Ivar Kreuger on:

[Wikipedia]

[Google]

[Amazon]

Ivar Kreuger (; 2 March 1880 – 12 March 1932) was a Swedish civil engineer, financier, entrepreneur and industrialist. In 1908, he co-founded the construction company

Kreuger was born in

Kreuger was born in

Ivar Kreuger never married, but lived for many years in different periods with Ingeborg Eberth (1889–1977), family name Hässler, born in Stockholm, who worked as a

Ivar Kreuger never married, but lived for many years in different periods with Ingeborg Eberth (1889–1977), family name Hässler, born in Stockholm, who worked as a

In May 1908, Kreuger formed the construction firm

In May 1908, Kreuger formed the construction firm

for each late day. It is noteworthy that Kreuger & Toll's entire capital would have covered just two days of being late. The client, in turn, agreed to pay a bonus for every day the building was finished before the due date. Kreuger & Toll finished early and subsequently earned completion bonuses for every project. Within a few years, Kreuger & Toll was seen as the best building company in Sweden and one of the top firms in all of Europe. Within six years after its incorporation, Kreuger & Toll earned annual profits of around $200,000 and was paying a substantial dividend of 15%.''Kreuger Genius And Swindler'' by Robert Shaplen (Alfred A. Knopf Inc. New York; 1960)p.44 In 1917, the company was split into two separate companies: Kreuger & Toll Construction AB, with the majority of shares owned by Paul Toll. Ivar Kreuger was not among the board members in the construction company. How much of Paul Toll's company Ivar Kreuger owned has not been revealed—just that Paul Toll owned 60% in 1917 and, around 1930, 66% of the construction company. Kreuger & Toll Construction Co. has never shown up in any Kreuger & Toll Holding organisation charts. Kreuger & Toll Holding became his financial holding company, with Ivar Kreuger as the general manager and major share holder. He controlled it with a tight grip. The board of directors consisted of Ivar, his father, Paul Toll and two very close colleagues. After Ivar got involved in his father's match factories in Kalmar, he became more focused on "constructing" new companies or taking control of other corporations - usually paying with his own securities instead of cash - rather than buildings and bridges. Thus, by 1927, Ivar had bought banks, mining companies, railways, timber and paper firms, film distributors, real estate in several European cities as well as a controlling stake in L.M.

In 1911 and 1912, the Kreuger family match factories in

In 1911 and 1912, the Kreuger family match factories in

Ivar Kreuger

– bibliography at Project Runeberg

at www.ivarkreuger.com * *

"Kreuger: The Original Bernard Madoff?"

The Ivar Kreuger Homepage

* {{DEFAULTSORT:Kreuger, Ivar 1880 births 1932 deaths 20th-century Swedish engineers 20th-century Swedish businesspeople Burials at Norra begravningsplatsen Great Depression in Sweden KTH Royal Institute of Technology alumni Suicides by firearm in France Swedish civil engineers Swedish people of German descent People from Kalmar People in finance Unsolved deaths 1932 suicides

Kreuger & Toll Byggnads AB

Kreuger & Toll was a company founded on May 18, 1908 by two Swedish engineers, Ivar Kreuger and Paul Toll, with Henrik Kreüger working as a consultant and chief engineer.

History

Early 1908, Ivar and his cousin Henrik Kreüger planned to estab ...

, which specialized in new building techniques. By aggressive investments and innovative financial instruments, he built a global match

A match is a tool for starting a fire. Typically, matches are made of small wooden sticks or stiff paper. One end is coated with a material that can be ignited by friction generated by striking the match against a suitable surface. Wooden matc ...

and financial empire. Between the two world wars, he negotiated match monopolies

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a speci ...

with European, Central American and South American governments, and finally controlled between two thirds and three quarters of worldwide match production, becoming known as the "Match King".''Kreuger Genius And Swindler'' by Robert Shaplen (Alfred A. Knopf Inc. New York; 1960, p.9)

Kreuger's financial empire has been described by one biographer as a Ponzi scheme

A Ponzi scheme (, ) is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are comin ...

, based on the supposedly fantastic profitability of his match monopolies. However, in a Ponzi scheme early investors are paid dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-in ...

s from their own money or that of subsequent investors. Although Kreuger did this to some extent, he also controlled many legitimate and often very profitable businesses, and owned banks, real estate, a gold mine, and pulp

Pulp may refer to:

* Pulp (fruit), the inner flesh of fruit

Engineering

* Dissolving pulp, highly purified cellulose used in fibre and film manufacture

* Pulp (paper), the fibrous material used to make paper

* Molded pulp, a packaging material

...

and industrial companies, besides his many match companies. Many of them have survived to this day. Kreuger & Toll, for example, was composed of bona fide businesses, and there were others like it. Another biographer called Kreuger a "genius and swindler", and John Kenneth Galbraith

John Kenneth Galbraith (October 15, 1908 – April 29, 2006), also known as Ken Galbraith, was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through t ...

wrote that he was the "Leonardo

Leonardo is a masculine given name, the Italian, Spanish, and Portuguese equivalent of the English, German, and Dutch name, Leonard

Leonard or ''Leo'' is a common English masculine given name and a surname.

The given name and surname originate ...

of larcenists". Kreuger's financial empire collapsed during the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

. The Price Waterhouse

PricewaterhouseCoopers is an international professional services brand of firms, operating as partnerships under the PwC brand. It is the second-largest professional services network in the world and is considered one of the Big Four accounting ...

autopsy of his financial empire stated: "The manipulations were so childish that anyone with but a rudimentary knowledge of bookkeeping could see the books were falsified." In March 1932, he was found dead in the bedroom of his flat in Paris. The police concluded that he had committed suicide, but decades later, his brother Torsten claimed that he had been murdered, which spawned some controversial literature on the subject.

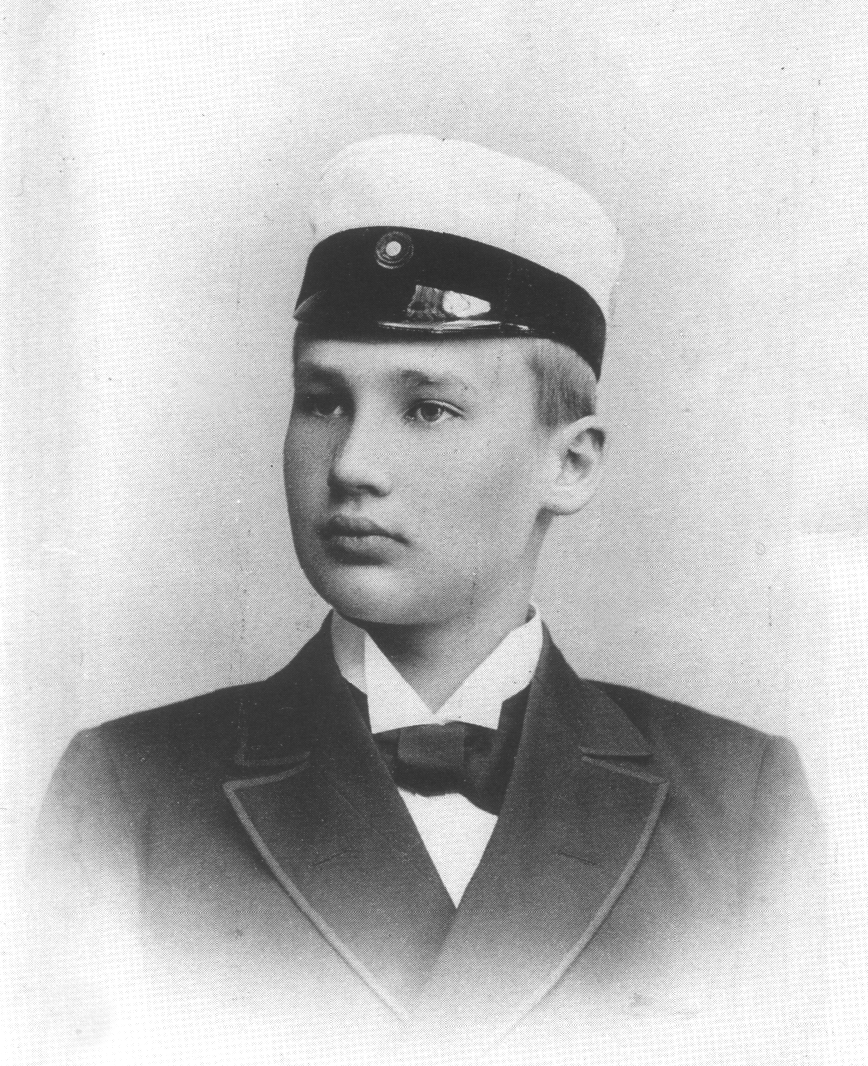

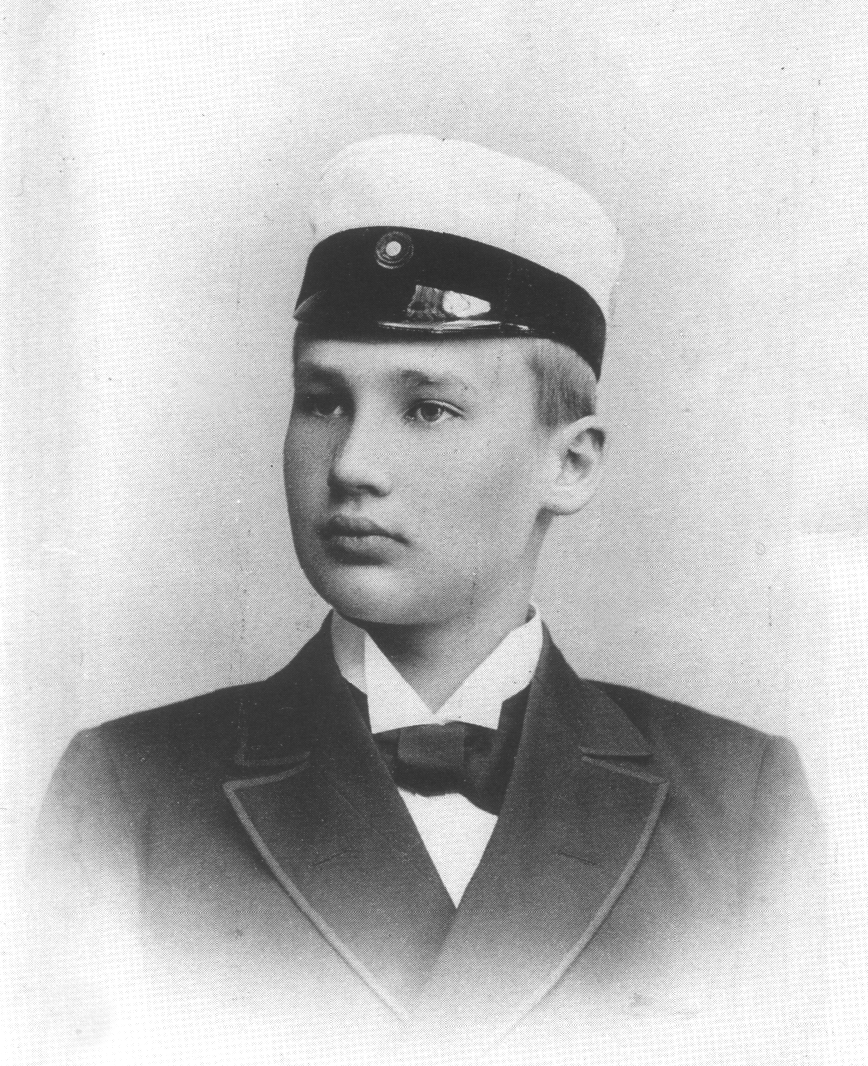

Early life

Kreuger was born in

Kreuger was born in Kalmar

Kalmar (, , ) is a city in the southeast of Sweden, situated by the Baltic Sea. It had 36,392 inhabitants in 2010 and is the seat of Kalmar Municipality. It is also the capital of Kalmar County, which comprises 12 municipalities with a total of ...

, the eldest son of Ernst August Kreuger (1852–1946), an industrialist in the match industry in that city, and his wife Jenny Emelie Kreuger (''née'' Forssman; 1856–1949). Ivar Kreuger had five siblings: Ingrid (born 1877), Helga (born 1878), Torsten (born 1884), Greta (born 1889) and Britta (born 1891).

At school, Ivar skipped ahead two classes by taking private lessons. At age 16, he began studies at the Royal Institute of Technology

The KTH Royal Institute of Technology ( sv, Kungliga Tekniska högskolan, lit=Royal Institute of Technology), abbreviated KTH, is a public research university in Stockholm, Sweden. KTH conducts research and education in engineering and technolo ...

in Stockholm

Stockholm () is the Capital city, capital and List of urban areas in Sweden by population, largest city of Sweden as well as the List of urban areas in the Nordic countries, largest urban area in Scandinavia. Approximately 980,000 people liv ...

, from which he graduated with combined master's degrees covering both the faculties of mechanical

Mechanical may refer to:

Machine

* Machine (mechanical), a system of mechanisms that shape the actuator input to achieve a specific application of output forces and movement

* Mechanical calculator, a device used to perform the basic operations of ...

and civil engineering, at the age of 20.

Personal life

Ivar Kreuger never married, but lived for many years in different periods with Ingeborg Eberth (1889–1977), family name Hässler, born in Stockholm, who worked as a

Ivar Kreuger never married, but lived for many years in different periods with Ingeborg Eberth (1889–1977), family name Hässler, born in Stockholm, who worked as a physical therapist

Physical therapy (PT), also known as physiotherapy, is one of the allied health professions. It is provided by physical therapists who promote, maintain, or restore health through physical examination, diagnosis, management, prognosis, patient ...

in Stockholm.

They met for the first time in Stockholm in 1913. According to the book she wrote in 1932, after Krueger's death, he was not interested in marriage or children, and was very much focused on his business. She broke off the relationship in 1917 and moved to Denmark, where she married a Danish engineer with the name Eberth. They had a daughter in 1919, Grete Eberth (later to be an actress in Stockholm, married name Mac Laury 1919–2002). After some years, however, she divorced Eberth and moved back to Stockholm with her daughter, reuniting with Kreuger. Mr. Eberth once kidnapped the daughter in Stockholm and brought her back to Denmark. Shortly thereafter Ingeborg, without notifying the authorities or police, went down to Denmark and brought the daughter back to Sweden by hiring a private fishing boat in Denmark that took them over Öresund to Sweden. The new period with Kreuger lasted until around 1928; after that they just met occasionally. The last time they met was in November 1931, just before Kreuger started on his final trip to America. Eberth received the news about his death in Paris on March 12, 1932, from newspaper headlines the day after.

Kreuger had private apartments in Stockholm, New York, Paris, and Warsaw

Warsaw ( pl, Warszawa, ), officially the Capital City of Warsaw,, abbreviation: ''m.st. Warszawa'' is the capital and largest city of Poland. The metropolis stands on the River Vistula in east-central Poland, and its population is officia ...

, and a country place used during the summer season on the private island Ängsholmen in the archipelago of Stockholm. On business tours in Europe, he preferred to meet his business associates in Paris and then stayed in his flat at 5, Av. Victor Emanuel III (today named Avenue Franklin D. Roosevelt). He owned several specially designed motor yachts

A yacht is a sailing or power vessel used for pleasure, cruising, or racing. There is no standard definition, though the term generally applies to vessels with a cabin intended for overnight use. To be termed a , as opposed to a , such a pleasu ...

, among them ''Elsa'' built in 1906, ''Loris'' (1913), ''Tärnan'' (1925), and the most famous, ''Svalan'' (''Swallow''), built at Lidingö

Lidingö, also known in its definite form ''Lidingön'' and as ''Lidingölandet'', is an island in the inner Stockholm archipelago, northeast of Stockholm, Sweden. In 2010, the population of the Lidingö urban area on the island was 31,561. It is ...

in 1928, a 37 ft, 4.9 ton motor yacht, equipped with a V12, 31.9 liter Hispano-Suiza engine from the US company Wright, with 650 HP output, capable of more than 50 knots. A replica of the boat has been built.

He had a large private library in both his apartments in Stockholm and New York and quite a large art collection. The paintings were sold at different auctions held in September 1932, as all of Kreuger's private assets were incorporated into the bankruptcy. The collection in Stockholm comprised 88 original paintings, among them 19 by Anders Zorn

Anders Leonard Zorn (18 February 1860 – 22 August 1920) was a Swedish painter. He attained international success as a painter, sculptor, and etching artist. Among Zorn's portrait subjects include King Oscar II of Sweden and three American ...

and a great number by old master

In art history, "Old Master" (or "old master")Old Masters De ...

s from the Netherlands. The New York collection included original paintings by Rembrandt

Rembrandt Harmenszoon van Rijn (, ; 15 July 1606 – 4 October 1669), usually simply known as Rembrandt, was a Dutch Golden Age painter, printmaker and draughtsman. An innovative and prolific master in three media, he is generally consid ...

and Anthony van Dyck

Sir Anthony van Dyck (, many variant spellings; 22 March 1599 – 9 December 1641) was a Brabantian Flemish Baroque artist who became the leading court painter in England after success in the Southern Netherlands and Italy.

The seventh c ...

.

Kreuger became the major shareholder when the Swedish film company AB Svensk Filmindustri (SF) was founded in 1919 and because of that, sometimes met celebrities from the film industry. In June 1924, Mary Pickford

Gladys Marie Smith (April 8, 1892 – May 29, 1979), known professionally as Mary Pickford, was a Canadian-American stage and screen actress and producer with a career that spanned five decades. A pioneer in the US film industry, she co-founde ...

and Douglas Fairbanks

Douglas Elton Fairbanks Sr. (born Douglas Elton Thomas Ullman; May 23, 1883 – December 12, 1939) was an American actor, screenwriter, director, and producer. He was best known for his swashbuckling roles in silent films including '' The Thie ...

were invited by SF to Stockholm and were guided around the Stockholm archipelago in Kreuger's motor yacht ''Loris''. A five-minute film sequence of this occasion is stored in SF's film archive. Pickford, Fairbanks, Kreuger, Charles Magnusson (the manager for SF), Greta Garbo

Greta Garbo (born Greta Lovisa Gustafsson; 18 September 1905 – 15 April 1990) was a Swedish-American actress. Regarded as one of the greatest screen actresses, she was known for her melancholic, somber persona, her film portrayals of tragedy, ...

and various SF employees appear in the film.

Early years in the United States

After the start of the 20th century, Kreuger spent seven years traveling and working abroad as an engineer in the USA, Mexico, South Africa and other countries, but spent most of the time in the US. In South Africa, he ran a restaurant for a short time together with his friendAnders Jordahl Anders Olsen Jordahl (April 4, 1878 – February 18, 1969) was a Norwegian-American engineer, inventor, entrepreneur and artist.

Anders Olsen Jordahl was born at Elverum in Hedmark, Norway. His parents were Ole Jordahl and Mary (Furer) Jordahl. ...

, but they soon sold the restaurant. At an early stage, he came in contact with the patented

Kahn System for concrete-steel constructions that was exploited by Julius Kahn's Trussed Concrete Steel Company

The Trussed Concrete Steel Company was founded in 1903 by Julius Kahn, an engineer and inventor. Its headquarters were in Detroit, Michigan, and its steel factory was in Youngstown, Ohio. The long company name changed to a shortened versi ...

, when working for different engineering companies, among them The Consolidated Engineering & Construction Co. and Purdy & Henderson in New York. This new technique had not been introduced in Sweden at that time. In 1907, he managed to get the representative rights for the system for both the Swedish and the German markets, and at the end of 1907, he returned to Sweden with the goal of introducing the new methods in both countries at the same time. At that time, one of the experts in Sweden in concrete-steel constructions was his cousin Henrik Kreüger

Henrik Kreüger (1882–1953) was born in Kalmar, Sweden, and obtained his M.Sc. in civil engineering in 1904 at the Royal Institute of Technology in Stockholm.

After graduating, he worked for the construction company Fritz Söderbergh in Stoc ...

working at KTH KTH may refer to:

* Keat Hong LRT station, Singapore, LRT station abbreviation

* Kent House railway station, London, National Rail station code

* KTH Royal Institute of Technology, a university in Sweden

* KTH Krynica, a Polish ice hockey team

* Khy ...

in Stockholm.

The building contractor and his innovations

In May 1908, Kreuger formed the construction firm

In May 1908, Kreuger formed the construction firm Kreuger & Toll

Kreuger & Toll was a company founded on May 18, 1908 by two Swedish engineers, Ivar Kreuger and Paul Toll, with Henrik Kreüger working as a consultant and chief engineer.

History

Early 1908, Ivar and his cousin Henrik Kreüger planned to estab ...

in Sweden with the engineer Paul Toll

Paul Sequens Esaias Toll (September 7, 1882 in Småland – July 3, 1946) was a Swedish construction engineer and co-founder, together with Ivar Kreuger, of the construction company Kreuger & Toll.

Paul Toll was born in the parish of Berga in K ...

, at that time working for the construction company Kasper Höglund AB, and his cousin Henrik Kreüger

Henrik Kreüger (1882–1953) was born in Kalmar, Sweden, and obtained his M.Sc. in civil engineering in 1904 at the Royal Institute of Technology in Stockholm.

After graduating, he worked for the construction company Fritz Söderbergh in Stoc ...

, working at the faculty of civil engineering at KTH KTH may refer to:

* Keat Hong LRT station, Singapore, LRT station abbreviation

* Kent House railway station, London, National Rail station code

* KTH Royal Institute of Technology, a university in Sweden

* KTH Krynica, a Polish ice hockey team

* Khy ...

, as a consulting engineer for the company. In Germany, he formed the company Deutsche Kahneisengesellschaft together with a colleague from his time in America, Anders Jordahl.

The concrete-steel construction method of constructing buildings was not fully accepted in Sweden at that time and in order to market the new technique, Kreuger held several lectures and wrote an illustrated article on the subject in a leading engineering magazine, ''Teknisk Tidskrift

''Teknisk Tidskrift'' (1871 – March 1872 ''Illustrerad Teknisk Tidning''), was founded in 1871 by the Swedish marine engineer Wilhelm Hoffstedt (1841–1907). The forerunner to '' Ny Teknik'', it has since its establishment been considered one ...

''. The new technology was a success and the firm won several prestigious contracts, such as the construction of the Stockholm Olympic Stadium

Stockholm Olympic Stadium ( sv, Stockholms Olympiastadion), most often called Stockholms stadion or (especially locally) simply Stadion, is a stadium in Stockholm, Sweden. Designed by architect Torben Grut, it was opened in 1912; its original use ...

(1911–12); the foundation work for the new Stockholm City Hall

Stockholm City Hall ( sv, Stockholms stadshus, ''Stadshuset'' locally) is the seat of Stockholm Municipality in Stockholm, Sweden. It stands on the eastern tip of Kungsholmen island, next to Riddarfjärden's northern shore and facing the islands ...

(1912–13) and the department store NK (1913–14) in Stockholm. The chief engineer behind these advanced projects was Henrik Kreüger.

Innovation in the construction business also included a definite commitment to finish the building on time. Hitherto the financial risk of delays were assumed by the clients. Kreuger & Toll was the first firm in Europe to commit to finish projects by a fixed date, thus shifting the risk to the builder, who after all was in the best position to reduce delays. When Kreuger won the contract to build a six-story "skyscraper", he promised that if construction wasn't finished by a particular date Kreuger & Toll would give the client a partial refund of $1,200 (about $18,000 in today's currencfor each late day. It is noteworthy that Kreuger & Toll's entire capital would have covered just two days of being late. The client, in turn, agreed to pay a bonus for every day the building was finished before the due date. Kreuger & Toll finished early and subsequently earned completion bonuses for every project. Within a few years, Kreuger & Toll was seen as the best building company in Sweden and one of the top firms in all of Europe. Within six years after its incorporation, Kreuger & Toll earned annual profits of around $200,000 and was paying a substantial dividend of 15%.''Kreuger Genius And Swindler'' by Robert Shaplen (Alfred A. Knopf Inc. New York; 1960)p.44 In 1917, the company was split into two separate companies: Kreuger & Toll Construction AB, with the majority of shares owned by Paul Toll. Ivar Kreuger was not among the board members in the construction company. How much of Paul Toll's company Ivar Kreuger owned has not been revealed—just that Paul Toll owned 60% in 1917 and, around 1930, 66% of the construction company. Kreuger & Toll Construction Co. has never shown up in any Kreuger & Toll Holding organisation charts. Kreuger & Toll Holding became his financial holding company, with Ivar Kreuger as the general manager and major share holder. He controlled it with a tight grip. The board of directors consisted of Ivar, his father, Paul Toll and two very close colleagues. After Ivar got involved in his father's match factories in Kalmar, he became more focused on "constructing" new companies or taking control of other corporations - usually paying with his own securities instead of cash - rather than buildings and bridges. Thus, by 1927, Ivar had bought banks, mining companies, railways, timber and paper firms, film distributors, real estate in several European cities as well as a controlling stake in L.M.

Ericsson

(lit. "Telephone Stock Company of LM Ericsson"), commonly known as Ericsson, is a Swedish multinational networking and telecommunications company headquartered in Stockholm. The company sells infrastructure, software, and services in informat ...

& Co., Sweden's leading phone company. He controlled about 50% of the world market in iron ore and cellulose. He owned mines all over the world including the Boliden

Boliden is a locality situated in Skellefteå Municipality, Västerbotten County, Sweden with 1,566 inhabitants in 2010. It lies 28,5 kilometers from Skellefteå City.

This is where Boliden AB

Boliden AB is a Swedish multinational metals, m ...

mine in Sweden, which had one of the richest gold deposits outside South Africa in addition to other minerals.

Kreuger formed Swedish Match

Swedish Match AB is a Swedish multinational tobacco company headquartered in Stockholm. The company manufactures snus, nicotine pouches, moist snuff, tobacco- and nicotine-free pouch products, chewing tobacco, chew bags, tobacco bits, cigars, ...

by merging his father's business with other match factories he had quietly bought during World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, the United States, and the Ottoman Empire, with fightin ...

. Its initial capital was around $10 million ($ in dollars) and Ivar owned about half of it, held all senior positions and controlled the board of directors.

The Swedish banker Oscar Rydbeck (1878–1951) became a close associate and an important teacher for Ivar in the financing business. He worked for Kreuger & Toll as a consultant from around 1912 until the Kreuger Crash in 1932 and was a member of its board of directors. For not having carried out his duties as a director he went to jail for 10 months after Ivar's death.

The match business

In 1911 and 1912, the Kreuger family match factories in

In 1911 and 1912, the Kreuger family match factories in Kalmar

Kalmar (, , ) is a city in the southeast of Sweden, situated by the Baltic Sea. It had 36,392 inhabitants in 2010 and is the seat of Kalmar Municipality. It is also the capital of Kalmar County, which comprises 12 municipalities with a total of ...

, Fredriksdal and Mönsterås

Mönsterås () is a locality and the seat of Mönsterås Municipality, Kalmar County, Sweden

Sweden, formally the Kingdom of Sweden,The United Nations Group of Experts on Geographical Names states that the country's formal name is the Ki ...

, run by his father Ernst Kreuger, uncle Fredrik Kreuger and his brother Torsten Kreuger, encountered financial problems. Kreuger was then advised by his banker Oscar Rydbeck to turn the factories into a stock corporation in order to raise more capital. This was the starting point for the reformation of the Swedish match industry as well as the major match companies in Norway and Finland. The goal was to get control of the entire match industry in Scandinavia.

With the family match factories as the base, Kreuger first founded the Swedish corporation ''AB Kalmar-Mönsterås Tändsticksfabrik'' in 1912. His father, Ernst, and uncle Fredrik, became the major shareholders and his brother Torsten was appointed the general manager. Ivar became a member of the board.

A merger between this company with several other small match companies in Sweden, the company ''AB Svenska Förenade Tändsticksfabriker'' was founded in 1913 with Ivar Kreuger as the general manager. Later, by merging with the largest match company in Sweden, ''AB Jönköping-Vulcan'', Svenska Tändsticks AB (Swedish Match

Swedish Match AB is a Swedish multinational tobacco company headquartered in Stockholm. The company manufactures snus, nicotine pouches, moist snuff, tobacco- and nicotine-free pouch products, chewing tobacco, chew bags, tobacco bits, cigars, ...

) was founded in 1917. Ivar had originally tried to convince ''AB Jönköping-Vulcan'' to merge in December 1912, but they had not been interested as Vulcan was the dominating match company in Sweden. Ivar then started to acquire all of the match companies as well as most of the raw material companies he could find in and around Sweden and then finally got ''AB Jönköping-Vulcan'' to accept the merger. He had been so persuasive in arguing for the merger that he managed to overvalue his side of the deal so that it was essentially the smaller organization taking over the larger one. It was his first big venture in inflating values, which became his prime tactic thereafter.

One of the main designers behind this operation, besides Ivar, was his banker Rydbeck. The total number of shares in the new company was 450,000. Ivar Kreuger personally owned 223,000 shares and his new holding company, Kreuger & Toll Holding AB, 60,000.

This company group now covered the entire match industry in Sweden, including all the major companies that manufactured the production machines used in the factories. The total number of employees working in match production in Sweden in 1917 was around 9000. It also had control over major companies supplying the raw material for the match industry. During this time Kreuger also acquired the largest match manufacturing companies in Norway ( Bryn and Halden

Halden (), between 1665 and 1928 known as Fredrikshald, is both a town and a municipality in Viken county, Norway. The municipality borders Sarpsborg to the northwest, Rakkestad to the north and Aremark to the east, as well as the Swedish muni ...

) and in Finland ( Wiborgs and Kekkola).

However, Kreuger not only "acquired" companies but also introduced a new way of thinking in the Swedish match industry with large scale production facilities as well as ideas to increase efficiency in production, administration, distribution, and marketing.

He managed to unite the Swedish match industry as well as the major match companies in Norway and Finland. With this new company structure the match industry in Scandinavia

Scandinavia; Sámi languages: /. ( ) is a subregion#Europe, subregion in Northern Europe, with strong historical, cultural, and linguistic ties between its constituent peoples. In English usage, ''Scandinavia'' most commonly refers to Denmark, ...

became a major competitor to large manufacturers elsewhere. Ivar's methods resembled those John D. Rockefeller

John Davison Rockefeller Sr. (July 8, 1839 – May 23, 1937) was an American business magnate and philanthropist. He has been widely considered the wealthiest American of all time and the richest person in modern history. Rockefeller was ...

used in the formation of the Standard Oil Trust

Standard Oil Company, Inc., was an American oil production, transportation, refining, and marketing company that operated from 1870 to 1911. At its height, Standard Oil was the largest petroleum company in the world, and its success made its co-f ...

transforming dozens of struggling factories into a strong and profitable monopoly. The methods had become illegal in the USA because of anti-trust laws, but were not against the law in Sweden at the time.

A German chemist had invented phosphorus

Phosphorus is a chemical element with the symbol P and atomic number 15. Elemental phosphorus exists in two major forms, white phosphorus and red phosphorus, but because it is highly reactive, phosphorus is never found as a free element on Ear ...

matches in 1832 but they were dangerous because the yellow phosphorus used was poisonous and because it was in the match head and thus could easily light by accident. The Swedes improved on the design by using a safer red phosphorus, which they put on the striking surface of the matchbox. They called them "safety matches". They made Sweden the leading exporter of matches and made matches the most important Swedish export.

It should be remembered that in the early part of the 20th century matches were a necessity for smoking and the lighting of stoves and gas appliances among other uses, and therefore demand for them was highly inelastic

In economics, elasticity measures the percentage change of one economic variable in response to a percentage change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the demand quantity to fall ...

, meaning that a monopolist could raise prices (and hence profits) significantly without much affecting the quantity sold.

By expanding the Swedish Match company through acquisition of government-created monopolies, the Swedish company became the world's largest match manufacturer. Kreuger set up an affiliate to Kreuger & Toll AB in the United States, and together with Lee, Higginson & Co. in New York, formed the International Match Corporation. This group eventually came to control almost 75% of the world production in matches.

Other business

From 1925 to 1930, years when many countries in Europe were suffering after theFirst World War

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, the United States, and the Ottoman Empire, with fightin ...

, Kreuger's companies gave loans to governments to speed up reconstruction. As a security, the governments would grant him the match monopoly in their country. This means that Kreuger gained a monopoly in match production, sales, or distribution, or a complete monopoly. The monopoly agreements differed from country to country. The capital was raised to a large extent through loans from Swedish and American banks, combined with issuing a large amount of participating debentures. Kreuger also often moved money from one corporation he controlled to another.

Kreuger did not limit himself to matches, but gained control of most of the forestry

Forestry is the science and craft of creating, managing, planting, using, conserving and repairing forests, woodlands, and associated resources for human and environmental benefits. Forestry is practiced in plantations and natural stands. Th ...

industry in northern Sweden and planned to become head of a cellulose

Cellulose is an organic compound with the formula , a polysaccharide consisting of a linear chain of several hundred to many thousands of β(1→4) linked D-glucose units. Cellulose is an important structural component of the primary cell wall ...

cartel

A cartel is a group of independent market participants who collude with each other in order to improve their profits and dominate the market. Cartels are usually associations in the same sphere of business, and thus an alliance of rivals. Mos ...

. He also attempted to create a telephone monopoly in Sweden.

After founding the pulp manufacturer SCA

SCA may refer to:

Biology and health

* Sickle cell disease, also known as sickle cell anaemia

* Spinocerebellar ataxia, a neurological condition

* Statistical coupling analysis, a method to identify covarying pairs of amino acids in protein mult ...

, in 1929 Kreuger was able to acquire the majority shares in the telephone company Ericsson

(lit. "Telephone Stock Company of LM Ericsson"), commonly known as Ericsson, is a Swedish multinational networking and telecommunications company headquartered in Stockholm. The company sells infrastructure, software, and services in informat ...

; the mining company Boliden

Boliden is a locality situated in Skellefteå Municipality, Västerbotten County, Sweden with 1,566 inhabitants in 2010. It lies 28,5 kilometers from Skellefteå City.

This is where Boliden AB

Boliden AB is a Swedish multinational metals, m ...

(gold); major interests in the ball bearing

A ball bearing is a type of rolling-element bearing that uses balls to maintain the separation between the bearing races.

The purpose of a ball bearing is to reduce rotational friction and support radial and axial loads. It achieves this ...

manufacturer SKF

AB SKF (Swedish: ''Svenska Kullagerfabriken''; 'Swedish Ball Bearing Factory') is a Swedish bearing and seal manufacturing company founded in Gothenburg, Sweden, in 1907. The company manufactures and supplies bearings, seals, lubrication and l ...

; the bank Skandinaviska Kreditaktiebolaget and others.

Abroad he acquired Deutsche Unionsbank in Germany and Union de Banques à Paris in France, often with the acquired company's own money. These maneuvers were made both necessary and possible by his invention, decades ahead of his time, of Enron-style financial engineering, which reported profits when there were none and paid out ever increasing dividends by attracting new investment and/or looting the treasury of a newly acquired company.

By 1931, Kreuger controlled some 200 companies. However, the Stock Market Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange colla ...

turned out to be a major factor in exposing his accounting that ultimately proved fatal to both him and his empire.

In the spring of 1930, he visited the United States and gave a lecture about the situation in world economics at the Industrial Club of Chicago with the title "The transfer problem and its importance to the United States". He was invited by President Hoover to the White House

The White House is the official residence and workplace of the president of the United States. It is located at 1600 Pennsylvania Avenue NW in Washington, D.C., and has been the residence of every U.S. president since John Adams in 1800. ...

to discuss the subject and in June he was awarded the title Doctor

Doctor or The Doctor may refer to:

Personal titles

* Doctor (title), the holder of an accredited academic degree

* A medical practitioner, including:

** Physician

** Surgeon

** Dentist

** Veterinary physician

** Optometrist

*Other roles

** ...

of Business Administration

Business administration, also known as business management, is the administration of a commercial enterprise. It includes all aspects of overseeing and supervising the business operations of an organization. From the point of view of management ...

by Syracuse University

Syracuse University (informally 'Cuse or SU) is a Private university, private research university in Syracuse, New York. Established in 1870 with roots in the Methodist Episcopal Church, the university has been nonsectarian since 1920. Locate ...

, where he had worked as a young chief engineer when Archbold Stadium

Archbold Stadium was a multi-purpose stadium in Syracuse, New York. It opened in 1907 and was home to the Syracuse Orangemen football team prior to the opening of the Carrier Dome in 1980.

History

After organizing athletics events at various ...

was built there in 1907.

In 1929, at the peak of his career, the Kreuger fortune was thought to be worth 30 billion Swedish kronor, equivalent to approximately US$100 billion in 2000, and consisting of more than 200 companies. In the same year, the total loans made by Swedish banks were barely 4 billion SEK.

Financial innovations and financial engineering

Obtaining a monopoly for the production and/or sale of matches in return for loans to governments was, in its essence, not a new way of doing business. Such schemes had been around for a long time (e.g. the Mississippi Bubble ofJohn Law

John Law may refer to:

Arts and entertainment

* John Law (artist) (born 1958), American artist

* John Law (comics), comic-book character created by Will Eisner

* John Law (film director), Hong Kong film director

* John Law (musician) (born 1961) ...

, and the South Sea Bubble

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both east and west.

Etymology

The word ''south'' comes from Old English ''sūþ'', from earlier Proto-Germanic ''*sunþaz ...

) but Kreuger was very creative inventing new ways of financing business, while making sure that he kept control of his companies.

B-shares

Kreuger financed his activities by selling shares and bonds of his companies as well as through large bank loans, mainly the last two. The use of debt in addition to equity is called leverage and it magnifies both gains and losses. With respect to selling shares, he invented dual class ownership shares since he did not want to lose control of his companies. He called the class of shares with reducedvoting power

Voting interest (or voting power) in business and accounting means the total number, or percent, of votes entitled to be cast on the issue at the time the determination of voting power is made, excluding a vote which is contingent upon the happeni ...

B shares. One of Kreuger's biographers, Frank Partnoy

Frank Partnoy is a Professor of Law at the University of California Berkeley School of Law. He was a George E. Barrett Professor of Law and Finance and the founding director of the Center on Corporate and Securities Law at the University of San ...

, called it "an ingenious piece of financial engineering". Ivar began with Swedish Match where he divided the common shares into two classes. Each class would have the same claim to dividends and profits, but the B shares would carry only 1/1000 of a vote, compared to one vote for each A share. In this way Ivar could double the size of his capital, while diluting his control by just a fraction of a percent.

Presently such shares are sometimes called A Shares with the B Shares having more voting power, as is the case with Google

Google LLC () is an American multinational technology company focusing on search engine technology, online advertising, cloud computing, computer software, quantum computing, e-commerce, artificial intelligence, and consumer electronics. ...

for instance where they carry ten times more voting power than the A Shares.

As already stated, these types of shares are used to this day although, unlike in Kreuger's time, there are often restrictions in some markets and/or jurisdictions nowadays. The New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed c ...

, for example, allows companies to list dual-class voting shares. Once shares are listed, however, companies are not allowed to reduce the voting rights of the existing shares or issue a new class of superior voting shares.

There is a wide range of dual-class share structures and their use between countries. In Canada, for example, an estimated 20% to 25% of companies currently listed on the TSX

The Toronto Stock Exchange (TSX; french: Bourse de Toronto) is a stock exchange located in Toronto, Ontario, Canada. It is the 10th largest exchange in the world and the third largest in North America based on market capitalization. Based in t ...

make use of some form of dual-class share structure or special voting rights. In the United States on the other hand, where rules on dual-class shares are much more restrictive and investor opposition is more vocal, just over 2% of companies issue restricted shares.

Convertible gold debentures

Ivar and Lee Higginson & Co., his investment banker in the USA, decided to have International Match issue new securities called convertible gold debentures. "Debenture" is a debt instrument not secured by physical collateral or assets. They were issued to mature in 20 years and they were payable in either dollars or gold, at the holder's option. These bonds gave investors the right to receive annual interest payments of 6.5 percent from International Match, which was an attractive rate at the time. Finally, these debentures were convertible, which meant that they could be converted into shares. If International Match performed well and the value of the shares increased, investors could switch from the debentures to the more valuable shares. The convertible feature made these securities particularly attractive: they have both downside protection (because in the case of bankruptcy the bond holders were paid before the shareholders) and upside potential. In other words, the best of both worlds. "Ivar and Lee Higginson had designed their first financial mousetrap." Ivar's popularity helped Lee Higginson sell $15 million of International Match gold debentures, at a price of $94.50 for each $100 of principal amount. Investors paid $94.50 in return for the right to receive interest of $6.50 per year for 20 years (6.5 percent of the hundred dollars principal amount.). The deal raised a total of $14,175,000, i.e. 94.5 percent of $15 million.American Certificates

Kreuger invented another financial instrument, which continues to be used and is nowadays known asAmerican depositary receipt

An American depositary receipt (ADR, and sometimes spelled ''depository'') is a negotiable security that represents securities of a foreign company and allows that company's shares to trade in the U.S. financial markets.

Shares of many non-U.S ...

s. That issue was called Kreuger & Toll "American Certificates". American investors had never seen an investment like this. It was part bond, part preferred stock, and part profit sharing option. The certificates enabled investors to gain exposure to a foreign company that had been paying dividends of 25 percent. It would be backed by the largest private loan to a foreign government (i.e. Germany) ever. Even in the midst of the growing panic investors went crazy for the issue and promised to buy 28 million dollars of the new securities. And this happened two days after Black Monday

Black Monday refers to specific Mondays when undesirable or turbulent events have occurred. It has been used to designate massacres, military battles, and stock market crashes.

Historic events

*1209, Dublin – when a group of 500 recently arriv ...

in 1929.

Binary foreign exchange option

The second Poland agreement also contained some extraordinary protection for International Match including a binary foreign exchange option, a kind of derivative contract, to protect International Match from any declines in the value of the dollar: "International Match Corporation shall have the right to obtain payment of interest in Dutch guilders or US dollars according to its choice and for all such payments one dollar shall be counted as 2½ guilders." To retain control of Garanta, Ivar created another innovative financial provision, which meant that during the first four years until October 1, 1929, International Match Corporation had the right to appoint the managing director of Garanta who alone was entitled to sign for the company. On or after October 1, 1929, International Match Corporation had the right to acquire 60 percent of the shares at par. This option term secured both initial control over Garanta and the right to own a majority of Garanta's shares in the future.Off balance sheet entities

This term means that details of an enterprise do not appear in the parent company's financial statements. Some of these entities were more or less secret. The associated debt, called "off balance sheet obligations", didn't appear in any financial statements of the companies Ivar controlled other than in summary form, if at all. Albert D. Berning of the firm Ernst & Ernst, International Match's auditor, rationalized it at the shareholder's meeting in 1926. He said "it is only customary to consolidate the assets and liabilities of companies in such a balance sheet when a substantial majority of the outstanding shares are owned by the parent company. Where less than such a majority is owned, the shares are included as investments." This invention gained rapid acceptance by others, e.g.Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, H ...

and Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before Bankruptcy of Lehman Brothers, filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Gol ...

. The former issued 250 million dollars' worth of complex securities (equivalent to about $ in dollars) in 1929. Lehman issued similar obligations, which immediately rose 30 percent. Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. ...

used them extensively and in the financial crisis of 2008 they played a major role in bringing down Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The compa ...

and Lehman Brothers.

Gambling

Despite the large number of ''bona fide

In human interactions, good faith ( la, bona fides) is a sincere intention to be fair, open, and honest, regardless of the outcome of the interaction. Some Latin phrases have lost their literal meaning over centuries, but that is not the case ...

'' companies Ivar controlled, he was an avid gambler.

He speculated with his personal funds and, especially, with the money of the corporations he controlled. Kreuger treated most of his companies as if they were exclusively his personal property. He frequently transferred funds from one corporation to another with little formality. A number of dummy corporations and holding companies (e.g. Garanta and Continental Investment Corporation) helped him to hide what he was doing. He also used other people as front men to conceal his actions, for example when he acquired almost half of the outstanding shares of Diamond Match Company

The Diamond Match Company has its roots in several nineteenth century companies. In the early 1850s, Edward Tatnall of Wilmington, Delaware was given an English recipe for making matches by a business acquaintance, William R. Smith. In 1853, Tatn ...

so as not to raise anti-trust

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust l ...

concerns in the USA. Towards the end, in 1932, when he frantically gambled with the securities of corporations he controlled in the vain attempt to reverse their falling prices, he played the markets himself and had friends help him in the effort to prop up share prices. Between the end of February and early March 1932 he needed to make over $10 million ($ in dollars) for payments, including Kreuger & Toll

Kreuger & Toll was a company founded on May 18, 1908 by two Swedish engineers, Ivar Kreuger and Paul Toll, with Henrik Kreüger working as a consultant and chief engineer.

History

Early 1908, Ivar and his cousin Henrik Kreüger planned to estab ...

dividends.

His speculations were in foreign currencies, equities and derivatives and he also signed loan agreements with governments not knowing where the funds would be coming from. For example, the majority stake he had bought in a chemical company in Griesheim, Germany returned 15 times his investment after two years when the company became part of I. G. Farben. Part of his attraction for investors were the high dividends Kreuger & Toll paid. Therefore, he also had to make sure that he had money to pay those dividends.

It has never been established how much Kreuger lost in these frantic efforts in early 1932, but it has been estimated to be between $50 million and $100 million (c. $ and $ in dollars).''Kreuger Genius and Swindler'' by Robert Shaplen (Alfred A. Knopf Inc. New York; 1960) p.182

His first sovereign loan went to Poland, and when Kreuger signed the agreement he had no idea where the funds would come from.

He made a deal with Germany for a $125 million-dollar loan ($ in dollars) with the conditions that Germany sign the Young Plan

The Young Plan was a program for settling Germany's World War I reparations. It was written in August 1929 and formally adopted in 1930. It was presented by the committee headed (1929–30) by American industrialist Owen D. Young, founder and for ...

and, of course, award him a match monopoly. (He already controlled 70% of German match production before the loan agreement.) When he signed the contract, again he had no idea where he would obtain the huge amount; however, he was lucky. Prime Minister Aristide Briand

Aristide Pierre Henri Briand (; 28 March 18627 March 1932) was a French statesman who served eleven terms as Prime Minister of France during the French Third Republic. He is mainly remembered for his focus on international issues and reconciliat ...

of France decided to repay a previous $75 million-dollar loan from Ivar before it was due. Incredibly, the French agreed to pay this sum by April 1930, just before Ivar's first payment to Germany was due. That payment gave Ivar enough cash to make his first installment. Either he had negotiated a sweetheart rescue deal with Prime Minister Briand, or he was incredibly lucky. He also made $5M (c. $ in dollars) due to the way the loan to France was structured. (It had been discounted and although France received only $70 million it was obligated to pay back $75 million.)

Companies controlled by Kreuger, c. 1930

It should be kept in mind that Kreuger controlled around 400 companies, therefore the following list is highly selective.''Kreuger Genius And Swindler'' by Robert Shaplen (Alfred A. Knopf Inc. New York; 1960) p. 6 * Kreuger & Toll AB. Holding company for most corporations Kreuger controlled. (Notable exceptions includeDiamond Match Company

The Diamond Match Company has its roots in several nineteenth century companies. In the early 1850s, Edward Tatnall of Wilmington, Delaware was given an English recipe for making matches by a business acquaintance, William R. Smith. In 1853, Tatn ...

, of which he owned almost half the outstanding shares, Ohio Match Company and I.G. Farben

Interessengemeinschaft Farbenindustrie AG (), commonly known as IG Farben (German for 'IG Dyestuffs'), was a German chemical and pharmaceutical conglomerate. Formed in 1925 from a merger of six chemical companies—BASF, Bayer, Hoechst, Agfa, ...

.)

* Svenska Tändsticks Aktiebolaget-STAB

* International Match Corporation, US. Holding company for countries outside Europe. Founded in 1923.

* Diamond Match, US

* Ohio Match, US

* Stora Kopparbergs Bergslags AB

* Svenska kullagerfabriken (Ball bearing company)

* LKAB

Luossavaara-Kiirunavaara Aktiebolag (LKAB) is a government owned Swedish mining company. The company mines iron ore at Kiruna and at Malmberget in northern Sweden. The company was established in 1890, and has been 100% state-owned since the 1950s ...

(Mining company)

* Bolidens Gruv AB (Mining company, mainly gold.)

* Hufvudstaden AB (Real estate company. Main interests in Stockholm City. Founded by Ivar Kreuger 1915.)

* Telefon AB L.M. Ericsson

* SCA

SCA may refer to:

Biology and health

* Sickle cell disease, also known as sickle cell anaemia

* Spinocerebellar ataxia, a neurological condition

* Statistical coupling analysis, a method to identify covarying pairs of amino acids in protein mult ...

(Cellulose industry.)

* Högbroforsens Industri AB (Cellulose industry.)

* Sirus A/G

* Szikra Ungar. Zundholzfabriken

* Alsing Trading Co, England

* SF (Movie industry.)

* Skandinaviska Kreditaktiebolaget

* Stockholms Inteckningsgaranti AB

* Trafik AB Grängesberg-Oxelösund (Railroad company.)

* Deutsche Bank

Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Sto ...

* Union de Banques à Paris

* Banque de Suède et de Paris

* Hollandsche Koopmansbank

* Aktienbauverein Passage

* AG für Hausbesitz

* Bank Amerykański w Polsce, Poland

Kreuger group loans to foreign states, 1925–1930

The total loans by Kreuger to foreign states have been estimated to US$ 387m in 1930, corresponding to about USD$ 7.1 - 10.4 bn in 2013 currency. *Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It is divided into 16 administrative provinces called voivodeships, covering an area of . Poland has a population of over 38 million and is the fifth-most populous ...

I, 1925: $6m and Poland II, 1930: $32.4m

* Free State Danzig, 1930: $1m

* Greece

Greece,, or , romanized: ', officially the Hellenic Republic, is a country in Southeast Europe. It is situated on the southern tip of the Balkans, and is located at the crossroads of Europe, Asia, and Africa. Greece shares land borders with ...

I, 1926: GB£1m and Greece II, 1931: £1m

* Ecuador

Ecuador ( ; ; Quechua: ''Ikwayur''; Shuar: ''Ecuador'' or ''Ekuatur''), officially the Republic of Ecuador ( es, República del Ecuador, which literally translates as "Republic of the Equator"; Quechua: ''Ikwadur Ripuwlika''; Shuar: ''Eku ...

I, 1927: $2m and Ecuador II, 1929: $1m

* France

France (), officially the French Republic ( ), is a country primarily located in Western Europe. It also comprises of Overseas France, overseas regions and territories in the Americas and the Atlantic Ocean, Atlantic, Pacific Ocean, Pac ...

, 1927: $75m

* Yugoslavia

Yugoslavia (; sh-Latn-Cyrl, separator=" / ", Jugoslavija, Југославија ; sl, Jugoslavija ; mk, Југославија ;; rup, Iugoslavia; hu, Jugoszlávia; rue, label=Pannonian Rusyn, Югославия, translit=Juhoslavija ...

, 1928: $22m

* Kingdom of Hungary

The Kingdom of Hungary was a monarchy in Central Europe that existed for nearly a millennium, from the Middle Ages into the 20th century. The Principality of Hungary emerged as a Christian kingdom upon the coronation of the first king Stephen ...

, 1928: $36m

* Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwe ...

, 1929: $125m

* Latvia

Latvia ( or ; lv, Latvija ; ltg, Latveja; liv, Leţmō), officially the Republic of Latvia ( lv, Latvijas Republika, links=no, ltg, Latvejas Republika, links=no, liv, Leţmō Vabāmō, links=no), is a country in the Baltic region of ...

, 1928: $6m

* Romania

Romania ( ; ro, România ) is a country located at the crossroads of Central Europe, Central, Eastern Europe, Eastern, and Southeast Europe, Southeastern Europe. It borders Bulgaria to the south, Ukraine to the north, Hungary to the west, S ...

, 1930: $30m

* Lithuania

Lithuania (; lt, Lietuva ), officially the Republic of Lithuania ( lt, Lietuvos Respublika, links=no ), is a country in the Baltic region of Europe. It is one of three Baltic states and lies on the eastern shore of the Baltic Sea. Lithuania ...

, 1930: $6m

* Bolivia

, image_flag = Bandera de Bolivia (Estado).svg

, flag_alt = Horizontal tricolor (red, yellow, and green from top to bottom) with the coat of arms of Bolivia in the center

, flag_alt2 = 7 × 7 square p ...

, 1930: 2 $m

* Estonia

Estonia, formally the Republic of Estonia, is a country by the Baltic Sea in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the sea across from Sweden, to the south by Latvia, a ...

, 1928: SEK 7.6m

* Guatemala

Guatemala ( ; ), officially the Republic of Guatemala ( es, República de Guatemala, links=no), is a country in Central America. It is bordered to the north and west by Mexico; to the northeast by Belize and the Caribbean; to the east by H ...

, 1930; $2.5m

* Turkey

Turkey ( tr, Türkiye ), officially the Republic of Türkiye ( tr, Türkiye Cumhuriyeti, links=no ), is a list of transcontinental countries, transcontinental country located mainly on the Anatolia, Anatolian Peninsula in Western Asia, with ...

, 1930: $10m

* Part of the "Young-loan" to Germany, 1930: US$15m

Kreuger planned to issue a loan of $75m to Italy, known as the "Italian Bond

Bond or bonds may refer to:

Common meanings

* Bond (finance), a type of debt security

* Bail bond, a commercial third-party guarantor of surety bonds in the United States

* Chemical bond, the attraction of atoms, ions or molecules to form chemica ...

" in 1930 but the deal was never completed.

End of the Kreuger empire and death

In March 1931, during a meeting at the German Ministry of Finance in Berlin, Swiss bankerFelix Somary

Felix Somary (21 November 1881, Vienna, Austria-Hungary – 11 July 1956, Zurich, Switzerland) was an Austrian-Swiss banker; he is also noted as a scholar of political economy.

Life

The son of a lawyer, Somary studied law and economy at the Un ...

already warned of a bankruptcy of Kreuger's match company. By mid-1931, rumours spread that Kreuger & Toll and other companies in Kreuger's empire were financially unstable. In February 1932, Kreuger turned to Sveriges Riksbank

Sveriges Riksbank, or simply the ''Riksbank'', is the central bank of Sweden. It is the world's oldest central bank and the fourth oldest bank in operation.

Etymology

The first part of the word ''riksbank'', ''riks'', stems from the Swedish w ...

for the second time in his life to support him in raising a large increase in his loans. At this time his total loans from Swedish banks were estimated at about half of the Swedish reserve currency, which had started to have negative effects on the value of the Swedish currency in the international financial market. In order to grant him more loans, the government required that a complete statement of accounts of Kreuger's entire company group be presented, as the bank's (Sveriges Riksbank

Sveriges Riksbank, or simply the ''Riksbank'', is the central bank of Sweden. It is the world's oldest central bank and the fourth oldest bank in operation.

Etymology

The first part of the word ''riksbank'', ''riks'', stems from the Swedish w ...

) own calculations showed that Kreuger & Toll finances were far too weak to give him more loans.

At that time, Ivar Kreuger was in the United States and was asked to return to Europe for a meeting with the chairman of the Riksbank, Ivar Rooth

Ivar Rooth (2 November 1888 – 27 February 1972) was a Swedish lawyer and economist who served as the governor of the Swedish National Bank from 1929 to 1948 and the second managing director of the International Monetary Fund (IMF) from 1951 ...

. He had left Sweden for the last time on 23 November 1931 and returned to Europe on the ship ''Ile de France'', arriving in Paris on 11 March 1932. The meeting with Ivar Rooth was scheduled to take place on 13 or 14 March in Berlin

Berlin ( , ) is the capital and largest city of Germany by both area and population. Its 3.7 million inhabitants make it the European Union's most populous city, according to population within city limits. One of Germany's sixteen constitue ...

. He met with Krister Littorin (vice president of Kreuger & Toll holding) and his own banker Oscar Rydbeck in Paris on 11 March to prepare for the Berlin meeting. But the day after, he was found dead in bed in his apartment at Avenue Victor Emanuel III. After questioning Kreuger's servants (his French maid, Mademoiselle Barrault, and the janitor

A janitor (American English, Scottish English), also known as a custodian, porter, cleanser, cleaner or caretaker, is a person who cleans and maintains buildings. In some cases, they will also carry out maintenance and security duties. A simil ...

who had had contact with Kreuger in the morning) the French police and a physician came to the conclusion that he had shot himself some time between 10:45 a.m. and 12:10 p.m. A 9-mm semi-automatic gun was found on the bed beside the body.

He left a sealed envelope in the room, addressed to Krister Littorin, which contained three other sealed envelopes - one addressed to his sister Britta; one to Sune Schéle; and one addressed to Littorin. In the letter to Littorin (for some reason written in English although Littorin was his closest Swedish colleague), he wrote:

I have made such a mess of things that I believe this to be the most satisfactory solution for everybody concerned. Please, take care of these two letters also see that two letters which were sent a couple of days ago by Jordahl to me at 5, Avenue Victor Emanuel are returned to Jordahl. The letters were sent by Majestic - Goodbye now and thanks. I K.''Ivar Kreuger was interred in

Norra begravningsplatsen

Norra begravningsplatsen, literally "The Northern Cemetery" in Swedish, is a major cemetery of the Stockholm urban area, located in Solna Municipality. Inaugurated on 9 June 1827, it is the burial site for a number of Swedish notables.

Nota ...

in Stockholm.

Murder allegations

While his family believed Ivar Kreuger to have been murdered, it was only more than 30 years after Ivar Kreuger's death that many previously classified Kreuger & Toll documents and Ivar Kreuger documents were made public. Based on these and his insight in his brother's business and life, Ivar's brother Torsten Kreuger wrote a book in 1963 (2nd edition) called ''Kreuger & Toll'', describing how Kreuger & Toll had been taken over, and how then the other Kreuger companies were taken over too. In 1965, Torsten Kreuger published ''Sanningen om Ivar Kreuger'' (published in English as: "Ivar Kreuger: The Truth at Last") claiming that his brother Ivar had been murdered. Recently, more books have been written claiming that more documents have re-appeared or were finally released to public scrutiny, and supporting Torsten Kreuger's claims that his brother was murdered: ''Därför mördades Ivar Kreuger'' ("The Reason for the Murder of Ivar Kreuger") () (1990), and ''Kreuger-Mordet: En utredning med nya fakta'' (translation: "The Kreuger Murder: An Investigation with New Facts") () (2000).The Kreuger Crash

Kreuger's death precipitated the ''Kreuger Crash'' which hit investors and companies worldwide, but particularly hard in the United States and Sweden. In 1933 and 1934, the U.S. Congress passed several security reform legislations that were meant to prevent a repeat of the Kreuger Crash. These bills were largely successful in their mission and the American financial industry did not witness frauds of the same magnitude until theEnron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. ...

scandal

A scandal can be broadly defined as the strong social reactions of outrage, anger, or surprise, when accusations or rumours circulate or appear for some reason, regarding a person or persons who are perceived to have transgressed in some way. Th ...

and Bernard Madoff

Bernard Lawrence Madoff ( ; April 29, 1938April 14, 2021) was an American fraudster and financier who was the admitted mastermind of the largest Ponzi scheme in history, worth about $64.8 billion. He was at one time chairman of the NASDAQ s ...

's Ponzi scheme

A Ponzi scheme (, ) is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are comin ...

.

A ''Foreign Affairs

''Foreign Affairs'' is an American magazine of international relations and U.S. foreign policy published by the Council on Foreign Relations, a nonprofit, nonpartisan, membership organization and think tank specializing in U.S. foreign policy and ...

'' report from 1930 had judged that of the $630m worth of assets the company claimed to have, $200m came from the match business, $30m were in the bank, and the other $400m were merely categorized as "other investments". When the company finally went bankrupt at the end of March 1932, claimed assets of $250m turned out to be non-existent.

Prior to the crash, Kreuger had issued thousands of participating debenture

In corporate finance, a debenture is a medium- to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The legal term "debenture" originally referred to a document that either creates a debt or acknowl ...

s. These were very popular, and a firm public belief in the rising Kreuger empire convinced contemporary Swedes to invest in these "Kreuger papers". Following the Kreuger crash, both the debentures and shares became worthless, and several thousand Swedes and small banks lost their savings and investments as a result. Large investors and suppliers apart from share holders, received a total of 43% back. The banks related to the Wallenberg family

The Wallenberg family is a prominent Swedish family, Europe's most powerful business dynasty. Wallenbergs are noted as bankers, industrialists, politicians, bureaucrats, diplomats and military. The Wallenberg sphere's holdings employ about 600 ...

company group, Stenbeck company group, and Handelsbanken

Svenska Handelsbanken AB is a Swedish bank providing banking services including traditional corporate transactions, investment banking and trading as well as consumer banking including insurance. Handelsbanken is one of the major banks in Sweden ...

took over most of the companies in the Kreuger empire. Swedish Match recovered shortly after the crash as did most of the industrial companies within the Kreuger empire. Swedish Match received a large government guaranteed loan that was fully repaid after several years. IMCO in US however did not survive. The liquidation took nine years and was eventually finished in 1941.

Tentative conclusions

One biographer called him a genius and swindler.John Kenneth Galbraith

John Kenneth Galbraith (October 15, 1908 – April 29, 2006), also known as Ken Galbraith, was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through t ...

wrote "Boiler-room operators, peddlers of stocks in the imaginary Canadian mines, mutual-fund managers whose genius and imagination are unconstrained by integrity, as well as less exotic larcenists, should read about Kreuger. He was the Leonardo of their craft." Ivar himself admitted to some extent that not all was above board when he said, "I've built my enterprise on the firmest ground that can be found—the foolishness of people." Perhaps Andrew Beattie summed it up best: "Ivar Kreuger is still a bit of an enigma in history. ...At times it seemed that he was a solid, if ruthless, businessman, and at other times he appeared every inch a scam artist. Between those times, he either built a match monopoly that overreached or orchestrated one of the biggest pyramid schemes in history."

Many of his financial schemes did indeed have some parallels with a Ponzi scheme in as much as he needed to raise more and more funds in order to finance the loans he extended to governments in exchange for match monopolies. It's obvious that it's impossible to have earnings in single digits (as these sovereign loans typically paid) and continue paying dividends in double digits. Dividends were as high as 20%.''Called to Account: Fourteen Financial Frauds that Shaped the American Accounting Profession, Routledge, 2008'' by Paul M. Clikeman, (Routledge, 2008) p. 23. Excerpts are at: https://books.google.com/books?hl=en&lr=&id=nn0G1wT8cagC&oi=fnd&pg=PR10&dq=related:bexGr3avgIsJ:scholar.google.com/&ots=KdIOMYm6Tu&sig=147GGhtVx7ieJfp68pXjr5wS0oU#v=onepage&q&f=false However, while paying high dividends was definitely one of the attractions of Kreuger's companies, paying dividends to his investors did not come exclusively from new investors, which is the case in Ponzi schemes.

Balance sheets and Profit and Loss statements served one major purpose, if not the only one, for Ivar and that was they had to be helpful in his fund raising efforts. Often they were just pure fantasy to be revised at will to please investors. He also frequently treated the assets of corporations he controlled as if they were his own. However, things should be seen in the context of the time. IBM, for example, consolidated all its accounts in one named Plant, Property, Equipment, Machines, Patents and Goodwill. American Can doubled its reported net earnings in 1913 by claiming only $1 million of depreciation after having claimed $2.5 million the previous year. Many companies set up arbitrary reserves in good times to be used in bad years and few holding companies published consolidated financial statements

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity.

Relevant financial information is presented in a structured manner and in a form which is easy to un ...

.

Accounting standards and auditors' responsibility for the accuracy of financial statements evolved over time. Corporations resisted publishing audited financial statements. US Steel

United States Steel Corporation, more commonly known as U.S. Steel, is an American integrated steel producer headquartered in Pittsburgh, Pennsylvania, with production operations primarily in the United States of America and in several countries ...

defied convention when it published its first audited financial statements in 1903. Indeed, accountants in the early 1900s "fiercely resisted efforts to impose strict accounting standards". It was not until the US Securities Acts' of 1933

Events

January

* January 11 – Sir Charles Kingsford Smith makes the first commercial flight between Australia and New Zealand.

* January 17 – The United States Congress votes in favour of Philippines independence, against the wis ...

and 1934

Events

January–February

* January 1 – The International Telecommunication Union, a specialist agency of the League of Nations, is established.

* January 15 – The 8.0 1934 Nepal–Bihar earthquake, Nepal–Bihar earthquake strik ...

—both heavily influenced by Kreuger's actions—that generally accepted accounting principles (GAAP) began to be established. Only in the 1970s and 1980s were auditors forced to accept more responsibility for the veracity of financial statements but loopholes continued to exist (and probably still do).

Dishonesty was part of Ivar's behaviour almost from the beginning of his career. In the first loan for a match monopoly, Ivar's brother Torsten negotiated with Dr. Marjam Glowacki, a senior Polish finance ministry official. After the documents were signed Ivar decided that it might be useful in the future to replicate Dr. Glowacki's signature. He ordered a rubber stamp that would produce a facsimile should he need it in the future. He did not use it; however, from then on he had rubber stamps made of official signatures of almost all his match deals. ''"Mostly, Ivar had been skirting the edges of legal rules, to preserve his own flexibility."'' But the forgery of Italian bonds was outright fraud. A lithographer

who had printed share certificates for Ivar made 42 Italian bills, which Ivar signed with the names of G. Boselli (an official in the Ministry of Finance) and A. Mosconi, (the Minister of Finance). It has never been explained why these forgeries were so crude. He even misspelled Boselli's name several times. Ivar kept them in his safe for almost two years. They would have been worth between 100 and 140 million dollars, if they had not been forged. (About 1.5 to 2.1 billion in today's money) When he was desperate for funds, Ivar

tried to use them claiming that they were genuine.

Yet it would be a mistake to conclude that Ivar was nothing but a crook. Reality was more nuanced. For one thing disclosure rules in his days were much less stringent. Many corporations refused to reveal details for fear competitors would gain an advantage. (At least that was the claim often made.) Some firms did not even publish quarterly results. Ivar, too, was very secretive and not only with investors. When he was on the verge of hiring somebody he usually asked: "Can he keep a secret?" He was also very fond of quoting his motto for success: "Silence, more silence, and still more silence." Also one cannot fault him for the speculative fever in the 1920s. Without the hunger for ever larger profits many of Ivar's schemes would not have been possible. Incidentally this facilitated a transfer of capital from the USA to Europe where it was, often desperately, needed. He sold shares in the US worth 250 million dollars (equivalent to c. 3.75 billion today) and transferred almost all of it to his holding company in Liechtenstein, Continental Investment Corporation. Shareholders of International Match had given him authority to do this so there was nothing wrong with it. There was also a tax advantage because of the advantageous deal he had negotiated with Liechtenstein. But Ivar did it above all to have the flexibility to manipulate balance sheets and financial statements so they would look more attractive to investors as well as helping him—to some extent—pay the high dividends of Swedish Match and Kreuger & Toll

Kreuger & Toll was a company founded on May 18, 1908 by two Swedish engineers, Ivar Kreuger and Paul Toll, with Henrik Kreüger working as a consultant and chief engineer.

History

Early 1908, Ivar and his cousin Henrik Kreüger planned to estab ...

. He got the nickname "Saviour of Europe" by lending about $400 million (equivalent to c. $6 billion today) to rebuild their shattered economies after World War I. He invented new financial instruments to help him raise funds and, of course, make him money. Indeed, many consider Ivar to be the father of modern financial schemes. Oscar Rydbeck, his Swedish banker, said Ivar was the third richest man in the world. He, however, claimed "money as such means nothing to me". Ivar was also a successful speculator for much of his life, earning money until shortly before the end. Trying to support the collapsing share prices of many of his companies (including ways which were—if not illegal—questionable, e.g. using straw men for share transactions. In the case of his acquisition of Diamond Match shares it was clearly illegal because of anti-trust laws.)

He controlled many legitimate, profitable businesses, some of which still exist to this day. (Examples include Swedish Match