|

Options Strategy

Option strategies are the simultaneous, and often mixed, buying or selling of one or more Option (finance), options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Butterfly (options)

In finance, a butterfly (or simply fly) is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower (when long the butterfly) or higher (when short the butterfly) than that asset's current implied volatility. Long butterfly A long butterfly position will make profit if the future volatility is lower than the implied volatility. A long butterfly options strategy consists of the following options: * Long 1 call with a strike price of (X − a) * Short 2 calls with a strike price of X * Long 1 call with a strike price of (X + a) where X = the spot price (i.e. current market price of underlying) and a > 0. Using put–call parity a long butterfly can also be created as follows: * Long 1 put with a strike price of (X + a) * Short 2 puts with a strike price of X * Long 1 put with a strike price of (X − a) where X = the spot price an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spread Option

In finance, a spread option is a type of option where the payoff is based on the difference in price between two underlying assets. For example, the two assets could be crude oil and heating oil; trading such an option might be of interest to oil refineries, whose profits are a function of the difference between these two prices. Spread options are generally traded over the counter, rather than on exchange. A 'spread option' is not the same as an ' option spread'. A spread option is a new, relatively rare type of exotic option In finance, an exotic option is an option which has features making it more complex than commonly traded vanilla options. Like the more general exotic derivatives they may have several triggers relating to determination of payoff. An exotic op ... on two underlyings, while an option spread is a combination trade: the purchase of one (vanilla) option and the sale of another option on the same underlying. Spread option valuation For a spread call, the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Strategies

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that are bullish on vo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ratio Spread

A ratio spread or frontspread is a multi-leg options position. Like a vertical, the ratio spread involves buying and selling options on the same underlying security with different strike prices and the same expiration date. In this spread, the number of option contracts sold is not equal to a number of contracts bought. An unequal number of options contracts gives this spread certain unique properties compared to a regular vertical spread. A typical ''ratio spread'' would be where twice as many option contracts are sold, thus forming a 1:2 ratio. Purpose Ideally, this strategy should be used when either A) the implied volatility of the options expiring in a particular month has recently moved sharply higher and is now beginning to decline, or B) the trader believes for whatever reason that the underlying market of the option(s) will move steadily in his favor during the life of the option. The trader will use call options in this strategy if they believe the underlying market wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jelly Roll (options)

A jelly roll, or simply a roll, is an options trading strategy that captures the cost of carry of the underlying asset while remaining otherwise neutral. It is often used to take a position on dividends or interest rates, or to profit from mispriced calendar spreads. A jelly roll consists of a long call and a short put with one expiry date, and a long put and a short call with a different expiry date, all at the same strike price. In other words, a trader combines a synthetic long position at one expiry date with a synthetic short position at another expiry date. Equivalently, the trade can be seen as a combination of a long time spread and a short time spread, one with puts and one with calls, at the same strike price. The value of a call time spread (composed of a long call option and a short call option at the same strike price but with different expiry dates) and the corresponding put time spread should be related by put-call parity, with the difference in price expl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Calendar Spread

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. These individual purchases, known as the legs of the spread, vary only in expiration date; they are based on the same underlying market and strike price. The usual case involves the purchase of futures or options expiring in a more distant month--the far leg--and the sale of futures or options in a more nearby month--the near leg. Uses The calendar spread can be used to attempt to take advantage of a difference in the implied volatilities between two different months' options. The trader will ordinarily implement this strategy when the options they are buying have a distinctly lower implied volatility than the options they are writing (selling). In the typical version of this strategy, a rise in the overall implied volatility of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iron Condor

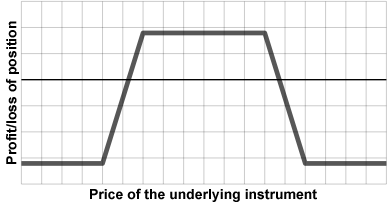

The iron condor is an options trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call(s) and put(s) respectively. The converse produces a short iron condor. The position is so named because of the shape of the profit/loss graph, which replicates that of a condor but with a different combination of options. Traders often refer to the inner options collectively as the "body" and the outer options as the "wings". The word ''iron'' in the name of this position indicates that, like an iron butterfly, this position is constructed using both calls and puts, by combining a bull put spread with a bear call spread. The combination of these two credit spreads makes the long iron con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iron Butterfly (options Strategy)

In finance an iron butterfly, also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three different strike prices. It is a limited-risk, limited-profit trading strategy that is structured for a larger probability of earning smaller limited profit when the underlying stock is perceived to have a low volatility. \mbox = \Delta(\mbox) \times (1+rt) - \mbox It is known as an iron butterfly because it replicates the characteristics of a butterfly with a different combination of options (compare iron condor The iron condor is an options trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instr ...). Short iron butterfly A short iron butterfly option strategy will attain maximum profit when the price of the underlying asset ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fence (finance)

Fence (also known as a Dutch Rudder) is an investment strategy that uses options to limit the range of possible returns on a financial instrument. A fence consists of the following elements: * long position in a financial instrument (e.g. a share, index or currency) * long put (normally with a strike price close to or at the current spot price of the financial instrument) * short put (with a strike price lower than the bought put - e.g. 80% of the current spot price) * short call (with a strike price higher than the current spot price). The expiration dates of all the options are usually the same. The call strike is normally chosen in such a way that the sum total of the three option premiums is equal to zero. This investment strategy will ensure that the value of the investment at expiry will be between the strike price In finance, the strike price (or exercise price) of an option is a fixed price at which the owner of the option can buy (in the case of a call), or sel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Condor (options)

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike prices. The buyer of a condor earns a profit if the underlying is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range (low volatility), while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit. A long condor consists of four options of the same type (all calls or all puts). The options at the outer strikes are bought and the inner strikes are sold (and the reverse is done for a short condor). The difference between the two lowest strikes must be the same as the d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collar (finance)

In finance, a collar is an option strategy that limits the range of possible positive or negative returns on an underlying to a specific range. A collar strategy is used as one of the ways to hedge against possible losses and it represents long put options financed with short call options. The collar combines the strategies of the protective put and the covered call. Equity collar Structure A collar is created by: * buying the underlying asset * buying a put option at strike price, X (called the ''floor'') * selling a call option at strike price, X + a (called the ''cap''). These latter two are a short risk reversal position. So: :Underlying − risk reversal = Collar The premium income from selling the call reduces the cost of purchasing the put. The amount saved depends on the strike price of the two options. Most commonly, the two strikes are roughly equal distances from the current price. For example, an investor would insure against loss more than 20% in return for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |