money mule on:

[Wikipedia]

[Google]

[Amazon]

Money is any item or verifiable record that is generally accepted as

Money is any item or verifiable record that is generally accepted as

The use of

The use of  The system of

The system of

In economics, money is any

In economics, money is any

Many items have been used as

Many items have been used as

Fiat money or fiat currency is money whose value is not derived from any intrinsic value or guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency (typically notes and coins from a central bank, such as the

Fiat money or fiat currency is money whose value is not derived from any intrinsic value or guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency (typically notes and coins from a central bank, such as the

. Retrieved July-18-09. Fiat money, if physically represented in the form of currency (paper or coins), can be accidentally damaged or destroyed. However, fiat money has an advantage over representative or commodity money, in that the same laws that created the money can also define rules for its replacement in case of damage or destruction. For example, the U.S. government will replace mutilated

In premodern China, the need for credit and for circulating a medium that was less of a burden than exchanging thousands of

In premodern China, the need for credit and for circulating a medium that was less of a burden than exchanging thousands of  At around the same time in the

At around the same time in the  By 1900, most of the industrializing nations were on some form of a gold standard, with paper notes and silver coins constituting the circulating medium. Private banks and governments across the world followed

By 1900, most of the industrializing nations were on some form of a gold standard, with paper notes and silver coins constituting the circulating medium. Private banks and governments across the world followed

Commercial bank money or

Commercial bank money or

When gold and silver are used as money, the money supply can grow only if the supply of these metals is increased by mining. This rate of increase will accelerate during periods of

When gold and silver are used as money, the money supply can grow only if the supply of these metals is increased by mining. This rate of increase will accelerate during periods of

The definition of money says it is money only "in a particular country or socio-economic context". In general, communities only use a single measure of value, which can be identified in the prices of goods listed for sale. There might be multiple media of exchange, which can be observed by what is given to purchase goods ("medium of exchange"), etc. In most countries, the government acts to encourage a particular forms of money, such as requiring it for taxes and punishing

The definition of money says it is money only "in a particular country or socio-economic context". In general, communities only use a single measure of value, which can be identified in the prices of goods listed for sale. There might be multiple media of exchange, which can be observed by what is given to purchase goods ("medium of exchange"), etc. In most countries, the government acts to encourage a particular forms of money, such as requiring it for taxes and punishing

excerpt

. * Ferguson, Niall. ''The Ascent of Money: A Financial History of the World'' (2009

excerpt

* Keen, Steve (February 2015)

"What Is Money and How Is It Created?"

argues, "Banks create money by issuing a loan to a borrower; they record the loan as an asset, and the money they deposit in the borrower’s account as a liability. This, in one way, is no different to the way the Federal Reserve creates money ... money is simply a third party’s promise to pay which we accept as full payment in exchange for goods. The two main third parties whose promises we accept are the government and the banks ... money ... is not backed by anything physical, and instead relies on trust. Of course, that trust can be abused ... we continue to ignore the main game: what the banks do (for good and for ill) that really drives the economy." ''

excerpt

* * Lanchester, John, "The Invention of Money: How the heresies of two bankers became the basis of our modern economy", ''

excerpt

"Money"

BBC Radio 4 discussion with Niall Ferguson, Richard J. Evans and Jane Humphries (''In Our Time'', Mar. 1, 2001) {{Authority control Currency Economic anthropology Emergence Trade

Money is any item or verifiable record that is generally accepted as

Money is any item or verifiable record that is generally accepted as payment

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the p ...

for goods and services

Goods are items that are usually (but not always) tangible, such as pens, physical books, salt, apples, and hats. Services are activities provided by other people, who include architects, suppliers, contractors, technologists, teachers, doctor ...

and repayment of debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The ...

s, such as taxes

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or ...

, in a particular country or socio-economic context. The primary functions which distinguish money are as a medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

, a unit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

, a store of value

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.

The most ...

and sometimes, a standard of deferred payment

In economics, standard of deferred payment is a function of money. It is the function of being a widely accepted way to value a debt, thereby allowing goods and services to be acquired now and paid for in the future.

The 19th-century economist W ...

.

Money was historically an emergent market phenomenon that possess intrinsic value as a commodity

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

The price of a comm ...

; nearly all contemporary money systems are based on unbacked fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometime ...

without use value

Use value (german: Gebrauchswert) or value in use is a concept in classical political economy and Marxist economics. It refers to the tangible features of a commodity (a tradeable object) which can satisfy some human requirement, want or need, or ...

. Its value is consequently derived by social convention, having been declared by a government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a ...

or regulatory entity to be legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in pa ...

; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private", in the case of the United States dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

. Contexts which erode public confidence, such as the circulation of counterfeit money

Counterfeit money is currency produced without the legal sanction of a state or government, usually in a deliberate attempt to imitate that currency and so as to deceive its recipient. Producing or using counterfeit money is a form of fraud or fo ...

or domestic hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

, can cause good money

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable co ...

to lose its value.

The money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

of a country comprises all currency in circulation

In monetary economics, the currency in circulation in a country is the value of

currency or cash (banknotes and coins) that has ever been issued by the country’s monetary authority less the amount that has been removed. More broadly, money in ci ...

(banknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable instrument, negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes w ...

s and coin

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order t ...

s currently issued) and, depending on the particular definition used, one or more types of bank money (the balances held in checking accounts

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. It is available to the ...

, savings account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transac ...

s, and other types of bank accounts

A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Each financial institution sets the terms and conditions for each type of ...

). Bank money, whose value exists on the books of financial institutions and can be converted into physical notes or used for cashless payment, forms by far the largest part of broad money

In economics, broad money is a measure of the amount of money, or money supply, in a national economy including both highly liquid "narrow money" and less liquid forms. The European Central Bank, the OECD and the Bank of England all have their own ...

in developed countries.

Etymology

The word money derives from the Latin word with the meaning "coin" via French . The Latin word is believed to originate from a temple ofJuno

Juno commonly refers to:

*Juno (mythology), the Roman goddess of marriage and queen of the gods

*Juno (film), ''Juno'' (film), 2007

Juno may also refer to:

Arts, entertainment and media Fictional characters

*Juno, in the film ''Jenny, Juno''

*Ju ...

, on Capitoline

The Capitolium or Capitoline Hill ( ; it, Campidoglio ; la, Mons Capitolinus ), between the Forum and the Campus Martius, is one of the Seven Hills of Rome.

The hill was earlier known as ''Mons Saturnius'', dedicated to the god Saturn. T ...

, one of Rome's seven hills. In the ancient world, Juno was often associated with money. The temple of Juno Moneta

In Roman mythology, Moneta (Latin Monēta) was a title given to two separate goddesses: It was the name of the goddess of memory (identified with the Greek goddess Mnemosyne), and it was an epithet of Juno, called Juno Moneta (Latin Iūno Monēt ...

at Rome was the place where the mint of Ancient Rome was located. The name "Juno" may have derived from the Etruscan goddess Uni

Uni or UNI may refer to:

Entertainment

*Uni Records, a division of MCA, formally called Universal City Records

*"U.N.I.", a song by Ed Sheeran from ''+'' (''Plus'')

*Uni, a species in the Neopets Trading Card Game

*Uni, a character in the anim ...

(which means "the one", "unique", "unit", "union", "united") and "Moneta" either from the Latin word "monere" (remind, warn, or instruct) or the Greek word "moneres" (alone, unique).

In the Western world a prevalent term for coin-money has been ''specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

'', stemming from Latin , meaning "in kind".

History

The use of

The use of barter

In trade, barter (derived from ''baretor'') is a system of exchange in which participants in a transaction directly exchange goods or services for other goods or services without using a medium of exchange, such as money. Economists distingu ...

-like methods may date back to at least 100,000 years ago, though there is no evidence of a society or economy that relied primarily on barter. Instead, non-monetary societies operated largely along the principles of gift economy

A gift economy or gift culture is a system of exchange where valuables are not sold, but rather given without an explicit agreement for immediate or future rewards. Social norms and customs govern giving a gift in a gift culture; although there ...

and debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The ...

. When barter did in fact occur, it was usually between either complete strangers or potential enemies.

Many cultures around the world eventually developed the use of commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representati ...

. The Mesopotamian shekel

Shekel or sheqel ( akk, 𒅆𒅗𒇻 ''šiqlu'' or ''siqlu,'' he, שקל, plural he, שקלים or shekels, Phoenician: ) is an ancient Mesopotamian coin, usually of silver. A shekel was first a unit of weight—very roughly —and became c ...

was a unit of weight, and relied on the mass of something like 160 grains

A grain is a small, hard, dry fruit (caryopsis) – with or without an attached hull layer – harvested for human or animal consumption. A grain crop is a grain-producing plant. The two main types of commercial grain crops are cereals and legumes ...

of barley

Barley (''Hordeum vulgare''), a member of the grass family, is a major cereal grain grown in temperate climates globally. It was one of the first cultivated grains, particularly in Eurasia as early as 10,000 years ago. Globally 70% of barley pr ...

. The first usage of the term came from Mesopotamia

Mesopotamia ''Mesopotamíā''; ar, بِلَاد ٱلرَّافِدَيْن or ; syc, ܐܪܡ ܢܗܪ̈ܝܢ, or , ) is a historical region of Western Asia situated within the Tigris–Euphrates river system, in the northern part of the F ...

circa 3000 BC. Societies in the Americas, Asia, Africa and Australia used shell money

Shell money is a medium of trade, exchange similar to coin money and other forms of commodity money, and was once commonly used in many parts of the world. Shell money usually consisted of whole or partial sea shells, often worked into beads or o ...

—often, the shells of the cowry

Cowrie or cowry () is the common name for a group of small to large sea snails, ocean, marine Gastropoda, gastropod Mollusca, mollusks in the family Cypraeidae, the cowries.

The term ''porcelain'' derives from the old Italian language, Italia ...

(''Cypraea moneta L.'' or ''C. annulus L.''). According to Herodotus

Herodotus ( ; grc, , }; BC) was an ancient Greek historian and geographer from the Greek city of Halicarnassus, part of the Persian Empire (now Bodrum, Turkey) and a later citizen of Thurii in modern Calabria ( Italy). He is known f ...

, the Lydians

The Lydians (known as ''Sparda'' to the Achaemenids, Old Persian cuneiform Wikt:𐎿𐎱𐎼𐎭, 𐎿𐎱𐎼𐎭) were Anatolians, Anatolian people living in Lydia, a region in western Anatolia, who spoke the distinctive Lydian language, an ...

were the first people to introduce the use of gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile met ...

and silver coin

Silver coins are considered the oldest mass-produced form of coinage. Silver has been used as a coinage metal since the times of the Greeks; their silver drachmas were popular trade coins. The ancient Persians used silver coins between 612–330 ...

s. It is thought by modern scholars that these first stamped coins

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to ...

were minted around 650 to 600 BC.

The system of

The system of commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representati ...

eventually evolved into a system of representative money

Representative money or receipt money is any medium of exchange, printed or digital, that represents something of Value (economics), value, but has little or no value of its own (intrinsic value). Unlike some forms of fiat money (which may have n ...

. This occurred because gold and silver merchants or banks would issue receipts to their depositors, redeemable for the commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representati ...

deposited. Eventually, these receipts became generally accepted as a means of payment and were used as money. Paper money or banknotes

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable instrument, negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes w ...

were first used in China during the Song dynasty

The Song dynasty (; ; 960–1279) was an imperial dynasty of China that began in 960 and lasted until 1279. The dynasty was founded by Emperor Taizu of Song following his usurpation of the throne of the Later Zhou. The Song conquered the rest ...

. These banknotes, known as "jiaozi

''Jiaozi'' (; ; pinyin: jiǎozi) are Chinese dumplings commonly eaten in China and other parts of East Asia. ''Jiaozi'' are folded to resemble Chinese sycee and have great cultural significance attached to them within China. ''Jiaozi'' ar ...

", evolved from promissory notes

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of ...

that had been used since the 7th century. However, they did not displace commodity money and were used alongside coins. In the 13th century, paper money became known in Europe through the accounts of travellers, such as Marco Polo

Marco Polo (, , ; 8 January 1324) was a Venetian merchant, explorer and writer who travelled through Asia along the Silk Road between 1271 and 1295. His travels are recorded in ''The Travels of Marco Polo'' (also known as ''Book of the Marv ...

and William of Rubruck

William of Rubruck ( nl, Willem van Rubroeck, la, Gulielmus de Rubruquis; ) was a Flemish Franciscan missionary and explorer.

He is best known for his travels to various parts of the Middle East and Central Asia in the 13th century, including the ...

. Marco Polo's account of paper money during the Yuan dynasty

The Yuan dynasty (), officially the Great Yuan (; xng, , , literally "Great Yuan State"), was a Mongol-led imperial dynasty of China and a successor state to the Mongol Empire after its division. It was established by Kublai, the fifth ...

is the subject of a chapter of his book, ''The Travels of Marco Polo

''Book of the Marvels of the World'' ( Italian: , lit. 'The Million', deriving from Polo's nickname "Emilione"), in English commonly called ''The Travels of Marco Polo'', is a 13th-century travelogue written down by Rustichello da Pisa from st ...

'', titled " How the Great Kaan Causeth the Bark of Trees, Made Into Something Like Paper, to Pass for Money All Over his Country." Banknotes were first issued in Europe by Stockholms Banco

Stockholms Banco (also known as the Palmstruch's Bank, sv, Palmstruchska banken) was the first European bank to print banknotes. It was founded in 1657 by Johan Palmstruch in Stockholm, began printing banknotes in 1661, but ran into financial d ...

in 1661 and were again also used alongside coins. The gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

, a monetary system

A monetary system is a system by which a government provides money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks.

Commodity money system

A commodity m ...

where the medium of exchange are paper notes that are convertible into pre-set, fixed quantities of gold, replaced the use of gold coins as currency in the 17th–19th centuries in Europe. These gold standard notes were made legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in pa ...

, and redemption into gold coins was discouraged. By the beginning of the 20th century, almost all countries had adopted the gold standard, backing their legal tender notes with fixed amounts of gold.

After World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposin ...

and the Bretton Woods Conference

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 Allied nations at the Mount Washington Hotel, situated in Bretton Woods, New Hampshire, Unite ...

, most countries adopted fiat currencies that were fixed to the U.S. dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

. The U.S. dollar was in turn fixed to gold. In 1971 the U.S. government suspended the convertibility of the dollar to gold. After this many countries de-pegged their currencies from the U.S. dollar, and most of the world's currencies became unbacked by anything except the governments' fiat of legal tender and the ability to convert the money into goods via payment. According to proponents of modern money theory

Modern Monetary Theory or Modern Money Theory (MMT) is a heterodox

*

*

*

*

*

* macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of ...

, fiat money is also backed by taxes. By imposing taxes, states create demand for the currency they issue.

Functions

In ''Money and the Mechanism of Exchange (1875)'',William Stanley Jevons

William Stanley Jevons (; 1 September 183513 August 1882) was an English economist and logician.

Irving Fisher described Jevons's book ''A General Mathematical Theory of Political Economy'' (1862) as the start of the mathematical method in ec ...

famously analyzed money in terms of four functions: a ''medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

'', a ''common measure of value'' (or unit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

), a ''standard of value'' (or standard of deferred payment

In economics, standard of deferred payment is a function of money. It is the function of being a widely accepted way to value a debt, thereby allowing goods and services to be acquired now and paid for in the future.

The 19th-century economist W ...

), and a ''store of value

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.

The most ...

''. By 1919, Jevons's four functions of money were summarized in the couplet

A couplet is a pair of successive lines of metre in poetry. A couplet usually consists of two successive lines that rhyme and have the same metre. A couplet may be formal (closed) or run-on (open). In a formal (or closed) couplet, each of the ...

:

:Money's a matter of functions four,

:A Medium, a Measure, a Standard, a Store.

This couplet would later become widely popular in macroeconomics textbooks. Most modern textbooks now list only three functions, that of medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

, unit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

, and store of value

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.

The most ...

, not considering a standard of deferred payment as a distinguished function, but rather subsuming it in the others.Krugman, Paul & Wells, Robin, ''Economics'', Worth Publishers, New York (2006)

There have been many historical disputes regarding the combination of money's functions, some arguing that they need more separation and that a single unit is insufficient to deal with them all. One of these arguments is that the role of money as a medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

conflicts with its role as a store of value

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.

The most ...

: its role as a store of value requires holding it without spending, whereas its role as a medium of exchange requires it to circulate. T.H. Greco. ''Money: Understanding and Creating Alternatives to Legal Tender'', White River Junction, Vt: Chelsea Green Publishing (2001). Others argue that storing of value is just deferral of the exchange, but does not diminish the fact that money is a medium of exchange that can be transported both across space and time. The term "financial capital" is a more general and inclusive term for all liquid instruments, whether or not they are a uniformly recognized tender.

Medium of exchange

When money is used to intermediate the exchange of goods and services, it is performing a function as a ''medium of exchange''. It thereby avoids the inefficiencies of a barter system, such as the inability to permanently ensure "coincidence of wants

The coincidence of wants (often known as double coincidence of wants) is an economic phenomenon where two parties each hold an item that the other wants, so they exchange these items directly without any monetary medium. Within economics, this h ...

". For example, between two parties in a barter system, one party may not have or make the item that the other wants, indicating the non-existence of the coincidence of wants. Having a medium of exchange can alleviate this issue because the former can have the freedom to spend time on other items, instead of being burdened to only serve the needs of the latter. Meanwhile, the latter can use the medium of exchange to seek for a party that can provide them with the item they want.

Measure of value

A ''unit of account'' (in economics) is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of relative worth and deferred payment, a unit of account is a necessary prerequisite for the formulation of commercial agreements that involve debt. Money acts as a standard measure and a common denomination of trade. It is thus a basis for quoting and bargaining of prices. It is necessary for developing efficient accounting systems.Standard of deferred payment

While ''standard of deferred payment'' is distinguished by some texts, particularly older ones, other texts subsume this under other functions. A "standard of deferred payment" is an accepted way to settle adebt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The ...

—a unit in which debts are denominated, and the status of money as legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in pa ...

, in those jurisdictions which have this concept, states that it may function for the discharge of debts. When debts are denominated in money, the real value of debts may change due to inflation and deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflation ...

, and for sovereign and international debts via debasement

A debasement of coinage is the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money, such as gold or silver coins. A coin is said to be debased if the quantity of gold, silver, copper or nick ...

and devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curren ...

.

Store of value

To act as a ''store of value'', money must be able to be reliably saved, stored, and retrieved—and be predictably usable as a medium of exchange when it is retrieved. The value of the money must also remain stable over time. Some have argued that inflation, by reducing the value of money, diminishes the ability of the money to function as a store of value.Properties

According to Desjardins, "many economists and experts in the field agree" that the properties of money are that it is a medium of exchange, a unit of account, and a store of value. To fulfill these various functions, he states that money must be: *Fungible

In economics, fungibility is the property of a good or a commodity whose individual units are essentially interchangeable, and each of whose parts is indistinguishable from any other part. Fungible tokens can be exchanged or replaced; for exam ...

: its individual units must be capable of mutual substitution (i.e., interchangeability).

* Durable

Durability is the ability of a physical product to remain functional, without requiring excessive maintenance or repair, when faced with the challenges of normal operation over its design lifetime. There are several measures of durability in use, ...

: able to withstand repeated use.

* Divisible: divisible to small units.

* Portable: easily carried and transported.

* Acceptable: everyone must accept the money as payment

* Limited in supply: its supply in circulation must be limited.

Money supply

In economics, money is any

In economics, money is any financial instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form ...

that can fulfill the functions of money (detailed above). These financial instruments together are collectively referred to as the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

of an economy. In other words, the money supply is the number of financial instruments within a specific economy available for purchasing goods or services. Since the money supply consists of various financial instruments (usually currency, demand deposits, and various other types of deposits), the amount of money in an economy is measured by adding together these financial instruments creating a ''monetary aggregate''.

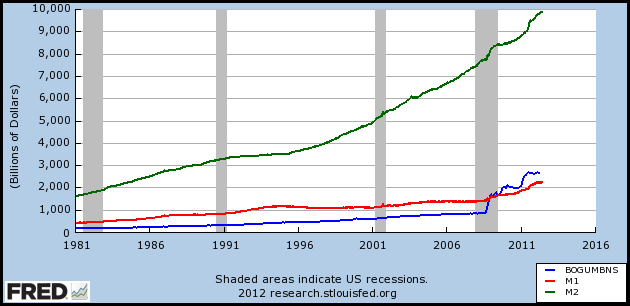

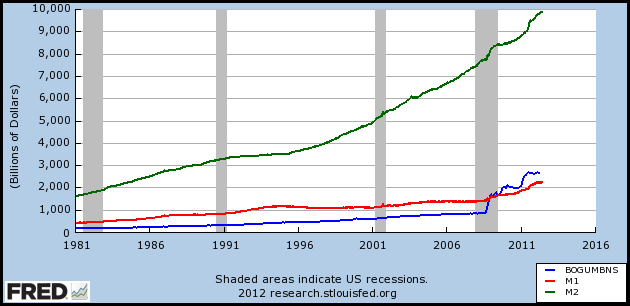

Economists employ different ways to measure the stock of money or money supply, reflected in different types of monetary aggregates, using a categorization system that focuses on the liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity, the ease with which an asset can be sold

* Accounting liquidity, the ability to meet cash obligations when due

* Liqui ...

of the financial instrument used as money. The most commonly used monetary aggregates (or types of money) are conventionally designated M1, M2, and M3. These are successively larger aggregate categories: M1 is currency (coins and bills) plus demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

s (such as checking accounts); M2 is M1 plus savings account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transac ...

s and time deposits under $100,000; M3 is M2 plus larger time deposits and similar institutional accounts. M1 includes only the most liquid financial instruments, and M3 relatively illiquid instruments. The precise definition of M1, M2, etc. may be different in different countries.

Another measure of money, M0, is also used; unlike the other measures, it does not represent actual purchasing power

Purchasing power is the amount of goods and services that can be purchased with a unit of currency. For example, if one had taken one unit of currency to a store in the 1950s, it would have been possible to buy a greater number of items than would ...

by firms and households in the economy. M0 is base money

In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This include ...

, or the amount of money actually issued by the central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

of a country. It is measured as currency plus deposits of banks and other institutions at the central bank. M0 is also the only money that can satisfy the reserve requirements of commercial banks

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with corp ...

.

Creation of money

In current economic systems, money is created by two procedures: Legal tender, or narrow money (M0) is the cash created by a Central Bank by minting coins and printing banknotes. Bank money, or broad money (M1/M2) is the money created by private banks through the recording of loans as deposits of borrowing clients, with partial support indicated by the ''cash ratio''. Currently, bank money is created as electronic money. In most countries, the majority of money is mostly created as M1/M2 by commercial banks making loans. Contrary to some popular misconceptions, banks do not act simply as intermediaries, lending out deposits that savers place with them, and do not depend on central bank money (M0) to create new loans and deposits.Market liquidity

"Market liquidity" describes how easily an item can be traded for another item, or into the common currency within an economy. Money is the most liquid asset because it is universally recognized and accepted as a common currency. In this way, money gives consumers thefreedom

Freedom is understood as either having the ability to act or change without constraint or to possess the power and resources to fulfill one's purposes unhindered. Freedom is often associated with liberty and autonomy in the sense of "giving on ...

to trade goods and services easily without having to barter.

Liquid financial instruments are easily tradable

Tradability is the property of a good or service that can be sold in another location distant from where it was produced. A good that is not tradable is called non-tradable. Different goods have differing levels of tradability: the higher the co ...

and have low transaction cost

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike produ ...

s. There should be no (or minimal) spread

Spread may refer to:

Places

* Spread, West Virginia

Arts, entertainment, and media

* ''Spread'' (film), a 2009 film.

* ''$pread'', a quarterly magazine by and for sex workers

* "Spread", a song by OutKast from their 2003 album ''Speakerboxxx/T ...

between the prices to buy and sell the instrument being used as money.

Types

Commodity

Many items have been used as

Many items have been used as commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representati ...

such as naturally scarce precious metal

Precious metals are rare, naturally occurring metallic chemical elements of high economic value.

Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lustre. ...

s, conch shell

Conch () is a common name of a number of different medium-to-large-sized sea snail, sea snails. Conch shells typically have a high Spire (mollusc), spire and a noticeable siphonal canal (in other words, the shell comes to a noticeable point a ...

s, barley

Barley (''Hordeum vulgare''), a member of the grass family, is a major cereal grain grown in temperate climates globally. It was one of the first cultivated grains, particularly in Eurasia as early as 10,000 years ago. Globally 70% of barley pr ...

, beads, etc., as well as many other things that are thought of as having value

Value or values may refer to:

Ethics and social

* Value (ethics) wherein said concept may be construed as treating actions themselves as abstract objects, associating value to them

** Values (Western philosophy) expands the notion of value beyo ...

. Commodity money value comes from the commodity out of which it is made. The commodity itself constitutes the money, and the money is the commodity.Mises, Ludwig von. ''The Theory of Money and Credit

''The Theory of Money and Credit'' is a 1912 economics book written by Ludwig von Mises, originally published in German as ''Theorie des Geldes und der Umlaufsmittel''. In it Mises expounds on his theory of the origins of money through his regres ...

'', (Indianapolis, IN: Liberty Fund, Inc., 1981), trans. H. E. Batson. Ch.3 Part One: The Nature of Money, Chapter 3: The Various Kinds of Money, Section 3: Commodity Money, Credit Money, and Fiat Money, Paragraph 25. Examples of commodities that have been used as mediums of exchange include gold, silver, copper, rice, Wampum

Wampum is a traditional shell bead of the Eastern Woodlands tribes of Native Americans. It includes white shell beads hand-fashioned from the North Atlantic channeled whelk shell and white and purple beads made from the quahog or Western Nort ...

, salt, peppercorns, large stones, decorated belts, shells, alcohol, cigarettes, cannabis, candy, etc. These items were sometimes used in a metric of perceived value in conjunction with one another, in various commodity valuation or price system

In economics, a price system is a system through which the valuations of any forms of property (tangible or intangible) are determined. All societies use price systems in the allocation and exchange of resources as a consequence of scarcity. Even ...

economies. The use of commodity money is similar to barter, but a commodity money provides a simple and automatic unit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

for the commodity which is being used as money. Although some gold coins

A gold coin is a coin that is made mostly or entirely of gold. Most gold coins minted since 1800 are 90–92% gold (22 karat), while most of today's gold bullion coins are pure gold, such as the Britannia, Canadian Maple Leaf, and American Bu ...

such as the Krugerrand

The Krugerrand (; ) is a South African coin, first minted on 3 July 1967 to help market South African gold and produced by Rand Refinery and the South African Mint. The name is a compound of ''Paul Kruger'', the former President of the South A ...

are considered legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in pa ...

, there is no record of their face value on either side of the coin. The rationale for this is that emphasis is laid on their direct link to the prevailing value of their fine gold content. American Eagles are imprinted with their gold content and legal tender face value.

Representative

In 1875, the British economistWilliam Stanley Jevons

William Stanley Jevons (; 1 September 183513 August 1882) was an English economist and logician.

Irving Fisher described Jevons's book ''A General Mathematical Theory of Political Economy'' (1862) as the start of the mathematical method in ec ...

described the money used at the time as "representative money

Representative money or receipt money is any medium of exchange, printed or digital, that represents something of Value (economics), value, but has little or no value of its own (intrinsic value). Unlike some forms of fiat money (which may have n ...

". Representative money is money that consists of token coin

In numismatics, token coins or trade tokens are coin-like objects used instead of coins. The field of token coins is part of exonumia and token coins are token money. Their denomination is shown or implied by size, color or shape. They are oft ...

s, paper money

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

or other physical tokens such as certificates, that can be reliably exchanged for a fixed quantity of a commodity such as gold or silver. The value of representative money stands in direct and fixed relation to the commodity that backs it, while not itself being composed of that commodity.

Fiat

Fiat money or fiat currency is money whose value is not derived from any intrinsic value or guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency (typically notes and coins from a central bank, such as the

Fiat money or fiat currency is money whose value is not derived from any intrinsic value or guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency (typically notes and coins from a central bank, such as the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

in the U.S.) to be legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in pa ...

, making it unlawful not to accept the fiat currency as a means of repayment for all debts, public and private.Black, Henry Campbell (1910). ''A Law Dictionary Containing Definitions Of The Terms And Phrases Of American And English Jurisprudence, Ancient And Modern'', p. 494. West Publishing Co. Black’s Law Dictionary

''Black's Law Dictionary'' is the most frequently used legal dictionary in the United States. Henry Campbell Black (1860–1927) was the author of the first two editions of the dictionary.

History

The first edition was published in 1891 by West ...

defines the word "fiat" to mean "a short order or warrant of a Judge or magistrate directing some act to be done; an authority issuing from some competent source for the doing of some legal act"

Some bullion coins

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from t ...

such as the Australian Gold Nugget

The Australian Gold Nugget is a gold bullion coin minted by the Perth Mint. The coins have been minted in denominations of oz, oz, oz, oz, 1 oz, 2 oz, 10 oz, and 1 kg of 24 carat gold. They have legal tender status in Australia and are one ...

and American Eagle

The bald eagle (''Haliaeetus leucocephalus'') is a bird of prey found in North America. A sea eagle, it has two known subspecies and forms a species pair with the white-tailed eagle (''Haliaeetus albicilla''), which occupies the same niche as ...

are legal tender, however, they trade based on the market price

A price is the (usually not negative) quantity of payment or Financial compensation, compensation given by one Party (law), party to another in return for Good (economics), goods or Service (economics), services. In some situations, the pr ...

of the metal content as a commodity

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

The price of a comm ...

, rather than their legal tender face value (which is usually only a small fraction of their bullion value).usmiNT.gov. Retrieved July-18-09. Fiat money, if physically represented in the form of currency (paper or coins), can be accidentally damaged or destroyed. However, fiat money has an advantage over representative or commodity money, in that the same laws that created the money can also define rules for its replacement in case of damage or destruction. For example, the U.S. government will replace mutilated

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s (U.S. fiat money) if at least half of the physical note can be reconstructed, or if it can be otherwise proven to have been destroyed. By contrast, commodity money that has been lost or destroyed cannot be recovered.

Coinage

These factors led to the shift of the store of value being the metal itself: at first silver, then both silver and gold, and at one point there was bronze as well. Now we have copper coins and other non-precious metals as coins. Metals were mined, weighed, and stamped into coins. This was to assure the individual taking the coin that he was getting a certain known weight of precious metal. Coins could be counterfeited, but they also created a newunit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

, which helped lead to banking. Archimedes' principle

Archimedes' principle (also spelled Archimedes's principle) states that the upward buoyant force that is exerted on a body immersed in a fluid, whether fully or partially, is equal to the weight of the fluid that the body displaces. Archimede ...

provided the next link: coins could now be easily tested for their fine

Fine may refer to:

Characters

* Sylvia Fine (''The Nanny''), Fran's mother on ''The Nanny''

* Officer Fine, a character in ''Tales from the Crypt'', played by Vincent Spano

Legal terms

* Fine (penalty), money to be paid as punishment for an offe ...

weight of the metal, and thus the value of a coin could be determined, even if it had been shaved, debased or otherwise tampered with (see Numismatics

Numismatics is the study or collection of currency, including coins, tokens, paper money, medals and related objects.

Specialists, known as numismatists, are often characterized as students or collectors of coins, but the discipline also includ ...

).

In most major economies using coinage, copper, silver, and gold formed three tiers of coins. Gold coins were used for large purchases, payment of the military, and backing of state activities. Silver coins were used for midsized transactions, and as a unit of account for taxes, dues, contracts, and fealty, while copper coins represented the coinage of common transaction. This system had been used in ancient India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the so ...

since the time of the Mahajanapadas

The Mahājanapadas ( sa, great realm, from ''maha'', "great", and '' janapada'' "foothold of a people") were sixteen kingdoms or oligarchic republics that existed in ancient India from the sixth to fourth centuries BCE during the second urban ...

. In Europe, this system worked through the medieval

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the Post-classical, post-classical period of World history (field), global history. It began with t ...

period because there was virtually no new gold, silver, or copper introduced through mining or conquest. Thus the overall ratios of the three coinages remained roughly equivalent.

Paper

In premodern China, the need for credit and for circulating a medium that was less of a burden than exchanging thousands of

In premodern China, the need for credit and for circulating a medium that was less of a burden than exchanging thousands of copper coins

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to ...

led to the introduction of paper money

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

. This economic phenomenon was a slow and gradual process that took place from the late Tang dynasty

The Tang dynasty (, ; zh, t= ), or Tang Empire, was an Dynasties in Chinese history, imperial dynasty of China that ruled from 618 to 907 AD, with an Zhou dynasty (690–705), interregnum between 690 and 705. It was preceded by the Sui dyn ...

(618–907) into the Song dynasty

The Song dynasty (; ; 960–1279) was an imperial dynasty of China that began in 960 and lasted until 1279. The dynasty was founded by Emperor Taizu of Song following his usurpation of the throne of the Later Zhou. The Song conquered the rest ...

(960–1279). It began as a means for merchants to exchange heavy coinage for receipt

A receipt (also known as a packing list, packing slip, packaging slip, (delivery) docket, shipping list, delivery list, bill of the parcel, manifest, or customer receipt) is a document acknowledging that a person has received money or propert ...

s of deposit issued as promissory note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of ...

s from shops of wholesalers, notes that were valid for temporary use in a small regional territory. In the 10th century, the Song dynasty

The Song dynasty (; ; 960–1279) was an imperial dynasty of China that began in 960 and lasted until 1279. The dynasty was founded by Emperor Taizu of Song following his usurpation of the throne of the Later Zhou. The Song conquered the rest ...

government began circulating these notes amongst the traders in their monopolized

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a spec ...

salt industry. The Song government granted several shops the sole right to issue banknotes, and in the early 12th century the government finally took over these shops to produce state-issued currency. Yet the banknotes issued were still regionally valid and temporary; it was not until the mid 13th century that a standard and uniform government issue of paper money was made into an acceptable nationwide currency. The already widespread methods of woodblock printing

Woodblock printing or block printing is a technique for printing text, images or patterns used widely throughout East Asia and originating in China in antiquity as a method of printing on textiles and later paper. Each page or image is create ...

and then Pi Sheng

Bi Sheng (; 972–1051 AD) was a Chinese artisan, engineer, and inventor of the world's first movable type technology, with printing being one of the Four Great Inventions. Bi Sheng's system was made of Chinese porcelain and was invented betwee ...

's movable type

Movable type (US English; moveable type in British English) is the system and technology of printing and typography that uses movable components to reproduce the elements of a document (usually individual alphanumeric characters or punctuatio ...

printing by the 11th century was the impetus for the massive production of paper money in premodern China.

medieval Islamic world

The Islamic Golden Age was a period of cultural, economic, and scientific flourishing in the history of Islam, traditionally dated from the 8th century to the 14th century. This period is traditionally understood to have begun during the reign ...

, a vigorous monetary economy

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it ...

was created during the 7th–12th centuries on the basis of the expanding levels of circulation of a stable high-value currency (the dinar

The dinar () is the principal currency unit in several countries near the Mediterranean Sea, and its historical use is even more widespread.

The modern dinar's historical antecedents are the gold dinar and the silver dirham, the main coin of ...

). Innovations introduced by economists, traders and merchants of the Muslim world include the earliest uses of credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), ...

, cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The pers ...

s, savings account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transac ...

s, transactional account

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. It is available to the ...

s, loaning, trusts

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the "settl ...

, exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

s, the transfer of credit and debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The ...

, and banking institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial insti ...

s for loans and deposits

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, Transaction account#Current accounts, current accounts or any of several othe ...

.

In Europe, paper money was first introduced in Sweden

Sweden, formally the Kingdom of Sweden,The United Nations Group of Experts on Geographical Names states that the country's formal name is the Kingdom of SwedenUNGEGN World Geographical Names, Sweden./ref> is a Nordic country located on ...

in 1661. Sweden was rich in copper, thus, because of copper's low value, extraordinarily big coins (often weighing several kilograms) had to be made. The advantages of paper currency were numerous: it reduced transport of gold and silver, and thus lowered the risks; it made loaning gold or silver at interest easier since the specie (gold or silver) never left the possession of the lender until someone else redeemed the note; and it allowed for a division of currency into credit and specie backed forms. It enabled the sale of stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

in joint stock companies

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareholders are ...

, and the redemption of those shares

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an ...

in the paper.

However, these advantages are held within their disadvantages. First, since a note has no intrinsic value, there was nothing to stop issuing authorities from printing more of it than they had specie to back it with. Second, because it increased the money supply, it increased inflationary pressures, a fact observed by David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" ''Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment philo ...

in the 18th century. The result is that paper money would often lead to an inflationary bubble, which could collapse if people began demanding hard money, causing the demand for paper notes to fall to zero. The printing of paper money was also associated with wars, and financing of wars, and therefore regarded as part of maintaining a standing army

A standing army is a permanent, often professional, army. It is composed of full-time soldiers who may be either career soldiers or conscripts. It differs from army reserves, who are enrolled for the long term, but activated only during wars or n ...

. For these reasons, paper currency was held in suspicion and hostility in Europe and America. It was also addictive since the speculative profits of trade and capital creation were quite large. Major nations established mints

A mint or breath mint is a food item often consumed as an after-meal refreshment or before business and social engagements to improve breath odor. Mints are commonly believed to soothe the stomach given their association with natural byproducts ...

to print money and mint coins, and branches of their treasury to collect taxes and hold gold and silver stock.

At this time both silver and gold were considered legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in pa ...

, and accepted by governments for taxes. However, the instability in the ratio between the two grew over the 19th century, with the increase both in the supply of these metals, particularly silver, and of trade. This is called bimetallism

Bimetallism, also known as the bimetallic standard, is a monetary standard in which the value of the monetary unit is defined as equivalent to certain quantities of two metals, typically gold and silver, creating a fixed rate of exchange betwee ...

and the attempt to create a bimetallic standard where both gold and silver backed currency remained in circulation occupied the efforts of inflationists. Governments at this point could use currency as an instrument of policy, printing paper currency such as the United States greenback, to pay for military expenditures. They could also set the terms at which they would redeem notes for specie, by limiting the amount of purchase, or the minimum amount that could be redeemed.

By 1900, most of the industrializing nations were on some form of a gold standard, with paper notes and silver coins constituting the circulating medium. Private banks and governments across the world followed

By 1900, most of the industrializing nations were on some form of a gold standard, with paper notes and silver coins constituting the circulating medium. Private banks and governments across the world followed Gresham's law

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable co ...

: keeping gold and silver paid but paying out in notes. This did not happen all around the world at the same time, but occurred sporadically, generally in times of war or financial crisis, beginning in the early part of the 20th century and continuing across the world until the late 20th century, when the regime of floating fiat currencies came into force. One of the last countries to break away from the gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

was the United States in 1971.

No country anywhere in the world today has an enforceable gold standard or silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following t ...

currency system.

Commercial bank

Commercial bank money or

Commercial bank money or demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

s are claims against financial institutions that can be used for the purchase of goods and services. A demand deposit account is an account from which funds can be withdrawn at any time by check or cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In bookkeeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-imm ...

withdrawal without giving the bank or financial institution any prior notice. Banks have the legal obligation to return funds held in demand deposits immediately upon demand (or 'at call'). Demand deposit withdrawals can be performed in person, via checks or bank drafts, using automatic teller machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, fund ...

s (ATMs), or through online banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial inst ...

.

Commercial bank money is created through fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

, the banking practise where banks keep only a fraction of their deposits

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, Transaction account#Current accounts, current accounts or any of several othe ...

in reserve

Reserve or reserves may refer to:

Places

* Reserve, Kansas, a US city

* Reserve, Louisiana, a census-designated place in St. John the Baptist Parish

* Reserve, Montana, a census-designated place in Sheridan County

* Reserve, New Mexico, a US vi ...

(as cash and other highly liquid assets) and lend out the remainder, while maintaining the simultaneous obligation to redeem all these deposits upon demand. Commercial bank money differs from commodity and fiat money in two ways: firstly it is non-physical, as its existence is only reflected in the account ledgers of banks and other financial institutions, and secondly, there is some element of risk that the claim will not be fulfilled if the financial institution becomes insolvent. The process of fractional-reserve banking has a cumulative effect of money creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central bank ...

by commercial banks, as it expands the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

(cash and demand deposits) beyond what it would otherwise be. Because of the prevalence of fractional reserve banking, the broad money supply of most countries is a multiple (greater than 1) of the amount of base money

In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This include ...

created by the country's central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

. That multiple (called the money multiplier

In monetary economics, a money multiplier is one of various closely related ratios of commercial bank money to central bank money (also called the monetary base) under a fractional-reserve banking system. It relates to the ''maximum'' amount of com ...

) is determined by the reserve requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the centra ...

or other financial ratio

A financial ratio or accounting ratio is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial ...

requirements imposed by financial regulators.

The money supply of a country is usually held to be the total amount of currency in circulation plus the total value of checking and savings deposits in the commercial banks in the country. In modern economies, relatively little of the money supply is in physical currency. For example, in December 2010 in the U.S., of the $8853.4 billion in broad money supply (M2), only $915.7 billion (about 10%) consisted of physical coins and paper money.

Digital or electronic

The development of computer technology in the second part of the twentieth century allowed money to be represented digitally. By 1990, in the United States all money transferred between its central bank and commercial banks was in electronic form. By the 2000s most money existed asdigital currency

Digital currency (digital money, electronic money or electronic currency) is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital cu ...

in bank databases. In 2012, by number of transaction, 20 to 58 percent of transactions were electronic (dependent on country).

Anonymous digital currencies were developed in the early 2000s. Early examples include Ecash Ecash was conceived by David Chaum as an anonymous cryptographic electronic money or electronic cash system in 1983. It was realized through his corporation Digicash and used as micropayment system at one US bank from 1995 to 1998.

Design

Chaum pub ...

, bit gold, RPOW, and b-money. Not much innovation occurred until the conception of Bitcoin

Bitcoin ( abbreviation: BTC; sign: ₿) is a decentralized digital currency that can be transferred on the peer-to-peer bitcoin network. Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distr ...

in 2008, which introduced the concept of a decentralised currency that requires no trusted third party

In cryptography, a trusted third party (TTP) is an entity which facilitates interactions between two parties who both trust the third party; the Third Party reviews all critical transaction communications between the parties, based on the ease of c ...

.

Monetary policy