|

TradeWeb

Tradeweb Markets Inc. is an international financial technology company that builds and operates electronic over-the-counter (OTC) marketplaces for trading fixed income products, ETFs, and derivatives. Its customers include banks, asset managers, central banks, pension funds and insurance companies. Tradeweb's headquarters are in New York City. History The company was co-founded in 1996 by Lee Olesky and Jim Toffey. The trading platform was launched in 1998 as the first multi-dealer online trading network for U.S. Treasuries. In 2000, the firm opened its London office and launched marketplaces for trading European government bonds and agencies. The firm was privately held until 2004, when it was acquired by Thomson Corporation (now Thomson-Reuters) for $535 million. Tradeweb established its Tokyo office in 2005, starting a partnership with CanDeal to launch Canadian debt securities trading. That year, the firm grew by introducing marketplaces for interest rate swaps, c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson Corporation

Thomson Corporation was one of the world's largest information companies. It was established in 1989 following a merger between International Thomson Organization and Thomson Newspapers. In 2008, it purchased Reuters Group to form Thomson Reuters. The Thomson Corporation was active in financial services, healthcare sectors, law, science and technology research, as well as tax and accounting sectors. The company operated through five segments (2007 onwards): Thomson Financial, Thomson Healthcare, Thomson Legal, Thomson Scientific and Thomson Tax & Accounting. Until 2007, Thomson was also a major worldwide provider of higher education textbooks, academic information solutions and reference materials. On 26 October 2006, Thomson announced the proposed sale of its Thomson Learning assets. In May 2007, Thomson Learning was acquired by Apax Partners and subsequently renamed Cengage Learning in July. The Thomson Learning brand was used to the end of August 2007. Subsequently, on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tradeweb Logo

Tradeweb Markets Inc. is an international financial technology company that builds and operates electronic over-the-counter (OTC) marketplaces for trading fixed income products, ETFs, and derivatives. Its customers include banks, asset managers, central banks, pension funds and insurance companies. Tradeweb's headquarters are in New York City. History The company was co-founded in 1996 by Lee Olesky and Jim Toffey. The trading platform was launched in 1998 as the first multi-dealer online trading network for U.S. Treasuries. In 2000, the firm opened its London office and launched marketplaces for trading European government bonds and agencies. The firm was privately held until 2004, when it was acquired by Thomson Corporation (now Thomson-Reuters) for $535 million. Tradeweb established its Tokyo office in 2005, starting a partnership with CanDeal to launch Canadian debt securities trading. That year, the firm grew by introducing marketplaces for interest rate swaps, c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lee Olesky

Lee Olesky is an American financial executive and entrepreneur. He is co-founder of Tradeweb (Nasdaq: TW) and formerly served as the company's Chairman and Chief Executive Officer. Tradeweb is an international financial technology company that builds and operates electronic over-the-counter marketplaces for trading fixed income products, ETFs, and derivatives. Olesky is a central figure in the development of electronic tradingAgini, SamuelTradeweb chief wants to create Amazon for bonds.Fn Financial News. 2018-11-16. retrieved 2021-11-19. in the global financial markets, an "electronic-trading pioneer" according to Fortune Magazine who built "a $21 billion juggernaut that has completely upended the Byzantine world of bond trading.". He is a frequent commentator on technology, the modernization of markets, and the growth of electronic trading. Education Olesky earned a B.A. in history from Tulane University and a J.D. from George Washington University Law School. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Fund

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides pension, retirement income. The U.S. Government's Social Security Trust Fund, which oversees $2.57 trillion in assets, is the world's largest public pension fund. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold about USD$6 Trillion (short scale), trillion in assets. In 2012, PricewaterhouseCoopers estimated that pension funds worldwide hold over $33.9 trillion in assets (and were expected to grow to more than $56 trillion by 2020), the largest for any category of institutional investor ahead of mutual funds, insurance companies, currency reserves, sovereign wealth funds, hedge funds, or private equity. Classifications Open vs. closed pension fund ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational corporation, multinational content-driven technology Conglomerate (company), conglomerate. The company was founded in Toronto, Ontario, Canada, and maintains its headquarters at 19 Duncan Street there. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group on 17 April 2008. It is majority-owned by the Woodbridge Company, a holding company for the Family tree of Thomson family, Thomson family of Canada. History Thomson Corporation The forerunner of the Thomson company was founded in 1934 by Roy Thomson, 1st Baron Thomson of Fleet, Roy Thomson in Ontario as the publisher of ''The Timmins Daily Press''. In 1953, Thomson acquired the ''The Scotsman, Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the government-granted monopoly, franchise for Scottish Television. In 1959, he bought the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repurchase Agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of secured short-term borrowing, usually, though not always using government securities as collateral. A contracting party sells a security to a lender and, by agreement between the two parties, repurchases the security back shortly afterwards, at a slightly higher contracted price. The difference in the prices and the time interval between sale and repurchase creates an effective interest rate on the loan. The mirror transaction, a "reverse repurchase agreement," is a form of secured contracted lending in which a party buys a security along with a concurrent commitment to sell the security back in the future at a specified time and price. Because this form of funding is often used by dealers, the convention is to reference the dealer's position in a transaction with an end party. Central banks also use repo and reverse repo transactions to manage banking system reserves. When the Feder ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Default Swap Index

A credit default swap index is a credit derivative used to hedge credit risk or to take a position on a basket of credit entities. Unlike a credit default swap, which is an over the counter credit derivative, a credit default swap index is a completely standardized credit security and may therefore be more liquid and trade at a smaller bid–offer spread. This means that it can be cheaper to hedge a portfolio of credit default swaps or bonds with a CDS index than it would be to buy many single name CDS to achieve a similar effect. Credit-default swap indexes are benchmarks for protecting investors owning bonds against default, and traders use them to speculate on changes in credit quality. Issuance There are currently two main families of corporate CDS indices: CDX and iTraxx. CDX indices contain North American and Emerging Market companies and are administered by CDS Index Company (CDSIndexCo) and marketed by Markit Group Limited, and iTraxx indices contain companies from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

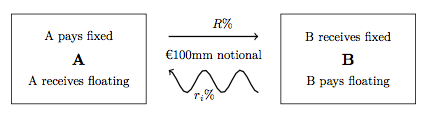

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CanDeal

CanDeal is a Canadian online exchange for Canadian dollar debt securities. It provides institutional investors access to liquidity for Canadian Government Bonds and money market instruments. CanDeal has offices in Toronto and Montreal and is owned by Canada's Six Major Banks and TMX Group (equally as of 2018 compared to a previous ownership structure in which TMX owned 47%). CanDeal became a member of the Investment Dealers Association of Canada, and was granted alternative trading system status by the Ontario Securities Commission on July 2, 2002. History *June 27, 2001 – CanDeal is created by founding shareholders BMO Nesbitt Burns, Basis100 inc., CIBC World Markets Inc., MoneyLine Network Inc., National Bank Financial Inc., RBC Dominion Securities Inc., Scotia Capital Inc. and TD Securities Inc. *July 8, 2002 – TMX Group acquires a 40% stake in CanDeal. *September 10, 2002 – CanDeal executes its first trade. *January 1, 2003 - CanDeal's founder Jayson Horne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Magazine

''Risk'' is an English financial industry trade magazine that specializes in financial risk management, regulation, and asset management. Since its establishment in 1987 by Peter Field, it has undergone ownership changes, transitioning from the Risk Waters Group to Incisive Media and now to Infopro Digital. The magazine's editorial team includes Kris Devasabai as editor-in-chief. Additionally, Risk organizes industry events and has a sister publication, Asia Risk. The magazine shifted to a digital-only format in June 2022 and is accessible through its website and app. Risk.net Risk.net is a news and analysis website covering the financial industry, with a particular focus on regulation, derivatives, risk management, asset management, and commodities. Risk.net publishes widely reported stories and analytical articles. Risk.net's financial coverage includes operational risk, accounting, Fundamental Review of the Trading Book, structured products, valuation adjustments, financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson-Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational content-driven technology conglomerate. The company was founded in Toronto, Ontario, Canada, and maintains its headquarters at 19 Duncan Street there. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group on 17 April 2008. It is majority-owned by the Woodbridge Company, a holding company for the Thomson family of Canada. History Thomson Corporation The forerunner of the Thomson company was founded in 1934 by Roy Thomson in Ontario as the publisher of ''The Timmins Daily Press''. In 1953, Thomson acquired the ''Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the franchise for Scottish Television. In 1959, he bought the Kemsley Group, a purchase that eventually gave him control of the ''Sunday Times''. He separately acquired the '' Times'' in 1967. He moved into the airline busi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |