|

Revenue Act Of 1943

The United States Revenue Act of 1943 increased federal excise taxes on, among other things, alcohol, jewelry, telephones, and admissions, and raised the excess profits tax rate from 90% to 95%. The 5% Victory Tax The Victory Tax was a 5% income tax established in the United States by the Revenue Act of 1942 The United States Revenue Act of 1942, Pub. L. 753, Ch. 619, 56 Stat. 798 (Oct. 21, 1942), increased individual income tax rates, increased corporate tax ... was lowered to 3%, and the postwar credit repealed. References United States federal taxation legislation 1943 in American law {{US-statute-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Government Of The United States

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a federal district (the city of Washington in the District of Columbia, where most of the federal government is based), five major self-governing territories and several island possessions. The federal government, sometimes simply referred to as Washington, is composed of three distinct branches: legislative, executive, and judicial, whose powers are vested by the U.S. Constitution in the Congress, the president and the federal courts, respectively. The powers and duties of these branches are further defined by acts of Congress, including the creation of executive departments and courts inferior to the Supreme Court. Naming The full name of the republic is "United States of America". No other name appears in the Constitution, and this i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alcohol (drug)

Alcohol, sometimes referred to by the chemical name ''ethanol'', is a depressant, depressant drug that is the active ingredient in alcoholic drink, drinks such as beer, wine, and distilled spirits (hard liquor). It is one of the oldest and most commonly consumed recreational drugs, causing the characteristic effects of alcohol intoxication ("drunkenness"). Among other effects, alcohol produces happiness and euphoria, anxiolytic, decreased anxiety, increased sociability, sedation, impairment of cognitive, memory, motor control, motor, and sense, sensory function, and generalized depression of central nervous system (CNS) function. Ethanol is only one of several types of Alcohol (chemistry), alcohol, but it is the only type of alcohol that is found in alcoholic beverages or commonly used for recreational purposes; other alcohols such as methanol and isopropyl alcohol are significantly more toxicity, toxic. A mild, brief exposure to isopropanol, being only moderately more toxic tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

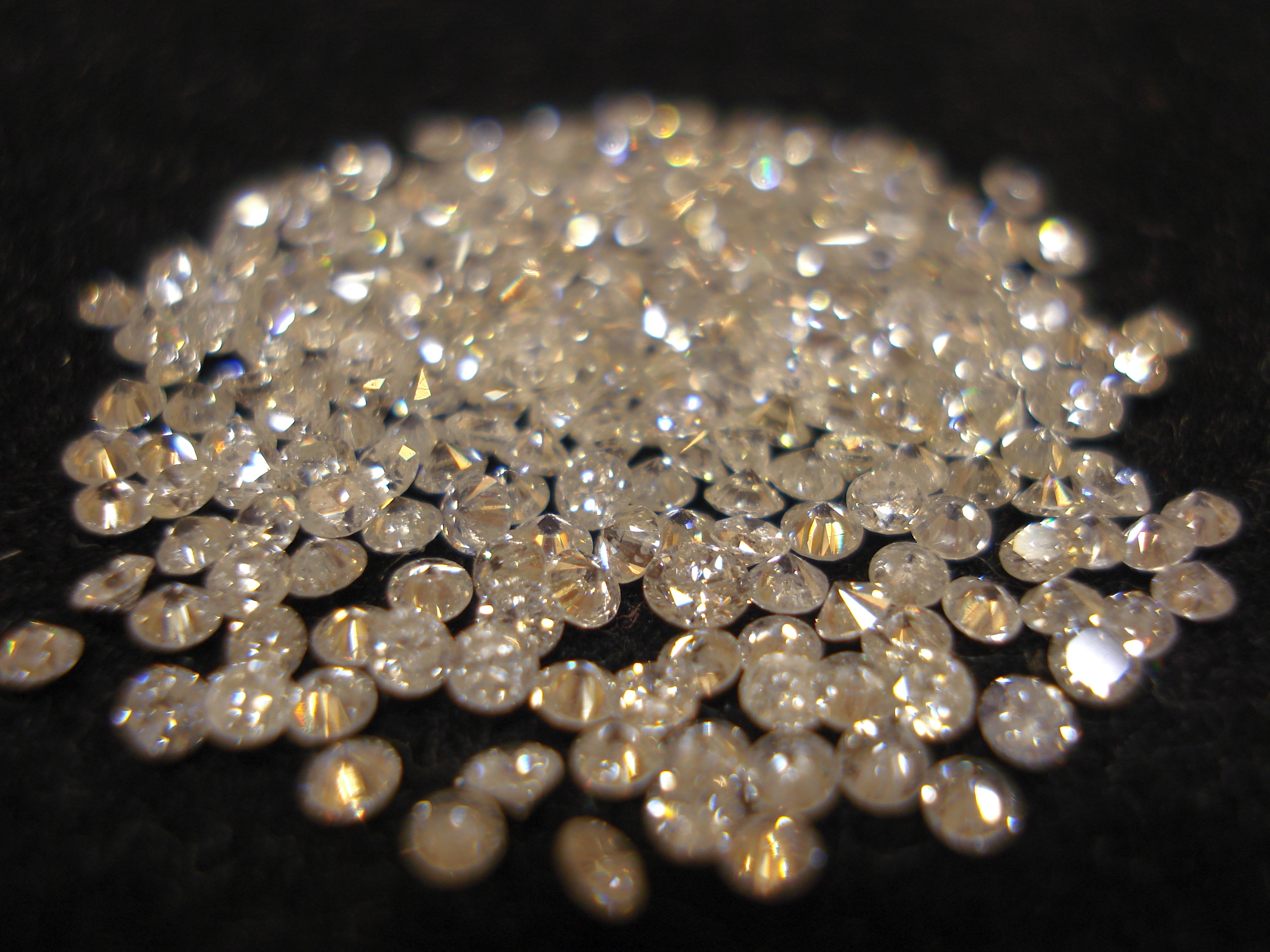

Jewelry

Jewellery ( UK) or jewelry (U.S.) consists of decorative items worn for personal adornment, such as brooches, rings, necklaces, earrings, pendants, bracelets, and cufflinks. Jewellery may be attached to the body or the clothes. From a western perspective, the term is restricted to durable ornaments, excluding flowers for example. For many centuries metal such as gold often combined with gemstones, has been the normal material for jewellery, but other materials such as glass, shells and other plant materials may be used. Jewellery is one of the oldest types of archaeological artefact – with 100,000-year-old beads made from ''Nassarius'' shells thought to be the oldest known jewellery.Study reveals 'oldest jewellery' , '' |

Telephone

A telephone is a telecommunications device that permits two or more users to conduct a conversation when they are too far apart to be easily heard directly. A telephone converts sound, typically and most efficiently the human voice, into electronic signals that are transmitted via cables and other communication channels to another telephone which reproduces the sound to the receiving user. The term is derived from el, τῆλε (''tēle'', ''far'') and φωνή (''phōnē'', ''voice''), together meaning ''distant voice''. A common short form of the term is ''phone'', which came into use early in the telephone's history. In 1876, Alexander Graham Bell was the first to be granted a United States patent for a device that produced clearly intelligible replication of the human voice at a second device. This instrument was further developed by many others, and became rapidly indispensable in business, government, and in households. The essential elements of a telephone are a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excess Profits Tax

In the United States, an excess profits tax is a tax on any profit above a certain amount. A predominantly wartime fiscal instrument, the tax was designed primarily to capture wartime profits that exceeded normal peacetime profits to prevent perverse incentives for manufacturers to engage in war profiteering and warmongering. History United Kingdom In Great Britain in World War I, the Treasury rejected proposals for a stiff capital levy, which the Labour Party wanted to use to weaken the capitalists. Instead, there was an excess profits tax, of 50 percent of profits above the normal prewar level; the rate was raised to 80 percent in 1917.Mark Billings and Lynne Oats, "Innovation and pragmatism in tax design: Excess Profits Duty in the UK during the First World War." ''Accounting History Review'' 24#2-3 (2014): 83-101. Excise taxes were added on luxury imports such as automobiles, clocks and watches. There was no sales tax or value added tax at this time in Britain. United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Victory Tax

The Victory Tax was a 5% income tax established in the United States by the Revenue Act of 1942 The United States Revenue Act of 1942, Pub. L. 753, Ch. 619, 56 Stat. 798 (Oct. 21, 1942), increased individual income tax rates, increased corporate tax rates (top rate rose from 31% to 40%), and reduced the personal exemption amount from $1,500 to .... Congress attempted to reduce the tax to 3% in the Revenue Act of 1943; that bill was vetoed by President Roosevelt, but his veto was overridden. The tax was eliminated in the Individual Income Tax Act of 1944. References United States federal income tax {{Tax-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Taxation Legislation

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |