|

Sigma-martingale

In mathematics and information theory of probability, a sigma-martingale is a semimartingale with an integral representation. Sigma-martingales were introduced by C.S. Chou and M. Emery in 1977 and 1978. In financial mathematics, sigma-martingales appear in the fundamental theorem of asset pricing as an equivalent condition to no free lunch with vanishing risk (a no-arbitrage condition). Mathematical definition An \mathbb^d-valued stochastic process X = (X_t)_^T is a ''sigma-martingale'' if it is a semimartingale and there exists an \mathbb^d-valued martingale ''M'' and an ''M''-integrable predictable process In stochastic analysis, a part of the mathematical theory of probability, a predictable process is a stochastic process whose value is knowable at a prior time. The predictable processes form the smallest class that is closed under taking limits of ... \phi with values in \mathbb_+ such that :X = \phi \cdot M. References {{probability-stub Martingale theory ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Semimartingale

In probability theory, a real valued stochastic process ''X'' is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined. The class of semimartingales is quite large (including, for example, all continuously differentiable processes, Brownian motion and Poisson processes). Submartingales and supermartingales together represent a subset of the semimartingales. Definition A real valued process ''X'' defined on the filtered probability space (Ω,''F'',(''F''''t'')''t'' ≥ 0,P) is called a semimartingale if it can be decomposed as :X_t = M_t + A_t where ''M'' is a local martingale and ''A'' is a càdlàg adapted process of locally bounded variation. An R''n''-valued process ''X'' = (''X''1,…,''X''''n'') is a semimartingale i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematics

Mathematics is an area of knowledge that includes the topics of numbers, formulas and related structures, shapes and the spaces in which they are contained, and quantities and their changes. These topics are represented in modern mathematics with the major subdisciplines of number theory, algebra, geometry, and analysis, respectively. There is no general consensus among mathematicians about a common definition for their academic discipline. Most mathematical activity involves the discovery of properties of abstract objects and the use of pure reason to prove them. These objects consist of either abstractions from nature orin modern mathematicsentities that are stipulated to have certain properties, called axioms. A ''proof'' consists of a succession of applications of deductive rules to already established results. These results include previously proved theorems, axioms, andin case of abstraction from naturesome basic properties that are considered true starting points of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Theory

Information theory is the scientific study of the quantification (science), quantification, computer data storage, storage, and telecommunication, communication of information. The field was originally established by the works of Harry Nyquist and Ralph Hartley, in the 1920s, and Claude Shannon in the 1940s. The field is at the intersection of probability theory, statistics, computer science, statistical mechanics, information engineering (field), information engineering, and electrical engineering. A key measure in information theory is information entropy, entropy. Entropy quantifies the amount of uncertainty involved in the value of a random variable or the outcome of a random process. For example, identifying the outcome of a fair coin flip (with two equally likely outcomes) provides less information (lower entropy) than specifying the outcome from a roll of a dice, die (with six equally likely outcomes). Some other important measures in information theory are mutual informat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Theory

Probability theory is the branch of mathematics concerned with probability. Although there are several different probability interpretations, probability theory treats the concept in a rigorous mathematical manner by expressing it through a set of axioms. Typically these axioms formalise probability in terms of a probability space, which assigns a measure taking values between 0 and 1, termed the probability measure, to a set of outcomes called the sample space. Any specified subset of the sample space is called an event. Central subjects in probability theory include discrete and continuous random variables, probability distributions, and stochastic processes (which provide mathematical abstractions of non-deterministic or uncertain processes or measured quantities that may either be single occurrences or evolve over time in a random fashion). Although it is not possible to perfectly predict random events, much can be said about their behavior. Two major results in probability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Theorem Of Asset Pricing

The fundamental theorems of asset pricing (also: of arbitrage, of finance), in both financial economics and mathematical finance, provide necessary and sufficient conditions for a market to be arbitrage-free, and for a market to be complete. An arbitrage opportunity is a way of making money with no initial investment without any possibility of loss. Though arbitrage opportunities do exist briefly in real life, it has been said that any sensible market model must avoid this type of profit.Pascucci, Andrea (2011) ''PDE and Martingale Methods in Option Pricing''. Berlin: Springer-Verlag The first theorem is important in that it ensures a fundamental property of market models. Completeness is a common property of market models (for instance the Black–Scholes model). A complete market is one in which every contingent claim can be replicated. Though this property is common in models, it is not always considered desirable or realistic. Discrete markets In a discrete (i.e. finite state) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

No Free Lunch With Vanishing Risk

No free lunch with vanishing risk (NFLVR) is a no-arbitrage argument. We have ''free lunch with vanishing risk'' if by utilizing a sequence of time self-financing portfolios, which converge to an arbitrage strategy, we can approximate a self-financing portfolio (called the ''free lunch with vanishing risk''). Mathematical representation For a semimartingale ''S'', let K = \ where a strategy is admissible if it is permitted by the market. Then define C = \. ''S'' is said to satisfy ''no free lunch with vanishing risk'' if \bar \cap L^_+(P) = \ such that \bar is the closure of ''C'' in the norm topology of L^_+(P). Fundamental theorem of asset pricing If S = (S_t)_^T is a semimartingale with values in \mathbb^d then ''S'' does not allow for a free lunch with vanishing risk if and only if there exists an equivalent martingale measure \mathbb such that ''S'' is a sigma-martingale In mathematics and information theory of probability, a sigma-martingale is a semimartingale with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

In economics and finance, arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalise on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practice, there are always risks in arbitrage, some minor (such as fluctuation of prices decreasing profit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Process

In probability theory and related fields, a stochastic () or random process is a mathematical object usually defined as a family of random variables. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. Examples include the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule. Stochastic processes have applications in many disciplines such as biology, chemistry, ecology, neuroscience, physics, image processing, signal processing, control theory, information theory, computer science, cryptography and telecommunications. Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance. Applications and the study of phenomena have in turn inspired the proposal of new stochastic processes. Examples of such stochastic processes include the Wiener process or Brownian motion process, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

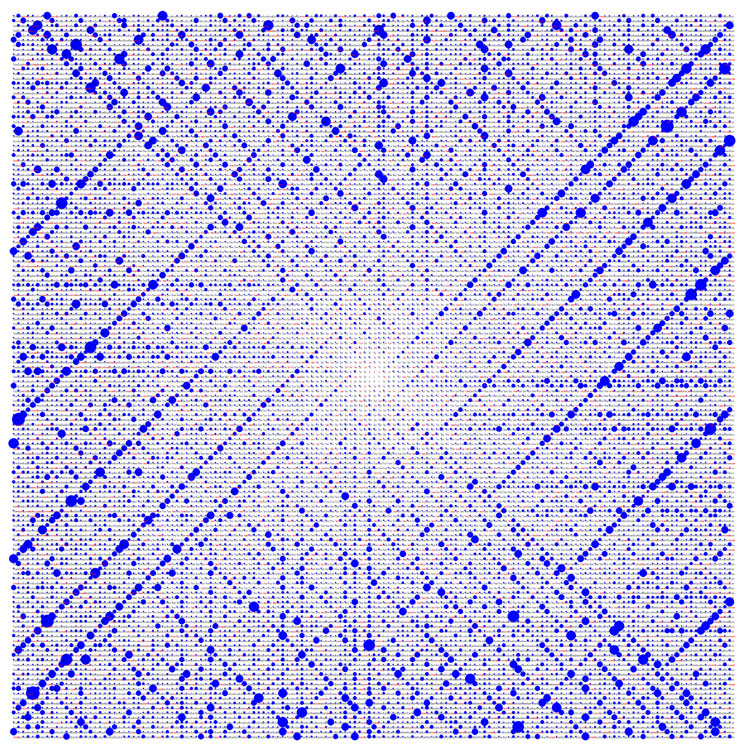

Martingale (probability Theory)

In probability theory, a martingale is a sequence of random variables (i.e., a stochastic process) for which, at a particular time, the conditional expectation of the next value in the sequence is equal to the present value, regardless of all prior values. History Originally, '' martingale'' referred to a class of betting strategies that was popular in 18th-century France. The simplest of these strategies was designed for a game in which the gambler wins their stake if a coin comes up heads and loses it if the coin comes up tails. The strategy had the gambler double their bet after every loss so that the first win would recover all previous losses plus win a profit equal to the original stake. As the gambler's wealth and available time jointly approach infinity, their probability of eventually flipping heads approaches 1, which makes the martingale betting strategy seem like a sure thing. However, the exponential growth of the bets eventually bankrupts its users due to f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ito Integral

Ito may refer to: Places * Ito Island, an island of Milne Bay Province, Papua New Guinea * Ito Airport, an airport in the Democratic Republic of the Congo * Ito District, Wakayama, a district located in Wakayama Prefecture, Japan * Itō, Shizuoka People * Itō (surname), for people with the Japanese surname Itō * , Japanese voice actor * Princess Ito (died 861), Japanese imperial princess * Ito Giani (1941–2018), Italian sprinter * Ito (footballer, born 1975), full name Antonio Álvarez Pérez, Spanish footballer * Ito (footballer, born 1992), full name Jorge Delgado Fidalgo, Spanish footballer * Ito (footballer, born 1994), full name Mario Manuel de Oliveira, Angolan footballer * , Japanese fashion model and actress (born 1995), Japanese fashion model and actress *Ito Smith (born 1995), American football player * Ito Curata (1959–2020), Filipino fashion designer * Ito Morabito (born 1977), French designer * Ito Ogawa (born 1973), Japanese novelist, lyricist, and transla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Predictable Process

In stochastic analysis, a part of the mathematical theory of probability, a predictable process is a stochastic process whose value is knowable at a prior time. The predictable processes form the smallest class that is closed under taking limits of sequences and contains all adapted left-continuous processes. Mathematical definition Discrete-time process Given a filtered probability space (\Omega,\mathcal,(\mathcal_n)_,\mathbb), then a stochastic process (X_n)_ is ''predictable'' if X_ is measurable with respect to the σ-algebra \mathcal_n for each ''n''. Continuous-time process Given a filtered probability space (\Omega,\mathcal,(\mathcal_t)_,\mathbb), then a continuous-time stochastic process (X_t)_ is ''predictable'' if X, considered as a mapping from \Omega \times \mathbb_ , is measurable with respect to the σ-algebra generated by all left-continuous adapted processes. This σ-algebra is also called the predictable σ-algebra. Examples * Every determini ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |