|

Richard Donchian

Richard Davoud Donchian (September 1905, in Hartford, Connecticut – April 24, 1993, in Fort Lauderdale, Florida) was an American commodities and futures trader, and a pioneer in the field of managed futures. The first publicly managed futures fund, Futures, Inc., was started by Donchian in 1949. He also developed the trend timing method of futures investing and introduced the mutual fund concept to the field of money management. Richard Donchian is considered to be the creator of the managed futures industry and is credited with developing a systematic approach to futures money management. His professional trading career was dedicated to advancing a more conservative approach to futures trading. Biography Donchian's parents were Armenian immigrants from Western Armenia, which was occupied by the Ottoman Empire in the 1880s, and had come to settle in the United States. As a young man Donchian went to school in Connecticut, later graduating from Yale University with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Master Of Business Administration

A Master of Business Administration (MBA; also Master's in Business Administration) is a postgraduate degree focused on business administration. The core courses in an MBA program cover various areas of business administration such as accounting, applied statistics, human resources, business communication, business ethics, business law, strategic management, business strategy, finance, managerial economics, management, entrepreneurship, marketing, supply-chain management, and operations management in a manner most relevant to management analysis and strategy. It originated in the United States in the early 20th century when the country industrialized and companies sought scientific management. Some programs also include elective courses and concentrations for further study in a particular area, for example, accounting, finance, marketing, and human resources, but an MBA is intended to be a generalized program. MBA programs in the United States typically require completing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moving Average (technical Analysis)

In statistics, a moving average (rolling average or running average) is a calculation to analyze data points by creating a series of averages of different subsets of the full data set. It is also called a moving mean (MM) or rolling mean and is a type of finite impulse response filter. Variations include: simple, cumulative, or weighted forms (described below). Given a series of numbers and a fixed subset size, the first element of the moving average is obtained by taking the average of the initial fixed subset of the number series. Then the subset is modified by "shifting forward"; that is, excluding the first number of the series and including the next value in the subset. A moving average is commonly used with time series data to smooth out short-term fluctuations and highlight longer-term trends or cycles. The threshold between short-term and long-term depends on the application, and the parameters of the moving average will be set accordingly. It is also used in economic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Air Force

The United States Air Force (USAF) is the air service branch of the United States Armed Forces, and is one of the eight uniformed services of the United States. Originally created on 1 August 1907, as a part of the United States Army Signal Corps, the USAF was established as a separate branch of the United States Armed Forces in 1947 with the enactment of the National Security Act of 1947. It is the second youngest branch of the United States Armed Forces and the fourth in order of precedence. The United States Air Force articulates its core missions as air supremacy, global integrated intelligence, surveillance and reconnaissance, rapid global mobility, global strike, and command and control. The United States Air Force is a military service branch organized within the Department of the Air Force, one of the three military departments of the Department of Defense. The Air Force through the Department of the Air Force is headed by the civilian Secretary of the Air Force ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Allied Invasion Of Sicily

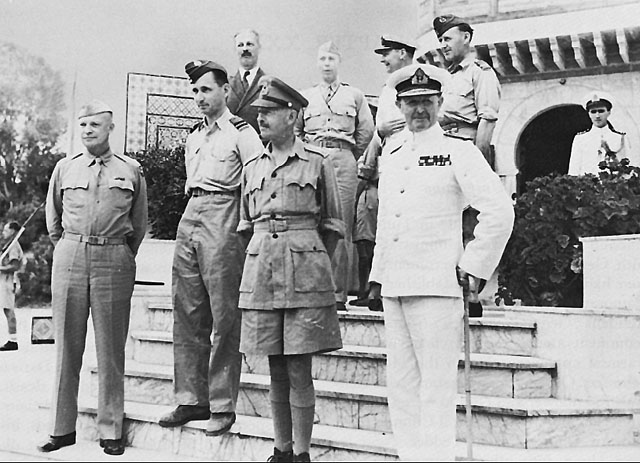

The Allied invasion of Sicily, also known as Operation Husky, was a major campaign of World War II in which the Allied forces invaded the island of Sicily in July 1943 and took it from the Axis powers ( Fascist Italy and Nazi Germany). It began with a large amphibious and airborne operation, followed by a six-week land campaign, and initiated the Italian campaign. To divert some of the Axis forces to other areas, the Allies engaged in several deception operations, the most famous and successful of which was Operation Mincemeat. Husky began on the night of 9–10 July 1943 and ended on 17 August. Strategically, Husky achieved the goals set out for it by Allied planners; the Allies drove Axis air, land and naval forces from the island and the Mediterranean sea lanes were opened for Allied merchant ships for the first time since 1941. These events led to the Italian leader, Benito Mussolini, being toppled from power in Italy on 25 July, and to the Allied invasion of Italy on 3 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing military alliances: the Allies and the Axis powers. World War II was a total war that directly involved more than 100 million personnel from more than 30 countries. The major participants in the war threw their entire economic, industrial, and scientific capabilities behind the war effort, blurring the distinction between civilian and military resources. Aircraft played a major role in the conflict, enabling the strategic bombing of population centres and deploying the only two nuclear weapons ever used in war. World War II was by far the deadliest conflict in human history; it resulted in 70 to 85 million fatalities, mostly among civilians. Tens of millions died due to genocides (including the Holocaust), starvation, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Research

Securities research is a discipline within the financial services industry. Securities research professionals are known most generally as "analysts", "research analysts", or "securities analysts"; all the foregoing terms are synonymous. Research analysts produce research reports and typically issue a recommendation: buy ("overweight"), hold, or sell ("underweight"); see target price and trade idea. These reports can be accessed from a number of sources, and brokerages will often offer the reports free to their customers. Research can be categorized by the security type, as well as by whether it is buy-side research or sell-side research; analysts further focus on particular industries. Although usually associated with fundamental analysis, research also focuses on technical analysis, and reports will often include both. See also Financial analyst #Securities firms. Analyst specialization Securities analysts are commonly divided between the two basic kinds of securities: e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brokerage Firm

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate or stock broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers for the perfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for the financial markets of the United States as a whole, the American financial services industry, New York–based financial interests, or the Financial District itself. Anchored by Wall Street, New York has been described as the world's principal financial center. Wall Street was originally known in Dutch as "de Waalstraat" when it was part of New Amsterdam in the 17th century, though the origins of the name vary. An actual wall existed on the street from 1685 to 1699. During the 17th century, Wall Street was a slave trading marketplace and a securities trading site, and from the early eighteenth century (1703) the location of Federal Hall, New York's first city hall. In the early 19th century, both residences and businesses occupied the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Crash Of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed. It was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its aftereffects. The Great Crash is mostly associated with October 24, 1929, called ''Black Thursday'', the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called ''Black Tuesday'', when investors traded some 16 million shares on the New York Stock Exchange in a single day. The crash, which followed the London Stock Exchange's crash of September, signaled the beginning of the Great Depression. Background The "Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Amer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reminiscences Of A Stock Operator

''Reminiscences of a Stock Operator'' is a 1923 roman à clef by American author Edwin Lefèvre. It is told in the first person by a character inspired by the life of stock trader Jesse Livermore up to that point. The book remains in print (). In December 2009, Wiley published an annotated edition in hardcover, , that bridges the gap between Lefèvre's fictionalized account and the actual people and places referred to in the book. It also includes a foreword by hedge fund manager Paul Tudor Jones. Plot The book can be divided into three parts: * 1890-1910: Livermore was able to make easy money by taking advantage of the bid–ask spread on inactive stocks with leverage of 100-to-1 at bucket shops. * 1910-1920: Livermore was a stock trader on the New York Stock Exchange, where he went boom and bust several times using high leverage. * 1920s: Livermore engaged in market manipulation which was not illegal or without precedent then, charging fees of 25% of the market value of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)