|

Market Anomaly

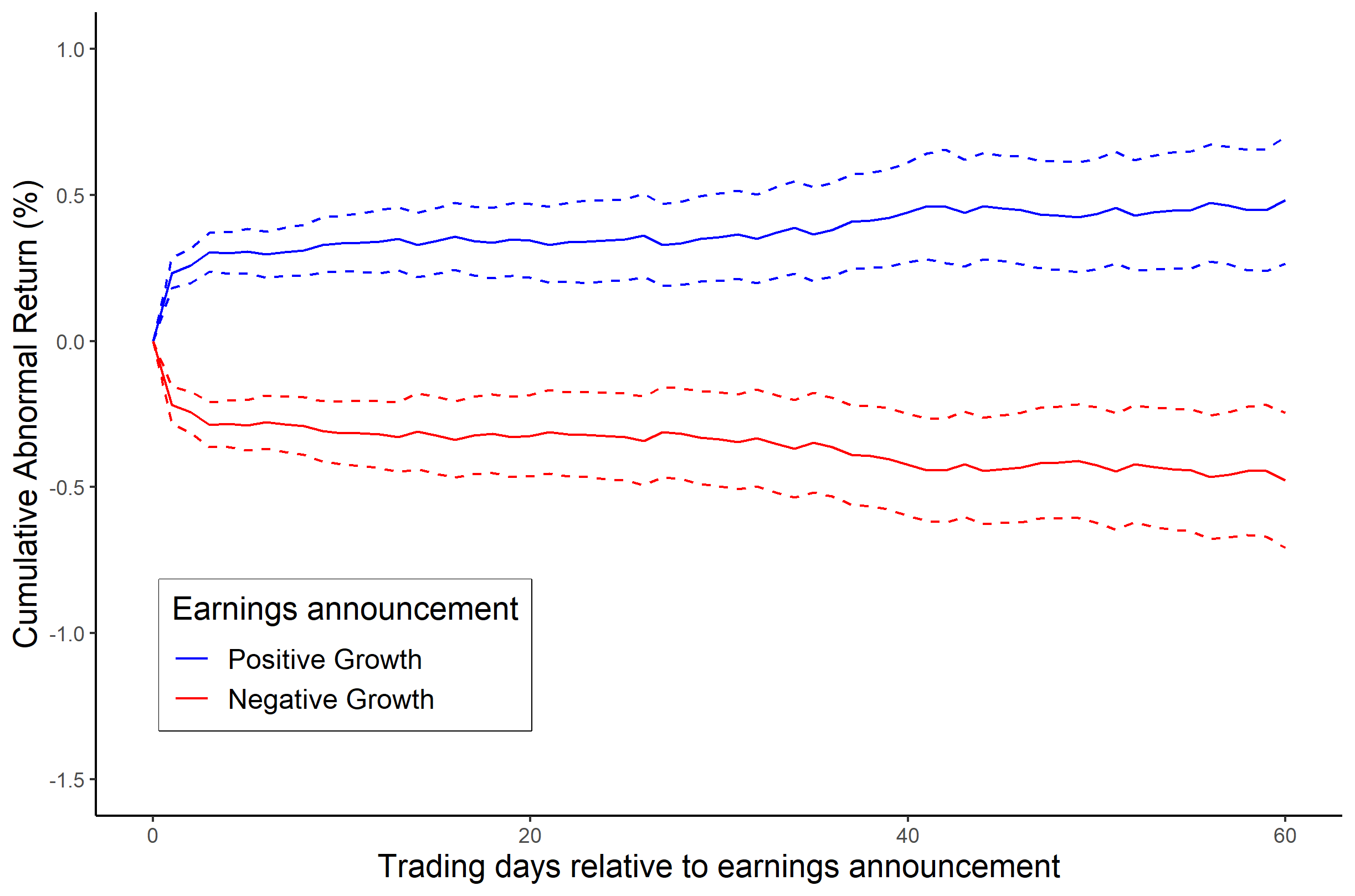

A market anomaly in a financial market is predictability that seems to be inconsistent with (typically risk-based) theories of asset prices. Standard theories include the capital asset pricing model and the Fama–French three-factor model, Fama-French Three Factor Model, but a lack of agreement among academics about the proper theory leads many to refer to anomalies without a reference to a benchmark theory (Daniel and Hirschleifer 2015 and Barberis 2018, for example). Indeed, many academics simply refer to anomalies as "return predictors", avoiding the problem of defining a benchmark theory. Academics have documented more than 150 return predictors (see ''Market anomaly#List of Anomalies Documented in Academic Journals, List of Anomalies Documented in Academic Journals).'' These "anomalies", however, come with many caveats. Almost all documented anomalies focus on illiquid, small stocks. Moreover, the studies do not account for trading costs. As a result, many anomalies do not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption-based Capital Asset Pricing Model

The consumption-based capital asset pricing model (CCAPM) is a model of the determination of Discounted cash flow#Discount rate, expected (i.e. required) return on an investment. The foundations of this concept were laid by the research of Robert Lucas Jr., Robert Lucas (1978) and Douglas Breeden (1979). The model is a generalization of the capital asset pricing model (CAPM). While the CAPM is derived in a static, one-period setting, the CCAPM uses a more realistic, multiple-period setup. The central implication of the CCAPM is that the expected return on an asset is related to "consumption risk", that is, how much uncertainty in consumption would come from holding the asset. Assets that lead to a large amount of uncertainty offer large expected returns, as investors want to be compensated for bearing consumption risk. The CAPM can be derived from the following special cases of the CCAPM: (1) a two-period model with quadratic utility, (2) two-periods, exponential utility, and normal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neglected Firm Effect

The neglected firm effect is the market anomaly phenomenon of lesser-known firms producing abnormally high returns on their stocks. The companies that are followed by fewer analysts will earn higher returns on average than companies that are followed by many analysts. The abnormally high return exhibited by neglected firms may be due to the lower liquidity or higher risks associated with the stock. At the same time, the impact on returns, and regarding earnings management is not always clear. According to Investopedia: Adam Hayes (2022) Neglected Firm Effect/ref> "Neglected firms are usually the small firms that analysts tend to ignore. Information available on these companies tends to be limited to those items that are required by law, on the other hand, have a higher profile, which provides large amounts of high quality information (in addition to legally required forms) to institutional investors such as pension or mutual fund A mutual fund is a professionally managed invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neglected Firm Effect

The neglected firm effect is the market anomaly phenomenon of lesser-known firms producing abnormally high returns on their stocks. The companies that are followed by fewer analysts will earn higher returns on average than companies that are followed by many analysts. The abnormally high return exhibited by neglected firms may be due to the lower liquidity or higher risks associated with the stock. At the same time, the impact on returns, and regarding earnings management is not always clear. According to Investopedia: Adam Hayes (2022) Neglected Firm Effect/ref> "Neglected firms are usually the small firms that analysts tend to ignore. Information available on these companies tends to be limited to those items that are required by law, on the other hand, have a higher profile, which provides large amounts of high quality information (in addition to legally required forms) to institutional investors such as pension or mutual fund A mutual fund is a professionally managed invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investopedia

Investopedia is a financial media website headquartered in New York City. Founded in 1999, Investopedia provides investment dictionaries, advice, reviews, ratings, and comparisons of financial products such as securities accounts. Investopedia has more than 32,000 articles and reaches 20 million unique monthly viewers and posts paid advertisements as investing information. It is part of the Dotdash Meredith family of brands owned by IAC. Investopedia offers educational technology into day trading, asset management, foreign exchange markets, as well as financial educational courses. It also hosts a stock market simulator. Self-paced, online courses from expert instructors are available on Investopedia Academy. History Founding and early history Investopedia was founded in 1999 by Cory Wagner and Cory Janssen in Edmonton, Alberta. At the time, Janssen was a business student at the University of Alberta. Wagner focused on business development and research and development, w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

False Discovery Rate

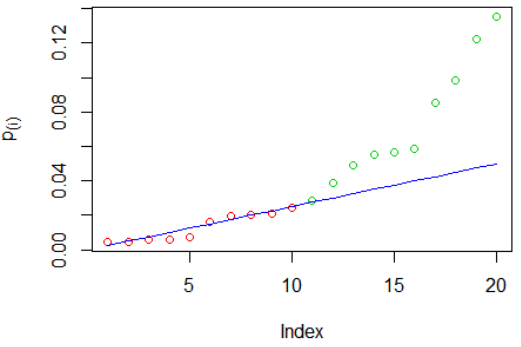

In statistics, the false discovery rate (FDR) is a method of conceptualizing the rate of type I errors in null hypothesis testing when conducting multiple comparisons. FDR-controlling procedures are designed to control the FDR, which is the expected proportion of "discoveries" (rejected null hypotheses) that are false (incorrect rejections of the null). Equivalently, the FDR is the expected ratio of the number of false positive classifications (false discoveries) to the total number of positive classifications (rejections of the null). The total number of rejections of the null include both the number of false positives (FP) and true positives (TP). Simply put, FDR = FP / (FP + TP). FDR-controlling procedures provide less stringent control of Type I errors compared to family-wise error rate (FWER) controlling procedures (such as the Bonferroni correction), which control the probability of ''at least one'' Type I error. Thus, FDR-controlling procedures have greater power, at the co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiple Comparisons Problem

In statistics, the multiple comparisons, multiplicity or multiple testing problem occurs when one considers a set of statistical inferences simultaneously or infers a subset of parameters selected based on the observed values. The more inferences are made, the more likely erroneous inferences become. Several statistical techniques have been developed to address that problem, typically by requiring a stricter significance threshold for individual comparisons, so as to compensate for the number of inferences being made. History The problem of multiple comparisons received increased attention in the 1950s with the work of statisticians such as Tukey and Scheffé. Over the ensuing decades, many procedures were developed to address the problem. In 1996, the first international conference on multiple comparison procedures took place in Israel. Definition Multiple comparisons arise when a statistical analysis involves multiple simultaneous statistical tests, each of which has a poten ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Data Dredging

Data dredging (also known as data snooping or ''p''-hacking) is the misuse of data analysis to find patterns in data that can be presented as statistically significant, thus dramatically increasing and understating the risk of false positives. This is done by performing many statistical tests on the data and only reporting those that come back with significant results. The process of data dredging involves testing multiple hypotheses using a single data set by exhaustively searching—perhaps for combinations of variables that might show a correlation, and perhaps for groups of cases or observations that show differences in their mean or in their breakdown by some other variable. Conventional tests of statistical significance are based on the probability that a particular result would arise if chance alone were at work, and necessarily accept some risk of mistaken conclusions of a certain type (mistaken rejections of the null hypothesis). This level of risk is called the ''s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intertemporal CAPM

Within mathematical finance, the Intertemporal Capital Asset Pricing Model, or ICAPM, is an alternative to the CAPM provided by Robert Merton. It is a linear factor model with wealth as state variable that forecast changes in the distribution of future returns or income. In the ICAPM investors are solving lifetime consumption decisions when faced with more than one uncertainty. The main difference between ICAPM and standard CAPM is the additional state variables that acknowledge the fact that investors hedge against shortfalls in consumption or against changes in the future investment opportunity set. Continuous time version Merton considers a continuous time market in equilibrium. The state variable (X) follows a brownian motion: : dX = \mu dt + s dZ The investor maximizes his Von Neumann–Morgenstern utility: :E_o \left\ where T is the time horizon and B (T),Tthe utility from wealth (W). The investor has the following constraint on wealth (W). Let w_i be the weight ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost of eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |