|

Robert A. Jarrow

__NOTOC__ Robert Alan Jarrow is the Ronald P. and Susan E. Lynch Professor of Investment Management at the Johnson Graduate School of Management, Cornell University. Professor Jarrow is a co-creator of the Heath–Jarrow–Morton framework for pricing interest rate derivatives, a co-creator of the reduced form Jarrow–Turnbull credit risk models employed for pricing credit derivatives, and the creator of the forward price martingale measure. These tools and models are now the standards utilized for pricing and hedging in major investment and commercial banks. derivativesstrategy.com He is on the advisory board of ''Mathematical Finance'' – a journal he co-started in 1989. He is also an associate or advisory editor for numerous other journals and serves on the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Americans

Americans are the citizens and nationals of the United States of America.; ; Although direct citizens and nationals make up the majority of Americans, many dual citizens, expatriates, and permanent residents could also legally claim American nationality. The United States is home to people of many racial and ethnic origins; consequently, American culture and law do not equate nationality with race or ethnicity, but with citizenship and an oath of permanent allegiance. Overview The majority of Americans or their ancestors immigrated to the United States or are descended from people who were brought as slaves within the past five centuries, with the exception of the Native American population and people from Hawaii, Puerto Rico, Guam, and the Philippine Islands, who became American through expansion of the country in the 19th century, additionally America expanded into American Samoa, the U.S. Virgin Islands and Northern Mariana Islands in the 20th century. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Martingale (probability Theory)

In probability theory, a martingale is a sequence of random variables (i.e., a stochastic process) for which, at a particular time, the conditional expectation of the next value in the sequence is equal to the present value, regardless of all prior values. History Originally, '' martingale'' referred to a class of betting strategies that was popular in 18th-century France. The simplest of these strategies was designed for a game in which the gambler wins their stake if a coin comes up heads and loses it if the coin comes up tails. The strategy had the gambler double their bet after every loss so that the first win would recover all previous losses plus win a profit equal to the original stake. As the gambler's wealth and available time jointly approach infinity, their probability of eventually flipping heads approaches 1, which makes the martingale betting strategy seem like a sure thing. However, the exponential growth of the bets eventually bankrupts its users due to f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economists

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Economists

American(s) may refer to: * American, something of, from, or related to the United States of America, commonly known as the "United States" or "America" ** Americans, citizens and nationals of the United States of America ** American ancestry, people who self-identify their ancestry as "American" ** American English, the set of varieties of the English language native to the United States ** Native Americans in the United States, indigenous peoples of the United States * American, something of, from, or related to the Americas, also known as "America" ** Indigenous peoples of the Americas * American (word), for analysis and history of the meanings in various contexts Organizations * American Airlines, U.S.-based airline headquartered in Fort Worth, Texas * American Athletic Conference, an American college athletic conference * American Recordings (record label), a record label previously known as Def American * American University, in Washington, D.C. Sports teams Soccer * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Living People

Related categories * :Year of birth missing (living people) / :Year of birth unknown * :Date of birth missing (living people) / :Date of birth unknown * :Place of birth missing (living people) / :Place of birth unknown * :Year of death missing / :Year of death unknown * :Date of death missing / :Date of death unknown * :Place of death missing / :Place of death unknown * :Missing middle or first names See also * :Dead people * :Template:L, which generates this category or death years, and birth year and sort keys. : {{DEFAULTSORT:Living people 21st-century people People by status ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Financial Economics

The ''Journal of Financial Economics'' is a peer-reviewed academic journal published by Elsevier, covering the field of finance. It is considered to be one of the premier finance journals. According to the ''Journal Citation Reports'', the journal has a 2020 impact factor of 6.988. The journal was founded by Michael C. Jensen, Eugene Fama, and Robert C. Merton in 1974. Mission The Journal of Financial Economics (JFE) is a leading peer-reviewed academic journal covering theoretical and empirical topics in financial economics. It provides a specialized forum for the publication of research in the area of financial economics and the theory of the firm, placing primary emphasis on the highest quality empirical, theoretical, and experimental contributions in the following major areas: capital markets, financial intermediation, entrepreneurial finance, corporate finance, corporate governance, the economics of organizations, macro finance, behavioral finance, and household finance. E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George S

George may refer to: People * George (given name) * George (surname) * George (singer), American-Canadian singer George Nozuka, known by the mononym George * George Washington, First President of the United States * George W. Bush, 43rd President of the United States * George H. W. Bush, 41st President of the United States * George V, King of Great Britain, Ireland, the British Dominions and Emperor of India from 1910-1936 * George VI, King of Great Britain, Ireland, the British Dominions and Emperor of India from 1936-1952 * Prince George of Wales * George Papagheorghe also known as Jorge / GEØRGE * George, stage name of Giorgio Moroder * George Harrison, an English musician and singer-songwriter Places South Africa * George, Western Cape ** George Airport United States * George, Iowa * George, Missouri * George, Washington * George County, Mississippi * George Air Force Base, a former U.S. Air Force base located in California Characters * George (Peppa Pig), a 2-yea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MIT Sloan School Of Management

The MIT Sloan School of Management (MIT Sloan or Sloan) is the business school of the Massachusetts Institute of Technology, a private university in Cambridge, Massachusetts. MIT Sloan offers bachelor's, master's, and doctoral degree programs, as well as executive education. Its degree programs are among the most selective in the world. MIT Sloan emphasizes innovation in practice and research. Many influential ideas in management and finance originated at the school, including the Black–Scholes model, the Solow–Swan model, the random walk hypothesis, the binomial options pricing model, and the field of system dynamics. The faculty has included numerous Nobel laureates in economics and John Bates Clark Medal winners. History The MIT Sloan School of Management began in 1914 as the engineering administration curriculum ("Course 15") in the MIT Department of Economics and Statistics. The scope and depth of this educational focus grew steadily in response to advances in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tuck School Of Business

The Tuck School of Business (also known as Tuck, and formally known as the Amos Tuck School of Administration and Finance) is the graduate business school of Dartmouth College, a private research university in Hanover, New Hampshire. Founded in 1900, the Tuck School was the first institution in the world to offer a master's degree in business administration. It is consistently ranked among the best business schools in the world by The Economist, Financial Times, Forbes, U.S. News & World Report, and Bloomberg Businessweek. In 2021, Tuck was ranked #2 in ''Bloomberg Businessweek'' and #6 in ''Forbes'' for best U.S. business school. The Tuck School awards only one degree, the Master of Business Administration (MBA) degree, through a full-time, residential program. Tuck is known for its rural setting and small class size — each MBA class consists of about 280 students. As such, both factors, combined with Tuck's commitment to the full-time MBA program, contribute to its high gi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

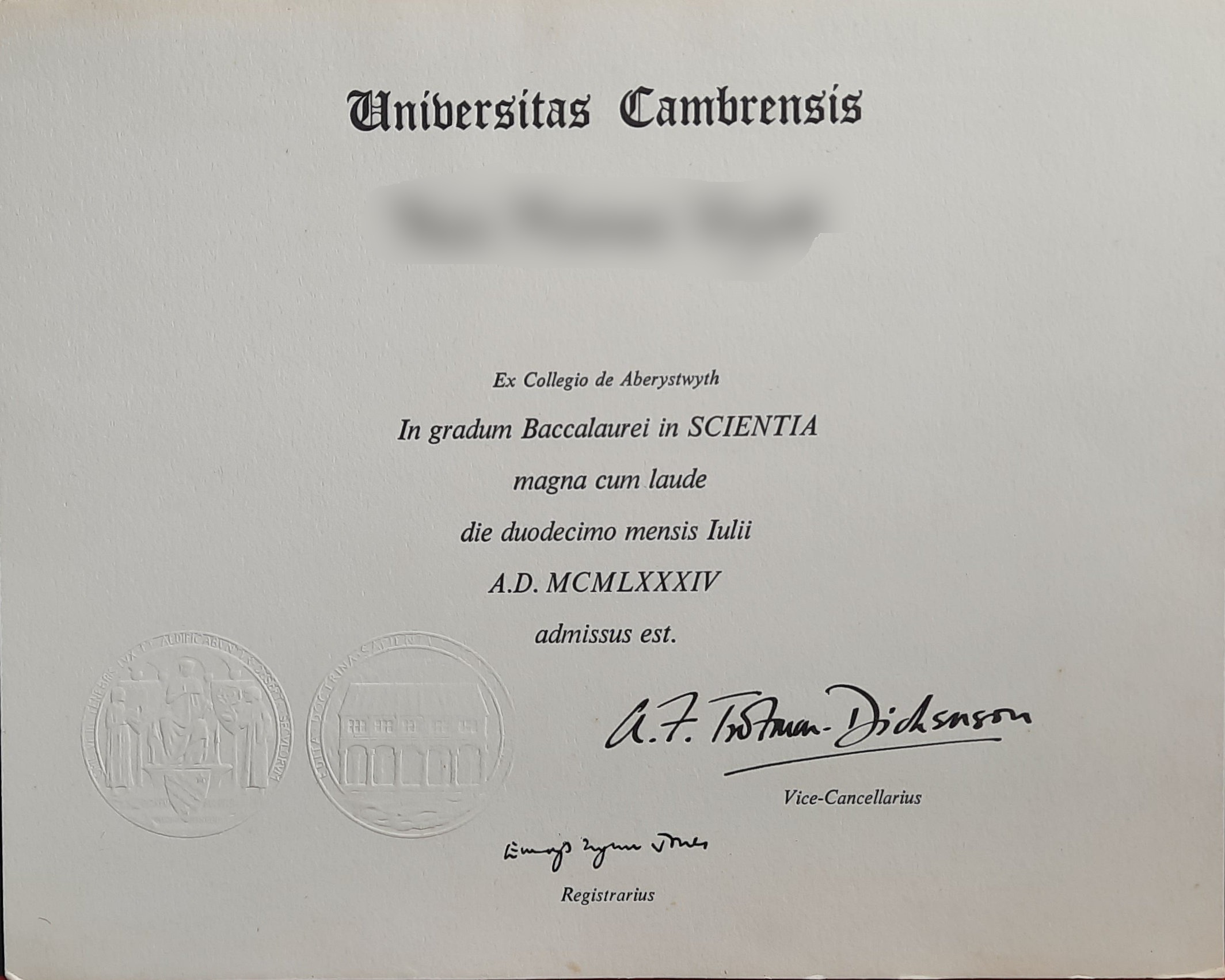

Magna Cum Laude

Latin honors are a system of Latin phrases used in some colleges and universities to indicate the level of distinction with which an academic degree has been earned. The system is primarily used in the United States. It is also used in some Southeastern Asian countries with European colonial history, such as Indonesia and the Philippines, although sometimes translations of these phrases are used instead of the Latin originals. The honors distinction should not be confused with the honors degrees offered in some countries, or with honorary degrees. The system usually has three levels of honor: ''cum laude'', ''magna cum laude'', and ''summa cum laude''. Generally, a college or university's regulations set out definite criteria a student must meet to obtain a given honor. For example, the student might be required to achieve a specific grade point average, submit an honors thesis for evaluation, be part of an honors program, or graduate early. Each school sets its own standards. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk (magazine)

''Risk'' magazine provides news and analysis covering the financial industry, with a particular focus on risk management, derivatives and complex finance. It includes articles and papers on credit risk, market risk, risk systems, swap option pricing, derivatives risk and pricing, regulation and asset management. Articles include news, features, comment, analysis and mathematical papers. Risk has a tradition of covers featuring pieces of abstract modern art. The magazine was founded by Peter Field in 1987. It was owned by Risk Waters Group, then acquired by Incisive Media, and is now owned by Infopro Digital. Editors include: Tom Osborn, Philip Alexander, Lukas Becker, Rob Mannix and Mauro Cesa, with Duncan Wood as Editor-in-Chief. Energy Risk — a sister title that covers energy trading and risk management — was spun off in 1994. Risk magazine has another sister publication – Asia Risk – focusing on the Asia-Pacific region. Risk also runs industry-specific events, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kamakura Corporation

Kamakura Corporation is a global financial software company headquartered in Honolulu, Honolulu, Hawaii. It specializes in software and data for risk management for banking, insurance and investment businesses. The company was founded in 1990 by its current CEO and Chairman Dr. Donald R. van Deventer, and as of 2019 Kamakura had served more than 330 clients in 47 countries.Veteran Wachovia Banker Martin Zorn Named Chief Administrative Officer of Kamakura Corporation 26 January 2011 Cornell University, Cornell professor Robert A. Jarrow, co-creator of the Heath–Jarrow–Morton framework for pricing interest rate derivatives and the reduced form Jarrow–Turnbu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |