Startup Capital on:

[Wikipedia]

[Google]

[Amazon]

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for  The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the Series A round. Venture capitalists provide this financing in the interest of generating a return through an eventual "exit" event, such as the company selling shares to the public for the first time in an initial public offering (IPO), or disposal of shares happening via a merger, via a sale to another entity such as a financial buyer in the

The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the Series A round. Venture capitalists provide this financing in the interest of generating a return through an eventual "exit" event, such as the company selling shares to the public for the first time in an initial public offering (IPO), or disposal of shares happening via a merger, via a sale to another entity such as a financial buyer in the

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S. Small Business Administration (SBA) to license private "Small Business Investment Companies" (SBICs) to help the financing and management of the small entrepreneurial businesses in the United States. The Small Business Investment Act of 1958 provided tax breaks that helped contribute to the rise of private-equity firms.

During the 1950s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction. It was a business that was growing very rapidly, and as the business grew, the transactions grew exponentially.

During the 1960s and 1970s, venture capital firms focused their investment activity primarily on starting and expanding companies. More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in 1962 by William Henry Draper III and Franklin P. Johnson, Jr. In 1965, Sutter Hill Ventures acquired the portfolio of Draper and Johnson as a founding action. Bill Draper and Paul Wythes were the founders, and Pitch Johnson formed Asset Management Company at that time.

It was also in the 1960s that the common form of private-equity fund, still in use today, emerged. Private-equity firms organized

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S. Small Business Administration (SBA) to license private "Small Business Investment Companies" (SBICs) to help the financing and management of the small entrepreneurial businesses in the United States. The Small Business Investment Act of 1958 provided tax breaks that helped contribute to the rise of private-equity firms.

During the 1950s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction. It was a business that was growing very rapidly, and as the business grew, the transactions grew exponentially.

During the 1960s and 1970s, venture capital firms focused their investment activity primarily on starting and expanding companies. More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in 1962 by William Henry Draper III and Franklin P. Johnson, Jr. In 1965, Sutter Hill Ventures acquired the portfolio of Draper and Johnson as a founding action. Bill Draper and Paul Wythes were the founders, and Pitch Johnson formed Asset Management Company at that time.

It was also in the 1960s that the common form of private-equity fund, still in use today, emerged. Private-equity firms organized

Venture Capital Loses Its Vigor

" New York Times, October 8, 1989. The growth of the industry was hampered by sharply declining returns, and certain venture firms began posting losses for the first time. In addition to the increased competition among firms, several other factors affected returns. The market for initial public offerings cooled in the mid-1980s before collapsing after the stock market crash in 1987, and foreign corporations, particularly from

. This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirements, which cannot be financed by cheaper alternatives such as debt. That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fast-growing technology and

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to

report by the National Venture Capital Association

The same numbers for all of 2010 were $23.4 billion in 3,496 deals. According to a report by Dow Jones VentureSource, venture capital funding fell to $6.4 billion in the US in the first quarter of 2013, an 11.8% drop from the first quarter of 2012, and a 20.8% decline from 2011. Venture firms have added $4.2 billion into their funds this year, down from $6.3 billion in the first quarter of 2013, but up from $2.6 billion in the fourth quarter of 2012.

H1 2019 MENA Venture Investment Report

' by MAGNiTT, 238 startup investment deals have taken place in the region in the first half of 2019, totaling in $471 million in investments. Compared to 2018’s H1 report, this represents an increase of 66% in total funding and 28% in number of deals. According to the report, the United Arab Emirates, UAE is the most active ecosystem in the region with 26% of the deals made in H1, followed by Egypt at 21%, and Lebanon at 13%. In terms of deals by sector, fintech remains the most active industry with 17% of the deals made, followed by e-commerce at 12%, and delivery and transport at 8%. The report also notes that a total of 130 institutions invested in MENA-based startups in H1 2019, 30% of which were headquartered outside the MENA, demonstrating international appetite for investments in the region. 15 startup exits have been recorded in H1 2019, with Careem’s $3.1 billion acquisition by Uber being the first unicorn exit in the region. Other notable exits include Souq.com exit to Amazon (company), Amazon in 2017 for $650 million.

Venture Capital's Role in Financing Innovation: What We Know and How Much We Still Need to Learn

" Journal of Economic Perspectives, 34 (3): 237-61.

equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend t ...

in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology

Clean technology, in short cleantech, is any process, product, or service that reduces negative environmental impacts through significant energy efficiency improvements, the sustainable use of resources, or environmental protection activities. Cle ...

or biotechnology.

The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the Series A round. Venture capitalists provide this financing in the interest of generating a return through an eventual "exit" event, such as the company selling shares to the public for the first time in an initial public offering (IPO), or disposal of shares happening via a merger, via a sale to another entity such as a financial buyer in the

The typical venture capital investment occurs after an initial " seed funding" round. The first round of institutional venture capital to fund growth is called the Series A round. Venture capitalists provide this financing in the interest of generating a return through an eventual "exit" event, such as the company selling shares to the public for the first time in an initial public offering (IPO), or disposal of shares happening via a merger, via a sale to another entity such as a financial buyer in the private equity secondary market

In finance, the private-equity secondary market (also often called private-equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private-equity and other alternative investment funds. Given t ...

or via a sale to a trading company such as a competitor.

In addition to angel investing, equity crowdfunding and other seed funding options, venture capital is attractive for new companies with limited operating history that are too small to raise capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used f ...

in the public market

A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions, livestock, and other goods. In different parts of the world, a marketplace may be described as a '' souk'' (from the Arabic), ' ...

s and have not reached the point where they are able to secure a bank loan or complete a debt offering. In exchange for the high risk that venture capitalists assume by investing in smaller and early-stage companies, venture capitalists usually get significant control over company decisions, in addition to a significant portion of the companies' ownership (and consequently value). Start-ups like Uber, Airbnb, Flipkart, Xiaomi & Didi Chuxing are highly valued startups, commonly known as Unicorns where venture capitalists contribute more than financing to these early-stage firms; they also often provide strategic advice to the firm's executives on its business model and marketing strategies.

Venture capital is also a way in which the private

Private or privates may refer to:

Music

* " In Private", by Dusty Springfield from the 1990 album ''Reputation''

* Private (band), a Denmark-based band

* "Private" (Ryōko Hirosue song), from the 1999 album ''Private'', written and also recorde ...

and public sectors can construct an institution that systematically creates business networks for the new firms and industries so that they can progress and develop. This institution helps identify promising new firms and provide them with finance, technical expertise, mentoring, talent acquisition, strategic partnership, marketing "know-how", and business models. Once integrated into the business network, these firms are more likely to succeed, as they become "nodes" in the search networks for designing and building products in their domain. However, venture capitalists' decisions are often biased, exhibiting for instance overconfidence and illusion of control, much like entrepreneurial decisions in general.

History

Origins of modern venture capital

Before World War II (1939–1945) venture capital was primarily the domain of wealthy individuals and families.J.P. Morgan

JP may refer to:

Arts and media

* ''JP'' (album), 2001, by American singer Jesse Powell

* ''Jp'' (magazine), an American Jeep magazine

* ''Jönköpings-Posten'', a Swedish newspaper

* Judas Priest, an English heavy metal band

* ''Jurassic Park ...

, the Wallenbergs, the Vanderbilts, the Whitneys, the Rockefellers, and the Warburgs were notable investors in private companies. In 1938, Laurance S. Rockefeller

Laurance Spelman Rockefeller (May 26, 1910 – July 11, 2004) was an American businessman, financier, philanthropist, and conservationist. Rockefeller was the third son and fourth child of John D. Rockefeller Jr. and Abby Aldrich Rockefeller. As ...

helped finance the creation of both Eastern Air Lines

Eastern Air Lines, also colloquially known as Eastern, was a major United States airline from 1926 to 1991. Before its dissolution, it was headquartered at Miami International Airport in an unincorporated area of Miami-Dade County, Florida.

Ea ...

and Douglas Aircraft, and the Rockefeller family had vast holdings in a variety of companies. Eric M. Warburg

Erich Moritz Warburg (15 April 1900 – 9 July 1990) was a German and American businessman and a member of the prominent Warburg family of German-Jewish bankers.

Early life and education

Warburg was born to a Jewish family in Hamburg, Germany on ...

founded E.M. Warburg & Co. in 1938, which would ultimately become Warburg Pincus, with investments in both leveraged buyouts and venture capital. The Wallenberg family started Investor AB in 1916 in Sweden and were early investors in several Swedish companies such as ABB, Atlas Copco, and Ericsson in the first half of the 20th century.

Only after 1945 did "true" venture capital investment firms begin to emerge, notably with the founding of American Research and Development Corporation (ARDC) and J.H. Whitney & Company in 1946.

Georges Doriot, the "father of venture capitalism", along with Ralph Flanders and Karl Compton

Karl Taylor Compton (September 14, 1887 – June 22, 1954) was a prominent American physicist and president of the Massachusetts Institute of Technology (MIT) from 1930 to 1948.

The early years (1887–1912)

Karl Taylor Compton was born in ...

(former president of MIT) founded ARDC in 1946 to encourage private-sector investment in businesses run by soldiers returning from World War II. ARDC became the first institutional private-equity investment firm to raise capital from sources other than wealthy families. Unlike most present-day venture capital firms, ARDC was a publicly-traded company. ARDC's most successful investment was its 1957 funding of Digital Equipment Corporation (DEC), which would later be valued at more than $355 million after its initial public offering in 1968. This represented a return of over 1200 times its investment and an annualized rate of return of 101% to ARDC.

Former employees of ARDC went on to establish several prominent venture capital firms including Greylock Partners, founded in 1965 by Charlie Waite and Bill Elfers; Morgan, Holland Ventures, the predecessor of Flagship Ventures, founded in 1982 by James Morgan; Fidelity Ventures, now Volition Capital, founded in 1969 by Henry Hoagland; and Charles River Ventures, founded in 1970 by Richard Burnes. ARDC continued investing until 1971, when Doriot retired. In 1972 Doriot merged ARDC with Textron after having invested in over 150 companies.

John Hay Whitney (1904–1982) and his partner Benno Schmidt (1913–1999) founded J.H. Whitney & Company in 1946. Whitney had been investing since the 1930s, founding Pioneer Pictures in 1933 and acquiring a 15% interest in Technicolor Corporation

Technicolor is a series of color motion picture processes, the first version dating back to 1916, and followed by improved versions over several decades.

Definitive Technicolor movies using three black and white films running through a special ...

with his cousin Cornelius Vanderbilt Whitney. Florida Foods Corporation proved Whitney's most famous investment. The company developed an innovative method for delivering nutrition to American soldiers, later known as Minute Maid

Minute Maid is a product line of beverages, usually associated with lemonade or orange juice, but which now extends to soft drinks of different kinds, including Hi-C. Minute Maid is sold under the Cappy brand in Central Europe and under the bran ...

orange juice and was sold to The Coca-Cola Company in 1960. J.H. Whitney & Company continued to make investments in leveraged buyout transactions and raised $750 million for its sixth institutional private-equity fund in 2005.

Early venture capital and the growth of Silicon Valley

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S. Small Business Administration (SBA) to license private "Small Business Investment Companies" (SBICs) to help the financing and management of the small entrepreneurial businesses in the United States. The Small Business Investment Act of 1958 provided tax breaks that helped contribute to the rise of private-equity firms.

During the 1950s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction. It was a business that was growing very rapidly, and as the business grew, the transactions grew exponentially.

During the 1960s and 1970s, venture capital firms focused their investment activity primarily on starting and expanding companies. More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in 1962 by William Henry Draper III and Franklin P. Johnson, Jr. In 1965, Sutter Hill Ventures acquired the portfolio of Draper and Johnson as a founding action. Bill Draper and Paul Wythes were the founders, and Pitch Johnson formed Asset Management Company at that time.

It was also in the 1960s that the common form of private-equity fund, still in use today, emerged. Private-equity firms organized

One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of 1958. The 1958 Act officially allowed the U.S. Small Business Administration (SBA) to license private "Small Business Investment Companies" (SBICs) to help the financing and management of the small entrepreneurial businesses in the United States. The Small Business Investment Act of 1958 provided tax breaks that helped contribute to the rise of private-equity firms.

During the 1950s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction. It was a business that was growing very rapidly, and as the business grew, the transactions grew exponentially.

During the 1960s and 1970s, venture capital firms focused their investment activity primarily on starting and expanding companies. More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in 1962 by William Henry Draper III and Franklin P. Johnson, Jr. In 1965, Sutter Hill Ventures acquired the portfolio of Draper and Johnson as a founding action. Bill Draper and Paul Wythes were the founders, and Pitch Johnson formed Asset Management Company at that time.

It was also in the 1960s that the common form of private-equity fund, still in use today, emerged. Private-equity firms organized limited partnership

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited ...

s to hold investments in which the investment professionals served as general partner and the investors, who were passive limited partners, put up the capital. The compensation structure, still in use today, also emerged with limited partners paying an annual management fee of 1.0–2.5% and a carried interest typically representing up to 20% of the profits of the partnership.

The growth of the venture capital industry was fueled by the emergence of the independent investment firms on Sand Hill Road, beginning with Kleiner Perkins

Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB), is an American venture capital firm which specializes in investing in incubation, early stage and growth companies. Since its founding in 1972, the firm has backed entrepreneurs ...

and Sequoia Capital

Sequoia Capital is an American venture capital firm. The firm is headquartered in Menlo Park, California, and specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. , Sequoia's total a ...

in 1972. Located in Menlo Park, CA

Menlo Park is a city at the eastern edge of San Mateo County within the San Francisco Bay Area of California in the United States. It is bordered by San Francisco Bay on the north and east; East Palo Alto, Palo Alto, and Stanford to the south ...

, Kleiner Perkins, Sequoia and later venture capital firms would have access to the many semiconductor companies based in the Santa Clara Valley as well as early computer

A computer is a machine that can be programmed to Execution (computing), carry out sequences of arithmetic or logical operations (computation) automatically. Modern digital electronic computers can perform generic sets of operations known as C ...

firms using their devices and programming and service companies.

Throughout the 1970s, a group of private-equity firms, focused primarily on venture capital investments, would be founded that would become the model for later leveraged buyout and venture capital investment firms. In 1973, with the number of new venture capital firms increasing, leading venture capitalists formed the National Venture Capital Association (NVCA). The NVCA was to serve as the industry trade group for the venture capital industry. Venture capital firms suffered a temporary downturn in 1974, when the stock market crashed and investors were naturally wary of this new kind of investment fund.

It was not until 1978 that venture capital experienced its first major fundraising year, as the industry raised approximately $750 million. With the passage of the Employee Retirement Income Security Act (ERISA) in 1974, corporate pension funds were prohibited from holding certain risky investments including many investments in privately held

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is ...

companies. In 1978, the US Labor Department relaxed certain restrictions of the ERISA, under the " prudent man rule", thus allowing corporate pension funds to invest in the asset class and providing a major source of capital available to venture capitalists.

1980s

The public successes of the venture capital industry in the 1970s and early 1980s (e.g., Digital Equipment Corporation, Apple Inc.,Genentech

Genentech, Inc., is an American biotechnology corporation headquartered in South San Francisco, California. It became an independent subsidiary of Roche in 2009. Genentech Research and Early Development operates as an independent center within R ...

) gave rise to a major proliferation of venture capital investment firms. From just a few dozen firms at the start of the decade, there were over 650 firms by the end of the 1980s, each searching for the next major "home run". The number of firms multiplied, and the capital managed by these firms increased from $3 billion to $31 billion over the course of the decade.POLLACK, ANDREW. Venture Capital Loses Its Vigor

" New York Times, October 8, 1989. The growth of the industry was hampered by sharply declining returns, and certain venture firms began posting losses for the first time. In addition to the increased competition among firms, several other factors affected returns. The market for initial public offerings cooled in the mid-1980s before collapsing after the stock market crash in 1987, and foreign corporations, particularly from

Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north ...

and Korea, flooded early-stage companies with capital.

In response to the changing conditions, corporations that had sponsored in-house venture investment arms, including General Electric and Paine Webber either sold off or closed these venture capital units. Additionally, venture capital units within Chemical Bank

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

Beginning ...

and Continental Illinois National Bank

The Continental Illinois National Bank and Trust Company was at one time the seventh-largest commercial bank in the United States as measured by deposits, with approximately $40 billion in assets. In 1984, Continental Illinois became the largest ...

, among others, began shifting their focus from funding early stage companies toward investments in more mature companies. Even industry founders J.H. Whitney & Company and Warburg Pincus began to transition toward leveraged buyouts and growth capital investments.

Venture capital boom and the Internet Bubble

By the end of the 1980s, venture capital returns were relatively low, particularly in comparison with their emerging leveraged buyout cousins, due in part to the competition for hot startups, excess supply of IPOs and the inexperience of many venture capital fund managers. Growth in the venture capital industry remained limited throughout the 1980s and the first half of the 1990s, increasing from $3 billion in 1983 to just over $4 billion more than a decade later in 1994. The advent of the World Wide Web in the early 1990s reinvigorated venture capital as investors saw companies with huge potential being formed.Netscape

Netscape Communications Corporation (originally Mosaic Communications Corporation) was an American independent computer services company with headquarters in Mountain View, California and then Dulles, Virginia. Its Netscape web browser was onc ...

and Amazon (company)

Amazon.com, Inc. ( ) is an American multinational technology company focusing on e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. It has been referred to as "one of the most influential economi ...

were founded in 1994, and Yahoo! in 1995. All were funded by venture capital. Internet IPOs—AOL in 1992; Netcom in 1994; UUNet, Spyglass and Netscape in 1995; Lycos, Excite, Yahoo!, CompuServe, Infoseek, C/NET, and E*Trade in 1996; and Amazon, ONSALE, Go2Net, N2K, NextLink, and SportsLine in 1997—generated enormous returns for their venture capital investors. These returns, and the performance of the companies post-IPO, caused a rush of money into venture capital, increasing the number of venture capital funds raised from about 40 in 1991 to more than 400 in 2000, and the amount of money committed to the sector from $1.5 billion in 1991 to more than $90 billion in 2000.

The bursting of the Dot-com bubble in 2000 caused many venture capital firms to fail and financial results in the sector to decline.

Private equity crash

TheNasdaq

The Nasdaq Stock Market () (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second ...

crash and technology slump that started in March 2000 shook virtually the entire venture capital industry as valuations for startup technology companies collapsed. Over the next two years, many venture firms had been forced to write-off large proportions of their investments, and many funds were significantly "under water

The underwater environment is the region below the surface of, and immersed in, liquid water in a natural or artificial feature (called a body of water), such as an ocean, sea, lake, pond, reservoir, river, canal, or aquifer. Some characterist ...

" (the values of the fund's investments were below the amount of capital invested). Venture capital investors sought to reduce the size of commitments they had made to venture capital funds, and, in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the s ...

. By mid-2003, the venture capital industry had shriveled to about half its 2001 capacity. Nevertheless, PricewaterhouseCoopers' MoneyTree Survey shows that total venture capital investments held steady at 2003 levels through the second quarter of 2005.

Although the post-boom years represent just a small fraction of the peak levels of venture investment reached in 2000, they still represent an increase over the levels of investment from 1980 through 1995. As a percentage of GDP, venture investment was 0.058% in 1994, peaked at 1.087% (nearly 19 times the 1994 level) in 2000 and ranged from 0.164% to 0.182% in 2003 and 2004. The revival of an Internet-driven environment in 2004 through 2007 helped to revive the venture capital environment. However, as a percentage of the overall private-equity market, venture capital has still not reached its mid-1990s level, let alone its peak in 2000.

Venture capital funds, which were responsible for much of the fundraising volume in 2000 (the height of the dot-com bubble), raised only $25.1 billion in 2006, a 2% decline from 2005 and a significant decline from its peak. The decline continued till their fortunes started to turn around in 2010 with $21.8 billion invested (not raised). The industry continued to show phenomenal growth and in 2020 hit $80 billion in fresh capital.

Financing

Obtaining venture capital is substantially different from raising debt or a loan. Lenders have a legal right to interest on a loan and repayment of the capital irrespective of the success or failure of a business. Venture capital is invested in exchange for an equity stake in the business. The return of the venture capitalist as a shareholder depends on the growth and profitability of the business. This return is generally earned when the venture capitalist "exits" by selling its shareholdings when the business is sold to another owner. Venture capitalists are typically very selective in deciding what to invest in, with a Stanford survey of venture capitalists revealing that 100 companies were considered for every company receiving financing. Ventures receiving financing must demonstrate an excellent management team, a large potential market, and most importantly high growth potential, as only such opportunities are likely capable of providing financial returns and a successful exit within the required time frame (typically 3–7 years) that venture capitalists expect. Because investments are illiquid and require the extended time frame to harvest, venture capitalists are expected to carry out detaileddue diligence

Due diligence is the investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

It can be a l ...

prior to investment. Venture capitalists also are expected to nurture the companies in which they invest, in order to increase the likelihood of reaching an IPO stage when valuations

Valuation may refer to:

Economics

*Valuation (finance), the determination of the economic value of an asset or liability

**Real estate appraisal, sometimes called ''property valuation'' (especially in British English), the appraisal of land or bui ...

are favourable. Venture capitalists typically assist at four stages in the company's development:

* Idea generation;

* Start-up

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend t ...

;

* Ramp-up; and

* Exit

Because there are no public exchanges listing their securities, private companies meet venture capital firms and other private-equity investors in several ways, including warm referrals from the investors' trusted sources and other business contacts; investor conferences and symposia; and summits where companies pitch directly to investor groups in face-to-face meetings, including a variant known as "Speed Venturing", which is akin to speed-dating for capital, where the investor decides within 10 minutes whether he wants a follow-up meeting. In addition, some new private online networks are emerging to provide additional opportunities for meeting investors.Cash-strapped entrepreneurs get creative, BBC News. This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirements, which cannot be financed by cheaper alternatives such as debt. That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fast-growing technology and

life sciences

This list of life sciences comprises the branches of science that involve the scientific study of life – such as microorganisms, plants, and animals including human beings. This science is one of the two major branches of natural science, the ...

or biotechnology fields.

If a company does have the qualities venture capitalists seek including a solid business plan, a good management team, investment and passion from the founders, a good potential to exit the investment before the end of their funding cycle, and target minimum returns in excess of 40% per year, it will find it easier to raise venture capital.

Financing stages

There are typically six stages of venture round financing offered in venture capital, that roughly correspond to these stages of a company's development. * Seed funding: The earliest round of financing needed to prove a new idea, often provided byangel investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or owners ...

s. Equity crowdfunding is also emerging as an option for seed funding.

* Start-up: Early stage firms that need funding for expenses associated with marketing and product development.

* Growth ( Series A round): Early sales and manufacturing funds. This is typically where VCs come in. Series A can be thought of as the first institutional round. Subsequent investment rounds are called Series B, Series C and so on. This is where most companies will have the most growth.

* Second round: Working capital for early stage companies that are selling product, but not yet turning a profit. This can also be called Series B round and so on.

* Expansion: Also called mezzanine financing, this is expansion money for a newly profitable company.

* Exit of venture capitalist: VCs can exit through secondary sale or an IPO or an acquisition. Early stage VCs may exit in later rounds when new investors (VCs or private-equity investors) buy the shares of existing investors. Sometimes a company very close to an IPO may allow some VCs to exit and instead new investors may come in hoping to profit from the IPO.

* Bridge financing is when a startup seeks funding in between full VC rounds. The objective is to raise a smaller amount of money to "bridge" the gap when current funds are expected to run out prior to planned future funding, intended to meet short-term working capital needs.

Between the first round and the fourth round, venture-backed companies may also seek to take venture debt.

Firms and funds

Venture capitalist

A venture capitalist or sometimes simply capitalist, is a person who makes capital investments in companies in exchange for an equity stake. The venture capitalist is often expected to bring managerial and technical expertise, as well as capital, to their investments. A venture capital fund refers to apooled investment

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages inc ...

vehicle (in the United States, often an LP or LLC

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a ...

) that primarily invests the financial capital of third-party investors in enterprises that are too risky for the standard capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers t ...

s or bank loans

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

. These funds are typically managed by a venture capital firm, which often employs individuals with technology backgrounds (scientists, researchers), business training and/or deep industry experience.

A core skill within VC is the ability to identify novel or disruptive technologies that have the potential to generate high commercial returns at an early stage. By definition, VCs also take a role in managing entrepreneurial companies at an early stage, thus adding skills as well as capital, thereby differentiating VC from buy-out private equity, which typically invest in companies with proven revenue, and thereby potentially realizing much higher rates of returns. Inherent in realizing abnormally high rates of returns is the risk of losing all of one's investment in a given startup company. As a consequence, most venture capital investments are done in a pool format, where several investors combine their investments into one large fund that invests in many different startup companies. By investing in the pool format, the investors are spreading out their risk to many different investments instead of taking the chance of putting all of their money in one start up firm.

Structure

Venture capital firms are typically structured as partnerships, thegeneral partners

A general partnership, the basic form of partnership under common law, is in most countries an association of persons or an unincorporated company with the following major features:

*Must be created by agreement, proof of existence and estoppel. ...

of which serve as the managers of the firm and will serve as investment advisors to the venture capital funds raised. Venture capital firms in the United States may also be structured as limited liability companies, in which case the firm's managers are known as managing members. Investors in venture capital funds are known as limited partner

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited p ...

s. This constituency comprises both high-net-worth individuals and institutions with large amounts of available capital, such as state and private pension fund

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.

Pension funds typically have large amounts of money to invest and are the major investors in listed and priva ...

s, university financial endowment

A financial endowment is a legal structure for managing, and in many cases indefinitely perpetuating, a pool of financial, real estate, or other investments for a specific purpose according to the will of its founders and donors. Endowments are o ...

s, foundations, insurance companies, and pooled investment

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages inc ...

vehicles, called funds of funds

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A ...

.

Types

Venture capitalist firms differ in their motivations and approaches. There are multiple factors, and each firm is different. Venture capital funds are generally three in types: * 1. Angel investors * 2. Financial VCs * 3. Strategic VCs Some of the factors that influence VC decisions include: * Business situation: Some VCs tend to invest in new, disruptive ideas, or fledgling companies. Others prefer investing in established companies that need support to go public or grow. * Some invest solely in certain industries. * Some prefer operating locally while others will operate nationwide or even globally. * VC expectations can often vary. Some may want a quicker public sale of the company or expect fast growth. The amount of help a VC provides can vary from one firm to the next. There are also estimates on how big of an exit a VC will expect for your company (i.e. if the size of the VC fund is $20M, estimate that they'll at least want you to exit for the size of the fund.Roles

Within the venture capital industry, the general partners and other investment professionals of the venture capital firm are often referred to as "venture capitalists" or "VCs". Typical career backgrounds vary, but, broadly speaking, venture capitalists come from either an operational or a finance background. Venture capitalists with an operational background (operating partner An operating partner is a title used by venture capital (VC) and private equity (PE) firms to describe a role dedicated to working with privately held companies to increase value. The role was created by large-capitalization private equity groups wh ...

) tend to be former founders or executives of companies similar to those which the partnership finances or will have served as management consultants. Venture capitalists with finance backgrounds tend to have investment banking

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated wit ...

or other corporate finance

Corporate finance is the area of finance that deals with the sources of funding, the capital structure of corporations, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and anal ...

experience.

Although the titles are not entirely uniform from firm to firm, other positions at venture capital firms include:

Structure of the funds

Mostventure capital funds

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which hav ...

have a fixed life of 10 years, with the possibility of a few years of extensions to allow for private companies still seeking liquidity. The investing cycle for most funds is generally three to five years, after which the focus is managing and making follow-on investments in an existing portfolio. This model was pioneered by successful funds in Silicon Valley through the 1980s to invest in technological trends broadly but only during their period of ascendance, and to cut exposure to management and marketing risks of any individual firm or its product.

In such a fund, the investors have a fixed commitment to the fund that is initially unfunded and subsequently "called down" by the venture capital fund over time as the fund makes its investments. There are substantial penalties for a limited partner (or investor) that fails to participate in a capital call.

It can take anywhere from a month to several years for venture capitalists to raise money from limited partners for their fund. At the time when all of the money has been raised, the fund is said to be closed and the 10-year lifetime begins. Some funds have partial closes when one half (or some other amount) of the fund has been raised. The vintage year generally refers to the year in which the fund was closed and may serve as a means to stratify VC funds for comparison.

From an investor's point of view, funds can be: (1) traditional—where all the investors invest with equal terms; or (2) asymmetric

Asymmetric may refer to:

*Asymmetry in geometry, chemistry, and physics

Computing

* Asymmetric cryptography, in public-key cryptography

*Asymmetric digital subscriber line, Internet connectivity

* Asymmetric multiprocessing, in computer architect ...

—where different investors have different terms. Typically asymmetry is seen in cases where investors have opposing interests, such as the need to not have unrelated business taxable income in the case of public tax-exempt investors.

Investment Decision Process

The decision process to fund a company is elusive. One study report in the Harvard Business Review states that VCs rarely use standard financial analytics. First, VCs engage in a process known as "generating deal flow," where they reach out to their network to source potential investments. The study also reported that few VCs use any type of financial analytics when they assess deals; VCs are primarily concerned about the cash returned from the deal as a multiple of the cash invested. According to 95% of the VC firms surveyed, VCs cite the founder or founding team as the most important factor in their investment decision. Other factors are also considered, including intellectual property rights and the state of the economy. Some argue that the most important thing a VC looks for in a company is high-growth. The funding decision process has spawned bias in the form of a large disparity between the funding men and minority groups, such as women and people of color. In 2021, female founders only received 2% of VC funding in the United States. Some research studies have found that VCs evaluate women differently and are less likely to fund female founders.Compensation

Venture capitalists are compensated through a combination of management fees and carried interest (often referred to as a "two and 20" arrangement): Because a fund may run out of capital prior to the end of its life, larger venture capital firms usually have several overlapping funds at the same time; doing so lets the larger firm keep specialists in all stages of the development of firms almost constantly engaged. Smaller firms tend to thrive or fail with their initial industry contacts; by the time the fund cashes out, an entirely new generation of technologies and people is ascending, whom the general partners may not know well, and so it is prudent to reassess and shift industries or personnel rather than attempt to simply invest more in the industry or people the partners already know.Alternatives

Because of the strict requirements venture capitalists have for potential investments, many entrepreneurs seek seed funding fromangel investors

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or owners ...

, who may be more willing to invest in highly speculative opportunities, or may have a prior relationship with the entrepreneur. Additionally, entrepreneurs may seek alternative financing, such as revenue-based financing, to avoid giving up equity ownership in the business. For entrepreneurs seeking more than just funding, startup studios can be an appealing alternative to venture capitalists, as they provide operational support and an experienced team.

Furthermore, many venture capital firms will only seriously evaluate an investment in a start-up company otherwise unknown to them if the company can prove at least some of its claims about the technology and/or market potential for its product or services. To achieve this, or even just to avoid the dilutive effects of receiving funding before such claims are proven, many start-ups seek to self-finance sweat equity until they reach a point where they can credibly approach outside capital providers such as venture capitalists or angel investors

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or owners ...

. This practice is called " bootstrapping".

Equity crowdfunding is emerging as an alternative to traditional venture capital. Traditional crowdfunding

Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet. Crowdfunding is a form of crowdsourcing and alternative finance. In 2015, over was raised worldwide by crow ...

is an approach to raising the capital required for a new project or enterprise by appealing to large numbers of ordinary people for small donations. While such an approach has long precedents in the sphere of charity, it is receiving renewed attention from entrepreneurs, now that social media and online communities make it possible to reach out to a group of potentially interested supporters at very low cost. Some equity crowdfunding models are also being applied specifically for startup funding, such as those listed at Comparison of crowd funding services. One of the reasons to look for alternatives to venture capital is the problem of the traditional VC model. The traditional VCs are shifting their focus to later-stage investments, and return on investment of many VC funds have been low or negative.

In Europe and India, Media for equity Media for equity is a financing option that provides start-up companies with advertising such as television, print, radio, and online, in exchange for equity.

The idea is to help the start-up companies increase their metrics in a very short period ...

is a partial alternative to venture capital funding. Media for equity investors are able to supply start-ups with often significant advertising campaigns in return for equity. In Europe, an investment advisory firm offers young ventures the option to exchange equity for services investment; their aim is to guide ventures through the development stage to arrive at a significant funding, mergers and acquisition, or other exit strategy.

In industries where assets can be securitized

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling ...

effectively because they reliably generate future revenue streams or have a good potential for resale in case of foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mortg ...

, businesses may more cheaply be able to raise debt to finance their growth. Good examples would include asset-intensive extractive industries such as mining, or manufacturing industries. Offshore funding is provided via specialist venture capital trusts, which seek to use securitization in structuring hybrid multi-market transactions via an SPV (special purpose vehicle

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

): a corporate entity that is designed solely for the purpose of the financing.

In addition to traditional venture capital and angel networks, groups have emerged, which allow groups of small investors or entrepreneurs themselves to compete in a privatized business plan competition where the group itself serves as the investor through a democratic process.

Law firms are also increasingly acting as an intermediary between clients seeking venture capital and the firms providing it.

Other forms include venture resources that seek to provide non-monetary support to launch a new venture.

Role in employment

Every year, there are nearly 2 million businesses created in the US, but only 600–800 get venture capital funding. According to the National Venture Capital Association, 11% of private sector jobs come from venture-backed companies and venture-backed revenue accounts for 21% of US GDP.Gender disparities

In 2020 female founded companies raised only 2.8% of capital investment from venture capital, the highest amount recorded.Babson College

Babson College is a private business school in Wellesley, Massachusetts. Established in 1919, its central focus is on entrepreneurship education. It was founded by Roger W. Babson as an all-male business institute, but became coeducational i ...

's Diana Report found that the number of women partners in VC firms decreased from 10% in 1999 to 6% in 2014. The report also found that 97% of VC-funded businesses had male chief executives, and that businesses with all-male teams were more than four times as likely to receive VC funding compared to teams with at least one woman.

Currently, about 3 percent of all venture capital is going to woman-led companies. More than 75% of VC firms in the US did not have any female venture capitalists at the time they were surveyed. It was found that a greater fraction of VC firms had never had a woman represent them on the board of one of their portfolio companies A portfolio company is a company or entity in which a venture capital firm, a startup studio, or a holding company invests. All companies currently backed by a private equity firm can be spoken of as the firm's portfolio.

A company may create ...

. In 2017 only 2.2% of all VC funding went to female founders.

For comparison, a UC Davis study focusing on large public companies in California found 49.5% with at least one female board seat. When the latter results were published, some '' San Jose Mercury News'' readers dismissed the possibility that sexism was a cause. In a follow-up '' Newsweek'' article, Nina Burleigh asked "Where were all these offended people when women like Heidi Roizen

Heidi Roizen (born 1958) is a Silicon Valley executive, venture capitalist, and entrepreneur.

She is known for speaking out against the Sexism in the technology industry, harassment of women in technology, having herself received harassment in th ...

published accounts of having a venture capitalist stick her hand in his pants under a table while a deal was being discussed?"

Geographical differences

Venture capital, as an industry, originated in the United States, and American firms have traditionally been the largest participants in venture deals with the bulk of venture capital being deployed in American companies. However, increasingly, non-US venture investment is growing, and the number and size of non-US venture capitalists have been expanding. Venture capital has been used as a tool for economic development in a variety of developing regions. In many of these regions, with less developed financial sectors, venture capital plays a role in facilitating access to finance forsmall and medium enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by international organizations such as the World Bank ...

(SMEs), which in most cases would not qualify for receiving bank loans.

In the year of 2008, while VC funding were still majorly dominated by U.S. money ($28.8 billion invested in over 2550 deals in 2008), compared to international fund investments ($13.4 billion invested elsewhere), there has been an average 5% growth in the venture capital deals outside the US, mainly in China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

and Europe. Geographical differences can be significant. For instance, in the UK, 4% of British investment goes to venture capital, compared to about 33% in the U.S.

VC funding has been shown to be positively related to a country's individualistic culture. According to economist Jeffrey Funk

Jeffrey may refer to:

* Jeffrey (name), including a list of people with the name

* ''Jeffrey'' (1995 film), a 1995 film by Paul Rudnick, based on Rudnick's play of the same name

* ''Jeffrey'' (2016 film), a 2016 Dominican Republic documentary film

...

however more than 90% of US startups valued over $1 billion lost money between 2019–2020 and return on investment from VC barely exceed return from public stock markets over the last 25 years.

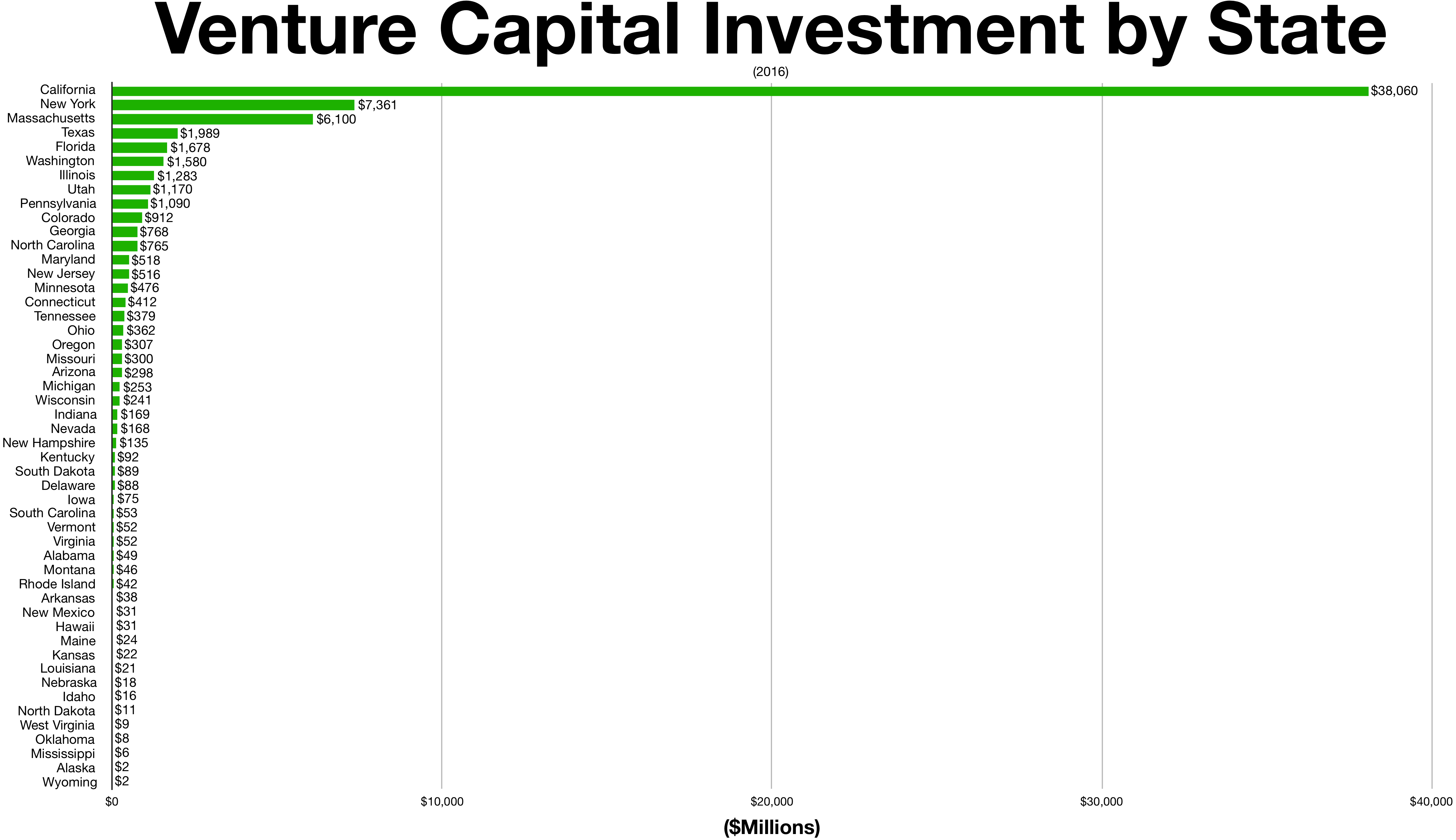

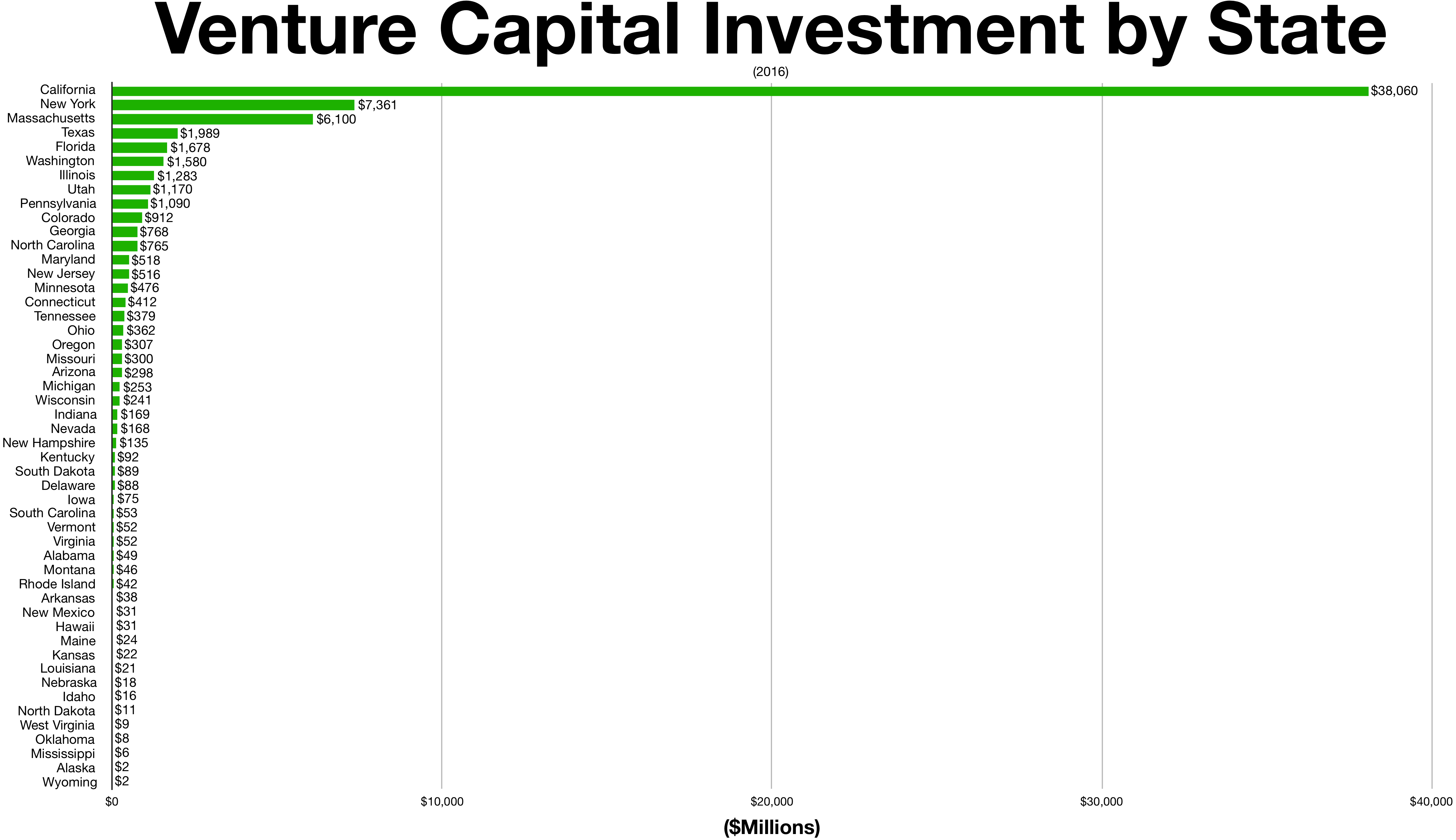

United States

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to

Venture capitalists invested some $29.1 billion in 3,752 deals in the U.S. through the fourth quarter of 2011, according to report by the National Venture Capital Association

The same numbers for all of 2010 were $23.4 billion in 3,496 deals. According to a report by Dow Jones VentureSource, venture capital funding fell to $6.4 billion in the US in the first quarter of 2013, an 11.8% drop from the first quarter of 2012, and a 20.8% decline from 2011. Venture firms have added $4.2 billion into their funds this year, down from $6.3 billion in the first quarter of 2013, but up from $2.6 billion in the fourth quarter of 2012.

Australia and New Zealand

In Australia and New Zealand, there are more than one hundred active VC funds, syndicates, or angel investors making VC-style investments. The State of Startup Funding report found that in 2021, over AUD $10 billion AUD was invested into Australian and New Zealand startups across 682 deals. This represents a 3x increase from the $3.1 billion that was invested in 2020. Some notable Australian and New Zealand startup success stories include graphic design company Canva, financial services provider Airwallex, New Zealand payments provider Vend (acquired by Lightspeed), rent-to-buy company OwnHome, and direct-to-consumer propositions such as Eucalyptus (a house of direct-to-consumer telehealth brands), and Lyka (a pet wellness company). In 2022, the largest Australian funds are Blackbird Ventures, Square Peg Capital, and Airtree Ventures. These three funds have more than $1 billion AUD under management across multiple funds. These funds have funding from institutional capital, including AustralianSuper and Hostplus, family offices, and sophisticated individual high-net-wealth investors. Outside of the 'Big 3', other notable institutional funds include AfterWork Ventures, Artesian, Folklore Ventures, Equity Venture Partners, Our Innovation Fund, Investible, Main Sequence Ventures (the VC arm of the CSIRO), and Tenacious Ventures. As the number of capital providers in the Australian and New Zealand ecosystem has grown, funds have started to specialise and innovate to differentiate themselves. For example, Tenacious Ventures is a $35 million specialised agritech fund, while AfterWork Ventures is a 'community-powered fund' that has coalesced a group of 120 experienced operators from across Australia's startups and tech companies. Its community is invested in its fund, and lean into assist with sourcing and evaluating deal opportunities, as well as supporting companies post-investment. Several Australian corporates have corporate VC arms, including NAB Ventures, Reinventure (associated with Westpac), IAG Firemark Ventures, and Telstra Ventures.Bulgaria

The Bulgarian venture capital industry has been growing rapidly in the past decade. As of the beginning of 2021, there are 18 VC and growth equity firms on the local market, with the total funding available for technology startups exceeding €200M. According to BVCA – Bulgarian Private Equity and Venture Capital Association, 59 transactions of total value of €29.4 million took place in 2020. Most of the venture capital investments in Bulgaria are concentrated in the seed and Series A stages. Sofia-based LAUNCHub Ventures recently launched one of the biggest funds in the region, with a target size of €70 million.Mexico

The Venture Capital industry in Mexico is a fast-growing sector in the country that, with the support of institutions and private funds, is estimated to reach US$100 billion invested by 2018.Israel

In Israel, high-tech entrepreneurship and venture capital have flourished well beyond the country's relative size. As it has very little natural resources and, historically has been forced to build its economy on knowledge-based industries, its VC industry has rapidly developed, and nowadays has about 70 active venture capital funds, of which 14 international VCs with Israeli offices, and additional 220 international funds which actively invest in Israel. In addition, as of 2010, Israel led the world in venture capital invested per capita. Israel attracted $170 per person compared to $75 in the USA. About two thirds of the funds invested were from foreign sources, and the rest domestic. In 2013, Wix.com joined 62 other Israeli firms on the Nasdaq.Canada

Canadian technology companies have attracted interest from the global venture capital community partially as a result of generous tax incentive through the Scientific Research and Experimental Development (SR&ED) investment tax credit program. The basic incentive available to any Canadian corporation performing R&D is a refundable tax credit that is equal to 20% of "qualifying" R&D expenditures (labour, material, R&D contracts, and R&D equipment). An enhanced 35% refundable tax credit of available to certain (i.e. small) Canadian-controlled private corporations (CCPCs). Because the CCPC rules require a minimum of 50% Canadian ownership in the company performing R&D, foreign investors who would like to benefit from the larger 35% tax credit must accept minority position in the company, which might not be desirable. The SR&ED program does not restrict the export of any technology or intellectual property that may have been developed with the benefit of SR&ED tax incentives. Canada also has a fairly unusual form of venture capital generation in its labour-sponsored venture capital corporations (LSVCC). These funds, also known as Retail Venture Capital or Labour Sponsored Investment Funds (LSIF), are generally sponsored by labor unions and offer tax breaks from government to encourage retail investors to purchase the funds. Generally, these Retail Venture Capital funds only invest in companies where the majority of employees are in Canada. However, innovative structures have been developed to permit LSVCCs to direct in Canadian subsidiaries of corporations incorporated in jurisdictions outside of Canada.Switzerland

Many Swiss start-ups are university spin-offs, in particular from its federal institutes of technology in Lausanne and Zurich. According to a study by the London School of Economics analysing 130ETH Zurich

(colloquially)

, former_name = eidgenössische polytechnische Schule

, image = ETHZ.JPG

, image_size =

, established =

, type = Public

, budget = CHF 1.896 billion (2021)

, rector = Günther Dissertori

, president = Joël Mesot

, ac ...

spin-offs over 10 years, about 90% of these start-ups survived the first five critical years, resulting in an average annual IRR of more than 43%.

Switzerland's most active early-stage investors are The Zurich Cantonal Bank

Zurich Cantonal Bank (german: Zürcher Kantonalbank, or ZKB) is the largest cantonal bank and fourth largest bank in Switzerland, as well as the leading financial services provider in the Greater Zurich area, with total assets of over CHF 150 bi ...

, investiere.ch, Swiss Founders Fund, as well as a number of angel investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or owners ...

clubs.

Europe

Leading early-stage venture capital investors in Europe include Mark Tluszcz of Mangrove Capital Partners and Danny Rimer of Index Ventures, both of whom were named on ''Forbes'' Magazine's Midas List of the world's top dealmakers in technology venture capital in 2007. In 2020, the first Italian Venture capital Fund named Primo Space was launched by Primomiglio SGR. This fund first closed €58 million out a target €80 million and is focused on Space investing.Nordic countries

Recent years have seen a revival of the Nordic venture scene with more than €3 billion raised by VC funds in the Nordic region over the last five years. Over the past five years, a total of €2.7 billion has been invested into Nordic startups. Known Nordic early-stage venture capital funds include NorthZone (Sweden), Maki.vc (Finland) and ByFounders (Copenhagen).Poland

As of March 2019, there are 130 active VC firms in Poland which have invested locally in over 750 companies, an average of 9 companies per portfolio. Since 2016, new legal institutions have been established for entities implementing investments in enterprises in the seed or startup phase. In 2018, venture capital funds invested in Polish startups (0.033% of GDP). As of March 2019, total assets managed by VC companies operating in Poland are estimated at . The total value of investments of the Polish VC market is worth .Asia

India is catching up with the West in the field of venture capital and a number of venture capital funds have a presence in the country (IVCA). In 2006, the total amount of private equity and venture capital in India reached $7.5 billion across 299 deals. In the Indian market, venture capital consists of investing in equity, quasi-equity, or conditional loans in order to promote unlisted, high-risk, or high-tech firms driven by technically or professionally qualified entrepreneurs. It is also used to refer to investors "providing seed", "start-up and first-stage financing", or financing companies that have demonstrated extraordinary business potential. Venture capital refers to capital investment; equity and debt ;both of which carry indubitable risk. The anticipated risk is very high. The venture capital industry follows the concept of "high risk, high return", innovative entrepreneurship, knowledge-based ideas and human capital intensive enterprises have become common as venture capitalists invest in risky finance to encourage innovation.China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

is also starting to develop a venture capital industry ( CVCA).

Vietnam is experiencing its first foreign venture capitals, including IDG Venture Vietnam ($100 million) and DFJ Vinacapital ($35 million)

Singapore is widely recognized and featured as one of the hottest places to both start up and invest, mainly due to its healthy ecosystem, its strategic location and connectedness to foreign markets. With 100 deals valued at US$3.5 billion, Singapore saw a record value of PE and VC investments in 2016. The number of PE and VC investments increased substantially over the last 5 years: In 2015, Singapore recorded 81 investments with an aggregate value of US$2.2 billion while in 2014 and 2013, PE and VC deal values came to US$2.4 billion and US$0.9 billion respectively. With 53 percent, tech investments account for the majority of deal volume. Moreover, Singapore is home to two of South-East Asia's largest unicorns. Garena is reportedly the highest-valued unicorn in the region with a US$3.5 billion price tag, while Grab (application), Grab is the highest-funded, having raised a total of US$1.43 billion since its incorporation in 2012.

Start-ups and small businesses in Singapore receive support from policymakers and the local government fosters the role VCs play to support entrepreneurship in Singapore and the region. For instance, in 2016, Singapore's Prime Minister's Office (Singapore)#National Research Foundation, National Research Foundation (NRF) has given out grants up to around $30 million to four large local enterprises for investments in startups in the city-state. This first of its kind partnership NRF has entered into is designed to encourage these enterprises to source for new technologies and innovative business models.

Currently, the rules governing VC firms are being reviewed by the Monetary Authority of Singapore, Monetary Authority of Singapore (MAS) to make it easier to set up funds and increase funding opportunities for start-ups. This mainly includes simplifying and shortening the authorization process for new venture capital managers and to study whether existing incentives that have attracted traditional asset managers here will be suitable for the VC sector. A public consultation on the proposals was held in January 2017 with changes expected to be introduced by July.

Middle East and North Africa

The Middle East and North Africa (MENA) venture capital industry is an early stage of development but growing. According toH1 2019 MENA Venture Investment Report

' by MAGNiTT, 238 startup investment deals have taken place in the region in the first half of 2019, totaling in $471 million in investments. Compared to 2018’s H1 report, this represents an increase of 66% in total funding and 28% in number of deals. According to the report, the United Arab Emirates, UAE is the most active ecosystem in the region with 26% of the deals made in H1, followed by Egypt at 21%, and Lebanon at 13%. In terms of deals by sector, fintech remains the most active industry with 17% of the deals made, followed by e-commerce at 12%, and delivery and transport at 8%. The report also notes that a total of 130 institutions invested in MENA-based startups in H1 2019, 30% of which were headquartered outside the MENA, demonstrating international appetite for investments in the region. 15 startup exits have been recorded in H1 2019, with Careem’s $3.1 billion acquisition by Uber being the first unicorn exit in the region. Other notable exits include Souq.com exit to Amazon (company), Amazon in 2017 for $650 million.

Sub-Saharan Africa

The Southern African venture capital industry is developing. The South African Government and Revenue Service is following the international trend of using tax-efficient vehicles to propel economic growth and job creation through venture capital. Section 12 J of the ''Income Tax Act'' was updated to include venture capital. Companies are allowed to use a tax-efficient structure similar to VCTs in the UK. Despite the above structure, the government needs to adjust its regulation around intellectual property, exchange control and other legislation to ensure that Venture capital succeeds. Currently, there are not many venture capital funds in operation and it is a small community; however, the number of venture funds are steadily increasing with new incentives slowly coming in from government. Funds are difficult to come by and due to the limited funding, companies are more likely to receive funding if they can demonstrate initial sales or traction and the potential for significant growth. The majority of the venture capital in Sub-Saharan Africa is centered on South Africa and Kenya. Entrepreneurship is a key to growth. Governments will need to ensure business friendly regulatory environments in order to help foster innovation. In 2019, venture capital startup funding grew to 1.3 billion dollars, increasing rapidly. The causes are as of yet unclear, but education is certainly a factor.Confidential information

Unlike public company, public companies, information regarding an entrepreneur's business is typically confidential and proprietary. As part of thedue diligence

Due diligence is the investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

It can be a l ...

process, most venture capitalists will require significant detail with respect to a company's business plan. Entrepreneurs must remain vigilant about sharing information with venture capitalists that are investors in their competitors. Most venture capitalists treat information confidentially, but as a matter of business practice, they do not typically enter into Non Disclosure Agreements because of the potential liability issues those agreements entail. Entrepreneurs are typically well advised to protect truly proprietary intellectual property.

Limited partners of venture capital firms typically have access only to limited amounts of information with respect to the individual portfolio companies in which they are invested and are typically bound by confidentiality provisions in the fund's limited partnership, limited partnership agreement.

Governmental regulations

There are several strict guidelines regulating those that deal in venture capital. Namely, they are not allowed to advertise or solicit business in any form as per the U.S. Securities and Exchange Commission guidelines.In popular culture

In books

* Mark Coggins' novel ''Vulture Capital'' (2002) features a venture capitalist protagonist who investigates the disappearance of the chief scientist in a biotech firm in which he has invested. Coggins also worked in the industry and was co-founder of a dot-com startup. * Drawing on his experience as reporter covering technology for the '' New York Times'', Matt Richtel produced the novel ''Hooked'' (2007), in which the actions of the main character's deceased girlfriend, a Silicon Valley venture capitalist, play a key role in the plot. * Great, detailed work on VC method of funding.In comics

* In the ''Dilbert'' comic strip, a character named "Vijay, the World's Most Desperate Venture Capitalist" frequently makes appearances, offering bags of cash to anyone with even a hint of potential. In one strip, he offers two small children with good math grades money based on the fact that if they marry and produce an engineer baby he can invest in the infant's first idea. The children respond that they are already looking for mezzanine funding. * Robert von Goeben and Kathryn Siegler produced a comic strip called ''The VC'' between the years 1997 and 2000 that parodied the industry, often by showing humorous exchanges between venture capitalists and entrepreneurs. Von Goeben was a partner in Redleaf Venture Management when he began writing the strip.In film

* In ''Wedding Crashers'' (2005), Jeremy Grey (Vince Vaughn) and John Beckwith (Owen Wilson) are bachelors who create appearances to play at different weddings of complete strangers, and a large part of the movie follows them posing as venture capitalists from New Hampshire. * The documentary ''Something Ventured'' (2011) chronicled the recent history of American technology venture capitalists.In television