|

Zimbabwe Revenue Authority

The Zimbabwe Revenue Authority, or ZIMRA, is the body responsible for collecting taxes and other revenue streams for the government in Zimbabwe. It derives its mandate from the Revenue Authority Act, passed by the parliament of Zimbabwe in 2002 and other related legislation. Revenue collection ZIMRA is responsible for assessing, collecting and accounting for revenue through the Ministry of Finance as specified by the Revenue Authority Act. The revenues and taxes administered by ZIMRA include: Trade regulation As part of its role in customs regulation, the authority monitors trade and all traffic through borders crossings, airports, and seaports. ZIMRA is tasked to reduce smuggling and illegal trade. The authority regulations on imports, exports and foreign exchange controls Foreign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zimbabwe

Zimbabwe (), officially the Republic of Zimbabwe, is a landlocked country located in Southeast Africa, between the Zambezi and Limpopo Rivers, bordered by South Africa to the south, Botswana to the south-west, Zambia to the north, and Mozambique to the east. The capital and largest city is Harare. The second largest city is Bulawayo. A country of roughly 15 million people, Zimbabwe has 16 official languages, with English, Shona language, Shona, and Northern Ndebele language, Ndebele the most common. Beginning in the 9th century, during its late Iron Age, the Bantu peoples, Bantu people (who would become the ethnic Shona people, Shona) built the city-state of Great Zimbabwe which became one of the major African trade centres by the 11th century, controlling the gold, ivory and copper trades with the Swahili coast, which were connected to Arab and Indian states. By the mid 15th century, the city-state had been abandoned. From there, the Kingdom of Zimbabwe was established, fol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties (i.e. tariffs) and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation. Each country has its own laws and regulations for the import and export of goods into and out of a country, enforced by their respective customs authorities; the import/export of some goods may be restricted or forbidden entirely. A wide range of penalties are faced by those who break these laws. Overview Taxation The traditional function of customs has been the assessment and collection of customs duties, which is a tariff or tax on the importation o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Africa

Africa is the world's second-largest and second-most populous continent, after Asia in both cases. At about 30.3 million km2 (11.7 million square miles) including adjacent islands, it covers 6% of Earth's total surface area and 20% of its land area.Sayre, April Pulley (1999), ''Africa'', Twenty-First Century Books. . With billion people as of , it accounts for about of the world's human population. Africa's population is the youngest amongst all the continents; the median age in 2012 was 19.7, when the worldwide median age was 30.4. Despite a wide range of natural resources, Africa is the least wealthy continent per capita and second-least wealthy by total wealth, behind Oceania. Scholars have attributed this to different factors including geography, climate, tribalism, colonialism, the Cold War, neocolonialism, lack of democracy, and corruption. Despite this low concentration of wealth, recent economic expansion and the large and young population make Afr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AllAfrica

AllAfrica is a website that aggregates news produced primarily on the African continent about all areas of African life, politics, issues and culture. It is available in both English and French and produced by AllAfrica Global Media, which has offices in Cape Town, Dakar, Lagos, Monrovia, Nairobi, and Washington, D.C. AllAfrica is the successor to the African News Service. Its stories can be displayed by categories and subcategories such as country, region, and by news topic. In 2008, AllAfrica rolled out a comment board system. The President of AllAfrica Global Media, Amadou Mahtar Ba, is a member of the International Advisory Board International is an adjective (also used as a noun) meaning "between nations". International may also refer to: Music Albums * ''International'' (Kevin Michael album), 2011 * ''International'' (New Order album), 2002 * ''International'' (The T ... of the African Press Organization. References External links * ReliefWeb archives of AllAf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ASYCUDA

The Automated System for Customs Data (ASYCUDA) is a computerized system designed by the United Nations Conference on Trade and Development (UNCTAD) to administer a country's customs. In 2004 there were more than 50 operational projects with expenditures exceeding US$7 million. It is the largest technical cooperation programme of the UNCTAD, covering over 80 countries and 4 regional projects. There are three generations of ASYCUDA in use: ASYCUDA version 2.7, ASYCUDA++ and ASYCUDA World. They were built using different paradigms and solutions available at conception. ASYCUDA World is the most recent version. Cape Verde adopted use of ASYCUDA World in January 2016. , 12 January 2016, accessed 1 February 2017 UNCTAD's aim was to build a computer system to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Road Pricing

Road pricing (also road user charges) are direct charges levied for the use of roads, including road tolls, distance or time-based fees, congestion charges and charges designed to discourage the use of certain classes of vehicle, fuel sources or more polluting vehicles. These charges may be used primarily for revenue generation, usually for road infrastructure financing, or as a transportation demand management tool to reduce peak hour travel and the associated traffic congestion or other social and environmental negative externalities associated with road travel such as air pollution, greenhouse gas emissions, visual intrusion, noise pollution and road traffic collisions. ''Executive Summary, pp. v''. In most countries toll roads, toll bridges and toll tunnels are often used primarily for revenue generation to repay long-term debt issued to finance the toll facility, or to finance capacity expansion, operations, and maintenance of the facility itself, or simply as genera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Presumptive Tax

Presumptive may refer to: * Heir presumptive, a person who is expected to inherit a throne, peerage, or other hereditary honor, but their position can be displaced by the birth of another person with a better claim to the position. * Presumptive nominee, a person who is candidate for president who has not yet received a party nomination, but is expected to receive that nomination in the near future. * Presumptive US president, a person who is expected to receive the majority of the Electoral College votes, but the appointed electors in each state have not yet met to cast their votes on the Monday after the second Wednesday in December. * Speaker-presumptive, a person who is not yet the speaker of a parliament, but is expected to become the speaker in the near future. * The Presumptive Tax Regime in Pakistan. * Presumptive mood, or irrealis mood, a grammatical mood In linguistics, grammatical mood is a grammatical feature of verbs, used for signaling modality. That is, it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Controls

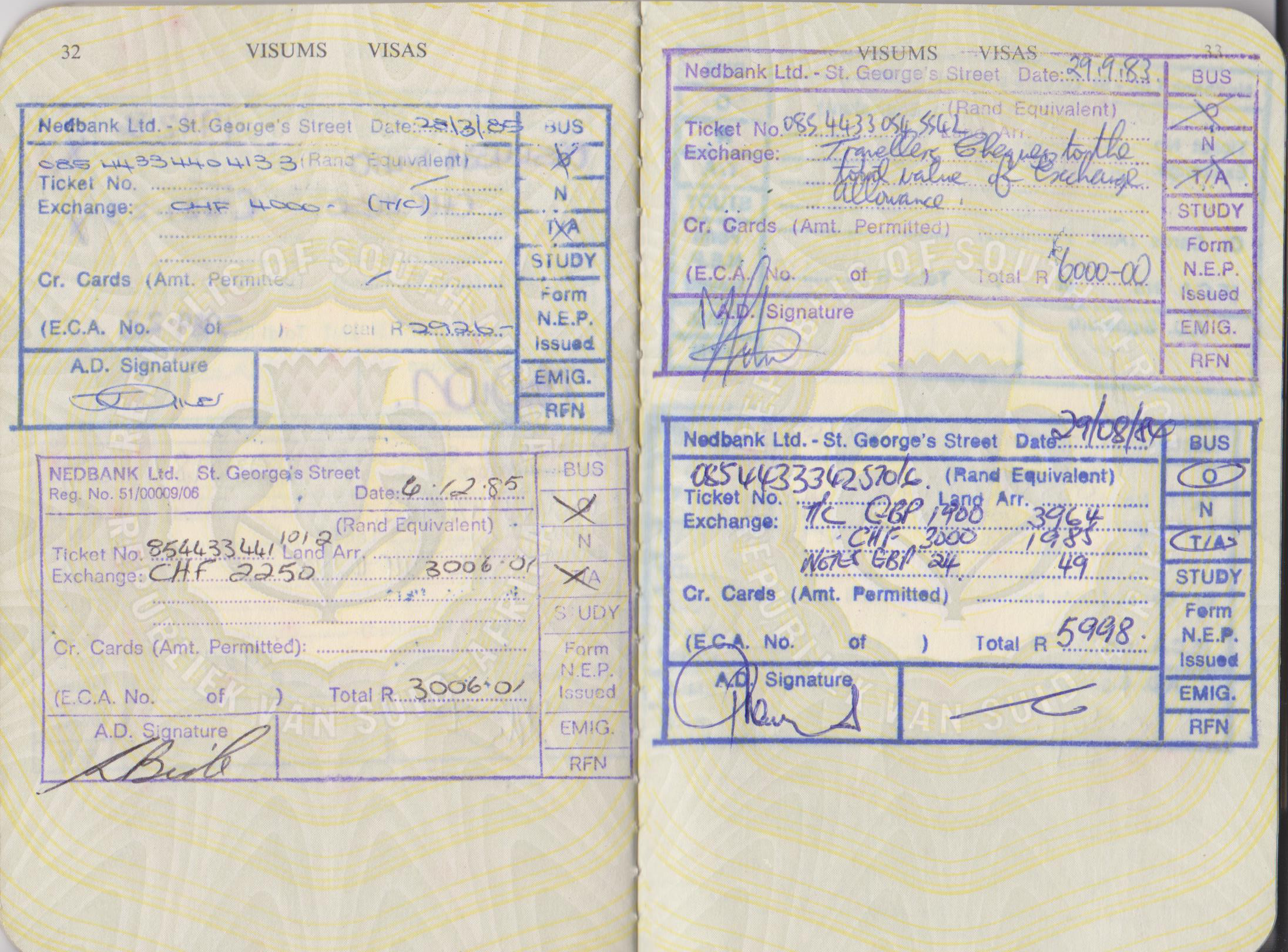

Foreign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the transfers of any currency across national borders. These controls allow countries to better manage their economies by controlling the inflow and outflow of currency, which may otherwise create exchange rate volatility. Countries with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies. They may also introduce capital controls, which limit foreign investment in the country. Rationale Common foreign exchange controls include: * banning the use of foreign currency within the country; * banning locals from possessing foreign currency; * restricting currency exchange to government-approved exchangers; * fixed exchange rates * restricting the amount of currency that may be imported or exported; Often, foreign exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smuggling

Smuggling is the illegal transportation of objects, substances, information or people, such as out of a house or buildings, into a prison, or across an international border, in violation of applicable laws or other regulations. There are various motivations to smuggle. These include the participation in illegal trade, such as in the drug trade, illegal weapons trade, prostitution, human trafficking, kidnapping, exotic wildlife trade, art theft, heists, chop shops, illegal immigration or illegal emigration, tax evasion, import/export restrictions, providing contraband to prison inmates, or the theft of the items being smuggled. Smuggling is a common theme in literature, from Bizet's opera ''Carmen'' to the James Bond spy books (and later films) '' Diamonds Are Forever'' and '' Goldfinger''. Etymology The verb ''smuggle'', from Low German ''smuggeln'' or Dutch ''smokkelen'' (="to transport (goods) illegally"), apparently a frequentative formation of a word meaning "to sneak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seaports

A port is a maritime facility comprising one or more wharves or loading areas, where ships load and discharge cargo and passengers. Although usually situated on a sea coast or estuary, ports can also be found far inland, such as Hamburg, Manchester and Duluth; these access the sea via rivers or canals. Because of their roles as ports of entry for immigrants as well as soldiers in wartime, many port cities have experienced dramatic multi-ethnic and multicultural changes throughout their histories. Ports are extremely important to the global economy; 70% of global merchandise trade by value passes through a port. For this reason, ports are also often densely populated settlements that provide the labor for processing and handling goods and related services for the ports. Today by far the greatest growth in port development is in Asia, the continent with some of the world's largest and busiest ports, such as Singapore and the Chinese ports of Shanghai and Ningbo-Zhou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |