|

Actuary

An actuary is a business professional who deals with the measurement and management of risk and uncertainty. The name of the corresponding field is actuarial science. These risks can affect both sides of the balance sheet and require asset management, liability management, and valuation skills. Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms. While the concept of insurance dates to antiquity, the concepts needed to scientifically measure and mitigate risks have their origins in the 17th century studies of probability and annuities. Actuaries of the 21st century require analytical skills, business knowledge, and an understanding of human behavior and information systems to design and manage programs that control risk. The actual steps needed to become an actuary are usually country-specific; however, almost all processes share a rigorous schooling or examination structure and take many years ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Actuary's Department

, type = Non-ministerial government department , logo = Actuary.svg , logo_width = 150px , logo_caption = , picture = , picture_width = , picture_caption = , formed = , dissolved = , superseding = , jurisdiction = United Kingdom , headquarters = Finlaison House, 15-17 Furnival Street, London, EC4A 1AB , region_code = GB , coordinates = , employees = c. 220 , budget = £0 (2020-2021) , minister1_name = , minister1_pfo = , chief1_name = Martin Clarke , chief1_position = Government Actuary , chief2_name = , chief2_position = , chief3_name = , chief3_position = , chief4_name = , chief4_position = , chief5_name = , chief5_position = , agency_type = , chief6_name = , chief6_position = , chief7_name = , chief7_position = , chief8_name = , chief8_position = , chief9_name = , chief9_position = , p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Actuarial Credentialing And Exams

The actuarial credentialing and exam process usually requires passing a rigorous series of professional examinations, most often taking several years in total, before one can become recognized as a credentialed actuary. In some countries, such as Denmark, most study takes place in a university setting. In others, such as the U.S., most study takes place during employment through a series of examinations. In the UK, and countries based on its process, there is a hybrid university-exam structure. Policies of various countries Australia The education system in Australia is divided into three components: an exam-based curriculum; a professionalism course; and work experience. The system is governed by the Institute of Actuaries of Australia. The exam-based curriculum is in three parts. Part I relies on exemptions from an accredited under-graduate degree from either Monash University, Macquarie University, University of New South Wales, University of Melbourne, Australian National Univ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Actuarial Reserves

In insurance, an actuarial reserve is a reserve set aside for future insurance liabilities. It is generally equal to the actuarial present value of the future cash flows of a contingent event. In the insurance context an actuarial reserve is the present value of the future cash flows of an insurance policy and the total liability of the insurer is the sum of the actuarial reserves for every individual policy. Regulated insurers are required to keep offsetting assets to pay off this future liability. The loss random variable The loss random variable is the starting point in the determination of any type of actuarial reserve calculation. Define K(x) to be the future state lifetime random variable of a person aged x. Then, for a death benefit of one dollar and premium P, the loss random variable, L, can be written in actuarial notation as a function of K(x) : L = v^ - P\ddot_ From this we can see that the present value of the loss to the insurance company now if the person dies in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hurricane Katrina

Hurricane Katrina was a destructive Category 5 Atlantic hurricane that caused over 1,800 fatalities and $125 billion in damage in late August 2005, especially in the city of New Orleans and the surrounding areas. It was at the time the costliest tropical cyclone on record and is now tied with 2017's Hurricane Harvey. The storm was the twelfth tropical cyclone, the fifth hurricane, and the third major hurricane of the 2005 Atlantic hurricane season, as well as the fourth-most intense Atlantic hurricane on record to make landfall in the contiguous United States. Katrina originated on August 23, 2005, as a tropical depression from the merger of a tropical wave and the remnants of Tropical Depression Ten. Early the following day, the depression intensified into a tropical storm as it headed generally westward toward Florida, strengthening into a hurricane two hours before making landfall at Hallandale Beach on August 25. After briefly weakening to tropical storm strength o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disability Insurance

Disability Insurance, often called DI or disability income insurance, or income protection, is a form of insurance that insures the beneficiary's earned income against the risk that a disability creates a barrier for completion of core work functions. For example, the worker may be unable to maintain composure in the case of psychological disorders or sustain an injury, illness or condition that causes physical impairment or incapacity to work. DI encompasses paid sick leave, short-term disability benefits (STD), and long-term disability benefits (LTD). The same concept is instantiated in some countries as income protection insurance. History In the late 19th century, modern disability insurance began to become available. It was originally known as "accident insurance". The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent railway system. It was regi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Annuity

A life annuity is an annuity, or series of payments at fixed intervals, paid while the purchaser (or annuitant) is alive. The majority of life annuities are insurance products sold or issued by life insurance companies however substantial case law indicates that annuity products are not necessarily insurance products. Annuities can be purchased to provide an income during retirement, or originate from a ''structured settlement'' of a personal injury lawsuit. Life annuities may be sold in exchange for the immediate payment of a lump sum (single-payment annuity) or a series of regular payments (flexible payment annuity), prior to the onset of the annuity. The payment stream from the issuer to the annuitant has an unknown duration based principally upon the date of death of the annuitant. At this point the contract will terminate and the remainder of the fund accumulated is forfeited unless there are other annuitants or beneficiaries in the contract. Thus a life annuity is a form o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morbidity

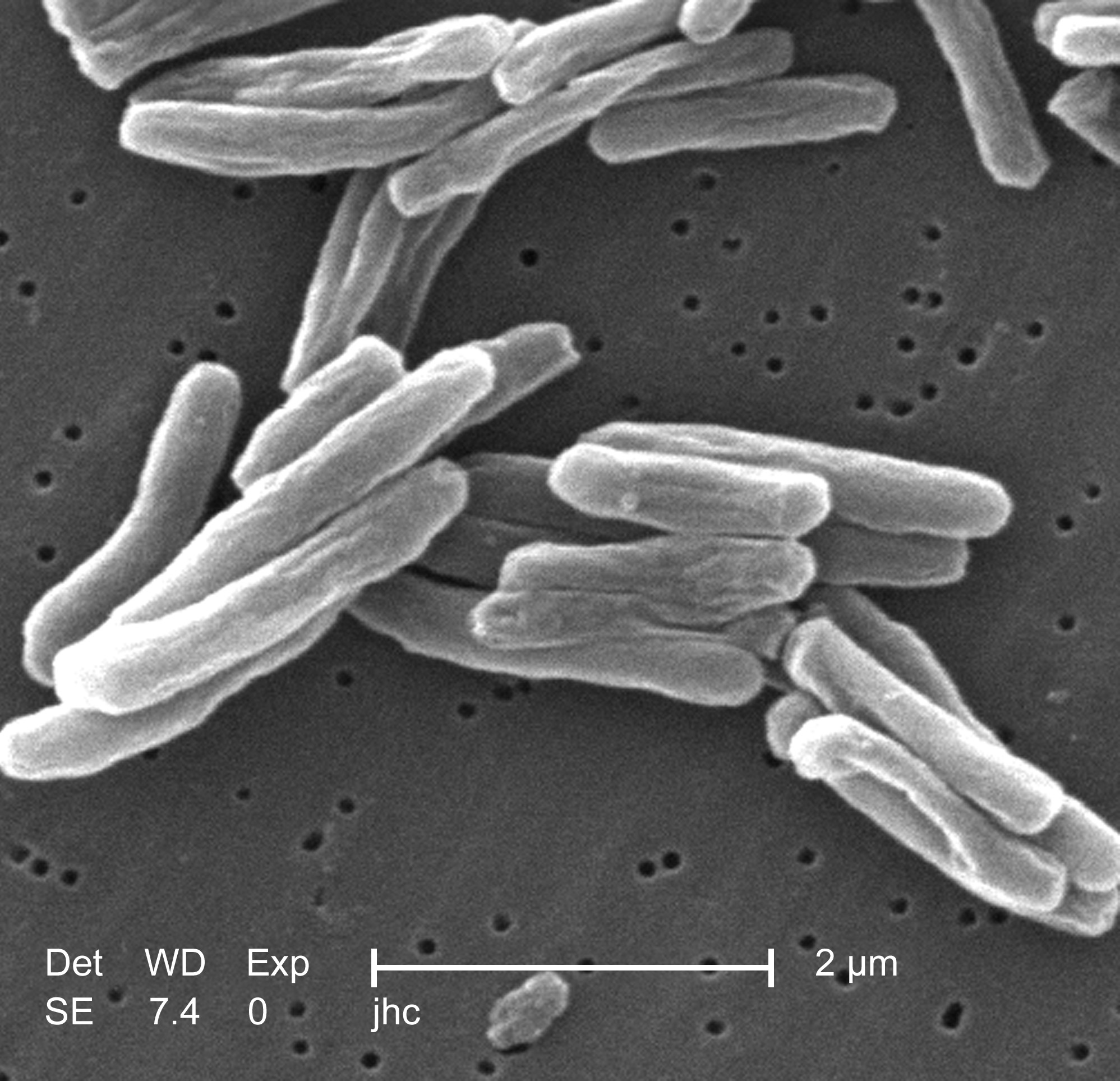

A disease is a particular abnormal condition that negatively affects the structure or function of all or part of an organism, and that is not immediately due to any external injury. Diseases are often known to be medical conditions that are associated with specific signs and symptoms. A disease may be caused by external factors such as pathogens or by internal dysfunctions. For example, internal dysfunctions of the immune system can produce a variety of different diseases, including various forms of immunodeficiency, hypersensitivity, allergies and autoimmune disorders. In humans, ''disease'' is often used more broadly to refer to any condition that causes pain, dysfunction, distress, social problems, or death to the person affected, or similar problems for those in contact with the person. In this broader sense, it sometimes includes injuries, disabilities, disorders, syndromes, infections, isolated symptoms, deviant behaviors, and atypical variations of structur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortality Rate

Mortality rate, or death rate, is a measure of the number of deaths (in general, or due to a specific cause) in a particular population, scaled to the size of that population, per unit of time. Mortality rate is typically expressed in units of deaths per 1,000 individuals per year; thus, a mortality rate of 9.5 (out of 1,000) in a population of 1,000 would mean 9.5 deaths per year in that entire population, or 0.95% out of the total. It is distinct from "morbidity", which is either the prevalence or incidence of a disease, and also from the incidence rate (the number of newly appearing cases of the disease per unit of time). An important specific mortality rate measure is the crude death rate, which looks at mortality from all causes in a given time interval for a given population. , for instance, the CIA estimates that the crude death rate globally will be 7.7 deaths per 1,000 people in a population per year. In a generic form, mortality rates can be seen as calculated using (d/ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Administration

The United States Social Security Administration (SSA) is an Independent agencies of the United States government, independent agency of the Federal government of the United States, U.S. federal government that administers Social Security (United States), Social Security, a social insurance program consisting of retirement, disability and survivor benefits. To qualify for most of these benefits, most workers pay Social Security taxes on their earnings; the claimant's benefits are based on the wage earner's contributions. Otherwise benefits such as Supplemental Security Income (SSI) are given based on need. The Social Security Administration was established by the Social Security Act of 1935 and is codified in (). It was created in 1935 as the "Social Security Board", then assumed its present name in 1946. Its current leader is Kilolo Kijakazi, who serves on an acting basis. SSA offers its services to the public through 1,200 field offices, a website, and a national toll-free nu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Computer Science

Computer science is the study of computation, automation, and information. Computer science spans theoretical disciplines (such as algorithms, theory of computation, information theory, and automation) to Applied science, practical disciplines (including the design and implementation of Computer architecture, hardware and Computer programming, software). Computer science is generally considered an area of research, academic research and distinct from computer programming. Algorithms and data structures are central to computer science. The theory of computation concerns abstract models of computation and general classes of computational problem, problems that can be solved using them. The fields of cryptography and computer security involve studying the means for secure communication and for preventing Vulnerability (computing), security vulnerabilities. Computer graphics (computer science), Computer graphics and computational geometry address the generation of images. Progr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

%2C_American_mathematician_and_actuary.jpeg)