|

IRS

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitution ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRS Sign

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitution ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IRS Building On Constitution Avenue In DC

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissioner Of Internal Revenue

The Commissioner of Internal Revenue is the head of the Internal Revenue Service (IRS), an agency within the United States Department of the Treasury. The office of Commissioner was created by Congress as part of the Revenue Act of 1862. Section 7803 of the Internal Revenue Code provides for the appointment of a Commissioner of Internal Revenue to administer and supervise the execution and application of the internal revenue laws. The Commissioner is appointed by the President of the United States, with the consent of the U.S. Senate, for a five-year term. Douglas O’Donnell became the current and Acting Commissioner of Internal Revenue after Charles P. Rettig's term as Commissioner ended on November 12, 2022. Responsibilities The Commissioner's duties include administering, managing, conducting, directing, and supervising "the execution and application of the internal revenue laws or related statutes and tax conventions to which the United States is a party" and advising the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act of 2010 amendment, it represents the U.S. healthcare system's most significant regulatory overhaul and expansion of coverage since the enactment of Medicare and Medicaid in 1965. The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered. The law also enacted a host of delivery system reforms intended to constrain healthcare costs and improve quality. After it went into effect, increases in overall healthcare spending slowed, including premiums for employer-based insurance plans. The increased coverage was due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Service

A revenue service, revenue agency or taxation authority is a government agency responsible for the intake of government revenue, including taxes and sometimes non-tax revenue. Depending on the jurisdiction, revenue services may be charged with tax collection, investigation of Tax avoidance and tax evasion, tax evasion, or carrying out audits. In certain instances, they also administer payments to certain relevant individuals (such as statutory sick pay, statutory maternity pay) as well as targeted financial support (welfare) to families and individuals (through payment of tax credits or transfer payments). The chief executive of the revenue agency is usually styled as Commissioner, Minister, Secretary or Director. Revenue services by jurisdiction }, AFIP) , — , - , , State Revenue Committee (Armenia), State Revenue Committee of Armenia ( hy, Պետական Եկամուտների Կոմիտե (ՊԵԿ)) , — , - , , Australian Taxation Office (ATO) , — , - , , National B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sixteenth Amendment To The United States Constitution

The Sixteenth Amendment (Amendment XVI) to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of '' Pollock v. Farmers' Loan & Trust Co.'' The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in ''Pollock''. Prior to the early 20th century, most federal revenue came from tariffs rather than taxes, although Congress had often imposed excise taxes on various goods. The Revenue Act of 1861 had introduced the first federal income tax, but that tax was repealed in 1872. During the late nineteenth century, various groups, including the Populist Party, favored the establishment of a progressive income tax at the federal level. These groups believed that tariffs unfairly taxed the poor, and they favored using the income tax to shif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Service

A revenue service, revenue agency or taxation authority is a government agency responsible for the intake of government revenue, including taxes and sometimes non-tax revenue. Depending on the jurisdiction, revenue services may be charged with tax collection, investigation of Tax avoidance and tax evasion, tax evasion, or carrying out audits. In certain instances, they also administer payments to certain relevant individuals (such as statutory sick pay, statutory maternity pay) as well as targeted financial support (welfare) to families and individuals (through payment of tax credits or transfer payments). The chief executive of the revenue agency is usually styled as Commissioner, Minister, Secretary or Director. Revenue services by jurisdiction }, AFIP) , — , - , , State Revenue Committee (Armenia), State Revenue Committee of Armenia ( hy, Պետական Եկամուտների Կոմիտե (ՊԵԿ)) , — , - , , Australian Taxation Office (ATO) , — , - , , National B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1862

The Revenue Act of 1862 (July 1, 1862, Ch. 119, ), was a bill the United States Congress passed to help fund the American Civil War. President Abraham Lincoln signed the act into law on July 1, 1862. The act established the office of the Commissioner of Internal Revenue, a department in charge of the collection of taxes, and levied excise taxes on most items consumed and traded in the United States. The act also introduced the United States' first progressive tax with the intent of raising millions of dollars for the Union. Background The American Civil War commenced in 1861 with the secession of many southern states (the group known as the Confederate States of America) from the United States (also known as the Union). In the early stages of the war, the Union believed that the conflict would be a relatively quick and easy victory.Thorndike, Joe. An Army of Officials: The Civil War Bureau of Internal Revenue. Tax History Project. TaxAnalysits, 21 Dec. 2001. Web. 25 Mar. 2013. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The depart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

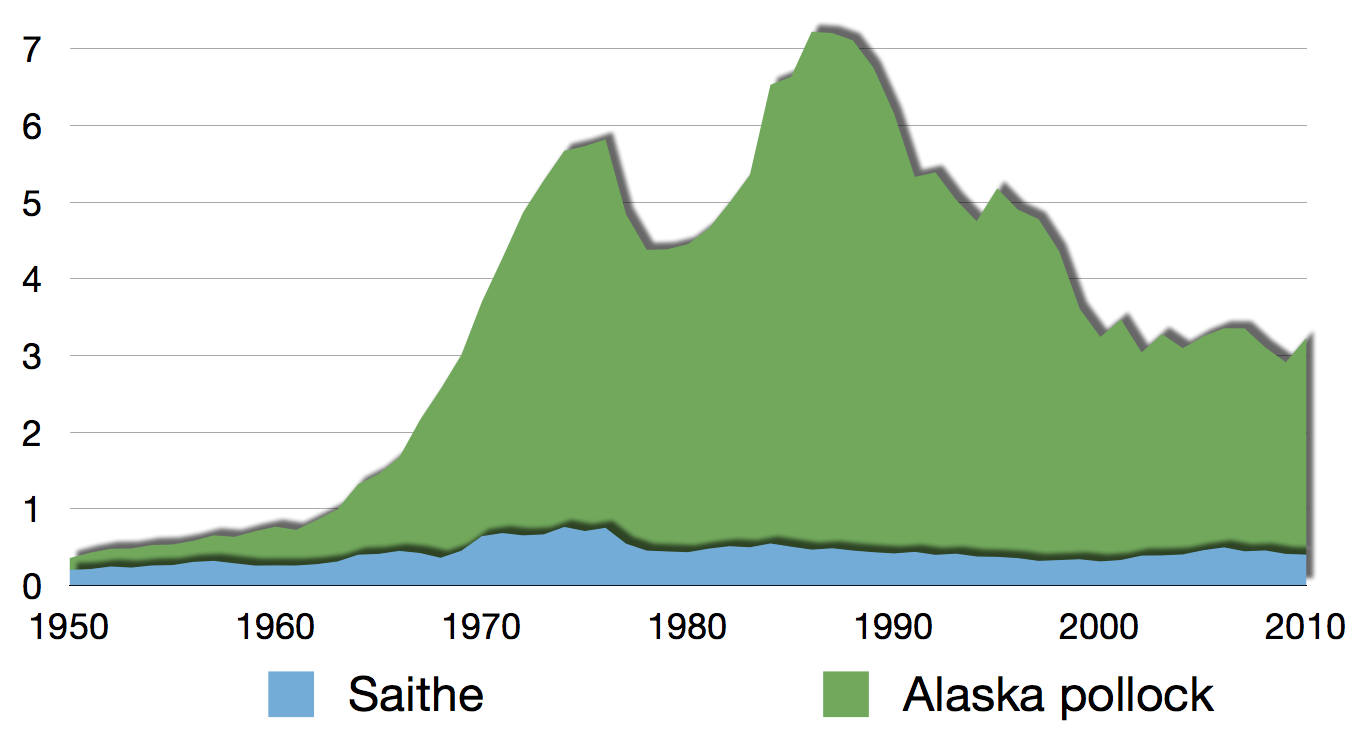

Pollock V

Pollock or pollack (pronounced ) is the common name used for either of the two species of North Atlantic marine fish in the genus ''Pollachius''. ''Pollachius pollachius'' is referred to as pollock in North America, Ireland and the United Kingdom, while ''Pollachius virens'' is usually known as saithe or coley in Great Britain and Ireland (derived from the older name coalfish). Other names for ''P. pollachius'' include the Atlantic pollock, European pollock, ''lieu jaune'', and lythe; while ''P. virens'' is also known as Boston blue (distinct from bluefish), silver bill, or saithe. Species The recognized species in this genus are: * ''Pollachius pollachius'' (Linnaeus, 1758) (pollack) * ''Pollachius virens'' (Linnaeus, 1758) (coalfish) Description Both species can grow to and can weigh up to . ''P. virens'' has a strongly defined, silvery lateral line running down the sides. Above the lateral line, the colour is a greenish black. The belly is white, while ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |