|

Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry. The FCA regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms.Archived here. Like its predecessor the FSA, the FCA is structured as a company limited by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the financial crisis of 2007–2008, the UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the ''Financial Services Act 2012'' received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority of the Bank of England. Until its abolition, Lord Turner of Ecchinswell was the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strong Customer Authentication

Strong customer authentication (SCA) is a requirement of the EU Revised Directive on Payment Services (PSD2) on payment service providers within the European Economic Area. The requirement ensures that electronic payments are performed with multi-factor authentication, to increase the security of electronic payments. Physical card transactions already commonly have what could be termed strong customer authentication in the EU (Chip and PIN), but this has not generally been true for Internet transactions across the EU prior to the implementation of the requirement, and many contactless card payments do not use a second authentication factor. The SCA requirement came into force on 14 September 2019. However, with the approval of the European Banking Authority, several EEA countries have announced that their implementation will be temporarily delayed or phased, with a final deadline set for 31 December 2020. Requirement Article 97(1) of the directive requires that payment service ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Celia Hoyles

Dame Celia Mary Hoyles, ( French; born 18 May 1946) is a British mathematician, educationalist and Professor of Mathematics Education at University College London (UCL), in the Institute of Education (IoE). Early life and education Celia Mary French was born on 18 May 1946. She was educated at the University of Manchester where she graduated with a first class degree in mathematics from the Department of Mathematics in 1967. She subsequently completed a Postgraduate Certificate in Education (PGCE) in 1971, and a Master of Education degree (MEd) in 1973. She completed a Doctor of Philosophy (PhD) degree in 1980, with a thesis titled "Factors in school learning - the pupils' view: a study with particular reference to mathematics". All her degrees are from the University of London. Career and research Hoyles began her career as a secondary school teacher, later becoming an academic. In the late 1980s she was co-presenter of ''Fun and Games'', a prime time television quiz show abo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Distribution Review

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the financial crisis of 2007–2008, the UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the ''Financial Services Act 2012'' received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority of the Bank of England. Until its abolition, Lord Turner of Ecchinswell was the FSA's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent Financial Advisers

Independent financial advisers (IFAs) are professionals who offer independent advice on financial matters to their clients and recommend suitable financial products from the ''whole of the market''. The term was developed to reflect a United Kingdom (UK) regulatory position and has a specific UK meaning, although it has been adopted in other parts of the world, such as Hong Kong. The term "independent financial adviser" was coined to describe the advisers working independently for their clients rather than representing an insurance company, bank or bancassurer. At the time (1988) the UK government was introducing the polarisation regime which forced advisers to either be tied to a single insurer or product provider or to be an independent practitioner. The term is commonly used in the United Kingdom where IFAs are regulated by the Financial Conduct Authority (FCA) and must meet strict qualification and competence requirements. Typically an independent financial adviser will c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Routledge

Routledge () is a British multinational publisher. It was founded in 1836 by George Routledge, and specialises in providing academic books, journals and online resources in the fields of the humanities, behavioural science, education, law, and social science. The company publishes approximately 1,800 journals and 5,000 new books each year and their backlist encompasses over 70,000 titles. Routledge is claimed to be the largest global academic publisher within humanities and social sciences. In 1998, Routledge became a subdivision and imprint of its former rival, Taylor & Francis Group (T&F), as a result of a £90-million acquisition deal from Cinven, a venture capital group which had purchased it two years previously for £25 million. Following the merger of Informa and T&F in 2004, Routledge became a publishing unit and major imprint within the Informa "academic publishing" division. Routledge is headquartered in the main T&F office in Milton Park, Abingdon, Oxfordshir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abingdon-on-Thames

Abingdon-on-Thames ( ), commonly known as Abingdon, is a historic market town and civil parish in the ceremonial county of Oxfordshire, England, on the River Thames. Historically the county town of Berkshire, since 1974 Abingdon has been administered by the Vale of White Horse district within Oxfordshire. The area was occupied from the early to middle Iron Age and the remains of a late Iron Age and Roman defensive enclosure lies below the town centre. Abingdon Abbey was founded around 676, giving its name to the emerging town. In the 13th and 14th centuries, Abingdon was an agricultural centre with an extensive trade in wool, alongside weaving and the manufacture of clothing. Charters for the holding of markets and fairs were granted by various monarchs, from Edward I to George II. The town survived the dissolution of the abbey in 1538, and by the 18th and 19th centuries, with the building of Abingdon Lock in 1790, and Wilts & Berks Canal in 1810, was a key link between major ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Society

A mutual organization, or mutual society is an organization (which is often, but not always, a company or business) based on the principle of mutuality and governed by private law. Unlike a true cooperative, members usually do not contribute to the capital of the company by direct investment, but derive their right to profits and votes through their customer relationship. A mutual organization or society is often simply referred to as ''a mutual''. A mutual exists with the purpose of raising funds from its membership or customers (collectively called its ''members''), which can then be used to provide common services to all members of the organization or society. A mutual is therefore owned by, and run for the benefit of, its members – it has no external shareholders to pay in the form of dividends, and as such does not usually seek to maximize and make large profits or capital gains. Mutuals exist for the members to benefit from the services they provide and often do not pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Compensation Scheme

The Financial Services Compensation Scheme (FSCS) is the UK's statutory deposit insurance and investors compensation scheme for customers of authorised financial services firms. This means that FSCS can pay compensation if a firm is unable, or likely to be unable, to pay claims against it. The FSCS is an operationally independent body, set up under the Financial Services and Markets Act 2000 (FSMA), and funded by a levy on authorised financial services firms. The scheme rules of the FSCS are made by the Financial Conduct Authority (FCA) and are contained in the FCA's Handbook. The FCA also appoint its Board and the FSCS is ultimately accountable to the FCA. The scheme covers deposits, insurance policies, insurance brokering, investments, mortgages and mortgage arrangement. FSCS is free to consumers and, since 2001, has helped more than 4.5 million people and paid out more than £26 billion. Since 31 December 2010, maintaining a single customer view has become mandatory for Uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Fair Trading

The Office of Fair Trading (OFT) was a non-ministerial government department of the United Kingdom, established by the Fair Trading Act 1973, which enforced both consumer protection and competition law, acting as the United Kingdom's economic regulator. The OFT's goal was to make markets work well for consumers, ensuring vigorous competition between fair dealing businesses and prohibiting unfair practices such as rogue trading, scams, and cartels. Its role was modified and its powers changed with the Enterprise Act 2002. The Department for Business, Innovation and Skills (BIS) announced reforms to the consumer protection and competition regimes. Under the provisions of the Enterprise and Regulatory Reform Act 2013, the Competition and Markets Authority (CMA) was established on 1 April 2014, combining many of the functions of the OFT and the Competition Commission and superseding both. Regulation for the consumer credit industry passed from the OFT to the new Financial Condu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wilmington, Delaware

Wilmington (Lenape: ''Paxahakink /'' ''Pakehakink)'' is the largest city in the U.S. state of Delaware. The city was built on the site of Fort Christina, the first Swedish settlement in North America. It lies at the confluence of the Christina River and Brandywine Creek, near where the Christina flows into the Delaware River. It is the county seat of New Castle County and one of the major cities in the Delaware Valley metropolitan area. Wilmington was named by Proprietor Thomas Penn after his friend Spencer Compton, Earl of Wilmington, who was prime minister during the reign of George II of Great Britain. At the 2020 census, the city's population was 70,898. The Wilmington Metropolitan Division, comprising New Castle County, Delaware, Cecil County, Maryland and Salem County, New Jersey, had an estimated 2016 population of 719,887. Wilmington is part of the Delaware Valley metropolitan statistical area, which also includes Philadelphia, Reading, Camden, and other ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Times

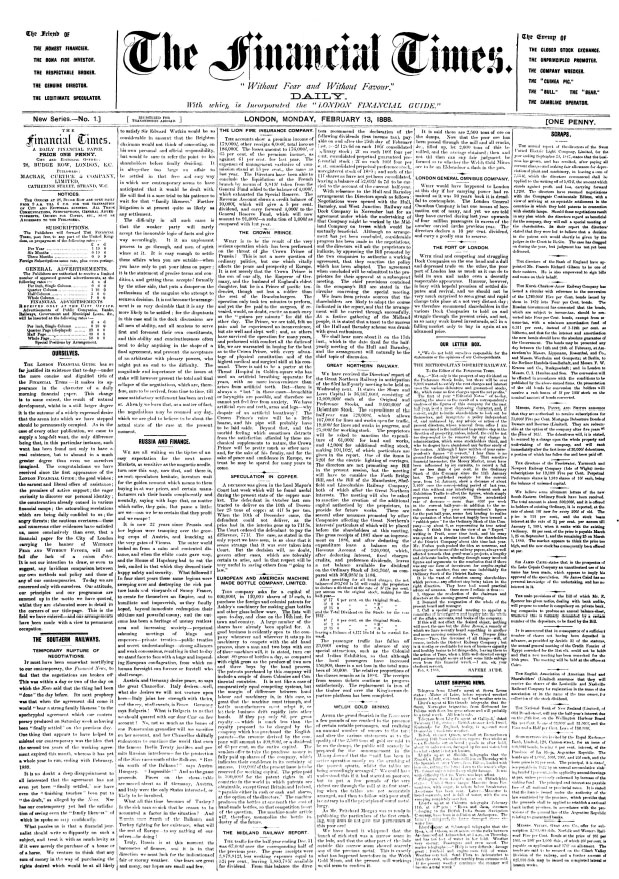

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a "Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |