|

Rent Guarantee Insurance

Rent guarantee insurance is a form of underwriting through which landlords can be protected against loss of rent if the lessee defaults. Globally, most firms offer this protection through regulated insurance companies, to ensure that the provider can make good on promises of payment. Normally, 'Landlord Rent Guarantee Insurance' is combined with 'Legal Assistance Insurance' whereby a landlord's legal costs of recovering rent and/or evicting a non-paying tenant are covered. Generally, the insurance payout starts only after one month, which does not always offer landlords adequate protection, thus decreasing the supposed benefits of the coverage. It is usually a condition of such policies that landlords ensure their tenants are professionally credit-checked before handing over keys. This product was traditionally offered in the UK and has now expanded to the United States with players such as Lloyd's of London backing companies for the last 3 years. All companies underwriting such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Landlord

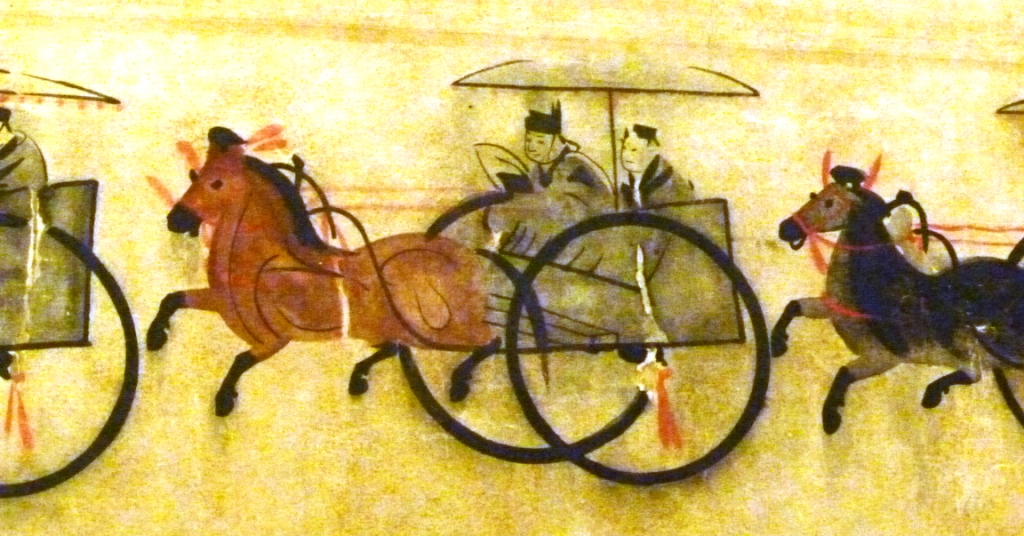

A landlord is the owner of a house, apartment, condominium, land, or real estate which is rented or leased to an individual or business, who is called a tenant (also a ''lessee'' or ''renter''). When a juristic person is in this position, the term landlord is used. Other terms include lessor and owner. The term landlady may be used for the female owners. The manager of a pub in the United Kingdom, strictly speaking a licensed victualler, is referred to as the landlord/landlady. In political economy it refers to the owner of natural resources alone (e.g., land, not buildings) from which an economic rent is the income received. History The concept of a landlord may be traced back to the feudal system of manoralism (seignorialism), where a landed estate is owned by a Lord of the Manor (mesne lords), usually members of the lower nobility which came to form the rank of knights in the high medieval period, holding their fief via subinfeudation, but in some cases the land may also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renting

Renting, also known as hiring or letting, is an agreement where a payment is made for the temporary use of a good, service or property owned by another. A gross lease is when the tenant pays a flat rental amount and the landlord pays for all property charges regularly incurred by the ownership. An example of renting is equipment rental. Renting can be an example of the sharing economy. History Various types of rent are referenced in Roman law: rent (''canon'') under the long leasehold tenure of Emphyteusis; rent (''reditus'') of a farm; ground-rent (''solarium''); rent of state lands (''vectigal''); and the annual rent (''prensio'') payable for the ''jus superficiarum'' or right to the perpetual enjoyment of anything built on the surface of land. Reasons for renting There are many possible reasons for renting instead of buying, for example: *In many jurisdictions (including India, Spain, Australia, United Kingdom and the United States) rent paid in a trade or business is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between the Kingdom of England (which included Wales, annexed in 1542) and the Kingdom of Scotland in 170 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyd's Of London

Lloyd's of London, generally known simply as Lloyd's, is an insurance and reinsurance market located in London, England. Unlike most of its competitors in the industry, it is not an insurance company; rather, Lloyd's is a corporate body governed by the Lloyd's Act 1871 and subsequent Acts of Parliament. It operates as a partially-mutualised marketplace within which multiple financial backers, grouped in syndicates, come together to pool and spread risk. These underwriters, or "members", are a collection of both corporations and private individuals, the latter being traditionally known as "Names". The business underwritten at Lloyd's is predominantly general insurance and reinsurance, although a small number of syndicates write term life insurance. The market has its roots in marine insurance and was founded by Edward Lloyd at his coffee house on Tower Street in 1688. Today, it has a dedicated building on Lime Street which is Grade I listed. Traditionally business is tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulation, financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry. The FCA regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms.Archived here. Like its predecessor the Financial Services Authority, FSA, the FCA is structured as a company limited by guarantee. The FCA works alongside the Prudential Regulation Authority (United Kingdom), Prudential Regulation Authority and the Financial Policy Committee to set regulatory requirements f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Landlords Insurance

Landlords' insurance is an insurance policy that covers a property owner from financial losses connected with rental properties. The policy covers the building, with the option of insuring any contents that belong to the landlord that are inside. Landlords' insurance is often referred to as buy-to-let insurance, however buy-to-let insurance is a type of landlords' insurance. It is important to distinguish between buy-to-let insurance which generally covers one property that has been purchased with a buy-to-let mortgage, and multi-property insurance, which covers two or more properties. Each of these types of landlords' insurance covers different things. Landlord insurance is separate from landlords' emergency cover. The policy will normally cover standard perils such as fire, lightning, explosion, storm, escape of water/oil, subsidence, theft and malicious damage. Each insurance policy is different and may or may not include all these items. Optional coverage might include accidenta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |