|

Ladder (option Combination)

In finance, a ladder, also known as a Christmas tree, is a combination of three options of the same type (all calls or all puts) at three different strike prices. A long ladder is used by traders who expect low volatility, while a short ladder is used by traders who expect high volatility. Ladders are in some ways similar to strangles, vertical spreads, condors, or ratio spreads. A long call ladder consists of buying a call at one strike price and selling a call at each of two higher strike prices, while a long put ladder consists of buying a put at one strike price and selling a put at each of two lower strike prices. A short ladder is the opposite position, in which one option is sold and the other two are bought. Often, the strike prices are chosen to make the ladder delta neutral. All three options must have the same expiry date. The term ''ladder'' is also used for an unrelated type of exotic option, and the term ''Christmas tree'' is also used for an unrelated option co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ladder Payoff Diagrams

A ladder is a vertical or inclined set of rungs or steps used for climbing or descending. There are two types: rigid ladders that are self-supporting or that may be leaned against a vertical surface such as a wall, and rollable ladders, such as those made of rope or aluminium, that may be hung from the top. The vertical members of a rigid ladder are called stringers or rails (US) or stiles (UK). Rigid ladders are usually portable, but some types are permanently fixed to a structure, building, or equipment. They are commonly made of metal, wood, or fiberglass, but they have been known to be made of tough plastic. Historical usages Ladders are ancient tools and technology. A ladder is featured in a Mesolithic rock painting that is at least 10,000 years old, depicted in the Spider Caves in Valencia, Spain. The painting depicts two humans using a ladder to reach a wild honeybee nest to harvest honey. The ladder is depicted as long and flexible, possibly made out of some sort of gra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exotic Option

In finance, an exotic option is an option which has features making it more complex than commonly traded vanilla options. Like the more general exotic derivatives they may have several triggers relating to determination of payoff. An exotic option may also include a non-standard underlying instrument, developed for a particular client or for a particular market. Exotic options are more complex than options that trade on an exchange, and are generally traded over-the-counter. Etymology The term "exotic option" was popularized by Mark Rubinstein's 1990 working paper (published 1992, with Eric Reiner) "Exotic Options", with the term based either on exotic wagers in horse racing, or due to the use of international terms such as "Asian option", suggesting the "exotic Orient". Journalist Brian Palmer used the "successful $1 bet on the superfecta" in the 2010 Kentucky Derby that "paid a whopping $101,284.60" as an example of the controversial high-risk, high-payout exotic bets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate or stock broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers for the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Exchange

In chemistry and physics, the exchange interaction (with an exchange energy and exchange term) is a quantum mechanical effect that only occurs between identical particles. Despite sometimes being called an exchange force in an analogy to classical force, it is not a true force as it lacks a force carrier. The effect is due to the wave function of indistinguishable particles being subject to exchange symmetry, that is, either remaining unchanged (symmetric) or changing sign (antisymmetric) when two particles are exchanged. Both bosons and fermions can experience the exchange interaction. For fermions, this interaction is sometimes called Pauli repulsion and is related to the Pauli exclusion principle. For bosons, the exchange interaction takes the form of an effective attraction that causes identical particles to be found closer together, as in Bose–Einstein condensation. The exchange interaction alters the expectation value of the distance when the wave functions of two or more ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Spread

Options spreads are the basic building blocks of many options trading strategies. A spread position is entered by buying and selling options of the same class on the same underlying security but with different strike prices or expiration dates. An option spread shouldn't be confused with a spread option. The three main classes of spreads are the horizontal spread, the vertical spread and the diagonal spread. They are grouped by the relationships between the strike price and expiration dates of the options involved - * Vertical spreads, or money spreads, are spreads involving options of the same underlying security, same expiration month, but at different strike prices. *Horizontal, calendar spreads, or time spreads are created using options of the same underlying security, same strike prices but with different expiration dates. *Diagonal spreads are constructed using options of the same underlying security but different strike prices and expiration dates. They are called diago ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Break-even Point

The break-even point (BEP) in economics, business—and specifically cost accounting—is the point at which total cost and total revenue are equal, i.e. "even". There is no net loss or gain, and one has "broken even", though opportunity costs have been paid and capital has received the risk-adjusted, expected return. In short, all costs that must be paid are paid, and there is neither profit nor loss. Overview The break-even point (BEP) or break-even level represents the sales amount—in either unit (quantity) or revenue (sales) terms—that is required to cover total costs, consisting of both fixed and variable costs to the company. Total profit at the break-even point is zero. It is only possible for a firm to pass the break-even point if the dollar value of sales is higher than the variable cost per unit. This means that the selling price of the goods must be higher than what the company paid for the good or its components for them to cover the initial price they paid (va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

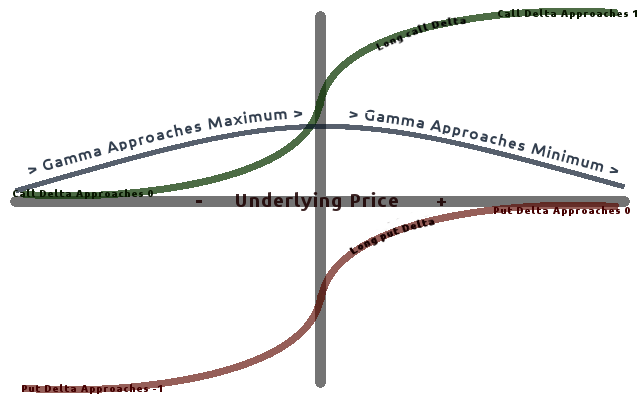

Greeks (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bearish

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be ''bullish''. On the contrary, if the market sentiment is ''bearish'', most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as ''permabulls'' and ''permabears'' respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bullish

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be ''bullish''. On the contrary, if the market sentiment is ''bearish'', most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as ''permabulls'' and ''permabears'' respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Spread

In options trading, a bear spread is a bearish, vertical spread options strategy that can be used when the options trader is moderately bearish on the underlying security. Because of put–call parity, a bear spread can be constructed using either put options or call options. If constructed using calls, it is a bear call spread (alternatively call credit spread). If constructed using puts, it is a bear put spread (alternatively put debit spread). Bear call spread A bear call spread is a limited profit, limited risk options trading strategy that can be used when the options trader is moderately bearish on the underlying security. It is entered by buying call options of a certain strike price and selling the same number of call options of lower strike price (in the money) on the same underlying security with the same expiration month. Example Consider a stock that costs $100 per share, with a call option with a strike price of $105 for $2 and a call option with a strike price of $95 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bull Spread

In options trading, a bull spread is a bullish, vertical spread options strategy that is designed to profit from a moderate rise in the price of the underlying security. Because of put–call parity, a bull spread can be constructed using either put options or call options. If constructed using calls, it is a bull call spread (alternatively call debit spread). If constructed using puts, it is a bull put spread (alternatively put credit spread). Bull call spread A bull call spread is constructed by buying a call option with a lower strike price (K), and selling another call option with a higher strike price. Often the call with the lower exercise price will be at-the-money In finance, moneyness is the relative position of the current price (or future price) of an underlying asset (e.g., a stock) with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly a th ... while the call with the higher exercise price is out-of- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underlying

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements ( hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets. Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (off-exchange) or on an exchange such as the Chicago Mercantile Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financial crisis of 2007–2009, there has been increased pressure to move derivatives to trade on exchanges. Derivatives are one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |