|

Taxation In Peru

Taxation represents the biggest source of revenues for the Peruvian government (up to 76%). For 2016, the projected amount of taxation revenues was S/.94.6 billion ($29 billion). There are four taxes that make up approximately 90 percent of the taxation revenues: * the income tax (both corporate and personal), * the value-added tax (VAT), * the import tax, * the excise tax. All these four types of taxes are imposed at the national level. There are also municipal taxes based on an individual’s or household’s residence as well as a municipal property tax and a municipal vehicle tax. Income tax Peruvian income taxes may be divided into 2 large groups: ''Corporate income tax'' The general income tax annual rate for resident entities is 29.5%. In addition to this, resident entities are obliged to make advance payments on a monthly basis by applying a coefficient over the accrued taxable income of the month. Advance payments are to be offset against the annual income tax ob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peru

, image_flag = Flag of Peru.svg , image_coat = Escudo nacional del Perú.svg , other_symbol = Great Seal of the State , other_symbol_type = Seal (emblem), National seal , national_motto = "Firm and Happy for the Union" , national_anthem = "National Anthem of Peru" , march = "March of Flags" , image_map = PER orthographic.svg , map_caption = , image_map2 = , capital = Lima , coordinates = , largest_city = capital , official_languages = Peruvian Spanish, Spanish , languages_type = Co-official languages , languages = , ethnic_groups = , ethnic_groups_year = 2017 , demonym = Peruvians, Peruvian , government_type = Unitary state, Unitary Semi-presidential system, semi-presidential republic , leader_title1 = President of Peru, President ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peruvian Sol

The sol (; plural: soles; currency sign: S/) is the currency of Peru; it is subdivided into 100 ''céntimos'' ("cents"). The ISO 4217 currency code is PEN. The sol replaced the Peruvian inti in 1991 and the name is a return to that of Peru's historic currency, as the previous incarnation of Peruvian sol (1863–1985), sol was in use from 1863 to 1985. Although ''sol'' in this usage is derived from the Latin ''solidus (coin), solidus'' (English: solid), the word also means "sun" in Spanish. There is thus a continuity with the old Peruvian inti, which was named after Inti, the Sun God of the Incas. At its introduction in 1991, the currency was officially called ''nuevo sol'' ("new sol"), but on November 13, 2015, the Congress of the Republic of Peru, Peruvian Congress voted to rename the currency simply ''sol''. History Currencies in use before the current Peruvian sol include: * The ''Spanish colonial real'' from the 16th to 19th centuries, with 8 reales equal to 1 peso. * The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

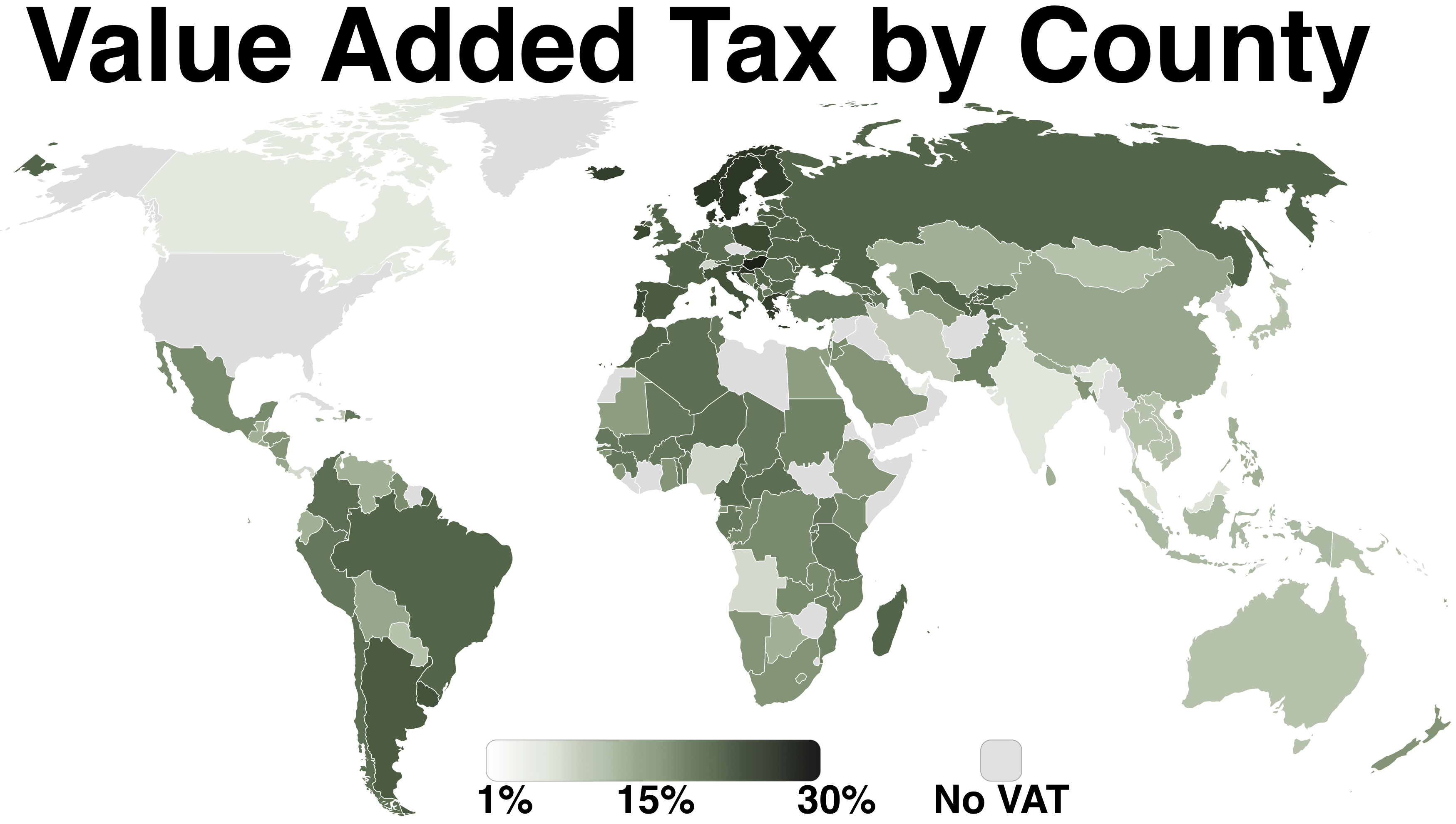

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Tax

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends. To avoid a dividend tax being levied, a corporation may distribute surplus funds to shareholders by way of a share buy-back. These, however, are normally treated as capital gains, but may offer tax benefits when the tax rate on capital gains is lower than the tax rate on dividends. Another potential strategy is to for a corporation not to distribute surplus funds to shareholders, who benefit from an increase in the value of their shareholding. These may also be subject to capital g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes). Double liability may be mitigated in a number of ways, for example, a jurisdiction may: * exempt foreign-source income from tax, * exempt foreign-source income from tax if tax had been paid on it in another jurisdiction, or above some benchmark to exclude tax haven jurisdictions, or * fully tax the foreign-source income but give a credit for taxes paid on the income in the foreign jurisdiction. Jurisdictions may enter into tax treaties with other countries, which set out rules to avoid double taxation. These treaties often include arrangements for exchange of information to prevent tax evasion such as when a person claims tax exemption in one country on the basis of non-residence in that country, but then does not declare it as foreign income in the other country; or who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andean Community

The Andean Community ( es, Comunidad Andina, CAN) is a free trade area with the objective of creating a customs union comprising the South American countries of Bolivia, Colombia, Ecuador, and Peru. The trade bloc was called the Andean Pact until 1996 and came into existence when the Cartagena Agreement was signed in 1969. Its headquarters are in Lima, Peru. The Andean Community has 113 million inhabitants over an area of 4,700,000 km². Its GDP has gone up to US$745.300 billion in 2005, including Venezuela, which was a member at the time. Its estimated PPP of GDP for 2011 amounts to US$902.86 billion, excluding Venezuela. Membership The original Andean Pact was founded in 1969 by Bolivia, Chile, Colombia, Ecuador, and Peru. In 1973 the pact gained its sixth member, Venezuela. In 1976 however, its membership was again reduced to five when Chile withdrew. Venezuela announced its withdrawal in 2006, reducing the Andean Community to four member states. Recently, with the new c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |