Currencies of Monaco on:

[Wikipedia]

[Google]

[Amazon]

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of

Originally currency was a form of receipt, representing grain stored in temple granaries in Sumer in ancient

Originally currency was a form of receipt, representing grain stored in temple granaries in Sumer in ancient

Most major economies using coinage had several tiers of coins of different values, made of copper, silver, and gold. Gold coins were the most valuable and were used for large purchases, payment of the military, and backing of state activities. Units of account were often defined as the value of a particular type of gold coin. Silver coins were used for midsized transactions, and sometimes also defined a unit of account, while coins of copper or silver, or some mixture of them (see

Most major economies using coinage had several tiers of coins of different values, made of copper, silver, and gold. Gold coins were the most valuable and were used for large purchases, payment of the military, and backing of state activities. Units of account were often defined as the value of a particular type of gold coin. Silver coins were used for midsized transactions, and sometimes also defined a unit of account, while coins of copper or silver, or some mixture of them (see

At around the same time in the medieval Islamic world, a vigorous

At around the same time in the medieval Islamic world, a vigorous

The currency used is based on the concept of lex monetae; that a sovereign state decides which currency it shall use. The

The currency used is based on the concept of lex monetae; that a sovereign state decides which currency it shall use. The

In most cases, a central bank has the exclusive power to issue all forms of currency, including coins and banknotes (

In most cases, a central bank has the exclusive power to issue all forms of currency, including coins and banknotes (

Tracker Monthly reporting and statistics on renminbi(RMB) progress towards becoming an international currency

/ref>

money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as ...

in any form, in use or circulation as a medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

, for example banknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

s and coin

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order t ...

s.

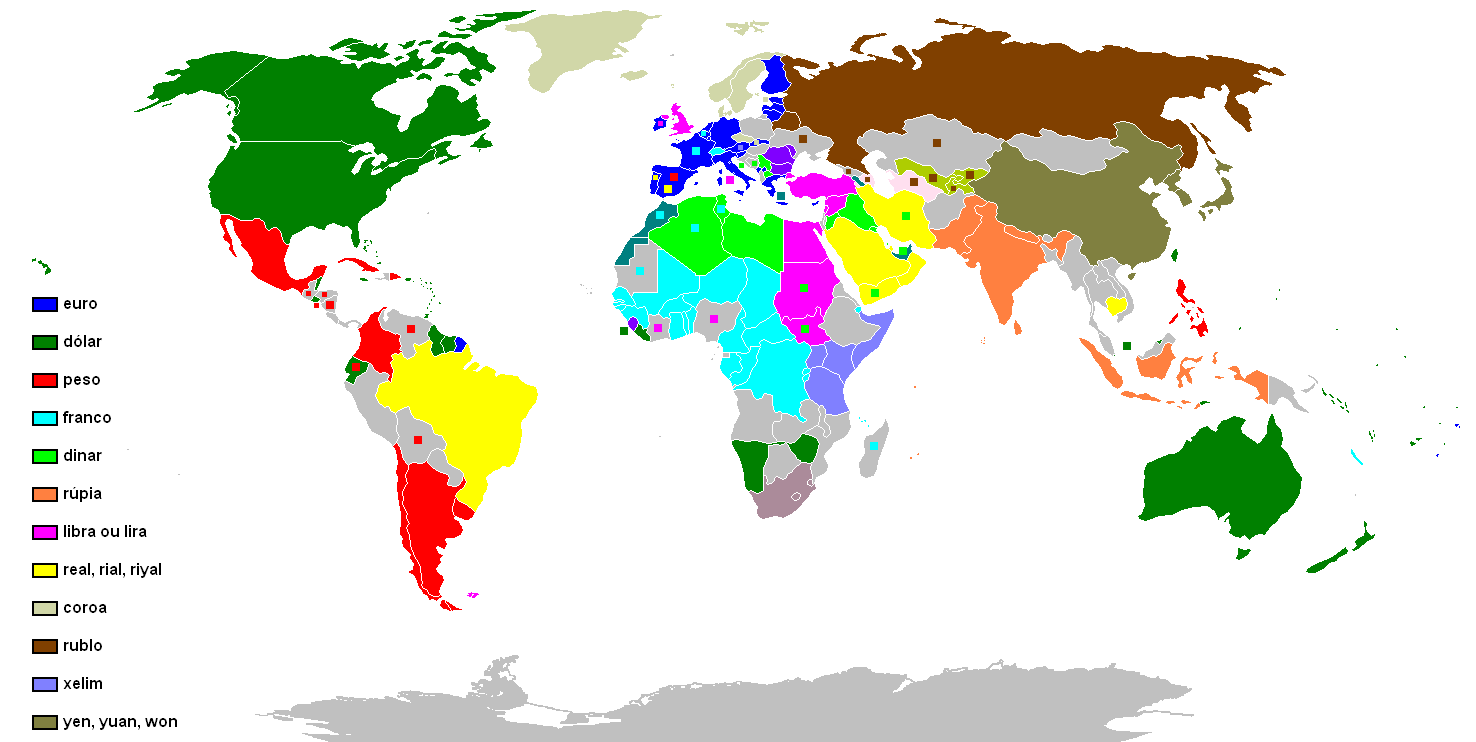

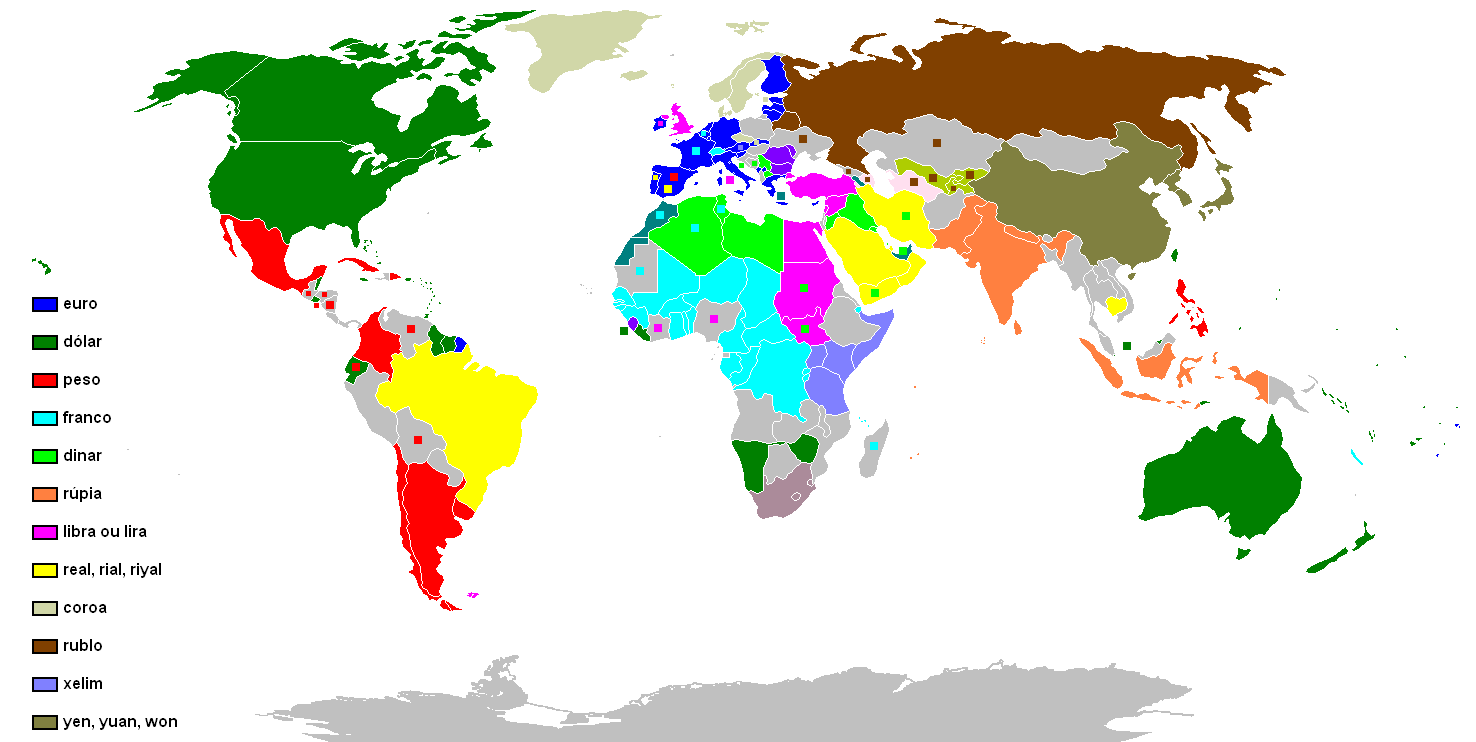

A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

s (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometime ...

. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

laws may require a particular unit of account for payments to government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is ...

agencies.

Other definitions of the term "currency" appear in the respective synonymous articles: banknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

, coin

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order t ...

, and money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as ...

. This article uses the definition which focuses on the currency systems of countries.

One can classify currencies into three monetary system

A monetary system is a system by which a government provides money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks.

Commodity money system

A commodity m ...

s: fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometim ...

, commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representat ...

, and representative money

Representative money or receipt money is any medium of exchange, printed or digital, that represents something of Value (economics), value, but has little or no value of its own (intrinsic value). Unlike some forms of fiat money (which may have n ...

, depending on what guarantees a currency's value (the economy

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the ...

at large vs. the government's physical metal reserve

Reserve or reserves may refer to:

Places

* Reserve, Kansas, a US city

* Reserve, Louisiana, a census-designated place in St. John the Baptist Parish

* Reserve, Montana, a census-designated place in Sheridan County

* Reserve, New Mexico, a US vi ...

s). Some currencies function as legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

in certain jurisdictions, or for specific purposes, such as payment to a government (taxes

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

), or government agencies (fees, fines). Others simply get traded for their economic value.

Digital currency has arisen with the popularity of computers and the Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a '' network of networks'' that consists of private, pub ...

. Whether digital notes and coins will be successfully developed remains dubious. Decentralized digital currencies, such as cryptocurrencies are different as they are not issued by a government monetary authority

In finance and economics, a monetary authority is the entity that manages a country’s currency and money supply, often with the objective of controlling inflation, interest rates, real GDP or unemployment rate. With its monetary tools, a m ...

. Many warnings issued by various countries note the opportunities that cryptocurrencies create for illegal activities, such as money laundering and terrorism

Terrorism, in its broadest sense, is the use of criminal violence to provoke a state of terror or fear, mostly with the intention to achieve political or religious aims. The term is used in this regard primarily to refer to intentional violen ...

.

In 2014 the United States IRS

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax ...

issued a statement explaining that virtual currency is treated as property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

for Federal income-tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency.

History

Early currency

Originally currency was a form of receipt, representing grain stored in temple granaries in Sumer in ancient

Originally currency was a form of receipt, representing grain stored in temple granaries in Sumer in ancient Mesopotamia

Mesopotamia ''Mesopotamíā''; ar, بِلَاد ٱلرَّافِدَيْن or ; syc, ܐܪܡ ܢܗܪ̈ܝܢ, or , ) is a historical region of Western Asia situated within the Tigris–Euphrates river system, in the northern part of the ...

and in Ancient Egypt.

In this first stage of currency, metals were used as symbols to represent value stored in the form of commodities. This formed the basis of trade in the Fertile Crescent

The Fertile Crescent ( ar, الهلال الخصيب) is a crescent-shaped region in the Middle East, spanning modern-day Iraq, Syria, Lebanon, Israel, Palestine and Jordan, together with the northern region of Kuwait, southeastern region of ...

for over 1500 years. However, the collapse of the Near Eastern trading system pointed to a flaw: in an era where there was no place that was safe to store value, the value of a circulating medium could only be as sound as the forces that defended that store. A trade could only reach as far as the credibility of that military. By the late Bronze Age

The Bronze Age is a historic period, lasting approximately from 3300 BC to 1200 BC, characterized by the use of bronze, the presence of writing in some areas, and other early features of urban civilization. The Bronze Age is the second prin ...

, however, a series of treaties

A treaty is a formal, legally binding written agreement between actors in international law. It is usually made by and between sovereign states, but can include international organizations, individuals, business entities, and other legal pers ...

had established safe passage for merchants around the Eastern Mediterranean, spreading from Minoan

The Minoan civilization was a Bronze Age Aegean civilization on the island of Crete and other Aegean Islands, whose earliest beginnings were from 3500BC, with the complex urban civilization beginning around 2000BC, and then declining from 1450B ...

Crete

Crete ( el, Κρήτη, translit=, Modern: , Ancient: ) is the largest and most populous of the Greek islands, the 88th largest island in the world and the fifth largest island in the Mediterranean Sea, after Sicily, Sardinia, Cyprus, ...

and Mycenae

Mycenae ( ; grc, Μυκῆναι or , ''Mykē̂nai'' or ''Mykḗnē'') is an archaeological site near Mykines in Argolis, north-eastern Peloponnese, Greece. It is located about south-west of Athens; north of Argos; and south of Corinth. ...

in the northwest to Elam and Bahrain

Bahrain ( ; ; ar, البحرين, al-Bahrayn, locally ), officially the Kingdom of Bahrain, ' is an island country in Western Asia. It is situated on the Persian Gulf, and comprises a small archipelago made up of 50 natural islands and an ...

in the southeast. It is not known what was used as a currency for these exchanges, but it is thought that ox-hide shaped ingots of copper, produced in Cyprus

Cyprus ; tr, Kıbrıs (), officially the Republic of Cyprus,, , lit: Republic of Cyprus is an island country located south of the Anatolian Peninsula in the eastern Mediterranean Sea. Its continental position is disputed; while it is ge ...

, may have functioned as a currency.

It is thought that the increase in piracy and raiding associated with the Bronze Age collapse

The Late Bronze Age collapse was a time of widespread societal collapse during the 12th century BC, between c. 1200 and 1150. The collapse affected a large area of the Eastern Mediterranean (North Africa and Southeast Europe) and the Near ...

, possibly produced by the Peoples of the Sea

The Sea Peoples are a hypothesized seafaring confederation that attacked ancient Egypt and other regions in the East Mediterranean prior to and during the Late Bronze Age collapse (1200–900 BCE).. Quote: "First coined in 1881 by the Fren ...

, brought the trading system of oxhide ingots to an end. It was only the recovery of Phoenician trade in the 10th and 9th centuries BC that led to a return to prosperity, and the appearance of real coinage, possibly first in Anatolia with Croesus of Lydia and subsequently with the Greeks and Persians. In Africa, many forms of value store have been used, including beads, ingots, ivory

Ivory is a hard, white material from the tusks (traditionally from elephants) and teeth of animals, that consists mainly of dentine, one of the physical structures of teeth and tusks. The chemical structure of the teeth and tusks of mammals i ...

, various forms of weapons, livestock, the manilla currency

Manillas are a form of commodity money, usually made of bronze or copper, which were used in West Africa.Chamberlain, C. C.(1963). The Teach Yourself ''Guide to Numismatics''. English Universities Press. p. 92. They were produced in large number ...

, and ochre and other earth oxides. The manilla rings of West Africa

West Africa or Western Africa is the westernmost region of Africa. The United Nations defines Western Africa as the 16 countries of Benin, Burkina Faso, Cape Verde, The Gambia, Ghana, Guinea, Guinea-Bissau, Ivory Coast, Liberia, Mali, M ...

were one of the currencies used from the 15th century onwards to sell slaves. African currency

African currency was originally formed from basic items, materials, animals and even people available in the locality to create a medium of exchange. This started to change from the 17th century onwards, as European colonial powers introduced thei ...

is still notable for its variety, and in many places, various forms of barter

In trade, barter (derived from ''baretor'') is a system of exchange in which participants in a transaction directly exchange goods or services for other goods or services without using a medium of exchange, such as money. Economists disti ...

still apply.

Coinage

The prevalence of metal coins possibly led to the metal itself being the store of value: first copper, then both silver and gold, and at one point also bronze. Today other non-precious metals are used for coins. Metals were mined, weighed, and stamped into coins. This was to assure the individual accepting the coin that he was getting a certain known weight of precious metal. Coins could be counterfeited, but the existence of standard coins also created a newunit of account

In economics, unit of account is one of the money functions. A unit of account is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of rela ...

, which helped lead to banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Becau ...

. Archimedes' principle

Archimedes' principle (also spelled Archimedes's principle) states that the upward buoyant force that is exerted on a body immersed in a fluid, whether fully or partially, is equal to the weight of the fluid that the body displaces. Archimedes' ...

provided the next link: coins could now be easily tested for their fine weight of the metal, and thus the value of a coin could be determined, even if it had been shaved, debased or otherwise tampered with (see Numismatics

Numismatics is the study or collection of currency, including coins, tokens, paper money, medals and related objects.

Specialists, known as numismatists, are often characterized as students or collectors of coins, but the discipline also includ ...

).

Most major economies using coinage had several tiers of coins of different values, made of copper, silver, and gold. Gold coins were the most valuable and were used for large purchases, payment of the military, and backing of state activities. Units of account were often defined as the value of a particular type of gold coin. Silver coins were used for midsized transactions, and sometimes also defined a unit of account, while coins of copper or silver, or some mixture of them (see

Most major economies using coinage had several tiers of coins of different values, made of copper, silver, and gold. Gold coins were the most valuable and were used for large purchases, payment of the military, and backing of state activities. Units of account were often defined as the value of a particular type of gold coin. Silver coins were used for midsized transactions, and sometimes also defined a unit of account, while coins of copper or silver, or some mixture of them (see debasement

A debasement of coinage is the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money, such as gold or silver coins. A coin is said to be debased if the quantity of gold, silver, copper or nick ...

), might be used for everyday transactions. This system had been used in ancient India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the so ...

since the time of the Mahajanapadas. The exact ratios between the values of the three metals varied greatly between different eras and places; for example, the opening of silver mines in the Harz

The Harz () is a highland area in northern Germany. It has the highest elevations for that region, and its rugged terrain extends across parts of Lower Saxony, Saxony-Anhalt, and Thuringia. The name ''Harz'' derives from the Middle High German ...

mountains of central Europe made silver relatively less valuable, as did the flood of New World

The term ''New World'' is often used to mean the majority of Earth's Western Hemisphere, specifically the Americas."America." ''The Oxford Companion to the English Language'' (). McArthur, Tom, ed., 1992. New York: Oxford University Press, p. ...

silver after the Spanish conquests. However, the rarity of gold consistently made it more valuable than silver, and likewise silver was consistently worth more than copper.

Paper money

In premodern China, the need for lending and for a medium of exchange that was less physically cumbersome than large numbers ofcopper

Copper is a chemical element with the symbol Cu (from la, cuprum) and atomic number 29. It is a soft, malleable, and ductile metal with very high thermal and electrical conductivity. A freshly exposed surface of pure copper has a pinkis ...

coins led to the introduction of paper money

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

, i.e. banknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

s. Their introduction was a gradual process that lasted from the late Tang dynasty

The Tang dynasty (, ; zh, t= ), or Tang Empire, was an imperial dynasty of China that ruled from 618 to 907 AD, with an interregnum between 690 and 705. It was preceded by the Sui dynasty and followed by the Five Dynasties and Ten Kingdom ...

(618–907) into the Song dynasty

The Song dynasty (; ; 960–1279) was an imperial dynasty of China that began in 960 and lasted until 1279. The dynasty was founded by Emperor Taizu of Song following his usurpation of the throne of the Later Zhou. The Song conquered the rest ...

(960–1279). It began as a means for merchants to exchange heavy coinage for receipt

A receipt (also known as a packing list, packing slip, packaging slip, (delivery) docket, shipping list, delivery list, bill of the parcel, manifest, or customer receipt) is a document acknowledging that a person has received money or propert ...

s of deposit issued as promissory notes by wholesaler

Wholesaling or distributing is the sale of goods or merchandise to retailers; to industrial, commercial, institutional or other professional business users; or to other wholesalers (wholesale businesses) and related subordinated services. In ...

s' shops. These notes were valid for temporary use in a small regional territory. In the 10th century, the Song dynasty

The Song dynasty (; ; 960–1279) was an imperial dynasty of China that began in 960 and lasted until 1279. The dynasty was founded by Emperor Taizu of Song following his usurpation of the throne of the Later Zhou. The Song conquered the rest ...

government began to circulate these notes amongst the traders in its monopolized salt industry. The Song government granted several shops the right to issue banknotes, and in the early 12th century the government finally took over these shops to produce state-issued currency. Yet the banknotes issued were still only locally and temporarily valid: it was not until the mid 13th century that a standard and uniform government issue of paper money became an acceptable nationwide currency. The already widespread methods of woodblock printing

Woodblock printing or block printing is a technique for printing text, images or patterns used widely throughout East Asia and originating in China in antiquity as a method of textile printing, printing on textiles and later paper. Each page o ...

and then Bi Sheng's movable type

Movable type (US English; moveable type in British English) is the system and technology of printing and typography that uses movable components to reproduce the elements of a document (usually individual alphanumeric characters or punctuation m ...

printing

Printing is a process for mass reproducing text and images using a master form or template. The earliest non-paper products involving printing include cylinder seals and objects such as the Cyrus Cylinder and the Cylinders of Nabonidus. The ...

by the 11th century were the impetus for the mass production of paper money in premodern China.

At around the same time in the medieval Islamic world, a vigorous

At around the same time in the medieval Islamic world, a vigorous monetary economy

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it ...

was created during the 7th–12th centuries on the basis of the expanding levels of circulation of a stable high-value currency (the dinar). Innovations introduced by Muslim economists, traders and merchants include the earliest uses of credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

, cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The pers ...

s, promissory notes, savings account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transa ...

s, transaction account

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. It is available to the ...

s, loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that ...

ing, trusts

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the "settl ...

, exchange rates, the transfer of credit and debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The ...

, and banking institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial insti ...

s for loans and deposits

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

...

.

In Europe, paper currency was first introduced on a regular basis in Sweden in 1661 (although Washington Irving

Washington Irving (April 3, 1783 – November 28, 1859) was an American short-story writer, essayist, biographer, historian, and diplomat of the early 19th century. He is best known for his short stories "Rip Van Winkle" (1819) and " The Legen ...

records an earlier emergency use of it, by the Spanish in a siege during the Conquest of Granada). As Sweden was rich in copper, many copper coins were in circulation, but its relatively low value necessitated extraordinarily big coins, often weighing several kilograms.

The advantages of paper currency were numerous: it reduced the need to transport gold and silver, which was risky; it facilitated loans of gold or silver at interest, since the underlying specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

(money in the form of gold or silver coins rather than notes) never left the possession of the lender until someone else redeemed the note; and it allowed a division of currency into credit- and specie-backed forms. It enabled the sale of stock in joint-stock companies

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareholders are ...

and the redemption of those shares in a paper.

But there were also disadvantages. First, since a note has no intrinsic value, there was nothing to stop issuing authorities from printing more notes than they had specie to back them with. Second, because this increased the money supply, it increased inflationary pressures, a fact observed by David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" ''Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment phil ...

in the 18th century. Thus paper money would often lead to an inflationary bubble, which could collapse if people began demanding hard money, causing the demand for paper notes to fall to zero. The printing of paper money was also associated with wars, and financing of wars, and therefore regarded as part of maintaining a standing army. For these reasons, paper currency was held in suspicion and hostility in Europe and America. It was also addictive since the speculative profits of trade and capital creation were quite large. Major nations established mints

A mint or breath mint is a food item often consumed as an after-meal refreshment or before business and social engagements to improve breath odor. Mints are commonly believed to soothe the stomach given their association with natural byproducts ...

to print money and mint coins, and branches of their treasury to collect taxes and hold gold and silver stock.

At that time, both silver and gold were considered a legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

and accepted by governments for taxes. However, the instability in the exchange rate between the two grew over the course of the 19th century, with the increases both in the supply of these metals, particularly silver, and in trade. The parallel use of both metals is called bimetallism, and the attempt to create a bimetallic standard where both gold and silver backed currency remained in circulation occupied the efforts of inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

ists. Governments at this point could use currency as an instrument of policy, printing paper currency such as the United States greenback, to pay for military expenditures. They could also set the terms at which they would redeem notes for specie, by limiting the amount of purchase, or the minimum amount that could be redeemed.

By 1900, most of the industrializing nations were on some form of gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the l ...

, with paper notes and silver coins constituting the circulating medium. Private bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

s and governments across the world followed Gresham's law

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable com ...

: keeping the gold and silver they received but paying out in notes. This did not happen all around the world at the same time, but occurred sporadically, generally in times of war or financial crisis, beginning in the early 20th century and continuing across the world until the late 20th century, when the regime of floating fiat currencies came into force. One of the last countries to break away from the gold standard was the United States in 1971, an action which was known as the Nixon shock. No country has an enforceable gold standard or silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following ...

currency system.

Banknote era

Abanknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

or bill is a type of currency and is commonly used as legal tender in many jurisdictions. Together with coin

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order t ...

s, banknotes make up the cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In bookkeeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-im ...

form of a currency. Banknotes were initially mostly paper, but Australia's Commonwealth Scientific and Industrial Research Organisation

The Commonwealth Scientific and Industrial Research Organisation (CSIRO) is an Australian Government agency responsible for scientific research.

CSIRO works with leading organisations around the world. From its headquarters in Canberra, CSIRO ...

developed a polymer currency in the 1980s; it went into circulation on the nation's bicentenary in 1988. Polymer banknotes had already been introduced in the Isle of Man

)

, anthem = "O Land of Our Birth"

, image = Isle of Man by Sentinel-2.jpg

, image_map = Europe-Isle_of_Man.svg

, mapsize =

, map_alt = Location of the Isle of Man in Europe

, map_caption = Location of the Isle of Man (green)

in Europe ...

in 1983. As of 2016, polymer currency is used in over 20 countries (over 40 if counting commemorative issues), and dramatically increases the life span of banknotes and reduces counterfeiting.

Modern currencies

The currency used is based on the concept of lex monetae; that a sovereign state decides which currency it shall use. The

The currency used is based on the concept of lex monetae; that a sovereign state decides which currency it shall use. The International Organization for Standardization

The International Organization for Standardization (ISO ) is an international standard development organization composed of representatives from the national standards organizations of member countries. Membership requirements are given in Art ...

has introduced a system of three-letter codes ( ISO 4217) to denote currency (as opposed to simple names or currency signs), in order to remove the confusion arising because there are dozens of currencies called the dollar

Dollar is the name of more than 20 currencies. They include the Australian dollar, Brunei dollar, Canadian dollar, Hong Kong dollar, Jamaican dollar, Liberian dollar, Namibian dollar, New Taiwan dollar, New Zealand dollar, Singapore dollar, ...

and several called the franc

The franc is any of various units of currency. One franc is typically divided into 100 centimes. The name is said to derive from the Latin inscription ''francorum rex'' (King of the Franks) used on early French coins and until the 18th centu ...

. Even the "pound" is used in nearly a dozen different countries; most of these are tied to the pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and ...

, while the remainder has varying values. In general, the three-letter code uses the ISO 3166-1

ISO 3166-1 (''Codes for the representation of names of countries and their subdivisions – Part 1: Country codes'') is a standard defining codes for the names of countries, dependent territories, and special areas of geographical interest. It ...

country code for the first two letters and the first letter of the name of the currency (D for dollar, for example) as the third letter. United States currency, for instance, is globally referred to as USD

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official ...

. Currencies such as the pound sterling have different codes, as the first two letters denote not the exact country name but an alternative name also used to describe the country. The pound's code is GBP where ''GB'' denotes Great Britain

Great Britain is an island in the North Atlantic Ocean off the northwest coast of continental Europe. With an area of , it is the largest of the British Isles, the largest European island and the ninth-largest island in the world. It i ...

instead of the United Kingdom.

The former currencies include the marks

Marks may refer to:

Business

* Mark's, a Canadian retail chain

* Marks & Spencer, a British retail chain

* Collective trade marks, trademarks owned by an organisation for the benefit of its members

* Marks & Co, the inspiration for the novel ...

that were in circulation in Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwe ...

and Finland

Finland ( fi, Suomi ; sv, Finland ), officially the Republic of Finland (; ), is a Nordic country in Northern Europe. It shares land borders with Sweden to the northwest, Norway to the north, and Russia to the east, with the Gulf of B ...

.

The International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

uses a different system when referring to national currencies.

Alternative currencies

Distinct from centrally controlled government-issued currencies, private decentralized trust-reduced networks support alternative currencies such asCardano (blockchain platform)

Cardano is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake. It can facilitate peer-to-peer transactions with its internal cryptocurrency, ADA.

Cardano's development began in 20 ...

, bitcoin, Ethereum's ether, Litecoin

Litecoin ( Abbreviation: LTC; sign: Ł) is a decentralized peer-to-peer cryptocurrency and open-source software project released under the MIT/X11 license. Inspired by Bitcoin, Litecoin was among the earliest altcoins, starting in October 201 ...

, Monero

Monero (; Abbreviation: XMR) is a decentralized cryptocurrency. It uses a public distributed ledger with privacy-enhancing technologies that obfuscate transactions to achieve anonymity and fungibility. Observers cannot decipher addresses t ...

, Peercoin

Peercoin, also known as Peer-to-Peer Coin, PP Coin, or PPC is a cryptocurrency utilizing both proof-of-stake and proof-of-work systems.

History

Peercoin is based on an August 2012 paper which listed the authors as Scott Nadal and Sunny King. K ...

, or Dogecoin

Dogecoin ( or , Abbreviation: DOGE; sign: Ð) is a cryptocurrency created by software engineers Billy Markus and Jackson Palmer, who decided to create a payment system as a "joke", making fun of the wild speculation in cryptocurrencies at the ...

, which are classified as cryptocurrency since the transfer of value is assured through cryptographic signatures validated by all users. There are also brand

A brand is a name, term, design, symbol or any other feature that distinguishes one seller's good or service from those of other sellers. Brands are used in business, marketing, and advertising for recognition and, importantly, to create ...

ed currencies, for example 'obligation' based stores of value, such as quasi-regulated BarterCard, Loyalty Points (Credit Cards, Airlines) or Game-Credits (MMO games) that are based on reputation of commercial products, or highly regulated 'asset-backed' 'alternative currencies' such as mobile-money schemes like MPESA (called E-Money Issuance).● ''TED Video:'' ● ''Corresponding written article:''

The currency may be Internet-based and digital, for instance, bitcoin is not tied to any specific country, or the IMF's SDR that is based on a basket of currencies (and assets held).

Possession and sale of alternative forms of currencies is often outlawed by governments in order to preserve the legitimacy of the constitutional currency for the benefit of all citizens. For example, Article I, section 8, clause 5 of the United States Constitution delegates to United States Congress, Congress the power to coin money and to regulate the value thereof. This power was delegated to Congress in order to establish and preserve a uniform standard of value and to insure a singular monetary system for all purchases and debts in the United States, public and private. Along with the power to coin money, the United States Congress has the concurrent power to restrain the circulation of money which is not issued under its own authority in order to protect and preserve the constitutional currency. It is a violation of federal law for individuals, or organizations to create private coin or currency systems to compete with the official coinage and currency of the United States.

Control and production

In most cases, a central bank has the exclusive power to issue all forms of currency, including coins and banknotes (

In most cases, a central bank has the exclusive power to issue all forms of currency, including coins and banknotes (fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometim ...

), and to restrain the circulation alternative currencies for its own area of circulation (a country or group of countries); it regulates the production of currency by banks (credit (finance), credit) through monetary policy.

An exchange rate is a price at which two currencies can be exchanged against each other. This is used for international trade, trade between the two currency zones. Exchange rates can be classified as either floating exchange rate, floating or fixed exchange-rate system, fixed. In the former, day-to-day movements in exchange rates are determined by the market; in the latter, governments intervene in the market to buy or sell their currency to balance supply and demand at a static exchange rate.

In cases where a country has control of its own currency, that control is exercised either by a central bank or by a Finance minister, Ministry of Finance. The institution that has control of monetary policy is referred to as the monetary authority. Monetary authorities have varying degrees of autonomy from the governments that create them. A monetary authority is created and supported by its sponsoring government, so independence can be reduced by the legislative or executive authority that creates it.

Several countries can use the same name for their own separate currencies (for example, a ''dollar'' in Australian dollar, Australia, Canadian dollar, Canada, and the United States dollar, United States). By contrast, several countries can also use the same currency (for example, the euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

or the CFA franc), or one country can declare the currency of another country to be legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

. For example, Panama and El Salvador have declared US currency to be legal tender, and from 1791 to 1857, Spanish dollars were legal tender in the United States. At various times countries have either re-stamped foreign coins or used currency boards, issuing one note of currency for each note of a foreign government held, as Ecuador currently does.

Each currency typically has a main currency unit (the dollar

Dollar is the name of more than 20 currencies. They include the Australian dollar, Brunei dollar, Canadian dollar, Hong Kong dollar, Jamaican dollar, Liberian dollar, Namibian dollar, New Taiwan dollar, New Zealand dollar, Singapore dollar, ...

, for example, or the euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

) and a fractional unit, often defined as of the main unit: 100 Cent (currency), cents = 1 dollar

Dollar is the name of more than 20 currencies. They include the Australian dollar, Brunei dollar, Canadian dollar, Hong Kong dollar, Jamaican dollar, Liberian dollar, Namibian dollar, New Taiwan dollar, New Zealand dollar, Singapore dollar, ...

, 100 centimes = 1 franc

The franc is any of various units of currency. One franc is typically divided into 100 centimes. The name is said to derive from the Latin inscription ''francorum rex'' (King of the Franks) used on early French coins and until the 18th centu ...

, 100 pence = 1 Pound sterling, pound, although units of or occasionally also occur. Some currencies do not have any smaller units at all, such as the Icelandic króna and the Japanese yen.

Mauritania and Madagascar are the only remaining countries that have theoretical fractional units not based on the decimal system; instead, the Mauritanian ouguiya is in theory divided into 5 khoums, while the Malagasy ariary is theoretically divided into 5 iraimbilanja. In these countries, words like ''dollar'' or ''pound'' "were simply names for given weights of gold". Due to inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

khoums and iraimbilanja have in practice fallen into disuse. (See non-decimal currencies for other historic currencies with non-decimal divisions.)

Currency convertibility

Subject to variation around the world, local currency can be converted to another currency or vice versa with or without central bank/government intervention. Such conversions take place in the foreign exchange market. Based on the above restrictions or free and readily conversion features, currencies are classified as: ; Fully convertible: When there are no restrictions or limitations on the amount of currency that can be traded on the international market, and the government does not artificially impose a fixed value or minimum value on the currency in international trade. The US dollar is one of the main fully convertible currencies. ; Partially convertible: Central banks control international investments flowing into and out of a country. While most domestic transactions are handled without any special requirements, there are significant restrictions on international investing, and special approval is often required in order to convert into other currencies. The Indian rupee and the renminbi are examples of partially convertible currencies. ; Nonconvertible: A government neither participates in the international currency market nor allows the conversion of its currency by individuals or companies. These currencies are also known as ''blocked'', e.g. the North Korean won and the Cuban peso. According to the three aspects of trade in goods and services, capital flows and national policies, the supply-demand relationship of different currencies determines the exchange ratio between currencies. Trade in goods and services Through cost transfer, goods and services circulating in the country (such as hotels, tourism, catering, advertising, household services) will indirectly affect the trade cost of goods and services and the price of export trade. Therefore, services and goods involved in international trade are not the only reason affecting the exchange rate. The large number of international tourists and overseas students has resulted in the flow of services and goods at home and abroad. It also represents that the competitiveness of global goods and services directly affects the change of international exchange rates. Capital flows National currencies will be traded on international markets for investment purposes. Investment opportunities in each country attract other countries into investment programs, so that these foreign currencies become the reserves of the central banks of each country. The exchange rate mechanism, in which currencies are quoted continuously between countries, is based on foreign exchange markets in which currencies are invested by individuals and traded or speculated by central banks and investment institutions. In addition, changes in interest rates, capital market fluctuations and changes in investment opportunities will affect the global capital inflows and outflows of countries around the world, and exchange rates will fluctuate accordingly. National policies The country's foreign trade, monetary and fiscal policies affect the exchange rate fluctuations. Foreign trade includes policies such as tariffs and import standards for commodity exports. The impact of monetary policy on the total amount and yield of money directly determines the changes in the international exchange rate. Fiscal policies, such as transfer payments, taxation ratios, and other factors, dominate the profitability of capital and economic development, and the ratio of national debt issuance to deficit determines the repayment capacity and credit rating of the country. Such policies determine the mechanism of linking domestic and foreign currencies and therefore have a significant impact on the generation of exchange rates. Currency convertibility is closely linked to economic development and finance. There are strict conditions for countries to achieve currency convertibility, which is a good way for countries to improve their economies. The currencies of some countries or regions in the world are freely convertible, such as the US dollar, Australian dollar and Japanese yen. The requirements for currency convertibility can be roughly divided into four parts: ; Sound microeconomic agency With a freely convertible currency, domestic firms will have to compete fiercely with their foreign counterparts. The development of competition among them will affect the implementation effect of currency convertibility. In addition, microeconomics is a prerequisite for macroeconomic conditions. ; The macroeconomic situation and policies are stable Since currency convertibility is the cross-border flow of goods and capital, it will have an impact on the macro economy. This requires that the national economy be in a normal and orderly state, that is, there is no serious inflation and economic overheating. In addition, the government should use macro policies to make mature adjustments to deal with the impact of currency exchange on the economy. ; A reasonable and open economy The maintainability of international balance of payments is the main performance of reasonable economic structure. Currency convertibility not only causes difficulties in the sustainability of international balance of payments but also affects the government's direct control over international economic transactions. To eliminate the foreign exchange shortage, the government needs adequate international reserves. ; Appropriate exchange rate regime and level The level of exchange rate is an important factor in maintaining exchange rate stability, both before and after currency convertibility. The exchange rate of freely convertible currency is too high or too low, which can easily trigger speculation and undermine the stability of macroeconomic and financial markets. Therefore, to maintain the level of exchange rate, a proper exchange rate regime is crucial.Local currency

In economics, a local currency is a currency not backed by a national government and intended to trade only in a small area. Advocates such as Jane Jacobs argue that this enables an economically depressed region to pull itself up, by giving the people living there a medium of exchange that they can use to exchange services and locally produced goods (in a broader sense, this is the original purpose of all money). Opponents of this concept argue that local currency creates a barrier that can interfere with economies of scale and comparative advantage and that in some cases they can serve as a means of tax evasion. Local currencies can also come into being when there is economic turmoil involving the national currency. An example of this is the Argentinian economic crisis of 2002 in which IOU (debt), IOUs issued by local governments quickly took on some of the characteristics of local currencies. One of the best examples of a local currency is the original LETS currency, founded on Vancouver Island in the early 1980s. In 1982, the Bank of Canada, Canadian Central Bank’s lending rates ran up to 14% which drove chartered bank lending rates as high as 19%. The resulting currency and credit scarcity left island residents with few options other than to create a local currency.List of major world payment currencies

The following table are estimates of the 20 most frequently used currencies in world payments in November 2022 by SWIFT./ref>

See also

Related concepts * Counterfeit money * Currency band * Currency transaction tax * Debasement * Exchange rate * Fiscal localism * Foreign exchange market * Foreign exchange reserves * Functional currency * History of banking * History of money * Mutilated currency * Optimum currency area * Slang terms for money * Virtual currency * World currency Accounting units * Currency pair * Currency symbol * Currency strength * European Currency Unit * Fictional currency * Franc Poincaré * Local currencies * Petrocurrency * Special drawing rights Lists * ISO 4217 * List of alternative names for currency * List of currencies * List of circulating currencies * List of proposed currencies * List of historical currencies * List of historical exchange rates * List of international trade topics * List of motifs on banknotesNotes

References

External links

* * * {{Authority control Currency, Foreign exchange market