|

The MacDowell Colony

MacDowell is an artist's residency program in Peterborough, New Hampshire, United States, founded in 1907 by composer Edward MacDowell and his wife, pianist and philanthropist Marian MacDowell. Prior to July 2020, it was known as the MacDowell Colony (or simply "the Colony") but the Board of Directors shortened the name to remove "terminology with oppressive overtones". After Edward MacDowell died in 1908, Marian MacDowell established the artists' residency program through a nonprofit association in honor of her husband, raising funds to transform her farm into a quiet retreat for creative artists to work. She led the organization for almost 25 years. Over the years, an estimated 8,300 artists have been supported in residence with nearly 15,000 fellowships, including the winners of at least 86 Pulitzer Prizes, 31 National Book Awards, 30 Tony Awards, 32 MacArthur Fellowships, 15 Grammys, 8 Oscars, 828 Guggenheim Fellowships, and 107 Rome Prizes. The artists' residency progra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peterborough, New Hampshire

Peterborough is a town in Hillsborough County, New Hampshire, United States. The population was 6,418 at the 2020 census. The main village, with 3,090 people at the 2020 census, is defined as the Peterborough census-designated place (CDP) and is located along the Contoocook River at the junction of U.S. Route 202 and New Hampshire Route 101. Peterborough is west of Manchester and northwest of Boston. History Granted by Massachusetts in 1737, it was first permanently settled in 1749. The town suffered several attacks during the French and Indian War. Nevertheless, by 1759, there were fifty families settled. Incorporated on January 17, 1760, by Governor Benning Wentworth, it was named after Lieutenant Peter Prescott (1709–1784) of Concord, Massachusetts, a prominent land speculator. The Contoocook River and Nubanusit Brook offered numerous sites for watermills, and Peterborough became a prosperous mill town. In 1810, the first cotton factory was established. By 1859, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grover Cleveland

Stephen Grover Cleveland (March 18, 1837June 24, 1908) was an American lawyer and politician who served as the 22nd and 24th president of the United States from 1885 to 1889 and from 1893 to 1897. Cleveland is the only president in American history to serve two non-consecutive terms in office. He won the popular vote for three presidential elections—in 1884, 1888, and 1892—and was one of two Democrats (followed by Woodrow Wilson in 1912) to be elected president during the era of Republican presidential domination dating from 1861 to 1933. In 1881, Cleveland was elected mayor of Buffalo, and in 1882, he was elected governor of New York. He was the leader of the pro-business Bourbon Democrats who opposed high tariffs, free silver, inflation, imperialism, and subsidies to business, farmers, or veterans. His crusade for political reform and fiscal conservatism made him an icon for American conservatives of the era. Cleveland won praise for his honesty, self-relianc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Hampshire Supreme Court

The New Hampshire Supreme Court is the supreme court of the U. S. state of New Hampshire and sole appellate court of the state. The Supreme Court is seated in the state capital, Concord. The Court is composed of a Chief Justice and four Associate Justices appointed by the Governor and Executive Council to serve during "good behavior" until retirement or the age of seventy. The senior member of the Court is able to specially assign lower-court judges, as well as retired justices, to fill vacancies on the Court. The Supreme Court is the administrative authority over the state's judicial system. The Court has both mandatory and discretionary appellate jurisdiction. In 2000, the Court created a "Three Judges Expedited" or 3JX panel to issue decisions in cases of less precedential value, with its decision only binding on the present case. In 2004, the court began accepting all appeals from the trial courts for the first time in 25 years. From 1776 to 1876, the then four-member cour ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Hampshire Superior Court

The New Hampshire Superior Court is the statewide court of general jurisdiction which provides jury trials in civil and criminal cases. There are 11 locations of the Superior Court, one for each county and two in Hillsborough County. Jurisdiction The Superior Court has jurisdiction in the following matters: * Negligence, contracts, real property rights and other civil matters with a minimum claim of $1,500 in damages in which either party requests a trial by jury. The Superior Court has exclusive jurisdiction over cases in which the damage claims exceed $25,000. * Divorce, child custody and support and domestic violence. The Superior Court and the District Court share jurisdiction over domestic violence cases. * Felonies (major crimes such as drugs, burglary, theft and aggravated felonious sexual assault). * Misdemeanor appeals from the District Court. * The Superior Court also has exclusive jurisdiction over petitions for injunctive relief, in which parties seek a cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charitable Organization

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, religious or other activities serving the public interest or common good). The legal definition of a charitable organization (and of charity) varies between countries and in some instances regions of the country. The regulation, the tax treatment, and the way in which charity law affects charitable organizations also vary. Charitable organizations may not use any of their funds to profit individual persons or entities. (However, some charitable organizations have come under scrutiny for spending a disproportionate amount of their income to pay the salaries of their leadership). Financial figures (e.g. tax refund, revenue from fundraising, revenue from sale of goods and services or revenue from investment) are indicators to assess the financial sustainability of a charity, especially to charity evaluators. This information can impact a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-profit Organization

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status. Key aspects of nonprofits are accountability, trustworthiness, honesty, and openness to ev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edward MacDowell Medal

The Edward MacDowell Medal is an award which has been given since 1960 to one person annually who has made an outstanding contribution to American culture and the arts. It is given by MacDowell, the first artist residency program in the United States. Background The award is named for composer Edward MacDowell, who, with pianist Marian MacDowell, his wife, founded the MacDowell artist residency (formerly known as The MacDowell Colony) in 1907. The residency exists to nurture the arts by offering creative individuals of the highest talent an inspiring environment in which to produce enduring works of the imagination. Each year, MacDowell welcomes more than 300 architects, composers, filmmakers, interdisciplinary artists, theatre artists, visual artists, and writers from across the United States and around the globe History of the award Established in 1960 with the first award going to Thornton Wilder, the award is given to one artist each year, from among seven artistic discipli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1938 New England Hurricane

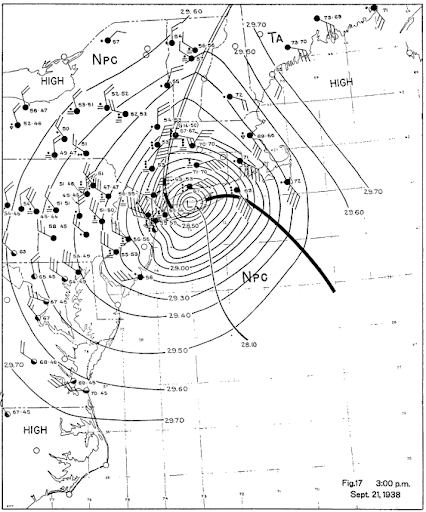

The 1938 New England Hurricane (also referred to as the Great New England Hurricane and the Long Island Express Hurricane) was one of the deadliest and most destructive tropical cyclones to strike Long Island, New York, and New England. The storm formed near the coast of Africa on September 9, becoming a Category 5 hurricane on the Saffir–Simpson hurricane scale, before making landfall as a Category 3 hurricane on Long Island on Wednesday, September 21. It is estimated that the hurricane killed 682 people, damaged or destroyed more than 57,000 homes, and caused property losses estimated at $306 million ($4.7 billion in 2017). Multiple other sources, however, mention that the 1938 hurricane might have really been a more powerful Category 4, having winds similar to Hurricanes Hugo, Harvey, Frederic and Gracie when it ran through Long Island and New England. Also, numerous others estimate the real damage between $347 million and almost $410 million. Damaged trees and buildings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by a virus, the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The first known case was identified in Wuhan, China, in December 2019. The disease quickly spread worldwide, resulting in the COVID-19 pandemic. The symptoms of COVID‑19 are variable but often include fever, cough, headache, fatigue, breathing difficulties, loss of smell, and loss of taste. Symptoms may begin one to fourteen days after exposure to the virus. At least a third of people who are infected do not develop noticeable symptoms. Of those who develop symptoms noticeable enough to be classified as patients, most (81%) develop mild to moderate symptoms (up to mild pneumonia), while 14% develop severe symptoms ( dyspnea, hypoxia, or more than 50% lung involvement on imaging), and 5% develop critical symptoms ( respiratory failure, shock, or multiorgan dysfunction). Older people are at a higher risk of developing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Isabelle Sprague Smith

Isabelle Sprague Smith, also Isabelle Dwight Sprague Smith (November 11, 1861 – December 28, 1950) was an American artist, teacher, and school principal until the mid-1920s. Her students donated the Isabelle D. Sprague Smith Studio to the MacDowell Colony, where she was a member, by 1918. She was director of the People's Institute of New York. Sprague Smith was president of the Bach Festival in New York, and the founder of the Bach Festival in Winter Park, Florida in 1935. Personal life and education Isabelle Dwight was born on November 11, 1861 in Clinton, New York, the daughter of Benjamin W. Dwight and Wealthy J. Dewey Dwight. Her uncle was Theodore William Dwight, the head of Columbia Law School, and her great-grandfather was Timothy Dwight IV, was the president of Yale University and before that was chaplain of General Samuel Holden Parsons's brigade during the Revolutionary War. She attended Dwight School in Clinton, in which her father was the founder and principal, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |