Commonwealth countries, or natural entity) is a person (in legal meaning, i.e., one who has its own legal personality) that is an individual human being, distinguished from the bro ...

).

One of the most attractive early advantages business corporations offered to their investors, compared to earlier business entities like sole proprietorship

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entity. A sole ...

s and joint partnership

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to acce ...

s, was limited liability. Limited liability means that a passive shareholder in a corporation will not be personally liable either for contractually agreed obligations of the corporation, or for tort

A tort is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with criminal wrongs that are punishable ...

s (involuntary harms) committed by the corporation against a third party. Limited liability in contract is uncontroversial because the parties to the contract could have agreed to it and could agree to waive it by contract. However, limited liability in tort remains controversial because third parties do not agree to waive

A waiver is the voluntary relinquishment or surrender of some known right or privilege.

Regulatory agencies of state departments or the federal government may issue waivers to exempt companies from certain regulations. For example, a United St ...

the right to pursue shareholders. There is significant evidence that limited liability in tort may lead to excessive corporate risk taking and more harm by corporations to third parties.

Where local law

A local ordinance is a law issued by a local government. such as a municipality, county, parish, prefecture, or the like.

China

In Hong Kong, all laws enacted by the territory's Legislative Council remain to be known as ''Ordinances'' () af ...

distinguishes corporations by their ability to issue stock, corporations allowed to do so are referred to as ''stock corporations''; one type of investment in the corporation is through stock, and owners of stock are referred to as ''stockholders'' or '' shareholders''. Corporations not allowed to issue stock are referred to as ''non-stock corporations''; i.e. those who are considered the owners of a non-stock corporation are persons (or other entities) who have obtained membership in the corporation and are referred to as a ''member'' of the corporation. Corporations chartered in regions where they are distinguished by whether they are allowed to be for-profit are referred to as ''for-profit'' and ''not-for-profit'' corporations, respectively.

There is some overlap between stock/non-stock and for-profit/ not-for-profit in that not-for-profit corporations are nearly always non-stock as well. A for-profit corporation is almost always a stock corporation, but some for-profit corporations may choose to be non-stock. To simplify the explanation, whenever "stockholder" or "shareholder" is used in the rest of this article to refer to a stock corporation, it is presumed to mean the same as "member" for a non-profit corporation or for a profit, non-stock corporation. Registered corporations have legal personality

Legal capacity is a quality denoting either the legal aptitude of a person to have rights and liabilities (in this sense also called transaction capacity), or altogether the personhood itself in regard to an entity other than a natural person ( ...

recognized by local authorities and their shares are owned by shareholders whose liability is generally limited to their investment.

Shareholders do not typically actively manage a corporation; shareholders instead elect or appoint a board of directors to control the corporation in a fiduciary

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for examp ...

capacity. In most circumstances, a shareholder may also serve as a director or officer of a corporation. Countries with co-determination employ the practice of workers of an enterprise having the right to vote for representatives on the board of directors in a company.

In American English

American English, sometimes called United States English or U.S. English, is the set of variety (linguistics), varieties of the English language native to the United States. English is the Languages of the United States, most widely spoken lan ...

, the word ''corporation'' is most often used to describe large business corporations. In British English

British English (BrE, en-GB, or BE) is, according to Lexico, Oxford Dictionaries, "English language, English as used in Great Britain, as distinct from that used elsewhere". More narrowly, it can refer specifically to the English language in ...

and in the Commonwealth countries

The Commonwealth of Nations is a voluntary association of 56 sovereign states. Most of them were British colonies or dependencies of those colonies.

No one government in the Commonwealth exercises power over the others, as is the case in a p ...

, the term ''company'' is more widely used to describe the same sort of entity while the word ''corporation'' encompasses all incorporated entities. In American English, the word ''company'' can include entities such as partnership

A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments o ...

s that would not be referred to as companies in British English as they are not a separate legal entity In the United States, a separate legal entity (SLE) refers to a type of legal entity with detached accountability. Any company is set up as an SLE to legally separate it from the individual or owner, such as a limited liability company or a corporat ...

. Late in the 19th century, a new form of the company having the limited liability protections of a corporation, and the more favorable tax treatment of either a sole proprietorship or partnership was developed. While not a corporation, this new type of entity became very attractive as an alternative for corporations not needing to issue stock. In Germany, the organization was referred to as ''Gesellschaft mit beschränkter Haftung

A ''Gesellschaft mit beschränkter Haftung'' (, abbreviated GmbH and also GesmbH in Austria; ) is a type of Juristic person, legal entity common in Germany, Austria, Switzerland (where it is equivalent to a ''société à responsabilité limit� ...

'' or ''GmbH''. In the last quarter of the 20th century, this new form of non-corporate organization became available in the United States and other countries, and was known as the ''limited liability company

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of ...

'' or ''LLC''. Since the GmbH and LLC forms of organization are technically not corporations (even though they have many of the same features), they will not be discussed in this article.

History

The word "corporation" derives from ''corpus'', the

The word "corporation" derives from ''corpus'', the Latin

Latin (, or , ) is a classical language belonging to the Italic branch of the Indo-European languages. Latin was originally a dialect spoken in the lower Tiber area (then known as Latium) around present-day Rome, but through the power of the ...

word for body, or a "body of people". By the time of Justinian

Justinian I (; la, Iustinianus, ; grc-gre, Ἰουστινιανός ; 48214 November 565), also known as Justinian the Great, was the Byzantine emperor from 527 to 565.

His reign is marked by the ambitious but only partly realized ''renovat ...

(reigned 527–565), Roman law

Roman law is the legal system of ancient Rome, including the legal developments spanning over a thousand years of jurisprudence, from the Twelve Tables (c. 449 BC), to the '' Corpus Juris Civilis'' (AD 529) ordered by Eastern Roman emperor Ju ...

recognized a range of corporate entities under the names ''Universitas'', ''corpus'' or ''collegium''. Following the passage of the ''Lex Julia

A ''lex Julia'' (plural: ''leges Juliae'') was an ancient Roman law that was introduced by any member of the gens Julia. Most often, "Julian laws", ''lex Julia'' or ''leges Juliae'' refer to moral legislation introduced by Augustus in 23 BC, o ...

'' during the reign of Julius Caesar

Gaius Julius Caesar (; ; 12 July 100 BC – 15 March 44 BC), was a Roman general and statesman. A member of the First Triumvirate, Caesar led the Roman armies in the Gallic Wars before defeating his political rival Pompey in a civil war, ...

as Consul

Consul (abbrev. ''cos.''; Latin plural ''consules'') was the title of one of the two chief magistrates of the Roman Republic, and subsequently also an important title under the Roman Empire. The title was used in other European city-states throu ...

and Dictator

A dictator is a political leader who possesses absolute power. A dictatorship is a state ruled by one dictator or by a small clique. The word originated as the title of a Roman dictator elected by the Roman Senate to rule the republic in tim ...

of the Roman Republic

The Roman Republic ( la, Res publica Romana ) was a form of government of Rome and the era of the classical Roman civilization when it was run through public representation of the Roman people. Beginning with the overthrow of the Roman Kin ...

(49–44 BC), and their reaffirmation during the reign of Caesar Augustus as '' Princeps senatus'' and Imperator of the Roman Army

The Roman army (Latin: ) was the armed forces deployed by the Romans throughout the duration of Ancient Rome, from the Roman Kingdom (c. 500 BC) to the Roman Republic (500–31 BC) and the Roman Empire (31 BC–395 AD), and its medieval contin ...

(27 BC–14 AD), ''collegia'' required the approval of the Roman Senate

The Roman Senate ( la, Senātus Rōmānus) was a governing and advisory assembly in ancient Rome. It was one of the most enduring institutions in Roman history, being established in the first days of the city of Rome (traditionally founded in ...

or the Emperor

An emperor (from la, imperator, via fro, empereor) is a monarch, and usually the sovereignty, sovereign ruler of an empire or another type of imperial realm. Empress, the female equivalent, may indicate an emperor's wife (empress consort), ...

in order to be authorized as legal bodies. These included the state itself (the ''Populus Romanus''), municipalities, and such private associations as sponsors of a religious cult

In modern English, ''cult'' is usually a pejorative term for a social group that is defined by its unusual religious, spiritual, or philosophical beliefs and rituals, or its common interest in a particular personality, object, or goal. This s ...

, burial clubs, political groups, and guilds of craftsmen or traders. Such bodies commonly had the right to own property and make contracts, to receive gifts and legacies, to sue and be sued, and, in general, to perform legal acts through representatives. Private associations were granted designated privileges and liberties by the emperor.

The concept of the corporation was revived in the Middle Ages

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the post-classical period of global history. It began with the fall of the Western Roman Empire ...

with the recovery and annotation of Justinian's ''Corpus Juris Civilis

The ''Corpus Juris'' (or ''Iuris'') ''Civilis'' ("Body of Civil Law") is the modern name for a collection of fundamental works in jurisprudence, issued from 529 to 534 by order of Justinian I, Byzantine Emperor. It is also sometimes referred ...

'' by the glossator

The scholars of the 11th- and 12th-century legal schools in Italy, France and Germany are identified as glossators in a specific sense. They studied Roman law based on the '' Digesta'', the ''Codex'' of Justinian, the ''Authenticum'' (an abridged ...

s and their successors the commentators

Commentator or commentators may refer to:

* Commentator (historical) or Postglossator, a member of a European legal school that arose in France in the fourteenth century

* Commentator (horse) (foaled 2001), American Thoroughbred racehorse

* The Co ...

in the 11th–14th centuries. Particularly important in this respect were the Italian jurists Bartolus de Saxoferrato

Bartolus de Saxoferrato (Italian: ''Bartolo da Sassoferrato''; 131313 July 1357) was an Italian law professor and one of the most prominent continental jurists of Medieval Roman Law. He belonged to the school known as the commentators or postglos ...

and Baldus de Ubaldis

Baldus de Ubaldis (Italian: ''Baldo degli Ubaldi''; 1327 – 28 April 1400) was an Italian jurist, and a leading figure in Medieval Roman Law and the school of Postglossators.

Life

A member of the noble family of the Ubaldi (Baldeschi), ...

, the latter of whom connected the corporation to the metaphor of the body politic to describe the state

State may refer to:

Arts, entertainment, and media Literature

* ''State Magazine'', a monthly magazine published by the U.S. Department of State

* ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States

* ''Our S ...

.

Early entities which carried on business and were the subjects of legal rights included the collegium

A (plural ), or college, was any association in ancient Rome that acted as a legal entity. Following the passage of the ''Lex Julia'' during the reign of Julius Caesar as Consul and Dictator of the Roman Republic (49–44 BC), and their rea ...

of ancient Rome

In modern historiography, ancient Rome refers to Roman civilisation from the founding of the city of Rome in the 8th century BC to the collapse of the Western Roman Empire in the 5th century AD. It encompasses the Roman Kingdom (753–509 BC ...

and the ''sreni

In Ancient India, a shreni ( sa, श्रेणि, śreṇi or , Prakrit: ) was an association of traders, merchants, and artisans. Generally, a separate shreni existed for a particular group of persons engaged in the same vocation or activity. ...

'' of the Maurya Empire in ancient India. In medieval Europe, churches became incorporated, as did local governments, such as the City of London Corporation

The City of London Corporation, officially and legally the Mayor and Commonalty and Citizens of the City of London, is the municipal governing body of the City of London, the historic centre of London and the location of much of the United King ...

. The point was that the incorporation would survive longer than the lives of any particular member, existing in perpetuity. The alleged oldest commercial corporation in the world, the Stora Kopparberg mining community in Falun

Falun () is a city and the seat of Falun Municipality in Dalarna County, Sweden, with 37,291 inhabitants in 2010. It is also the capital of Dalarna County. Falun forms, together with Borlänge, a metropolitan area with just over 100,000 inhabitan ...

, Sweden

Sweden, formally the Kingdom of Sweden,The United Nations Group of Experts on Geographical Names states that the country's formal name is the Kingdom of SwedenUNGEGN World Geographical Names, Sweden./ref> is a Nordic country located on ...

, obtained a charter from King Magnus Eriksson in 1347.

In medieval times

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the post-classical period of global history. It began with the fall of the Western Roman Empire an ...

, traders would do business through common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omnipres ...

constructs, such as partnership

A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments o ...

s. Whenever people acted together with a view to profit, the law deemed that a partnership arose. Early guild

A guild ( ) is an association of artisans and merchants who oversee the practice of their craft/trade in a particular area. The earliest types of guild formed as organizations of tradesmen belonging to a professional association. They sometimes ...

s and livery companies were also often involved in the regulation of competition between traders.

Mercantilism

Dutch and English chartered companies, such as the

Dutch and English chartered companies, such as the Dutch East India Company

The United East India Company ( nl, Verenigde Oostindische Compagnie, the VOC) was a chartered company established on the 20th March 1602 by the States General of the Netherlands amalgamating existing companies into the first joint-stock ...

(VOC) and the Hudson's Bay Company

The Hudson's Bay Company (HBC; french: Compagnie de la Baie d'Hudson) is a Canadian retail business group. A fur trading business for much of its existence, HBC now owns and operates retail stores in Canada. The company's namesake business di ...

, were created to lead the colonial ventures of European nations in the 17th century. Acting under a charter sanctioned by the Dutch government, the Dutch East India Company defeated Portuguese

Portuguese may refer to:

* anything of, from, or related to the country and nation of Portugal

** Portuguese cuisine, traditional foods

** Portuguese language, a Romance language

*** Portuguese dialects, variants of the Portuguese language

** Portu ...

forces and established itself in the Moluccan Islands

The Maluku Islands (; Indonesian: ''Kepulauan Maluku'') or the Moluccas () are an archipelago in the east of Indonesia. Tectonically they are located on the Halmahera Plate within the Molucca Sea Collision Zone. Geographically they are located ...

in order to profit from the Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia ...

an demand for spice

A spice is a seed, fruit, root, bark, or other plant substance primarily used for flavoring or coloring food. Spices are distinguished from herbs, which are the leaves, flowers, or stems of plants used for flavoring or as a garnish. Spice ...

s. Investors in the VOC were issued paper certificates as proof of share ownership, and were able to trade their shares on the original Amsterdam Stock Exchange. Shareholders were also explicitly granted limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

in the company's royal charter. In England, the government created corporations under a

In England, the government created corporations under a royal charter

A royal charter is a formal grant issued by a monarch under royal prerogative as letters patent. Historically, they have been used to promulgate public laws, the most famous example being the English Magna Carta (great charter) of 1215, but s ...

or an Act of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the Legislature, legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of ...

with the grant of a monopoly

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a speci ...

over a specified territory. The best-known example, established in 1600, was the East India Company

The East India Company (EIC) was an English, and later British, joint-stock company founded in 1600 and dissolved in 1874. It was formed to trade in the Indian Ocean region, initially with the East Indies (the Indian subcontinent and South ...

of London

London is the capital and largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary down to the North Sea, and has been a majo ...

. Queen Elizabeth I

Elizabeth I (7 September 153324 March 1603) was Queen of England and Ireland from 17 November 1558 until her death in 1603. Elizabeth was the last of the five House of Tudor monarchs and is sometimes referred to as the "Virgin Queen".

El ...

granted it the exclusive right to trade with all countries to the east of the Cape of Good Hope. Some corporations at this time would act on the government's behalf, bringing in revenue from its exploits abroad. Subsequently, the company became increasingly integrated with English and later British military and colonial policy, just as most corporations were essentially dependent on the Royal Navy

The Royal Navy (RN) is the United Kingdom's naval warfare force. Although warships were used by English and Scottish kings from the early medieval period, the first major maritime engagements were fought in the Hundred Years' War against F ...

's ability to control trade routes.

Labeled by both contemporaries and historians as "the grandest society of merchants in the universe", the English East India Company would come to symbolize the dazzlingly rich potential of the corporation, as well as new methods of business that could be both brutal and exploitative. On 31 December 1600, Queen Elizabeth I granted the company a 15-year monopoly on trade to and from the East Indies

The East Indies (or simply the Indies), is a term used in historical narratives of the Age of Discovery. The Indies refers to various lands in the East or the Eastern hemisphere, particularly the islands and mainlands found in and around ...

and Africa

Africa is the world's second-largest and second-most populous continent, after Asia in both cases. At about 30.3 million km2 (11.7 million square miles) including adjacent islands, it covers 6% of Earth's total surface area ...

. By 1711, shareholders in the East India Company were earning a return on their investment of almost 150 per cent. Subsequent stock offerings demonstrated just how lucrative the Company had become. Its first stock offering in 1713–1716 raised £418,000, its second in 1717–1722 raised £1.6 million.

A similar chartered company

A chartered company is an association with investors or shareholders that is incorporated and granted rights (often exclusive rights) by royal charter (or similar instrument of government) for the purpose of trade, exploration, and/or coloni ...

, the South Sea Company

The South Sea Company (officially The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, and for the encouragement of the Fishery) was a British joint-stock company founded in Ja ...

, was established in 1711 to trade in the Spanish South American colonies, but met with less success. The South Sea Company's monopoly rights were supposedly backed by the Treaty of Utrecht

The Peace of Utrecht was a series of peace treaties signed by the belligerents in the War of the Spanish Succession, in the Dutch city of Utrecht between April 1713 and February 1715. The war involved three contenders for the vacant throne ...

, signed in 1713 as a settlement following the War of the Spanish Succession

The War of the Spanish Succession was a European great power conflict that took place from 1701 to 1714. The death of childless Charles II of Spain in November 1700 led to a struggle for control of the Spanish Empire between his heirs, Phil ...

, which gave Great Britain

Great Britain is an island in the North Atlantic Ocean off the northwest coast of continental Europe. With an area of , it is the largest of the British Isles, the largest European island and the ninth-largest island in the world. It i ...

an ''asiento

The () was a monopoly contract between the Spanish Crown and various merchants for the right to provide African slaves to colonies in the Spanish Americas. The Spanish Empire rarely engaged in the trans-Atlantic slave trade directly from Afri ...

'' to trade in the region for thirty years. In fact, the Spanish remained hostile and let only one ship a year enter. Unaware of the problems, investors in Britain, enticed by extravagant promises of profit from company promoters

A corporate promoter is a firm or person who does the preliminary work related to the formation of a company, including its promotion, incorporation, and flotation, and solicits people to invest money in the company, usually when it is being f ...

bought thousands of shares. By 1717, the South Sea Company was so wealthy (still having done no real business) that it assumed the public debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

of the British government. This accelerated the inflation of the share price further, as did the Bubble Act 1720

The Bubble Act 1720 (also Royal Exchange and London Assurance Corporation Act 1719) was an Act of the Parliament of Great Britain passed on 11 June 1720 that incorporated the Royal Exchange and London Assurance Corporation, but more significan ...

, which (possibly with the motive of protecting the South Sea Company from competition) prohibited the establishment of any companies without a Royal Charter. The share price rose so rapidly that people began buying shares merely in order to sell them at a higher price, which in turn led to higher share prices. This was the first speculative bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be ...

the country had seen, but by the end of 1720, the bubble had "burst", and the share price sank from £1000 to under £100. As bankruptcies and recriminations ricocheted through government and high society, the mood against corporations and errant directors was bitter.

In the late 18th century,

In the late 18th century, Stewart Kyd

Stewart Kyd (1759 – 26 January 1811) was a Scottish politician and legal writer.

Life

A native of Arbroath, Forfarshire, he went at the age of fourteen from Arbroath grammar school to King's College, Aberdeen. Abandoning a design of entering t ...

, the author of the first treatise on corporate law in English, defined a corporation as:

Development of modern company law

Due to the late 18th century abandonment ofmercantilist

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce ...

economic theory and the rise of classical liberalism

Classical liberalism is a political tradition and a branch of liberalism that advocates free market and laissez-faire economics; civil liberties under the rule of law with especial emphasis on individual autonomy, limited government, econo ...

and laissez-faire

''Laissez-faire'' ( ; from french: laissez faire , ) is an economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies) deriving from special interest groups ...

economic theory due to a revolution in economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

led by Adam Smith and other economists, corporations transitioned from being government or guild

A guild ( ) is an association of artisans and merchants who oversee the practice of their craft/trade in a particular area. The earliest types of guild formed as organizations of tradesmen belonging to a professional association. They sometimes ...

affiliated entities to being public and private economic entities free of governmental directions. Smith wrote in his 1776 work ''The Wealth of Nations

''An Inquiry into the Nature and Causes of the Wealth of Nations'', generally referred to by its shortened title ''The Wealth of Nations'', is the '' magnum opus'' of the Scottish economist and moral philosopher Adam Smith. First published in ...

'' that mass corporate activity could not match private entrepreneurship, because people in charge of others' money would not exercise as much care as they would with their own.

Deregulation

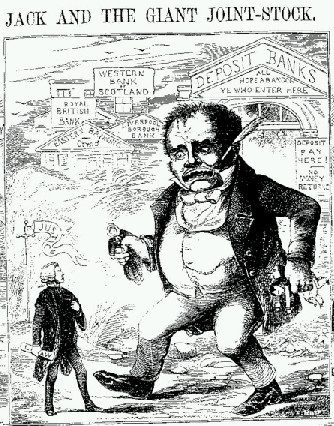

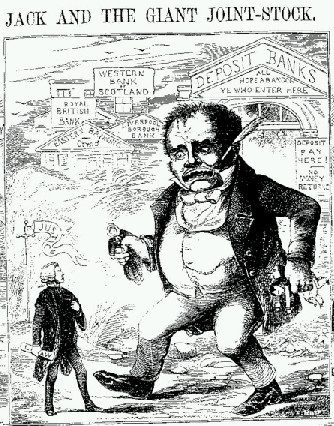

The British Bubble Act 1720s prohibition on establishing companies remained in force until its repeal in 1825. By this point, the

The British Bubble Act 1720s prohibition on establishing companies remained in force until its repeal in 1825. By this point, the Industrial Revolution

The Industrial Revolution was the transition to new manufacturing processes in Great Britain, continental Europe, and the United States, that occurred during the period from around 1760 to about 1820–1840. This transition included going f ...

had gathered pace, pressing for legal change to facilitate business activity. The repeal was the beginning of a gradual lifting on restrictions, though business ventures (such as those chronicled by Charles Dickens

Charles John Huffam Dickens (; 7 February 1812 – 9 June 1870) was an English writer and social critic. He created some of the world's best-known fictional characters and is regarded by many as the greatest novelist of the Victorian e ...

in ''Martin Chuzzlewit

''The Life and Adventures of Martin Chuzzlewit'' (commonly known as ''Martin Chuzzlewit'') is a novel by Charles Dickens, considered the last of his picaresque novels. It was originally serialised between 1842 and 1844. While he was writing it ...

'') under primitive companies legislation were often scams. Without cohesive regulation, proverbial operations like the "Anglo-Bengalee Disinterested Loan and Life Assurance Company" were undercapitalized ventures promising no hope of success except for richly paid promoters.

The process of incorporation was possible only through a royal charter

A royal charter is a formal grant issued by a monarch under royal prerogative as letters patent. Historically, they have been used to promulgate public laws, the most famous example being the English Magna Carta (great charter) of 1215, but s ...

or a private act

Proposed bills are often categorized into public bills and private bills. A public bill is a proposed law which would apply to everyone within its jurisdiction. This is unlike a private bill which is a proposal for a law affecting only a single p ...

and was limited, owing to Parliament's jealous protection of the privileges and advantages thereby granted. As a result, many businesses came to be operated as unincorporated associations

A voluntary group or union (also sometimes called a voluntary organization, common-interest association, association, or society) is a group of individuals who enter into an agreement, usually as volunteers, to form a body (or organization) to ac ...

with possibly thousands of members. Any consequent litigation had to be carried out in the joint names of all the members and was almost impossibly cumbersome. Though Parliament would sometimes grant a private act to allow an individual to represent the whole in legal proceedings, this was a narrow and necessarily costly expedient, allowed only to established companies.

Then, in 1843, William Gladstone became the chairman of a Parliamentary Committee on Joint Stock Companies, which led to the Joint Stock Companies Act 1844, regarded as the first modern piece of company law. The Act created the Registrar of Joint Stock Companies

A company register is a register of organizations in the jurisdiction they operate under.

A statistical business register has a different purpose than a company register. While a commercial/trade register serves a purpose of protection, accounta ...

, empowered to register companies by a two-stage process. The first, provisional, stage cost £5 and did not confer corporate status, which arose after completing the second stage for another £5. For the first time in history, it was possible for ordinary people through a simple registration procedure to incorporate. The advantage of establishing a company as a separate legal person

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

was mainly administrative, as a unified entity under which the rights and duties of all investors and managers could be channeled.

Limited liability

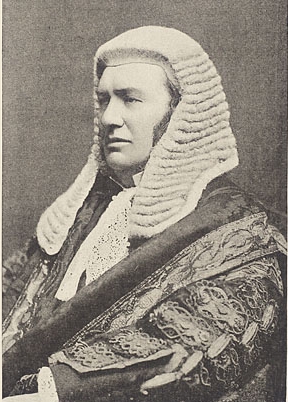

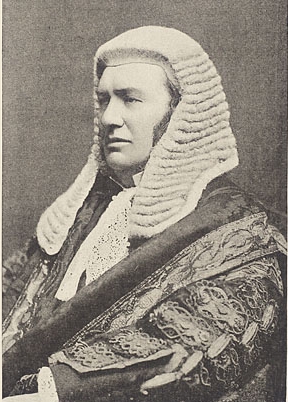

However, there was still no limited liability and company members could still be held responsible for unlimited losses by the company. The next, crucial development, then, was the Limited Liability Act 1855, passed at the behest of the then Vice President of the Board of Trade, Robert Lowe. This allowed investors to limit their liability in the event of business failure to the amount they invested in the company – shareholders were still liable directly to creditors, but just for the unpaid portion of their shares. (The principle that shareholders are liable to the corporation had been introduced in the Joint Stock Companies Act 1844). The 1855 Act allowed limited liability to companies of more than 25 members (shareholders).Insurance companies

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge ...

were excluded from the act, though it was standard practice for insurance contracts to exclude action against individual members. Limited liability for insurance companies was allowed by the Companies Act 1862

The Companies Act 1862 (25 & 26 Vict. c.89) was an Act of the Parliament of the United Kingdom regulating UK company law, whose descendant is the Companies Act 2006.

Provisions

*s 6 'Any seven or more persons associated for any lawful purpose may ...

.

This prompted the English periodical ''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Eco ...

'' to write in 1855 that "never, perhaps, was a change so vehemently and generally demanded, of which the importance was so much overrated." The major error of this judgment was recognised by the same magazine more than 70 years later, when it claimed that, " e economic historian of the future... may be inclined to assign to the nameless inventor of the principle of limited liability, as applied to trade corporations, a place of honour with Watt

The watt (symbol: W) is the unit of power or radiant flux in the International System of Units (SI), equal to 1 joule per second or 1 kg⋅m2⋅s−3. It is used to quantify the rate of energy transfer. The watt is named after James ...

and Stephenson, and other pioneers of the Industrial Revolution. "

These two features – a simple registration procedure and limited liability – were subsequently codified into the landmark 1856 Joint Stock Companies Act. This was subsequently consolidated with a number of other statutes in the Companies Act 1862, which remained in force for the rest of the century, up to and including the time of the decision in ''Salomon v A Salomon & Co Ltd

is a landmark UK company law case. The effect of the House of Lords' unanimous ruling was to uphold firmly the doctrine of corporate personality, as set out in the Companies Act 1862, so that creditors of an insolvent company could not sue th ...

''.

The legislation shortly gave way to a railway boom, and from then, the numbers of companies formed soared. In the later nineteenth century, depression took hold, and just as company numbers had boomed, many began to implode and fall into insolvency. Much strong academic, legislative and judicial opinion was opposed to the notion that businessmen could escape accountability for their role in the failing businesses.

Further developments

In 1892,

In 1892, Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwe ...

introduced the Gesellschaft mit beschränkter Haftung

A ''Gesellschaft mit beschränkter Haftung'' (, abbreviated GmbH and also GesmbH in Austria; ) is a type of Juristic person, legal entity common in Germany, Austria, Switzerland (where it is equivalent to a ''société à responsabilité limit� ...

with a separate legal personality

Legal capacity is a quality denoting either the legal aptitude of a person to have rights and liabilities (in this sense also called transaction capacity), or altogether the personhood itself in regard to an entity other than a natural person ( ...

and limited liability even if all the shares of the company were held by only one person. This inspired other countries to introduce corporations of this kind.

The last significant development in the history of companies was the 1897 decision of the House of Lords in '' Salomon v. Salomon & Co.'' where the House of Lords confirmed the separate legal personality of the company, and that the liabilities of the company were separate and distinct from those of its owners.

In the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

, forming a corporation usually required an act of legislation until the late 19th century. Many private firms, such as Carnegie's steel company and Rockefeller Rockefeller is a German surname, originally given to people from the village of Rockenfeld near Neuwied in the Rhineland and commonly referring to subjects associated with the Rockefeller family. It may refer to:

People with the name Rockefeller f ...

's Standard Oil, avoided the corporate model for this reason (as a trust

Trust often refers to:

* Trust (social science), confidence in or dependence on a person or quality

It may also refer to:

Business and law

* Trust law, a body of law under which one person holds property for the benefit of another

* Trust (bus ...

). State governments began to adopt more permissive corporate laws from the early 19th century, although these were all restrictive in design, often with the intention of preventing corporations from gaining too much wealth and power.

New Jersey

New Jersey is a state in the Mid-Atlantic and Northeastern regions of the United States. It is bordered on the north and east by the state of New York; on the east, southeast, and south by the Atlantic Ocean; on the west by the Delaware ...

was the first state to adopt an "enabling" corporate law, with the goal of attracting more business to the state, in 1896. In 1899, Delaware followed New Jersey's lead with the enactment of an enabling corporate statute, but Delaware only became the leading corporate state after the enabling provisions of the 1896 New Jersey corporate law were repealed in 1913.

The end of the 19th century saw the emergence of holding companies

A holding company is a company whose primary business is holding a controlling interest in the securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own shares of other companies ...

and corporate mergers creating larger corporations with dispersed shareholders. Countries began enacting antitrust laws to prevent anti-competitive practices and corporations were granted more legal rights and protections.

The 20th century saw a proliferation of laws allowing for the creation of corporations by registration across the world, which helped to drive economic booms in many countries before and after World War I. Another major post World War I shift was toward the development of conglomerates, in which large corporations purchased smaller corporations to expand their industrial base.

Starting in the 1980s, many countries with large state-owned corporations moved toward privatization

Privatization (also privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation when ...

, the selling of publicly owned (or 'nationalised') services and enterprises to corporations. Deregulation (reducing the regulation of corporate activity) often accompanied privatization as part of a laissez-faire policy.

Ownership and control

A corporation is, at least in theory, owned and controlled by its members. In a joint-stock company the members are known as shareholders, and each of their shares in the ownership, control, and profits of the corporation is determined by the portion of shares in the company that they own. Thus a person who owns a quarter of the shares of a joint-stock company owns a quarter of the company, is entitled to a quarter of the profit (or at least a quarter of the profit given to shareholders as dividends) and has a quarter of the votes capable of being cast at general meetings. In another kind of corporation, the legal document which established the corporation or which contains its current rules will determine the requirements for membership in the corporation. What these requirements are depends on the kind of corporation involved. In aworker cooperative

A worker cooperative is a cooperative owned and self-managed by its workers. This control may mean a firm where every worker-owner participates in decision-making in a democratic fashion, or it may refer to one in which management is elected by ...

, the members are people who work for the cooperative. In a credit union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provisi ...

, the members are people who have accounts with the credit union.

The day-to-day activities of a corporation are typically controlled by individuals appointed by the members. In some cases, this will be a single individual but more commonly corporations are controlled by a committee or by committees. Broadly speaking, there are two kinds of committee structure.

* A single committee known as a board of directors is the method favored in most common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omnipres ...

countries. Under this model, the board of directors is composed of both executive and non-executive directors, the latter being meant to supervise the former's management of the company.

* A two-tiered committee structure with a supervisory board

In corporate governance, a governance board also known as council of delegates are chosen by the stockholders of a company to promote their interests through the governance of the company and to hire and fire the board of directors.

In civil s ...

and a managing board is common in civil law countries.

In countries with co-determination (such as in Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwe ...

), workers elect a fixed fraction of the corporation's board.

Formation

Historically, corporations were created by a charter granted by the government. Today, corporations are usually registered with the state, province, or national government and regulated by the laws enacted by that government. Registration is the main prerequisite to the corporation's assumption of limited liability. The law sometimes requires the corporation to designate its principal address, as well as aregistered agent

In United States business law, a registered agent (also known as a resident agent, statutory agent, or agent for service of process) is a business or individual designated to receive service of process (SOP) when a business entity is a party ...

(a person or company designated to receive legal service of process). It may also be required to designate an agent

Agent may refer to:

Espionage, investigation, and law

*, spies or intelligence officers

* Law of agency, laws involving a person authorized to act on behalf of another

** Agent of record, a person with a contractual agreement with an insuranc ...

or other legal representatives of the corporation.

Generally, a corporation files articles of incorporation

Article often refers to:

* Article (grammar), a grammatical element used to indicate definiteness or indefiniteness

* Article (publishing), a piece of nonfictional prose that is an independent part of a publication

Article may also refer to:

...

with the government, laying out the general nature of the corporation, the amount of stock it is authorized to issue, and the names and addresses of directors. Once the articles are approved, the corporation's directors meet to create bylaws

A by-law (bye-law, by(e)law, by(e) law), or as it is most commonly known in the United States bylaws, is a set of rules or law established by an organization or community so as to regulate itself, as allowed or provided for by some higher authorit ...

that govern the internal functions of the corporation, such as meeting procedures and officer positions.

In theory, a corporation can not own its own stock. An exception is treasury stock

A treasury stock or reacquired stock is stock which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings).

Stock repurchases are used as a tax efficie ...

, where the company essentially buys back stock from its shareholders, which reduces its outstanding shares. This essentially becomes the equivalent of unissued capital, where it is not classified as an asset on the balance sheet (passive capital).

The law of the jurisdiction in which a corporation operates will regulate most of its internal activities, as well as its finances. If a corporation operates outside its home state, it is often required to register with other governments as a foreign corporation

Foreign corporation is a term used in the United States to describe an existing corporation (or other type of corporate entity, such as a limited liability company or LLC) that conducts business in a state or jurisdiction other than where it was ...

, and is almost always subject to laws of its host state pertaining to employment

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any othe ...

, crime

In ordinary language, a crime is an unlawful act punishable by a state or other authority. The term ''crime'' does not, in modern criminal law, have any simple and universally accepted definition,Farmer, Lindsay: "Crime, definitions of", in Ca ...

s, contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tr ...

s, civil actions

-

A lawsuit is a proceeding by a party or parties against another in the civil court of law. The archaic term "suit in law" is found in only a small number of laws still in effect today. The term "lawsuit" is used in reference to a civil actio ...

, and the like.

Naming

Corporations generally have a distinct name. Historically, some corporations were named after the members of their boards of directors: for example, the "President and Fellows of Harvard College

The President and Fellows of Harvard College (also called the Harvard Corporation or just the Corporation) is the smaller and more powerful of Harvard University's two governing boards, and is now the oldest corporation in America. Together with ...

" is the name of one of the two governing boards of Harvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of high ...

, but it is also the exact name under which Harvard was legally incorporated. Nowadays, corporations in most jurisdictions may have a distinct name that does not need to make reference to the members of their boards. In Canada, this possibility is taken to its logical extreme: many smaller Canadian corporations have no names at all, merely numbers based on a registration number (for example, "12345678 Ontario Limited"), which is assigned by the provincial or territorial government where the corporation incorporates.

In most countries, corporate names include a term or an abbreviation that denotes the corporate status of the entity (for example, "Incorporated" or "Inc." in the United States) or the limited liability of its members (for example, "Limited", "Ltd.", or "LLC"). These terms vary by jurisdiction and language. In some jurisdictions, they are mandatory, and in others, such as California, they are not. Their use puts everybody on constructive notice Constructive notice is the legal fictionThe phrase "legal fiction" should not be construed to mean that the concept of constructive notice is legally invalid. that signifies that a person or entity should have known, as a reasonable person would hav ...

that they are dealing with an entity whose liability is limited: one can only collect from whatever assets the entity still controls when one obtains a judgment against it.

Some jurisdictions do not allow the use of the word "company" alone to denote corporate status, since the word " company" may refer to a partnership or some other form of collective ownership (in the United States it can be used by a sole proprietorship

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entity. A sole ...

but this is not generally the case elsewhere).

Personhood

Despite not being human beings, corporations have been ruledlegal persons

In law, a legal person is any person or 'thing' (less ambiguously, any legal entity) that can do the things a human person is usually able to do in law – such as enter into contracts, sue and be sued, own property, and so on. The reason for ...

in a few countries, and have many of the same rights as natural person

In jurisprudence, a natural person (also physical person in some Commonwealth countries, or natural entity) is a person (in legal meaning, i.e., one who has its own legal personality) that is an individual human being, distinguished from the bro ...

s do. For example, a corporation can own property, and can sue or be sued for as long as it exists. Corporations can exercise human rights

Human rights are moral principles or normsJames Nickel, with assistance from Thomas Pogge, M.B.E. Smith, and Leif Wenar, 13 December 2013, Stanford Encyclopedia of PhilosophyHuman Rights Retrieved 14 August 2014 for certain standards of hu ...

against real individuals and the state, and they can themselves be responsible for human rights violations. Corporations can be "dissolved" either by statutory operation, the order of the court, or voluntary action on the part of shareholders. Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet i ...

may result in a form of corporate failure, when creditors force the liquidation and dissolution of the corporation under court order, but it most often results in a restructuring of corporate holdings. Corporations can even be convicted of special criminal offenses in the UK, such as fraud and corporate manslaughter

Corporate manslaughter is a crime in several jurisdictions, including England and Wales and Hong Kong. It enables a corporation to be punished and censured for culpable conduct that leads to a person's death. This extends beyond any compensation t ...

. However, corporations are not considered living entities in the way that humans are.

Legal scholars and others, such as Joel Bakan

Joel Conrad Bakan (born 1959) is an American-Canadian writer, jazz musician, filmmaker, and professor at the Peter A. Allard School of Law at the University of British Columbia.

Born in Lansing, Michigan, and raised for most of his childhood in ...

, have observed that a business corporation created as a "legal person" has a psychopathic personality because it is required to elevate its own interests above those of others even when this inflicts major risks and grave harms on the public or on other third-parties. Such critics note that the legal mandate of the corporation to focus exclusively on corporate profits and self interest often victimizes employees, customers, the public at large, and/or the natural resources

Natural resources are resources that are drawn from nature and used with few modifications. This includes the sources of valued characteristics such as commercial and industrial use, aesthetic value, scientific interest and cultural value. ...

. The political theorist David Runciman

David Walter Runciman, 4th Viscount Runciman of Doxford, (born 1 March 1967) is an English academic who teaches politics and history at Cambridge University, where he is Professor of Politics. From October 2014 to October 2018 he was also Head ...

notes that corporate personhood forms a fundamental part of the modern history of the idea of the state

State may refer to:

Arts, entertainment, and media Literature

* ''State Magazine'', a monthly magazine published by the U.S. Department of State

* ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States

* ''Our S ...

, and believes the idea of the corporation as legal person can help to clarify the role of citizens as political stakeholders, and to break down the sharp conceptual dichotomy between the state and the people or the individual, a distinction that, on his account, is "increasingly unable to meet the demands placed on the state in the modern world".

See also

Notes

Further reading

* * Bakan, Joel. ''The New Corporation: How "Good" Corporations Are Bad for Democracy''. (2020) * Blackstone, W. ''Commentaries on the Laws of England'' (1765) 455–473 * Blumberg, Phillip I., ''The Multinational Challenge to Corporation Law: The Search for a New Corporate Personality'', (1993) * Blumberg, PI, ''The Multinational Challenge to Corporation Law'' (1993) * Bromberg, Alan R. ''Crane and Bromberg on Partnership''. 1968. * Brown, Bruce''The History of the Corporation''

(2003) * Cadman, John William. ''The Corporation in New Jersey: Business and Politics'' (1949) * Conard, Alfred F. ''Corporations in Perspective''. 1976. * Cooke, C.A., ''Corporation, Trust and Company: A Legal History'', (1950) * Davies, PL, and LCB Gower, ''Principles of Modern Company Law'' (6th ed., Sweet and Maxwell, 1997), chapters 2–4 * Davis, John P

(1904) * Davis, Joseph S

(1917) * Dignam, Alan and John Lowry (2020), ''Company Law'',

Oxford University Press

Oxford University Press (OUP) is the university press of the University of Oxford. It is the largest university press in the world, and its printing history dates back to the 1480s. Having been officially granted the legal right to print books ...

* Dodd, Edwin Merrick. ''American Business Corporations Until 1860, with Special Reference to Massachusetts'' (1954)

* DuBois, A. B. ''The English Business Company after the Bubble Act'' (1938)

* Formoy, RR, ''The Historical Foundations of Company Law'' (Sweet and Maxwell 1923) 21

* Freedman, Charles. ''Joint-stock Enterprise in France: From Privileged Company to Modern Corporation'' (1979)

* Frentrop, P, ''A History of Corporate Governance 1602–2002'' (Brussels et al., 2003)

* Freund, Ernst''The Legal Nature of the Corporation''

(1897), MCMaster.ca * Hallis, Frederick. ''Corporate Personality: A Study in Jurisprudence'' (1930) * Hessen, Robert. ''In Defense of the Corporation''. Hoover Institute. 1979. * Hunt, Bishop. ''The Development of the Business Corporation in England '' (1936) * Klein and Coffee. ''Business Organization and Finance: Legal and Economic Principles''. Foundation. 2002. * Kocaoglu, Kagan (Cahn Kojaolu

A Comparative Bibliography: Regulatory Competition on Corporate Law

* Kyd, S, ''A Treatise on the Law of Corporations'' (1793–1794) * Mahoney, PG, "Contract or Concession? An Essay on the History of Corporate Law" (2000) 34 Ga. Law Review 873 * Majumdar, Ramesh Chandra

(1920) * Means, Robert Charles. ''Underdevelopment and the Development of Law: Corporations and Corporation Law in Nineteenth-century Colombia'', (1980) * Micklethwait, John and Wooldridge, Adrian. ''The Company: A Short History of a Revolutionary Idea''. New York: Modern Library. 2003. * Owen, Thomas. ''The Corporation Under Russian Law: A Study in Tsarist Economic Policy'' (1991) * Rungta, Radhe Shyam. ''The Rise of the Business Corporation in India, 1851–1900'' (1970) * Scott, W. R

(1912) * Sobel, Robert. ''The Age of Giant Corporations: A Microeconomic History of American Business''. (1984) * Tooze, Adam, "Democracy and Its Discontents", ''

The New York Review of Books

''The New York Review of Books'' (or ''NYREV'' or ''NYRB'') is a semi-monthly magazine with articles on literature, culture, economics, science and current affairs. Published in New York City, it is inspired by the idea that the discussion of i ...

'', vol. LXVI, no. 10 (6 June 2019), pp. 52–53, 56–57. "Democracy has no clear answer for the mindless operation of bureaucratic

The term bureaucracy () refers to a body of non-elected governing officials as well as to an administrative policy-making group. Historically, a bureaucracy was a government administration managed by departments staffed with non-elected offi ...

and technological power. We may indeed be witnessing its extension in the form of artificial intelligence

Artificial intelligence (AI) is intelligence—perceiving, synthesizing, and inferring information—demonstrated by machines, as opposed to intelligence displayed by animals and humans. Example tasks in which this is done include speech r ...

and robotics

Robotics is an interdisciplinary branch of computer science and engineering. Robotics involves design, construction, operation, and use of robots. The goal of robotics is to design machines that can help and assist humans. Robotics integrate ...

. Likewise, after decades of dire warning, the environmental problem

Environmental issues are Human impact on the environment, effects of human activity on the biophysical environment, Climate change, most often of which are harmful effects that cause environmental degradation. Environmental protection is the prac ...

remains fundamentally unaddressed.... Bureaucratic overreach and environmental catastrophe are precisely the kinds of slow-moving existential challenges that democracies deal with very badly.... Finally, there is the threat du jour: corporations and the technologies they promote." (pp. 56–57.)

External links

*US Corporate Law

United States corporate law regulates the governance, finance and power of corporations in US law. Every state and territory has its own basic corporate code, while federal law creates minimum standards for trade in company shares and governanc ...

at Wikibooks

an Audio from a talk about the history of corporations and the English Law by Barrister Daniel Bennett

{{Authority control Companies Corporate law Legal entities Types of organization