|

Butterfly (options)

In finance, a butterfly (or simply fly) is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower (when long the butterfly) or higher (when short the butterfly) than that asset's current implied volatility. Long butterfly A long butterfly position will make profit if the future volatility is lower than the implied volatility. A long butterfly options strategy consists of the following options: * Long 1 call with a strike price of (X − a) * Short 2 calls with a strike price of X * Long 1 call with a strike price of (X + a) where X = the spot price (i.e. current market price of underlying) and a > 0. Using put–call parity a long butterfly can also be created as follows: * Long 1 put with a strike price of (X + a) * Short 2 puts with a strike price of X * Long 1 put with a strike price of (X − a) where X = the spot price and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Butterfly Option

Long may refer to: Measurement * Long, characteristic of something of great time, duration * Long, characteristic of something of great length * Longitude (abbreviation: long.), a geographic coordinate * Longa (music), note value in early music mensural notation Places Asia * Long District, Laos * Long District, Phrae, Thailand * Longjiang (other) or River Long (lit. "dragon river"), one of several rivers in China * Yangtze River or Changjiang (lit. "Long River"), China Elsewhere * Long, Somme, France * Long, Washington, United States People * Long (surname) * Long (surname 龍) (Chinese surname) Fictional characters * Long (Bloody Roar), Long (''Bloody Roar''), in the video game series Sports * Long, a Fielding (cricket)#Modifiers, fielding term in cricket * Long, in tennis and similar games, beyond the service line during a serve and beyond the baseline during play Other uses * , a U.S. Navy ship name * Long (finance), a position in finance, especially stock marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional " long" position, where the investor will profit if the value of the asset rises. There are a number of ways of achieving a short position. The most fundamental method is "physical" selling short or short-selling, which involves borrowing assets (often securities such as shares or bonds) and selling them. The investor will later purchase the same number of the same type of securities in order to return them to the lender. If the price has fallen in the meantime, the investor will have made a profit equal to the difference. Conversely, if the price has risen then the investor will bear a loss. The short seller must usually pay a fee to borrow the securities (charged at a particular rate over time, similar to an interest payment), and reimburse the lender for any cash returns such as dividends that were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bearish

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be ''bullish''. On the contrary, if the market sentiment is ''bearish'', most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as ''permabulls'' and ''permabears'' respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ladder (option Combination)

In finance, a ladder, also known as a Christmas tree, is a combination of three options of the same type (all calls or all puts) at three different strike prices. A long ladder is used by traders who expect low volatility, while a short ladder is used by traders who expect high volatility. Ladders are in some ways similar to strangles, vertical spreads, condors, or ratio spreads. A long call ladder consists of buying a call at one strike price and selling a call at each of two higher strike prices, while a long put ladder consists of buying a put at one strike price and selling a put at each of two lower strike prices. A short ladder is the opposite position, in which one option is sold and the other two are bought. Often, the strike prices are chosen to make the ladder delta neutral. All three options must have the same expiry date. The term ''ladder'' is also used for an unrelated type of exotic option, and the term ''Christmas tree'' is also used for an unrelated option co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Condor (options)

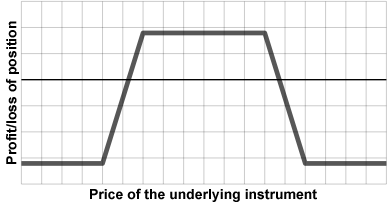

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike prices. The buyer of a condor earns a profit if the underlying is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range (low volatility), while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit. A long condor consists of four options of the same type (all calls or all puts). The options at the outer strikes are bought and the inner strikes are sold (and the reverse is done for a short condor). The difference between the two lowest strikes must be the same as the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iron Butterfly (options)

In finance an iron butterfly, also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three different strike prices. It is a limited-risk, limited-profit trading strategy that is structured for a larger probability of earning smaller limited profit when the underlying stock is perceived to have a low volatility. \mbox = \Delta(\mbox) \times (1+rt) - \mbox It is known as an iron butterfly because it replicates the characteristics of a butterfly with a different combination of options (compare iron condor The iron condor is an options trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instrum ...). Short iron butterfly A short iron butterfly option strategy will attain maximum profit when the price of the underlying asset a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lognormal Distribution

In probability theory, a log-normal (or lognormal) distribution is a continuous probability distribution of a random variable whose logarithm is normally distributed. Thus, if the random variable is log-normally distributed, then has a normal distribution. Equivalently, if has a normal distribution, then the exponential function of , , has a log-normal distribution. A random variable which is log-normally distributed takes only positive real values. It is a convenient and useful model for measurements in exact and engineering sciences, as well as medicine, economics and other topics (e.g., energies, concentrations, lengths, prices of financial instruments, and other metrics). The distribution is occasionally referred to as the Galton distribution or Galton's distribution, after Francis Galton. The log-normal distribution has also been associated with other names, such as McAlister, Gibrat and Cobb–Douglas. A log-normal process is the statistical realization of the multipl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulation T

Federal Reserve Board Regulation T (also referred to as Reg T) is 12 CFR §220 – Code of Federal Regulations, Title 12, Chapter II, Subchapter A, Part 220 (Credit by Brokers and Dealers). Regulation T governs the extension of credit by securities brokers and dealers in the United States. Its best-known function is the control of margin requirements for stocks bought on margin. The initial margin requirement for such margin stock purchases has been 50% since 1974, but Regulation T gives the Federal Reserve the authority to change this percentage. Raising the margin requirement ostensibly reduces risk in the financial system by reducing the potential leverage and total buying power of investors. Conversely, lowering the margin requirement increases systemic risk In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expiration (options)

In finance, the expiration date of an option contract (represented by Greek letter tau, τ) is the last date on which the holder of the option may exercise it according to its terms. In the case of options with "automatic exercise", the net value of the option is credited Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt ... to the long and debited to the short position holders. Typically, exchange-traded option contracts expire according to a pre-determined calendar. For instance, for U.S. exchange-listed equity stock option contracts, the expiration date is always the Saturday that follows the third Friday of the month, unless that Friday is a market holiday, in which case the expiration is on Thursday right before that Friday. The clearing firm may automatically exercise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Put–call Parity

In financial mathematics, put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to (and hence has the same value as) a single forward contract at this strike price and expiry. This is because if the price at expiry is above the strike price, the call will be exercised, while if it is below, the put will be exercised, and thus in either case one unit of the asset will be purchased for the strike price, exactly as in a forward contract. The validity of this relationship requires that certain assumptions be satisfied; these are specified and the relationship is derived below. In practice transaction costs and financing costs (leverage) mean this relationship will not exactly hold, but in liquid markets the relationship is close to exact. Assumptions Put–call parity is a static replication, and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strike Price

In finance, the strike price (or exercise price) of an option is a fixed price at which the owner of the option can buy (in the case of a call), or sell (in the case of a put), the underlying security or commodity. The strike price may be set by reference to the spot price, which is the market price of the underlying security or commodity on the day an option is taken out. Alternatively, the strike price may be fixed at a discount or premium. The strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the market price of the underlying instrument at that time. Moneyness Moneyness is the value of a financial contract if the contract settlement is financial. More specifically, it is the difference between the strike price of the option and the current trading price of its underlying security. In options trading, terms such as ''in-the-m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)