|

TradeWeb

Tradeweb Markets Inc. (Tradeweb) is an international financial services company that builds and operates electronic over-the-counter (OTC) marketplaces for trading fixed income products, ETFs, and derivatives. The company was co-founded in 1996 by Lee Olesky and Jim Toffey.Janet Whitman and Agnes T. Crane"Thomson Signs An Agreement To Buy TradeWeb,"''The Wall Street Journal'', April 9, 2004. Its customers include banks, asset managers, central banks, pension funds and insurance companies. Tradeweb's headquarters are in New York City. History Tradeweb was launched in 1998, creating the first multi-dealer online trading network for U.S. Treasuries. In 2000, the firm opened its London office and launched marketplaces for trading European government bonds and agencies. The firm was privately held until 2004, when it was acquired by Thomson Corporation (now Thomson-Reuters) for $535 million. Tradeweb established its Tokyo office in 2005, starting a partnership with CanDeal t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tradeweb Logo

Tradeweb Markets Inc. (Tradeweb) is an international financial services company that builds and operates electronic over-the-counter (OTC) marketplaces for trading fixed income products, ETFs, and derivatives. The company was co-founded in 1996 by Lee Olesky and Jim Toffey.Janet Whitman and Agnes T. Crane"Thomson Signs An Agreement To Buy TradeWeb,"''The Wall Street Journal'', April 9, 2004. Its customers include banks, asset managers, central banks, pension funds and insurance companies. Tradeweb's headquarters are in New York City. History Tradeweb was launched in 1998, creating the first multi-dealer online trading network for U.S. Treasuries. In 2000, the firm opened its London office and launched marketplaces for trading European government bonds and agencies. The firm was privately held until 2004, when it was acquired by Thomson Corporation (now Thomson-Reuters) for $535 million. Tradeweb established its Tokyo office in 2005, starting a partnership with CanDeal t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lee Olesky

Lee Olesky is an American financial executive and entrepreneur. He is co-founder, Chairman and Chief Executive Officer of Tradeweb (Nasdaq: TW), an international financial services company that builds and operates electronic over-the-counter marketplaces for trading fixed income products, ETFs, and derivatives. Olesky is a central figure in the development of electronic tradingAgini, SamuelTradeweb chief wants to create Amazon for bonds.Fn Financial News. 2018-11-16. retrieved 2021-11-19. in the global financial markets, an "electronic-trading pioneer" according to Fortune Magazine who built "a $21 billion juggernaut that has completely upended the Byzantine world of bond trading.". He is a frequent commentator on technology, the modernization of markets, and the growth of electronic trading. Education Olesky earned a B.A. in history from Tulane University and a J.D. from George Washington University Law School. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson-Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational media conglomerate. The company was founded in Toronto, Ontario, Canada, where it is headquartered at the Bay Adelaide Centre. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group in April 2008. It is majority-owned by The Woodbridge Company, a holding company for the Thomson family. History Thomson Corporation The forerunner of the Thomson company was founded by Roy Thomson in 1934 in Ontario, as the publisher of ''The Timmins Daily Press''. In 1953, Thomson acquired the ''Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the franchise for Scottish Television. In 1959, he bought the Kemsley Group, a purchase that eventually gave him control of the '' Sunday Times''. He separately acquired the ''Times'' in 1967. He moved into the airline business in 1965, when he acquired Britanni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational media conglomerate. The company was founded in Toronto, Ontario, Canada, where it is headquartered at the Bay Adelaide Centre. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group in April 2008. It is majority-owned by The Woodbridge Company, a holding company for the Thomson family. History Thomson Corporation The forerunner of the Thomson company was founded by Roy Thomson in 1934 in Ontario, as the publisher of ''The Timmins Daily Press''. In 1953, Thomson acquired the ''Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the franchise for Scottish Television. In 1959, he bought the Kemsley Group, a purchase that eventually gave him control of the '' Sunday Times''. He separately acquired the ''Times'' in 1967. He moved into the airline business in 1965, when he acquired Britanni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell 1000

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. , the stocks of the Russell 1000 Index had a weighted average market capitalization of $608.1 billion and a median market capitalization of $15.1 billion. , components ranged in market capitalization from $1.8 billion to $1.4 trillion. The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. The ticker symbol is ^RUI. There are several exchange-traded funds and mutual funds that track the index. Record values Annual returns Top sectors by weight *Technology *Consumer Discretionary * Health Care *Industrials *Financial services Top 10 holdings *Apple () *Microsoft () *Amazon () *Alphabet (Class A) () * Tesla () *Alphabet (Class C) () * Meta () *Nvidia () *Berkshire Hathaway () *UnitedHealth Group () (as of Dece ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CanDeal

CanDeal is a Canadian online exchange for Canadian dollar debt securities. It provides institutional investors access to liquidity for Canadian Government Bonds and money market instruments. CanDeal has offices in Toronto and Montreal and is owned by Canada's Six Major Banks and TMX Group (equally as of 2018 compared to a previous ownership structure in which TMX owned 47%). CanDeal became a member of the Investment Dealers Association of Canada, and was granted alternative trading system status by the Ontario Securities Commission on July 2, 2002. History *June 27, 2001 – CanDeal is created by founding shareholders BMO Nesbitt Burns, Basis100 inc., CIBC World Markets Inc., MoneyLine Network Inc., National Bank Financial Inc., RBC Dominion Securities Inc., Scotia Capital Inc. and TD Securities Inc. *July 8, 2002 – TMX Group acquires a 40% stake in CanDeal. *September 10, 2002 – CanDeal executes its first trade. *January 1, 2003 - CanDeal's founder Jayson Horner l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Default Swap Index

A credit default swap index is a credit derivative used to hedge credit risk or to take a position on a basket of credit entities. Unlike a credit default swap, which is an over the counter credit derivative, a credit default swap index is a completely standardized credit security and may therefore be more liquid and trade at a smaller bid–offer spread. This means that it can be cheaper to hedge a portfolio of credit default swaps or bonds with a CDS index than it would be to buy many single name CDS to achieve a similar effect. Credit-default swap indexes are benchmarks for protecting investors owning bonds against default, and traders use them to speculate on changes in credit quality. Issuance There are currently two main families of corporate CDS indices: CDX and iTraxx. CDX indices contain North American and Emerging Market companies and are administered by CDS Index Company (CDSIndexCo) and marketed by Markit Group Limited, and iTraxx indices contain companies from the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

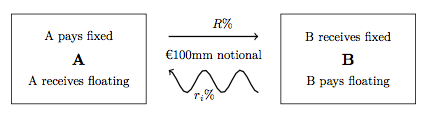

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the List of United States cities by population density, most densely populated major city in the United States, and is more than twice as populous as second-place Los Angeles. New York City lies at the southern tip of New York (state), New York State, and constitutes the geographical and demographic center of both the Northeast megalopolis and the New York metropolitan area, the largest metropolitan area in the world by urban area, urban landmass. With over 20.1 million people in its metropolitan statistical area and 23.5 million in its combined statistical area as of 2020, New York is one of the world's most populous Megacity, megacities, and over 58 million people live within of the city. New York City is a global city, global Culture of New ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Magazine

''Risk'' magazine provides news and analysis covering the financial industry, with a particular focus on risk management, derivatives and complex finance. It includes articles and papers on credit risk, market risk, risk systems, swap option pricing, derivatives risk and pricing, regulation and asset management. Articles include news, features, comment, analysis and mathematical papers. Risk has a tradition of covers featuring pieces of abstract modern art. The magazine was founded by Peter Field in 1987. It was owned by Risk Waters Group, then acquired by Incisive Media, and is now owned by Infopro Digital. Editors include: Tom Osborn, Philip Alexander, Lukas Becker, Rob Mannix and Mauro Cesa, with Duncan Wood as Editor-in-Chief. Energy Risk — a sister title that covers energy trading and risk management — was spun off in 1994. Risk magazine has another sister publication – Asia Risk – focusing on the Asia-Pacific region. Risk also runs industry-specific events, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repurchase Agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price. The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, either in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets. In 2007–2008, a run on the repo market, in which funding for investment banks was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Trading

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary, such as brokers, market makers, Investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone based trading. Sometimes the term trading platform is also used in reference to the trading software alone. Electronic trading platforms typically stream live market prices on which users can trade and may prov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |