|

Subprime Mortgage Crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the Financial crisis of 2007–2008, 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a 2000s United States housing bubble, housing bubble, leading to Mortgage loan, mortgage delinquencies, foreclosures, and the devaluation of Mortgage-backed security, housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with Mortgage-backed security, mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

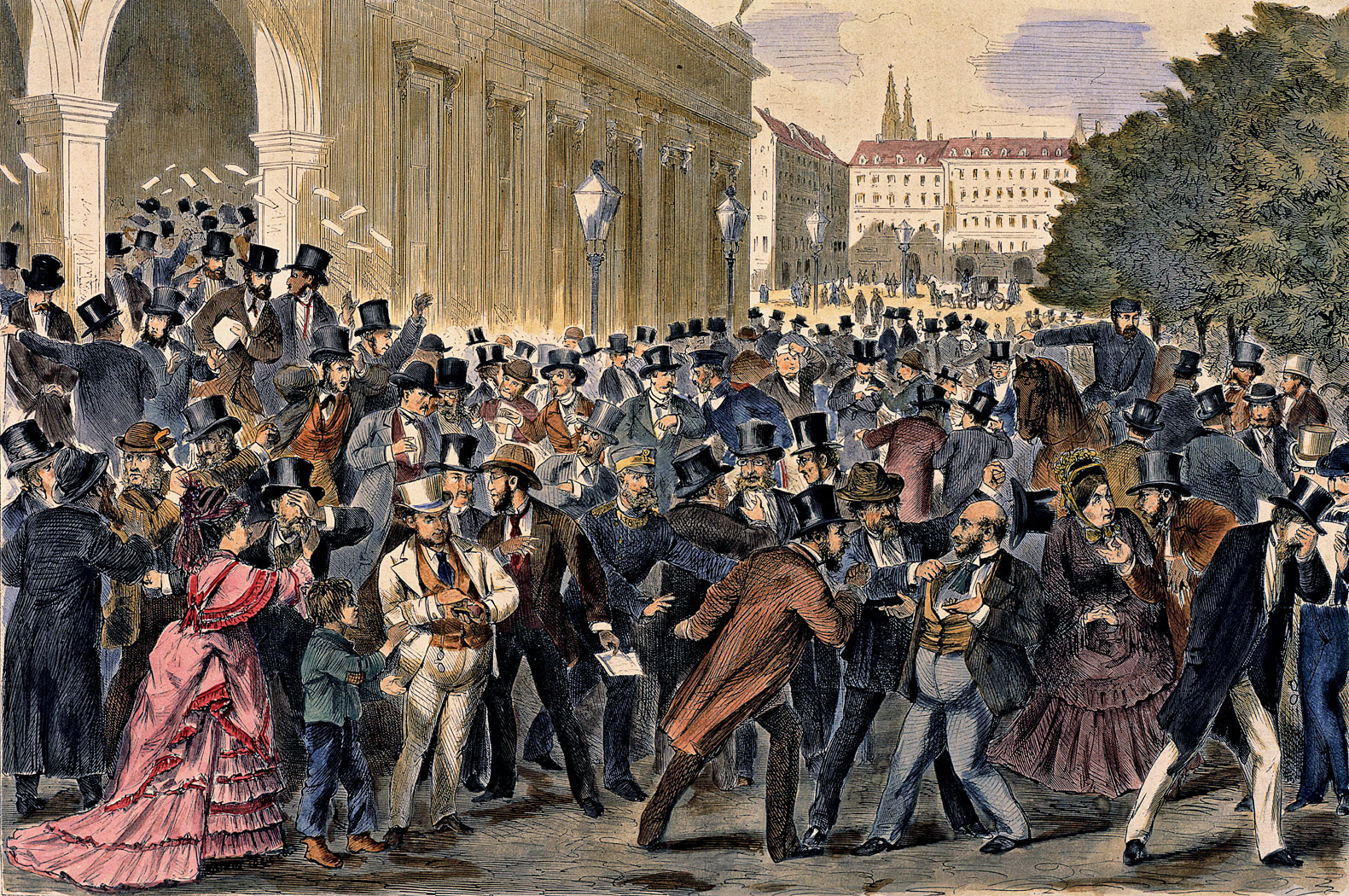

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Debt Crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone member states (Greece, Portugal, Ireland, Spain, and Cyprus) were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF). The eurozone crisis was caused by a balance-of-payments crisis, which is a sudden stop of foreign capital into countries that had substantial deficits and were dependent on foreign lending. The crisis was worsened by the inability of states to resort to devaluation (reductions in the value of the national currency) due to having the Euro as a shared currency. Debt accumulation in some eurozone members was in part due t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark Zandi

Mark M. Zandi is an Iranian-American economist who is the chief economist of Moody's Analytics, where he directs economic research. Zandi's research interests encompass macroeconomics, financial markets and public policy. He analyzes the economic impact of government spending policies and monetary policy response. A trusted advisor to policy makers, he has testified before Congress on the economic outlook, the nation's fiscal challenges, fiscal stimulus and financial regulatory reform. Zandi also publishes on mortgage finance reform and the determinants of foreclosure and personal bankruptcy. He was one of the first economists to warn of the financial crisis of 2008 in 2005. Early life and education Zandi was born in Atlanta, Georgia, and is of Iranian descent. The son of Professor Iraj Zandi, he grew up in Radnor, Pennsylvania. Zandi received his B.S. in economics from The Wharton School of the University of Pennsylvania and a Ph.D. in economics from the University of Pennsylv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis. In the years leading up to the failure, Bear Stearns was heavily involved in securitization and issued large amounts of asset-backed securities which were, in the case of mortgages, pioneered by Lewis Ranieri, "the father of mortgage securities". As investor losses mounted in those markets in 2006 and 2007, the company actually increased its exposure, especially to the mortgage-backed assets that were central to the subprime mortgage crisis. In March 2008, the Federal Reserve Bank of New York provided an emergency loan to try to avert a sudden co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008. The biggest sovereign default is Greece, with $138 billion in March 2012. Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms "insolvency", illiquidity and " bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meaning debtors are unable to pay their debts. * Bankruptcy: A legal finding tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Broadcasting Service

The Public Broadcasting Service (PBS) is an American public broadcaster and non-commercial, free-to-air television network based in Arlington, Virginia. PBS is a publicly funded nonprofit organization and the most prominent provider of educational programming to public television stations in the United States, distributing shows such as ''Frontline'', '' Nova'', ''PBS NewsHour'', ''Sesame Street'', and ''This Old House''. PBS is funded by a combination of member station dues, the Corporation for Public Broadcasting, pledge drives, and donations from both private foundations and individual citizens. All proposed funding for programming is subject to a set of standards to ensure the program is free of influence from the funding source. PBS has over 350 member television stations, many owned by educational institutions, nonprofit groups both independent or affiliated with one particular local public school district or collegiate educational institution, or entities owned by or r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Moyers Journal

''Bill Moyers Journal'' was an American television current affairs program that covered an array of current affairs and human issues, including economics, history, literature, religion, philosophy, science, and most frequently politics. Bill Moyers executive produced, wrote and hosted the ''Journal'' when it was created. WNET in New York produced it and PBS aired it from 1972 to 1976. In 1979, following a nearly three-year hiatus, PBS announced that ''Bill Moyers Journal'' would return for a second series, which would cover a broader range of issues in depth. This included election coverage and documentary footage from several U.S. states, among them Florida, Texas, Illinois, Washington, D.C. and Nevada. In addition, among its pop-culture coverage, the ''Journal'' reported on the 25th anniversary of the premiere of the long-running NBC talk program ''The Tonight Show''. Like the first installment, the second one was produced by WNET in New York City, and was aired on PBS. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

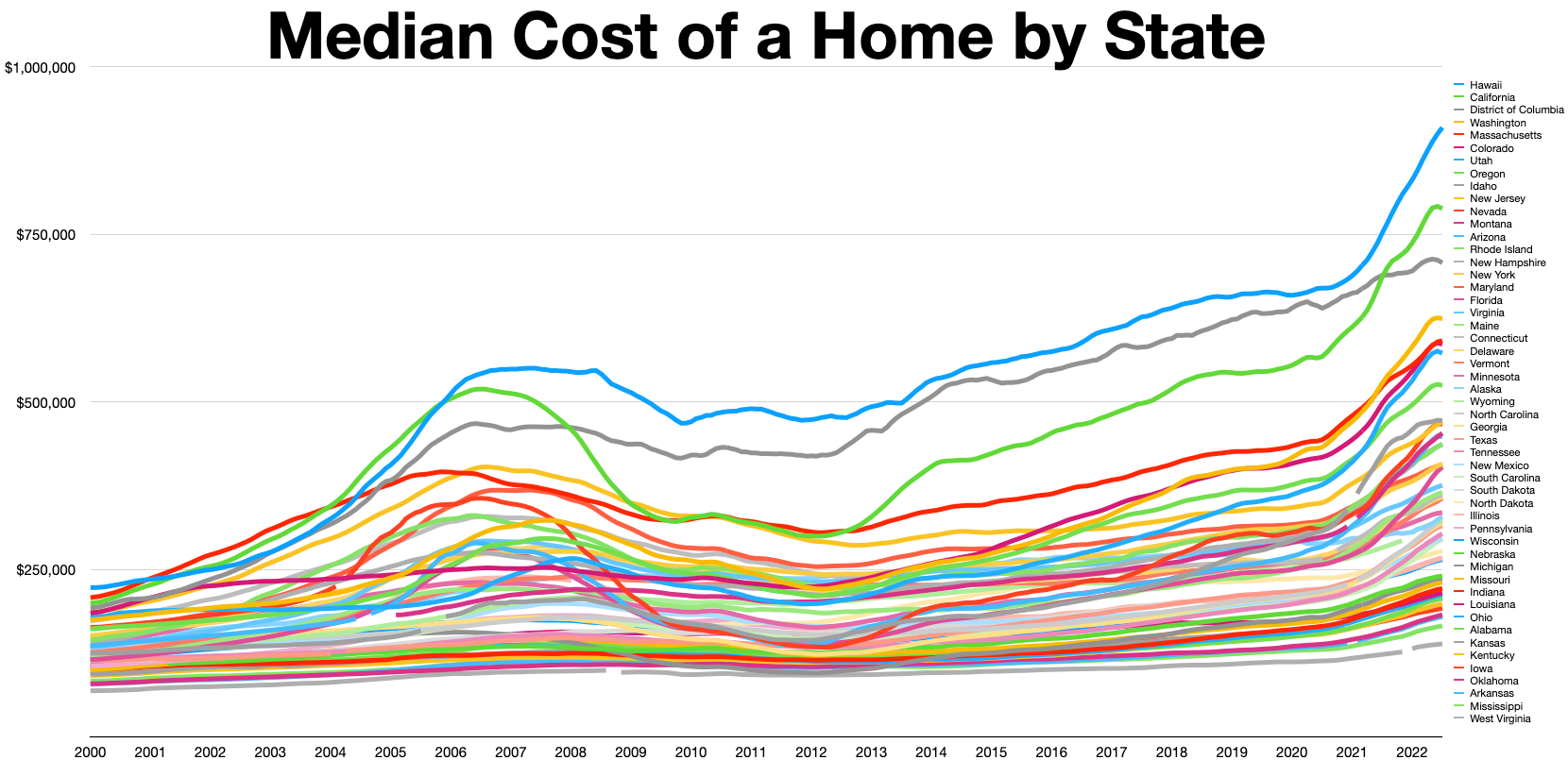

United States Housing Bubble

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States. Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, Henry Paulson, the U.S. Secretary of the Treasury, called the bursting housing bubble "the most significant risk to our economy". Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but mortgage markets, home buil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Crisis Diagram - X1

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time. These loans are characterized by higher interest rates, poor quality collateral, and less favorable terms in order to compensate for higher credit risk. Many subprime loans were packaged into mortgage-backed securities (MBS) and ultimately defaulted, contributing to the financial crisis of 2007–2008.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). Defining subprime risk The term ''subprime'' refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. As people become economically active, records are cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lending & Borrowing Decisions - 10 19 08

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)