|

Replicating Portfolio

In mathematical finance, a replicating portfolio for a given asset or series of cash flows is a portfolio of assets with the same properties (especially cash flows). This is meant in two distinct senses: static replication, where the portfolio has the same cash flows as the reference asset (and no changes need to be made to maintain this), and dynamic replication, where the portfolio does not have the same cash flows, but has the same "Greeks" as the reference asset, meaning that for small (properly, infinitesimal) changes to underlying market parameters, the price of the asset and the price of the portfolio change in the same way. Dynamic replication requires continual adjustment, as the asset and portfolio are only assumed to behave similarly at a single point (mathematically, their partial derivatives are equal at a single point). Given an asset or liability, an offsetting replicating portfolio (a " hedge") is called a static hedge or dynamic hedge, and constructing such a portf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often with the help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Self-financing Portfolio

In financial mathematics, a self-financing portfolio is a portfolio having the feature that, if there is no exogenous infusion or withdrawal of money, the purchase of a new asset must be financed by the sale of an old one. This concept is used to define for example admissible strategies and replicating portfolios, the latter being fundamental for arbitrage-free derivative pricing. Mathematical definition Discrete time Assume we are given a discrete filtered probability space (\Omega,\mathcal,\_^T,P), and let K_t be the solvency cone (with or without transaction costs) at time ''t'' for the market. Denote by L_d^p(K_t) = \. Then a portfolio (H_t)_^T (in physical units, i.e. the number of each stock) is self-financing (with trading on a finite set of times only) if : for all t \in \ we have that H_t - H_ \in -K_t \; P-a.s. with the convention that H_ = 0. If we are only concerned with the set that the portfolio can be at some future time then we can say that H_ \in -K_0 - ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Actuarial Science

Actuarial science is the discipline that applies mathematics, mathematical and statistics, statistical methods to Risk assessment, assess risk in insurance, pension, finance, investment and other industries and professions. Actuary, Actuaries are professionals trained in this discipline. In many countries, actuaries must demonstrate their competence by passing a series of rigorous professional examinations focused in fields such as probability and predictive analysis. Actuarial science includes a number of interrelated subjects, including mathematics, probability theory, statistics, finance, economics, financial accounting and computer science. Historically, actuarial science used deterministic models in the construction of tables and premiums. The science has gone through revolutionary changes since the 1980s due to the proliferation of high speed computers and the union of stochastic actuarial models with modern financial theory. Many universities have undergraduate and gradu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Portfolio Theories

Portfolio may refer to: Objects * Portfolio (briefcase), a type of briefcase Collections * Portfolio (finance), a collection of assets held by an institution or a private individual * Artist's portfolio, a sample of an artist's work or a case used to display artwork, photographs etc. * Career portfolio, an organized presentation of an individual's education, work samples, and skills * Electronic portfolio, a collection of electronic documents * IT portfolio, in IT portfolio management, the portfolio of large classes of items of enterprise Information Technology * Patent portfolio, a collection of patents owned by a single entity * Project portfolio, in project portfolio management, the portfolio of projects in an organization * Ministry (government department), the post and responsibilities of a head of a government department Computing * Atari Portfolio, a palmtop computer * Extensis Portfolio, a digital asset manager * PDF portfolio Media Music * ''Portfol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Pricing

Pricing is the Business process, process whereby a business sets and displays the price at which it will sell its products and services and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the marketplace, competition, market condition, brand, and quality of the product. Pricing is a fundamental aspect of product management and is one of the four Ps of the marketing mix, the other three aspects being product, promotion, and Distribution (business), place. Price is the only revenue generating element among the four Ps, the rest being cost center (business), cost centers. However, the other Ps of marketing will contribute to decreasing price elasticity and so enable price increases to drive greater revenue and profits. Pricing can be a manual or automatic process of applying prices to purchase and sales orders, based on factors such as a fixed amount, quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

With-profits Policy

A with-profits policy ( Commonwealth) or participating policy ( U.S.) is an insurance contract that participates in the profits of a life insurance company. The company is often a mutual life insurance company, or had been one when it began its with-profits product line. Similar arrangements are found in other countries such as those in continental Europe. With-profits policies evolved over many years. Originally they developed as a means of distributing unplanned surplus, arising e.g. from lower than anticipated death rates. More recently they have been used to provide flexibility to pursue a more adventurous investment policy to aim to achieve long-term capital growth. They have been accepted as a form of long-term collective investment whereby the investor chooses the insurance company based on factors such as financial strength, historic returns and the terms of the contracts offered. The premiums paid by with-profits and non-profit policyholders are pooled within the in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Zero-coupon Bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably. In contrast, an investor who has a regular bond receives income from coupon payments, which are made semi-annually or annually. The investor also receives the principal or face value of the investment when the bond matures. Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

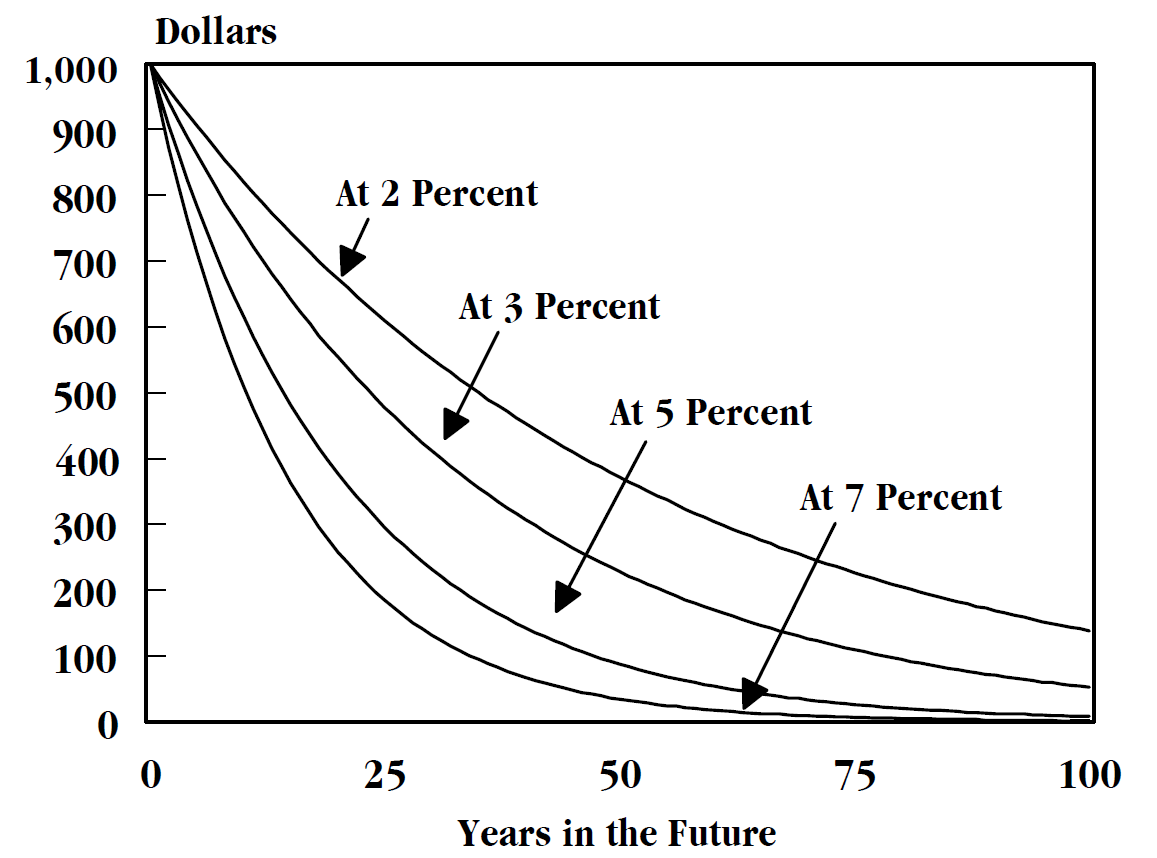

Discounting

In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient Market", "Market Value" and "Opportunity Cost" in Downes, J. and Goodman, J. E. ''Dictionary of Finance and Investment Terms'', Baron's Financial Guides, 2003. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date.See "Discount", "Compound Interest", "Efficient Markets Hypothesis", "Efficient Resource Allocation", "Pareto-Optimality", "Price", "Price Mechanism" and "Efficient Market" in Black, John, ''Oxford Dictionary of Economics'', Oxford University Press, 2002. This Financial transaction, transaction is based on the fact that most people prefer current interest to delayed interest because of Mortality salience, mortality effects, impatience effects, and Motivational sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Net Premium Valuation

A net premium valuation is an actuarial calculation, used to place a value on the liabilities of a life insurer. Background It involves calculating a present value for the contractual liabilities of a contract, and deducting the value of future premiums. Both contractual liabilities, and future premiums in this calculation allow only for mortality and interest. The key with a net premium valuation is that the premiums being valued are theoretical measures - they make no reference to the actual premiums being charged by the insurer. This technique is a well-established actuarial valuation method, that became popular because of its simplicity, consistency, and ease of calculation. See also *Gross premiums written * Life Assurance * Term life insurance * Permanent life insurance * Whole life insurance * Universal life insurance * Variable universal life insurance * Corporate-owned life insurance * Servicemembers' Group Life Insurance * Segregated funds * Annuity * Independent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Actuary

An actuary is a professional with advanced mathematical skills who deals with the measurement and management of risk and uncertainty. These risks can affect both sides of the balance sheet and require investment management, asset management, liability (financial accounting), liability management, and valuation skills. Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms. The name of the corresponding academic discipline is actuarial science. While the concept of insurance dates to antiquity, the concepts needed to scientifically measure and mitigate risks have their origins in 17th-century studies of probability and annuities. Actuaries in the 21st century require analytical skills, business knowledge, and an understanding of human behavior and information systems; actuaries use this knowledge to design programs that manage risk, by determining if the implementation of strategies proposed for mit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typically involves consent to transfer of goods, services, money, or promise to transfer any of thos ... between an insurance policy holder and an insurance , insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Put–call Parity

In financial mathematics, the put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to (and hence has the same value as) a single forward contract at this strike price and expiry. This is because if the price at expiry is above the strike price, the call will be exercised, while if it is below, the put will be exercised, and thus in either case one unit of the asset will be purchased for the strike price, exactly as in a forward contract. The validity of this relationship requires that certain assumptions be satisfied; these are specified and the relationship is derived below. In practice transaction costs and financing costs (leverage) mean this relationship will not exactly hold, but in liquid markets the relationship is close to exact. Assumptions Put–call parity is a static replication, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |