|

Shares Outstanding

Shares outstanding are all the shares of a corporation that have been authorized, issued and purchased by investors and are held by them. They are distinguished from treasury shares, which are shares held by the corporation itself, thus representing no exercisable rights. Shares outstanding and treasury shares together amount to the number of issued shares. Shares outstanding can be calculated as either basic or fully diluted. The basic count is the current number of shares. Dividend distributions and voting in the general meeting of shareholders are calculated according to this number. The fully diluted shares outstanding count, on the other hand, includes diluting securities, such as warrants, capital notes or convertibles. If the company has any diluting securities, this indicates the potential future increased number of shares outstanding. Finding the number of shares outstanding The number of outstanding shares may change due to changes in the number of issued shares, as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

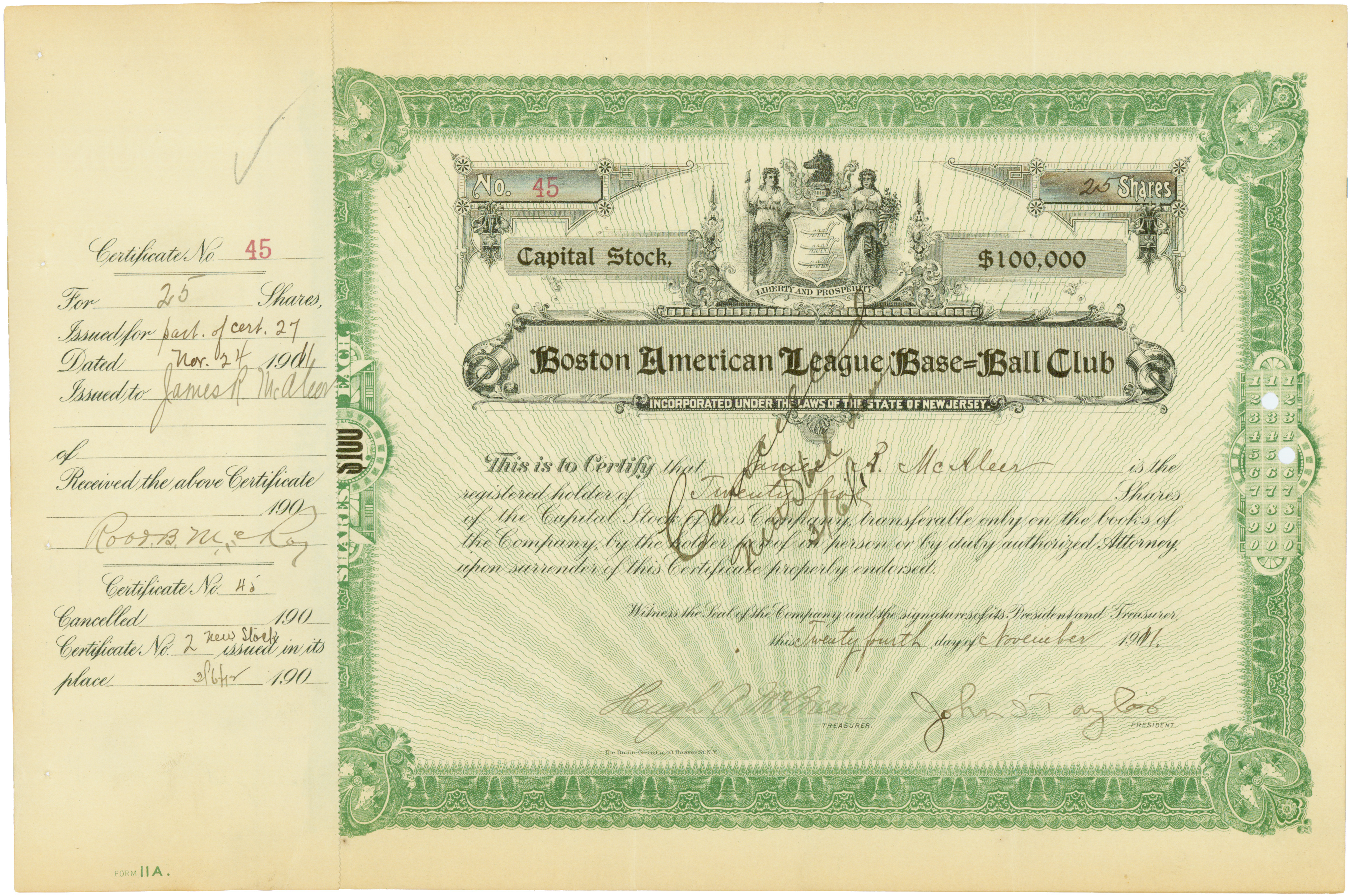

Share (finance)

In finance, financial markets, a share (sometimes referred to as stock or Equity (finance), equity) is a unit of Equity (finance), equity ownership in the Stock, capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share expresses the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the Financial capital, capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Terminology ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

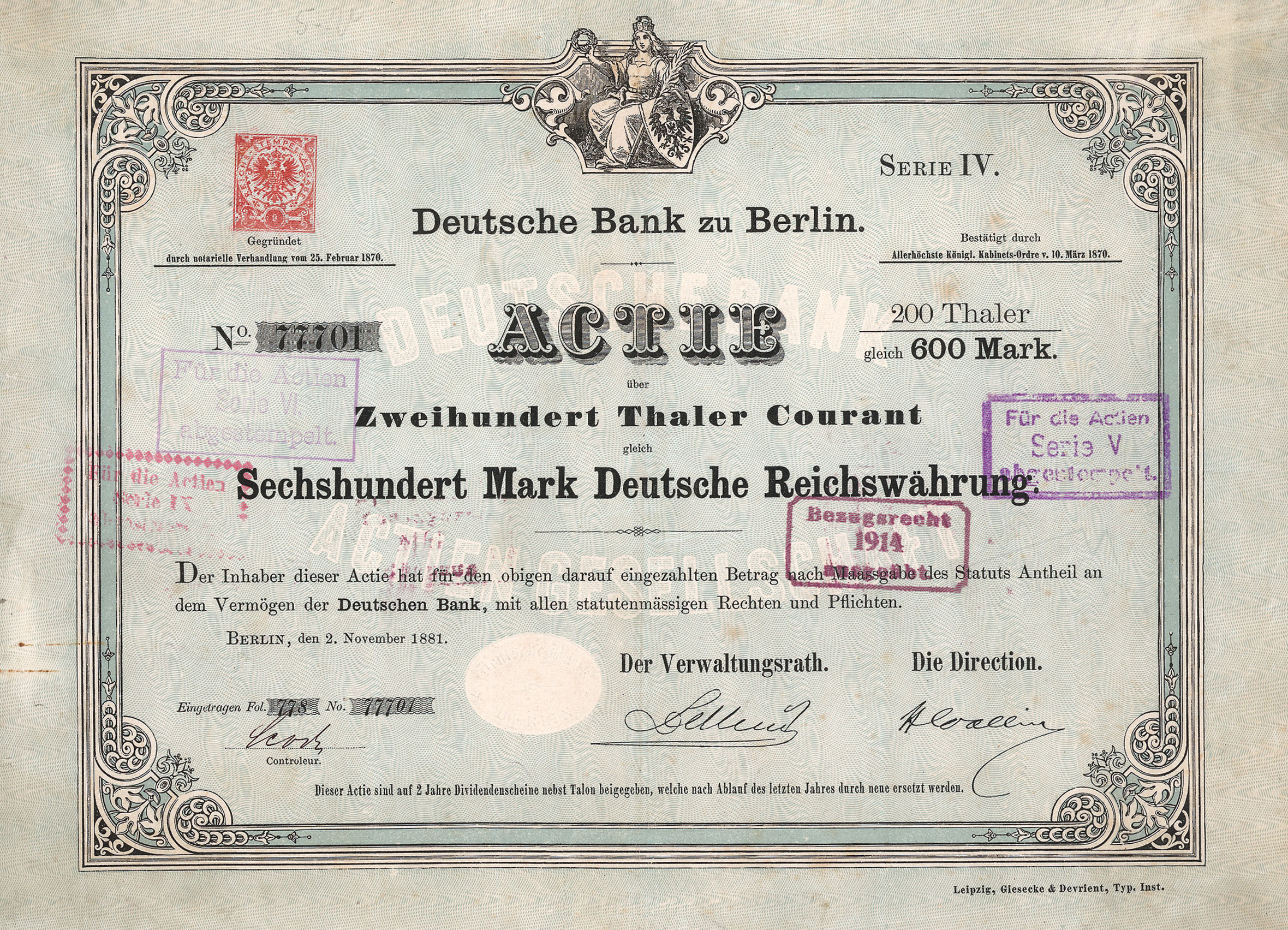

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Float

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tel Aviv Stock Exchange

The Tel Aviv Stock Exchange (TASE; ), colloquially known as The Bursa, is the only public stock exchange in Israel and a public company itself, listed on its own exchange since August 1, 2019. It is regulated by the ''Securities Law (1968)'' and is under the direct supervision of the Israel Securities Authority (ISA). The TASE plays a significant role in the Israeli economy, facilitating the trade of securities and the raising of capital and debt for companies and the government on the Israeli capital market. Trading on the TASE is conducted exclusively through its 23 members, which include major banks and investment houses that collect a fee for their services. The TASE was founded in 1953, with its precursor dating back to 1935. As of 2021, it lists 473 companies, 901 series of corporate bonds, 204 series of government bonds, 416 index-tracking products, and 1,231 mutual funds. The exchange's market capitalization for equities stands at US$ 216 billion, and for bonds at US$ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissione Nazionale Per Le Società E La Borsa

The Commissione Nazionale per le Società e la Borsa (CONSOB; Italian Companies and Exchange Commission) is the government authority of Italy responsible for regulating the Italian securities market. This includes the regulation of the Italian stock exchange, the Borsa Italiana. History The Italian Companies and Exchange Commission (CONSOB) was founded in 1974 through legislation merging the functions and jurisdictions that until then had been part of the Italian Ministry of Treasury. This was primarily power to monitor the securities markets. Over time CONSOBs powers and responsibilities have expanded significantly. In 1983 a new law extended its jurisdiction to protecting public savings, and two years later CONSOB received juridical personality and autonomy. In 1991, it was attributed powers to audit securities brokerage companies and monitor insider trading. Responsibilities and functions CONSOB carries out several functions: * it regulates the investment services and operatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Netherlands Authority For The Financial Markets

The Netherlands Authority for the Financial Markets () is the financial services regulatory authority for the Netherlands. Its role is comparable to the role of the SEC in the United States. History The Netherlands Authority for the Financial Markets (AFM) was set up on 1 March 2002 as the successor to the Securities Board of the Netherlands ( or STE, itself established in 1989). As part of the legislation that created the AFM, its responsibilities were greatly expanded to cover all financial products, including savings, investments, loans, insurance and accounting. The AFM falls under the political responsibility of the Minister of Finance but is an autonomous administrative authority, which means that the AFM operates autonomously based on the powers given by the Minister of Finance. Responsibilities and operations The Netherlands Authority for the Financial Markets is the body responsible for regulating behaviour on the financial markets in the Netherlands. This includes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AB InBev

Anheuser-Busch InBev SA/NV, known as AB InBev, is an American-Belgian Multinational corporation, multinational Drink industry, drink and brewing company, brewing company based in Leuven, Belgium. It is the largest brewer in the world, and in 2023, was ranked 72nd in the Forbes Global 2000, ''Forbes'' Global 2000. Additionally, AB InBev has offices in New York City, alongside regional headquarters in São Paulo, London, St. Louis, Mexico City, Bremen, Johannesburg, and others. It has approximately 630 beer brands in 150 countries.''Annual Report 2020.'' Retrieved 6 April 2020. AB InBev was formed through InBev acquiring the American company Anheuser-Busch. Anheuser-Busch InBev SA/NV is a publicly listed company, with its primary listing on the Euronext Brussels. It has secondary listings on Mexican Stock Exchange, Mexi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

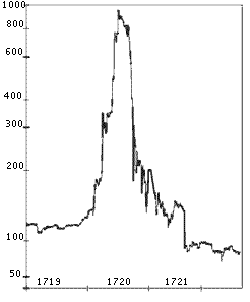

Convertible Debt

In finance, a convertible bond, convertible note, or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering. Convertible bonds are also considered debt security because the companies agree to give fixed or floating interest rate as they do in common bonds for the funds of investor. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Note

{{Unreferenced, date=June 2019, bot=noref (GreenC bot) Capital notes are several types of securities. "Capital note" has a number of meanings, as it can be either an equity security, a debt security or a form of security used in structured finance. In all cases, the use of the term "capital" is to denote that the security is relatively junior in the issuing corporation's order of priorities in claims for its assets. Convertibles Capital notes are a form of convertible security exercisable into shares. They are equity vehicles. Capital notes are similar to warrants, except that they often do not have an expiration date or an exercise price (hence, the entire consideration the company expects to receive, for its future issue of shares, is paid when the capital note is issued). Capital notes may be issued in connection with a debt-for-equity swap restructuring: instead of promptly issuing the debt-replacing shares, the company issues convertible securities, in order to postpone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |