|

UniCredit Țiriac Bank

UniCredit Bank is a Romanian bank and member of UniCredit Group. It has a network of 8,500 branches in 17 European countries, and a presence in another 50 international markets. Being one of the top 5 banks on the Romanian market, UniCredit Bank has 208 branches and almost 3,000 employees. At the end of 2015, the bank had total assets in amount of 34,6 billion RON and included approximately 600,000 active customers. Among the offered services are: financial solutions for individuals, SMEs, companies and freelancers. UniCredit Bank is recognized for specializing in the real estate market and is the only bank with a dedicated real estate department. In addition, the bank offers cross border solutions, through which the bank manages the customer’s banking relations in multiple countries, ensuring that they receive the same quality of service as in their country. In 2012 and 2013, the prestigious ''Euromoney'' magazine awarded UniCredit Bank Award “Best Bank for Cash Managemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Telephone Banking

Telephone banking is a service provided by a bank or other financial institution that enables customers to perform over the telephone a range of financial transactions that do not involve cash or financial instruments (such as checks) without the need to visit a bank branch or ATM. History Telephone banking became commercially available in the 1980s, first introduced by Girobank in the United Kingdom, which established a dedicated telephone banking service in 1984. Telephone banking saw growth during the 1980s and early 1990s and was heavily used by the first generation of direct banks. However, the development of online banking in the early 2000s started a long-term decline in the use of telephone banking in favor of internet banking. The advent of mobile banking further eroded the use of telephone banking in the 2010s. Operation To use a financial institution's telephone banking facility, a customer must first register with the institution for the service. They would ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1990

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Bucharest

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Over time, companies have evolved to have the following features: "separate legal personality, limited liability, transferable shares, investor ownership, and a managerial hierarchy". The company, as an entity, was created by the state which granted the privilege of incorporation. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is to generate sales, revenue, and profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duties according to the publicly declared incorporation pu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Romania

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ancien ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Austria

UniCredit Bank Austria AG, branded and widely referred to as Bank Austria, is an Austrian bank, 99,9965% owned by Milan-based pan-European banking group UniCredit. Bank Austria was formed in 1991 by merger of Vienna's Länderbank and Zentralsparkasse, acquired Creditanstalt-Bankverein in 1997, and merged with it to form Bank Austria-Creditanstalt (BA-CA) in 2002. Its name reverted to Bank Austria in 2008, as UniCredit, the bank's owner since 2005, phased out the history-laden Creditanstalt brand. History Bank Austria was formed in 1991 by the merger of the troubled Länderbank and Vienna's Zentralsparkasse, in practice a takeover of the former by the latter led by its general director ; the merged entity became Austria's largest bank. In 1996, the Austrian government announced the privatization of Creditanstalt-Bankverein, in which it held a majority stake. In January 1997, Bank Austria acquired the stake for about 1.25 billion euros. In turn, Bank Austria sold a majority s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Current Accounts

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash. Transaction accounts are known by a variety of descriptions, including a current account (British English), chequing account or checking account when held by a bank, share draft account when held by a credit union in North America. In the Commonwealth of Nations, United Kingdom, Hong Kong, India, Ireland, Australia, New Ze ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Di Roma

Banca di Roma was an Italian bank based in Rome, formed in 1992 by merger of Banco di Santo Spirito and Banco di Roma. From 2008 it was a subsidiary of UniCredit under the name UniCredit Banca di Roma S.p.A.. In 2010 the subsidiary was absorbed into the bank, but retained as a registered trademark. In 2008 the bank had 1533 branches: 608 in Lazio, 219 in Campania, 173 in Apulia, 171 in Tuscany, 99 in Marche, 84 in Umbria, 59 in Sardegna, 49 in Abruzzo, 38 in Molise, 23 in Calabria and 10 in Basilicata. (Sicily and Northern Italy were served by sister companies Banco di Sicilia and UniCredit Banca respectively) History Banca di Roma S.p.A. was formed by the merger of Banco di Santo Spirito, Banco di Roma and Cassa di Risparmio di Roma. In 1991 the banking section of Cassa di Risparmio di Roma was absorbed by Banco di Santo Spirito, as Legge Amato required all saving banks of Italy () had to transform into S.p.A. (company limited by shares). The owner, Fondazione Cassa di Ri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an Interbank lending market, interbank exchange rate of 141 Japanese yen to the United States dollar means that ¥141 will be exchanged for or that will be exchanged for ¥141. In this case it is said that the price of a dollar in relation to yen is ¥141, or equivalently that the price of a yen in relation to dollars is $1/141. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating exchange rate, floating, fixed exchange rate, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Teller Machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of other names, including automatic teller machines (ATMs) in the United States (sometimes RAS syndrome, redundantly as "ATM machine"). In Canada, the term automated banking machine (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM rather than ABM. In British English, the terms cashpoint, cash machine and hole in the wall are also used. ATMs that are Independent ATM deployer, not operated by a financial institution are known as "White-label ABMs, white-label" ATMs. Using an ATM, customers can access their bank deposit or credit accounts in order to make ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Live Chat

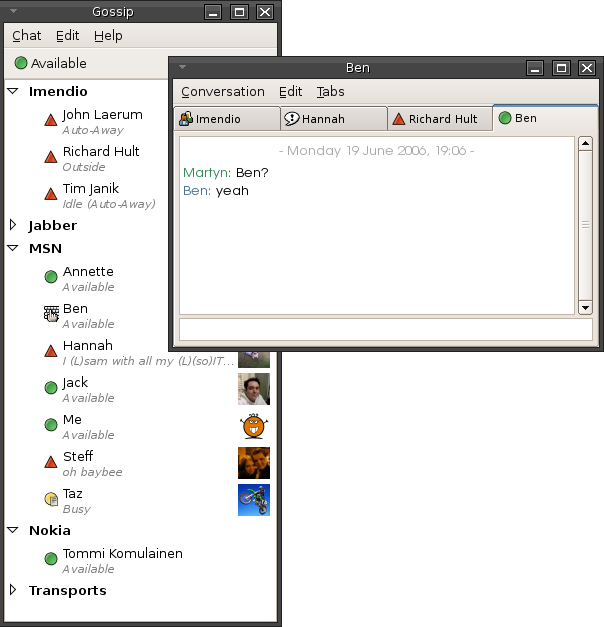

Online chat is any direct text-, audio- or video-based (webcams), one-on-one or one-to-many ( group) chat (formally also known as synchronous conferencing), using tools such as instant messengers, Internet Relay Chat (IRC), talkers and possibly MUDs or other online games. Online chat includes web-based applications that allow communication – often directly addressed, but anonymous between users in a multi-user environment. Web conferencing is a more specific online service, that is often sold as a service, hosted on a web server controlled by the vendor. Online chat may address point-to-point communications as well as multicast communications from one sender to multiple receivers and voice and video chat, or may be a feature of a web conferencing service. ''Online chat'' in a narrower sense is any kind of communication over the Internet that offers a real-time transmission of text messages from sender to receiver. Chat messages are generally short in order to enable other ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |