|

Condor (options)

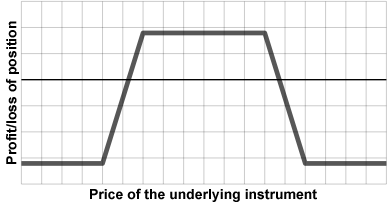

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike prices. The buyer of a condor earns a profit if the underlying is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range (low volatility), while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit. A long condor consists of four options of the same type (all calls or all puts). The options at the outer strikes are bought and the inner strikes are sold (and the reverse is done for a short condor). The difference between the two lowest strikes must be the same as the dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Condor Strategy

Condor is the common name for two species of New World vultures, each in a monotypic genus. The name derives from the Quechua ''kuntur''. They are the largest flying land birds in the Western Hemisphere. They are: * The Andean condor (''Vultur gryphus''), which inhabits the Andean mountains. * The California condor (''Gymnogyps californianus''), currently restricted to the western coastal mountains of the United States and Mexico and the northern desert mountains of Arizona in the United States. Taxonomy Condors are part of the family Cathartidae which contains the New World vultures, whereas the 15 species of Old World vultures are in the family Accipitridae, that also includes hawks, eagles, and kites. The New World and Old World vultures evolved from different ancestors. They both are carrion-eaters and the two groups are similar in appearance due to convergent evolution. Description Both condors are very large broad-winged soaring birds, the Andean condor being shorte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expiry Date

An expiration date or expiry date is a previously determined date after which something should no longer be used, either by operation of law or by exceeding the anticipated shelf life for perishable goods. Expiration dates are applied to selected food products and to some other manufactured products like infant car seats where the age of the product may impact its safe use. The legal definition and usage of terms will vary between countries and products. Different terms may be used for products that tend to spoil and those that tend to be shelf-stable. The term ''Use by'' is often applied to products such as milk and meat that are more likely to spoil and can become dangerous to those eating them. Such products should not be consumed past the date shown. The term ''Best before'' is often applied to products that may deteriorate slightly in quality, but are unlikely to become dangerous as a result, such as dried foods. Such products can be eaten after their ''Best before'' date ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ladder (option Combination)

In finance, a ladder, also known as a Christmas tree, is a combination of three options of the same type (all calls or all puts) at three different strike prices. A long ladder is used by traders who expect low volatility, while a short ladder is used by traders who expect high volatility. Ladders are in some ways similar to strangles, vertical spreads, condors, or ratio spreads. A long call ladder consists of buying a call at one strike price and selling a call at each of two higher strike prices, while a long put ladder consists of buying a put at one strike price and selling a put at each of two lower strike prices. A short ladder is the opposite position, in which one option is sold and the other two are bought. Often, the strike prices are chosen to make the ladder delta neutral. All three options must have the same expiry date. The term ''ladder'' is also used for an unrelated type of exotic option, and the term ''Christmas tree'' is also used for an unrelated option co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iron Condor

The iron condor is an options trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call(s) and put(s) respectively. The converse produces a short iron condor. The position is so named because of the shape of the profit/loss graph, which replicates that of a condor but with a different combination of options. Traders often refer to the inner options collectively as the "body" and the outer options as the "wings". The word ''iron'' in the name of this position indicates that, like an iron butterfly, this position is constructed using both calls and puts, by combining a bull put spread with a bear call spread. The combination of these two credit spreads makes the long iron condor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Condor

Condor is the common name for two species of New World vultures, each in a monotypic genus. The name derives from the Quechua ''kuntur''. They are the largest flying land birds in the Western Hemisphere. They are: * The Andean condor (''Vultur gryphus''), which inhabits the Andean mountains. * The California condor (''Gymnogyps californianus''), currently restricted to the western coastal mountains of the United States and Mexico and the northern desert mountains of Arizona in the United States. Taxonomy Condors are part of the family Cathartidae which contains the New World vultures, whereas the 15 species of Old World vultures are in the family Accipitridae, that also includes hawks, eagles, and kites. The New World and Old World vultures evolved from different ancestors. They both are carrion-eaters and the two groups are similar in appearance due to convergent evolution. Description Both condors are very large broad-winged soaring birds, the Andean condor being short ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strangle (options)

In finance, a strangle is a options strategy involving the purchase or sale of two options, allowing the holder to profit based on how much the price of the underlying security moves, with a neutral exposure to the ''direction'' of price movement. A strangle consists of one call and one put with the same expiry and underlying but different strike prices. Typically the call has a higher strike price than the put. If the put has a higher strike price instead, the position is sometimes called a guts. If the options are purchased, the position is known as a long strangle, while if the options are sold, it is known as a short strangle. A strangle is similar to a straddle position; the difference is that in a straddle, the two options have the same strike price. Given the same underlying security, strangle positions can be constructed with lower cost and lower probability of profit than straddles. Characteristics A strangle, requires the investor to simultaneously buy or sell both a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vertical Spread

In options trading, a vertical spread is an options strategy involving buying and selling of multiple options of the same underlying security, same expiration date, but at different strike prices. They can be created with either all calls or all puts. The term originates from the trading sheets that were used in the open outcry pits on which option prices were listed out by expiry date & strike price, thus looking down the sheet (vertical) the trader would see all options of the same maturity. Vertical spreads can sometimes approximate binary options, and can be produced using vanilla options. *Bull vertical spread - Bull call spread In options trading, a bull spread is a bullish, vertical spread options strategy that is designed to profit from a moderate rise in the price of the underlying security. Because of put–call parity, a bull spread can be constructed using either ... and bull put spread are bullish vertical spreads constructed using calls and puts respectively. *B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spread Trade

In finance, a spread trade (also known as relative value trade) is the simultaneous purchase of one security and sale of a related security, called legs, as a unit. Spread trades are usually executed with options or futures contracts as the legs, but other securities are sometimes used. They are executed to yield an overall net position whose value, called the spread, depends on the difference between the prices of the legs. Common spreads are priced and traded as a unit on futures exchanges rather than as individual legs, thus ensuring simultaneous execution and eliminating the execution risk of one leg executing but the other failing. Spread trades are executed to attempt to profit from the widening or narrowing of the spread, rather than from movement in the prices of the legs directly. Spreads are either "bought" or "sold" depending on whether the trade will profit from the widening or narrowing of the spread. Margin The volatility of the spread is typically much lower than t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theta (finance)

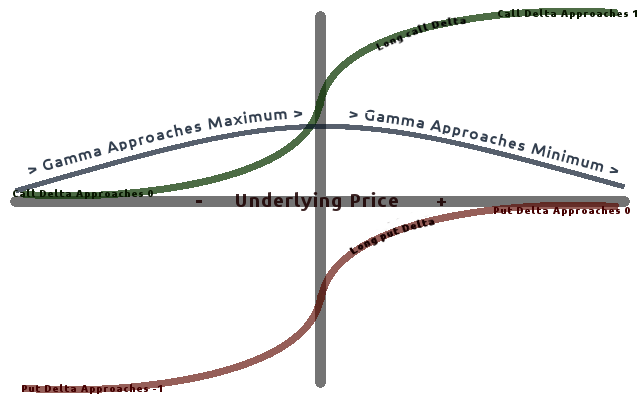

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especially ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Put Option

In finance, a put or put option is a derivative instrument in financial markets that gives the holder (i.e. the purchaser of the put option) the right to sell an asset (the ''underlying''), at a specified price (the ''strike''), by (or at) a specified date (the ''expiry'' or ''maturity'') to the ''writer'' (i.e. seller) of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. page 15 , 4.2.3 Positive and negative sentiment The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index. Puts may also be combined with other derivatives as part of more complex investment strategies, and in particular, may be useful for hedging. Holding a European put option is equivalent to holding the corresponding call option and selling an appropriate forward contract. This equivalence is called " put-call parity". Put options are most commonly used in the stock market to protect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Strategy

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that are bullish on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |