|

Tradeweb Logo

Tradeweb Markets Inc. (Tradeweb) is an international financial services company that builds and operates electronic over-the-counter (OTC) marketplaces for trading fixed income products, ETFs, and derivatives. The company was co-founded in 1996 by Lee Olesky and Jim Toffey.Janet Whitman and Agnes T. Crane"Thomson Signs An Agreement To Buy TradeWeb,"''The Wall Street Journal'', April 9, 2004. Its customers include banks, asset managers, central banks, pension funds and insurance companies. Tradeweb's headquarters are in New York City. History Tradeweb was launched in 1998, creating the first multi-dealer online trading network for U.S. Treasuries. In 2000, the firm opened its London office and launched marketplaces for trading European government bonds and agencies. The firm was privately held until 2004, when it was acquired by Thomson Corporation (now Thomson-Reuters) for $535 million. Tradeweb established its Tokyo office in 2005, starting a partnership with CanDeal t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Companies

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Trading

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary, such as brokers, market makers, Investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone based trading. Sometimes the term trading platform is also used in reference to the trading software alone. Electronic trading platforms typically stream live market prices on which users can trade and may prov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational media conglomerate. The company was founded in Toronto, Ontario, Canada, where it is headquartered at the Bay Adelaide Centre. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group in April 2008. It is majority-owned by The Woodbridge Company, a holding company for the Thomson family. History Thomson Corporation The forerunner of the Thomson company was founded by Roy Thomson in 1934 in Ontario, as the publisher of ''The Timmins Daily Press''. In 1953, Thomson acquired the ''Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the franchise for Scottish Television. In 1959, he bought the Kemsley Group, a purchase that eventually gave him control of the '' Sunday Times''. He separately acquired the ''Times'' in 1967. He moved into the airline business in 1965, when he acquired Britanni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repurchase Agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price. The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, either in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets. In 2007–2008, a run on the repo market, in which funding for investment banks was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Default Swap Index

A credit default swap index is a credit derivative used to hedge credit risk or to take a position on a basket of credit entities. Unlike a credit default swap, which is an over the counter credit derivative, a credit default swap index is a completely standardized credit security and may therefore be more liquid and trade at a smaller bid–offer spread. This means that it can be cheaper to hedge a portfolio of credit default swaps or bonds with a CDS index than it would be to buy many single name CDS to achieve a similar effect. Credit-default swap indexes are benchmarks for protecting investors owning bonds against default, and traders use them to speculate on changes in credit quality. Issuance There are currently two main families of corporate CDS indices: CDX and iTraxx. CDX indices contain North American and Emerging Market companies and are administered by CDS Index Company (CDSIndexCo) and marketed by Markit Group Limited, and iTraxx indices contain companies from the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

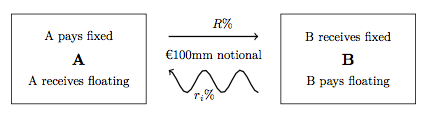

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CanDeal

CanDeal is a Canadian online exchange for Canadian dollar debt securities. It provides institutional investors access to liquidity for Canadian Government Bonds and money market instruments. CanDeal has offices in Toronto and Montreal and is owned by Canada's Six Major Banks and TMX Group (equally as of 2018 compared to a previous ownership structure in which TMX owned 47%). CanDeal became a member of the Investment Dealers Association of Canada, and was granted alternative trading system status by the Ontario Securities Commission on July 2, 2002. History *June 27, 2001 – CanDeal is created by founding shareholders BMO Nesbitt Burns, Basis100 inc., CIBC World Markets Inc., MoneyLine Network Inc., National Bank Financial Inc., RBC Dominion Securities Inc., Scotia Capital Inc. and TD Securities Inc. *July 8, 2002 – TMX Group acquires a 40% stake in CanDeal. *September 10, 2002 – CanDeal executes its first trade. *January 1, 2003 - CanDeal's founder Jayson Horner l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Magazine

''Risk'' magazine provides news and analysis covering the financial industry, with a particular focus on risk management, derivatives and complex finance. It includes articles and papers on credit risk, market risk, risk systems, swap option pricing, derivatives risk and pricing, regulation and asset management. Articles include news, features, comment, analysis and mathematical papers. Risk has a tradition of covers featuring pieces of abstract modern art. The magazine was founded by Peter Field in 1987. It was owned by Risk Waters Group, then acquired by Incisive Media, and is now owned by Infopro Digital. Editors include: Tom Osborn, Philip Alexander, Lukas Becker, Rob Mannix and Mauro Cesa, with Duncan Wood as Editor-in-Chief. Energy Risk — a sister title that covers energy trading and risk management — was spun off in 1994. Risk magazine has another sister publication – Asia Risk – focusing on the Asia-Pacific region. Risk also runs industry-specific events, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson-Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational media conglomerate. The company was founded in Toronto, Ontario, Canada, where it is headquartered at the Bay Adelaide Centre. Thomson Reuters was created by the Thomson Corporation's purchase of the British company Reuters Group in April 2008. It is majority-owned by The Woodbridge Company, a holding company for the Thomson family. History Thomson Corporation The forerunner of the Thomson company was founded by Roy Thomson in 1934 in Ontario, as the publisher of ''The Timmins Daily Press''. In 1953, Thomson acquired the ''Scotsman'' newspaper and moved to Scotland the following year. He consolidated his media position in Scotland in 1957, when he won the franchise for Scottish Television. In 1959, he bought the Kemsley Group, a purchase that eventually gave him control of the '' Sunday Times''. He separately acquired the ''Times'' in 1967. He moved into the airline business in 1965, when he acquired Britanni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomson Corporation

The Thomson Corporation was one of the world's largest information companies. It was established in 1989 following a merger between International Thomson Organisation Ltd (ITOL) and Thomson Newspapers. In 2008, it purchased Reuters Group to form Thomson Reuters. The Thomson Corporation was active in financial services, healthcare sectors, law, science and technology research and tax and accounting sectors. The company operated through five segments (2007 onwards): Thomson Financial, Thomson Healthcare, Thomson Legal, Thomson Scientific and Thomson Tax & Accounting. Until 2007, Thomson was also a major worldwide provider of higher education textbooks, academic information solutions and reference materials. On 26 October 2006, Thomson announced the proposed sale of its Thomson Learning assets. In May 2007, Thomson Learning was acquired by Apax Partners and subsequently renamed Cengage Learning in July. The Thomson Learning brand was used to the end of August 2007. Subsequently ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Agency Debt

Agency debt, also known as an Agency bond or Agency Security, is a security, usually a bond, issued by a United States government-sponsored agency or federal budget agency. The offerings of these agencies are backed but not guaranteed by the US government. Some prominent issuers of these securities are the Federal Home Loan Banks (FHLBanks), Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac). See also Mortgage-backed security A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment b ... References {{US-gov-stub Securities (finance) Bonds (finance) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |