|

TARGET2

TARGET2 was the real-time gross settlement (RTGS) system for the Eurozone from its phased introduction in 2007-2008 until its replacement with T2 in March 2023. As such, it was one of the Eurosystem's TARGET Services, replacing the original TARGET (Trans-European Automated Real-time Gross Settlement Express Transfer System) RTGS introduced in 1999. Like the other TARGET Services, it was developed and owned by the Eurosystem. Overview TARGET2 was based on an integrated central technical infrastructure, known as the Single Shared Platform (SSP). SSP was operated by three providing central banks: France (Banque de France), Germany (Deutsche Bundesbank) and Italy (Banca d'Italia). It started to replace the predecessor system TARGET in November 2007. TARGET2 was also an interbank RTGS payment system for the clearing of cross-border transfers in the eurozone. Participants in the system were either direct or indirect. Direct participants held an RTGS account and had access to real- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TARGET Services

TARGET Services (for Transeuropean Automated Real-time Gross-settlement Express Transfer) are payment services operated by the Eurosystem for the euro area and beyond on its proprietary financial market infrastructures. As of late 2024, TARGET Services included T2 (RTGS), T2 for large payments (which replaced TARGET2 in 2023), TARGET2-Securities (T2S) for securities transactions, and TARGET Instant Payment Settlement (TIPS) for instant payments. A fourth service, the Eurosystem Collateral Management System (ECMS), is to complement the TARGET suite in mid-June 2025. History In 1993, as the Maastricht Treaty entered into force, central banks of the EU agreed that all of them should have an real-time gross settlement (RTGS) system, as some had already done in the previous decade. In 1995, they decided to interlink these national infrastructures through a pan-European system that they called TARGET. That original TARGET system duly began operations on . Its first version had a decentr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

T2 (RTGS)

T2 is a financial market infrastructure that provides real-time gross settlement (RTGS) of payments, mostly in euros. It is operated by the European Central Bank and is the critical payments infrastructure of the euro area. With turnover in the trillions of euros every day, it is one of the largest payment systems in the world. It is one of three so-called TARGET Services, together with TARGET2-Securities (T2S) for securities and TARGET Instant Payment Settlement (TIPS) for fast payments. The acronym TARGET stands for Trans-European Automated Real-time Gross-Settlement Express Transfer. T2 replaced its predecessor RTGS system, TARGET2 (itself introduced in 2007-2008), on . Overview Like other RTGS systems, T2 allows individual banks to submit payment orders and have them settled in central bank money, namely the euro. T2 settles payments between banks as well as those related to the Eurosystem's own operations. Member banks can connect to T2 either via SWIFT or via NEXI-Colt, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TARGET2 Securities

TARGET2-Securities, in shorthand T2S, is the Eurosystem's platform for securities settlement in central bank money. T2S offers centralised delivery-versus-payment (DvP) settlement across several European securities markets, without being itself a central securities depository (CSD) since it does not offer CSD services such as custody or asset servicing. T2S is one of the Eurosystem's TARGET Services, together with T2 and TARGET Instant Payment Settlement (TIPS) for cash payments. Background Historically, financial market infrastructures in Europe were created to meet the requirements of national financial markets. In most cases, there were one or two dominant players at each stage of the value chain: typically one stock exchange for trading, one central counterparty (CCP) for clearing and at least one CSD for settlement. Furthermore, these national infrastructures were primarily designed to manage securities denominated in the national currency. Securities settlement acros ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hans-Werner Sinn

Hans-Werner Sinn (born 7 March 1948) is a German economist who served as President of the Ifo Institute for Economic Research from 1999 to 2016. He currently serves on the German ministry of economy’s advisory council. He is Professor Emeritus of Economics and Public Finance at the University of Munich. Education and career After studying economics at the University of Münster from 1967 to 1972 and receiving his doctorate from the University of Mannheim in 1978, Sinn was awarded the venia legendi in 1983, also from the University of Mannheim. Since 1984 Sinn has been full professor in the faculty of economics at the University of Munich (LMU), first holding the chair for economics and insurance, and from 1994 the chair for economics and public finance. During leaves of absence from Mannheim and Munich he held visiting professorships (1978/79 and 1984/85) at the University of Western Ontario in Canada. During sabbaticals he was also visiting researcher at the London Schoo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Identifier Code

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as a Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to a non-financial organization, the code may also be known as a Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements. The overlapping issue between ISO 9362 and ISO 13616 is discussed in the article International Bank Account Number (also called IBAN). The SWIFT network do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International use, most important central banks with a balance sheet total of around 7 trillion. The Governing Council of the European Central Bank, ECB Governing Council makes monetary policy for the Eurozone and the European Union, administers the foreign exchange reserves of EU member states, engages in foreign exchange operations, and defines the intermediate monetary objectives and key interest rate of the EU. The Executive Board of the European Central Bank, ECB Executive Board enforces the policies and decisions of the Governing Council, and may direct the national central banks when doing so. The ECB has the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the volume must be approved by the EC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Bundesbank

The Deutsche Bundesbank (, , colloquially Buba, sometimes alternatively abbreviated as BBk or DBB) is the National central bank (Eurosystem), national central bank for Germany within the Eurosystem. It was the German central bank from 1957 to 1998, issuing the Deutsche Mark (DM). It succeeded the Bank deutscher Länder, which had introduced the DM on 20 June 1948. The Bundesbank was the first central bank to be given full independence, leading this form of central bank to be referred to as the "Bundesbank model", as opposed, for instance, to the "New Zealand model", which has a goal (i.e. inflation target) set by the government. The Bundesbank was greatly respected for its control of inflation through the second half of the 20th century. This made the German Mark one of the most respected currencies, and the Bundesbank gained substantial indirect influence in many European countries. As of 2023, its balance sheet total was €2.516 trillion, making it the 4th largest central bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

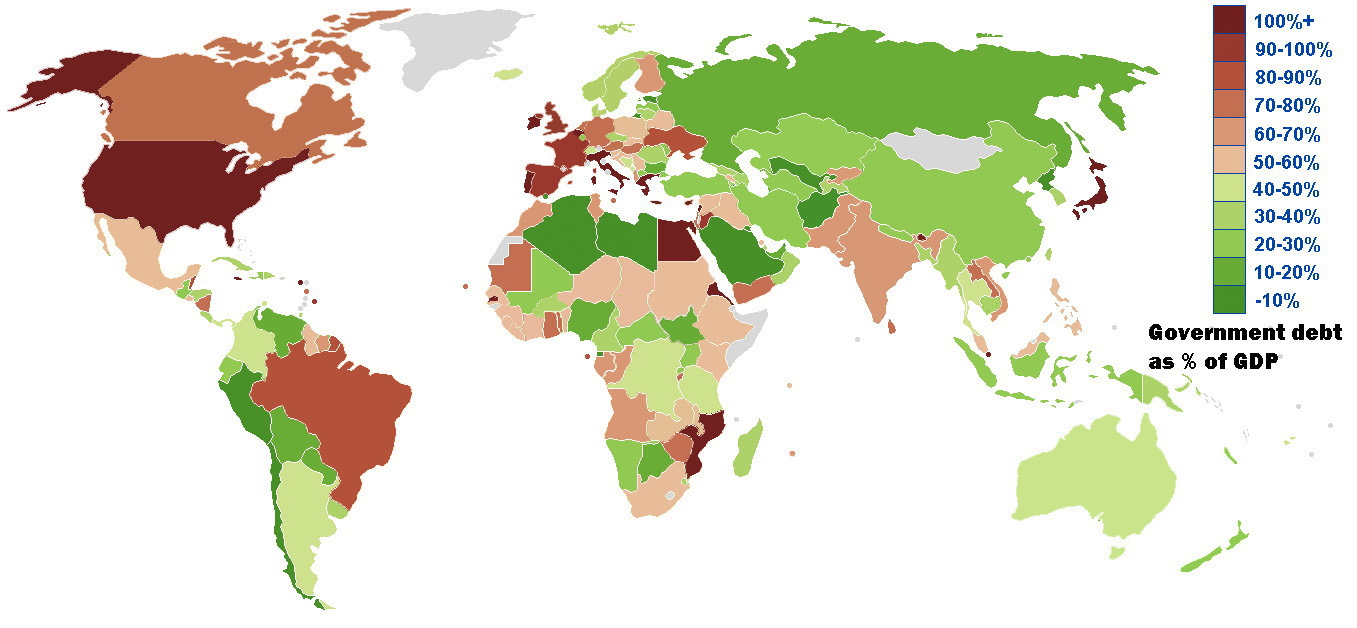

Euro Area Crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The eurozone member states of Greece, Portugal, Ireland, and Cyprus were unable to repay or refinance their government debt or to bailout fragile banks under their national supervision and needed assistance from other eurozone countries, the European Central Bank (ECB), and the International Monetary Fund (IMF). The crisis included the Greek government-debt crisis, the 2008–2014 Spanish financial crisis, the 2010–2014 Portuguese financial crisis, the post-2008 Irish banking crisis and the post-2008 Irish economic downturn, as well as the 2012–2013 Cypriot financial crisis. The crisis contributed to changes in leadership in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ISO 20022

ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information. The repository contains a huge amount of financial services metadata that has been shared and standardized across the industry. The metadata is stored in UML models with a special ISO 20022 UML Profile. Underlying all of this is the ISO 20022 metamodel – a model of the models. The UML profile is the metamodel transformed into UML. The metadata is transformed into the syntax of messages used in financial networks. The first syntax supported for messages was XML Schema. ISO 20022 is widely used in financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real-time Gross Settlement

Real-time gross settlement (RTGS) systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a "real-time" and on a " gross" basis to avoid settlement risk. Settlement in "real time" means a payment transaction is not subjected to any waiting period, with transactions being settled as soon as they are processed. "Gross settlement" means the transaction is settled on a one-to-one basis, without bundling or netting with any other transaction. "Settlement" means that once processed, payments are final and irrevocable. History As of 1985, three central banks implemented RTGS systems, while by the end of 2005, RTGS systems had been implemented by 90 central banks. The first system that had the attributes of an RTGS system was the US Fedwire system which was launched in 1970. This was based on a previous method of transferring funds electronically between US federal reserve banks via telegraph. The United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Target2 Graph - ECB Data (1)

Target may refer to: Warfare and shooting * Shooting target, used in marksmanship training and various shooting sports ** Bullseye (target), the goal one for which one aims in many of these sports ** Aiming point, in field artillery, fixed at a specific target * Targeting (warfare), lists various military targets * Color chart (or reference card), the reference target used in digital imaging for accurate color reproduction Places * Target, Allier, France * Target Lake, a lake in Minnesota Terms * Target market, marketing strategy ** Target audience, intended audience or readership of a publication, advertisement, or type of message * In mathematics, the target of a function is also called the codomain; more generally, a morphism has a target * Target (cricket), the total number of runs a team needs to win People * Target (rapper), stage name of Croatian hip-hop artist Nenad Šimun * DJ Target, stage name of English grime DJ Darren Joseph, member of Roll Deep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |