|

Tax Reduction And Simplification Act Of 1977

The Tax Reduction and Simplification Act of 1977 was passed by the 95th United States Congress and signed into law by President Jimmy Carter on May 23, 1977. It replaced the percentage standard deduction and minimum standard deduction with a single standard deduction of $3,200 (joint returns) and temporarily extended the general tax credit (maximum of $35/capita or 2% of $9,000 income) through 1978. See also * Congressional Budget and Impoundment Control Act of 1974 The Congressional Budget and Impoundment Control Act of 1974 (, , ) is a United States federal law that governs the role of the Congress in the United States budget process. The Congressional budget process Titles I through IX of the law are also ... References External links * United States federal taxation legislation 1977 in American law {{tax-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Al Ullman

Albert Conrad Ullman (March 9, 1914 – October 11, 1986) was an American politician in the Democratic Party who represented in the United States House of Representatives from 1957 to 1981. One of the most influential Oregonians ever to be elected to Congress, along with Senator Wayne Morse, Ullman presided over the powerful House Committee on Ways and Means during a period of time in which he was deeply involved in shaping national policy on issues relating to taxation, budget reform, federal entitlement programs, international trade, and energy. Background Ullman was born in Great Falls, Montana, and raised initially at Gildford, Montana, after which the family moved to Cathcart, near Snohomish, Washington, where his father ran a small country grocery store. Two of his grandparents were German immigrants, and the other two had emigrated from Bohemia, then part of the Austro-Hungarian Empire. In 1935, he graduated from Whitman College in Walla Walla, Washington (where he pla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Democratic Party (United States)

The Democratic Party is one of the two major contemporary political parties in the United States. Founded in 1828, it was predominantly built by Martin Van Buren, who assembled a wide cadre of politicians in every state behind war hero Andrew Jackson, making it the world's oldest active political party.M. Philip Lucas, "Martin Van Buren as Party Leader and at Andrew Jackson's Right Hand." in ''A Companion to the Antebellum Presidents 1837–1861'' (2014): 107–129."The Democratic Party, founded in 1828, is the world's oldest political party" states Its main political rival has been the Republican Party since the 1850s. The party is a big tent, and though it is often described as liberal, it is less ideologically uniform than the Republican Party (with major individuals within it frequently holding widely different political views) due to the broader list of unique voting blocs that compose it. The historical predecessor of the Democratic Party is considered to be th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oregon

Oregon () is a U.S. state, state in the Pacific Northwest region of the Western United States. The Columbia River delineates much of Oregon's northern boundary with Washington (state), Washington, while the Snake River delineates much of its eastern boundary with Idaho. The 42nd parallel north, 42° north parallel delineates the southern boundary with California and Nevada. Oregon has been home to many Indigenous peoples of the Americas, indigenous nations for thousands of years. The first European traders, explorers, and settlers began exploring what is now Oregon's Pacific coast in the early-mid 16th century. As early as 1564, the Spanish expeditions to the Pacific Northwest, Spanish began sending vessels northeast from the Philippines, riding the Kuroshio Current in a sweeping circular route across the northern part of the Pacific. In 1592, Juan de Fuca undertook detailed mapping and studies of ocean currents in the Pacific Northwest, including the Oregon coast as well as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Committee On Ways And Means

The Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other programs including Social Security, unemployment benefits, Medicare, the enforcement of child support laws, Temporary Assistance for Needy Families, foster care, and adoption programs. Members of the Ways and Means Committee are not allowed to serve on any other House Committee unless they are granted a waiver from their party's congressional leadership. It has long been regarded as the most prestigious committee of the House of Representatives. The United States Constitution requires that all bills regarding taxation must originate in the U.S. House of Representatives, and House rules dictate that all bills regarding taxation must pass through Ways and Means. This system imparts upon the committee and its members a significant degree of influe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Committee On Appropriations

The United States House Committee on Appropriations is a committee of the United States House of Representatives that is responsible for passing appropriation bills along with its Senate counterpart. The bills passed by the Appropriations Committee regulate expenditures of money by the government of the United States. As such, it is one of the most powerful committees, and its members are seen as influential. History The constitutional basis for the Appropriations Committee comes from Article one, Section nine, Clause seven of the U.S. Constitution, which says: :No money shall be drawn from the treasury, but in consequence of appropriations made by law; and a regular statement and account of receipts and expenditures of all public money shall be published from time to time. This clearly delegated the power of appropriating money to Congress, but was vague beyond that. Originally, the power of appropriating was taken by the Committee on Ways and Means, but the United States C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Senate Committee On Finance

The United States Senate Committee on Finance (or, less formally, Senate Finance Committee) is a standing committee of the United States Senate. The Committee concerns itself with matters relating to taxation and other revenue measures generally, and those relating to the insular possessions; bonded debt of the United States; customs, collection districts, and ports of entry and delivery; deposit of public moneys; general revenue sharing; health programs under the Social Security Act (notably Medicare and Medicaid) and health programs financed by a specific tax or trust fund; national social security; reciprocal trade agreements; tariff and import quotas, and related matters thereto; and the transportation of dutiable goods. It is considered to be one of the most powerful committees in Congress. History The Committee on Finance is one of the original committees established in the Senate. First created on December 11, 1815, as a select committee and known as the Committee o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jimmy Carter

James Earl Carter Jr. (born October 1, 1924) is an American politician who served as the 39th president of the United States from 1977 to 1981. A member of the Democratic Party (United States), Democratic Party, he previously served as the 76th governor of Georgia from 1971 to 1975 and as a Georgia state senator from 1963 to 1967. Since leaving office, Carter has remained engaged in political and social projects, receiving the Nobel Peace Prize in 2002 for his humanitarian work. Born and raised in Plains, Georgia, Carter graduated from the United States Naval Academy in 1946 with a Bachelor of Science degree and joined the United States Navy, serving on numerous submarines. After the death of his father in 1953, he left his naval career and returned home to Plains, where he assumed control of his family's peanut-growing business. He inherited little, due to his father's forgiveness of debts and the division of the estate amongst himself and his siblings. Nevertheless, his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

95th United States Congress

The 95th United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, DC from January 3, 1977, to January 3, 1979, during the final weeks of the administration of U.S. President Gerald Ford and the first two years of the administration of U.S. President Jimmy Carter. The apportionment of seats in this House of Representatives was based on the Nineteenth Census of the United States in 1970. Both chambers maintained a Democratic supermajority, and with Jimmy Carter being sworn in as President on January 20, 1977, this gave the Democrats an overall federal government trifecta for the first time since the 90th Congress ending in 1969. , this was the most recent Congress to approve an amendment (the unratified District of Columbia Voting Rights Amendment) to the Constitution. This is the last time democrats or any party held a 2/3rd ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

President Of The United States

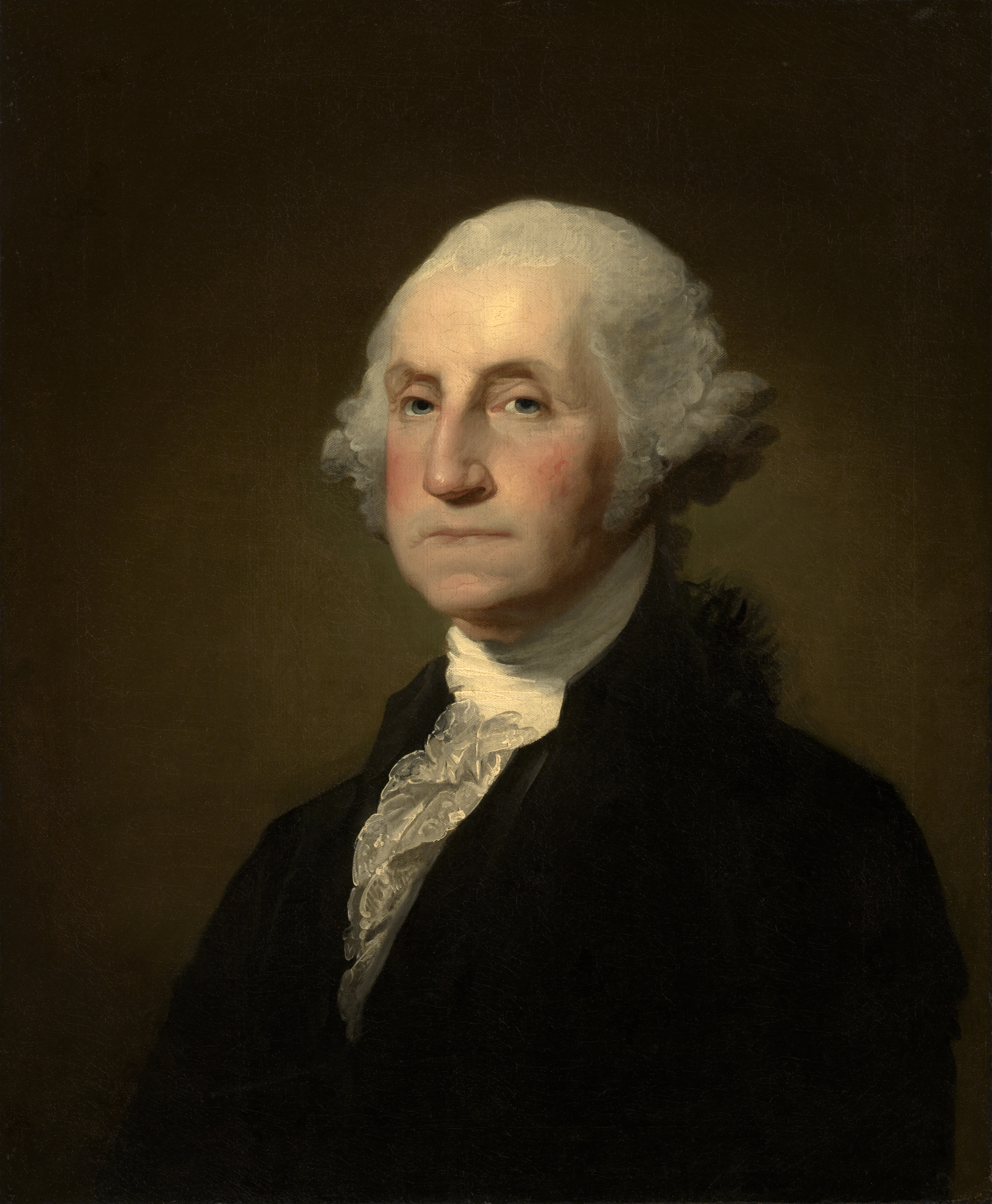

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces. The power of the presidency has grown substantially since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasingly strong role in American political life since the beginning of the 20th century, with a notable expansion during the presidency of Franklin D. Roosevelt. In contemporary times, the president is also looked upon as one of the world's most powerful political figures as the leader of the only remaining global superpower. As the leader of the nation with the largest economy by nominal GDP, the president possesses significant domestic and international hard and soft power. Article II of the Constitution establ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable. The standard deduction is available to US citizens and aliens who are resident for tax purposes and who are individuals, married persons, and heads of household. The standard deduction is based on filing status and typically increases each year. It is not available to nonresident aliens residing in the United States (with few exceptions, for example, students from India on F1 visa status can use the standard deduction). Additional amounts are available for persons who are blind and/or are at least 65 years of age. The standard deduction is distinct from the personal exemption, which was eliminated by The Tax Cuts and Jobs Act of 2017 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget And Impoundment Control Act Of 1974

The Congressional Budget and Impoundment Control Act of 1974 (, , ) is a United States federal law that governs the role of the Congress in the United States budget process. The Congressional budget process Titles I through IX of the law are also known as the Congressional Budget Act of 1974. Title II created the Congressional Budget Office. Title III governs the procedures by which Congress annually adopts a budget resolution, a concurrent resolution that is not signed by the President, which sets fiscal policy for the Congress. This budget resolution sets limits on revenues and spending that may be enforced in Congress through procedural objections called points of order. The budget resolution can also specify that a budget reconciliation bill be written, which the Congress will then consider under expedited procedures. Later amendments The act has been amended several times, including provisions in the Balanced Budget and Emergency Deficit Control Act of 1985, the Budget ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)