|

Quarterly Publication Of Individuals Who Have Chosen To Expatriate

The Quarterly Publication of Individuals Who Have Chosen to Expatriate, also known as the Quarterly Publication of Individuals, Who Have Chosen to Expatriate, as Required by Section 6039G, is a publication of the United States Internal Revenue Service (IRS) in the ''Federal Register'', listing the names of certain individuals with respect to whom the IRS has received information regarding loss of citizenship during the preceding quarter. Overview The practice of publishing the names of ex-citizens is not unique to the United States. South Korea's Ministry of Justice (South Korea), Ministry of Justice, for example, also publishes the names of people losing South Korean nationality law, South Korean nationality in the government gazette. Prior to the 1990s, however, loss of United States citizenship was not a matter of public record; the United States Department of State, State Department considered that routine disclosure of the names of List of former United States citizens who rel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emigration From The United States

Emigration from the United States is the process where citizens from the United States move to live in other countries, creating an American diaspora (overseas Americans). The process is the reverse of the immigration to the United States. The United States does not keep track of emigration, and counts of Americans abroad are thus only available based on statistics kept by the destination countries. History Due to the flow of people back and forth between the United Kingdom and its colonies, as well as between the colonies, there has been an American diaspora of a sort since before the United States was founded. During the American Revolutionary War, a number of American Loyalists relocated to other countries, chiefly Canada and the United Kingdom. Residence in countries outside the British Empire was unusual, and usually limited to the well-to-do, such as Benjamin Franklin, who was able to self-finance his trip to Paris as a U.S. diplomat. 18th century After the American Revo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxpayer Identification Number

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. In the United States it is also known as a Tax Identification Number or Federal Taxpayer Identification Number. A TIN may be assigned by the Social Security Administration or by the Internal Revenue Service (IRS). Types Any government-provided number that can be used in the US as a unique identifier when interacting with the IRS is a TIN, though none of them are referred to exclusively as a Taxpayer Identification Number. A TIN may be: * a Social Security number (SSN) * an Individual Taxpayer Identification Number (ITIN) * an Employer Identification Number (EIN), also known as a FEIN (Federal Employer Identification Number) * an Adoption Taxpayer Identification Number, used as a temporary number for a child for whom the adopting parents cannot obtain an SSN * a Preparer Tax Identification Number, used by paid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

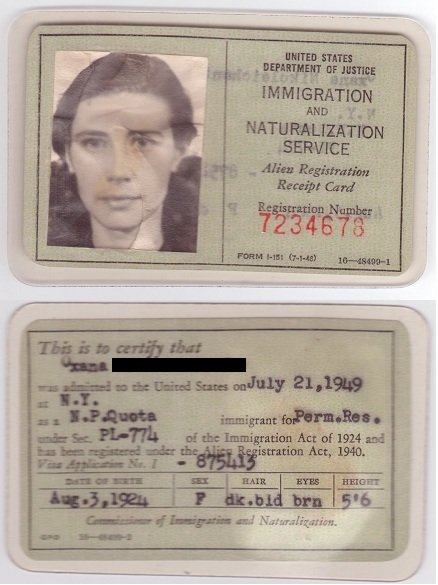

Immigration And Naturalization Service

The United States Immigration and Naturalization Service (INS) was an agency of the U.S. Department of Labor from 1933 to 1940 and the U.S. Department of Justice from 1940 to 2003. Referred to by some as former INS and by others as legacy INS, the agency ceased to exist under that name on March 1, 2003, when most of its functions were transferred to three new entities – U.S. Citizenship and Immigration Services (USCIS), U.S. Immigration and Customs Enforcement (ICE), and U.S. Customs and Border Protection (CBP) – within the newly created Department of Homeland Security (DHS), as part of a major government reorganization following the September 11 attacks of 2001. Prior to 1933, there were separate offices administering immigration and naturalization matters, known as the Bureau of Immigration and the Bureau of Naturalization, respectively. The INS was established on June 10, 1933, merging these previously separate areas of administration. In 1890, the federal government ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Accountability Office

The U.S. Government Accountability Office (GAO) is a legislative branch government agency that provides auditing, evaluative, and investigative services for the United States Congress. It is the supreme audit institution of the federal government of the United States. It identifies its core "mission values" as: accountability, integrity, and reliability. It is also known as the "congressional watchdog". Powers of GAO The work of the GAO is done at the request of congressional committees or subcommittees or is mandated by public laws or committee reports. It also undertakes research under the authority of the Comptroller General. It supports congressional oversight by: * auditing agency operations to determine whether federal funds are being spent efficiently and effectively; * investigating allegations of illegal and improper activities; * reporting on how well government programs and policies are meeting their objectives; * performing policy analyses and outlining options f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Residence (United States)

A green card, known officially as a permanent resident card, is an identity document which shows that a person has permanent residency in the United States. ("The term 'lawfully admitted for permanent residence' means the status of having been lawfully accorded the privilege of residing permanently in the United States as an immigrant in accordance with the immigration laws, such status not having changed."). Green card holders are formally known as lawful permanent residents (LPRs). , there are an estimated 13.9 million green card holders, of whom 9.1 million are eligible to become United States citizens. Approximately 65,000 of them serve in the U.S. Armed Forces. Green card holders are statutorily entitled to apply for U.S. citizenship after showing by a preponderance of the evidence that they, among other things, have continuously resided in the United States for one to five years and are persons of good moral character.''Al-Sharif v. United States Citizenship and Immig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Regulations

Treasury Regulations are the tax regulations issued by the United States Internal Revenue Service (IRS), a bureau of the United States Department of the Treasury. These regulations are the Treasury Department's official interpretations of the Internal Revenue Code and are one source of U.S. federal income tax law. Authority and citations Section 7805 of the Internal Revenue Code gives the United States Secretary of the Treasury the power to create the necessary rules and regulations for enforcing the Internal Revenue Code. These regulations, including but not limited to the "Income Tax Regulations," are located in Title 26 of the Code of Federal Regulations, or "C.F.R." Each regulation is generally organized to correspond to the Internal Revenue Code section interpreted by that regulation. Citations to the Treasury Regulations may appear in different formats. For instance, the definition of gross income in the regulations may be cited to as "26 C.F.R. 1.61-1" or as "Treas. Reg. 1.6 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Bar Association

The American Bar Association (ABA) is a voluntary bar association of lawyers and law students, which is not specific to any jurisdiction in the United States. Founded in 1878, the ABA's most important stated activities are the setting of academic standards for law schools, and the formulation of model ethical codes related to the legal profession. As of fiscal year 2017, the ABA had 194,000 dues-paying members, constituting approximately 14.4% of American attorneys. In 1979, half of all lawyers in the U.S. were members of the ABA. The organization's national headquarters are in Chicago, Illinois, and it also maintains a significant branch office in Washington, D.C. History The ABA was founded on August 21, 1878, in Saratoga Springs, New York, by 75 lawyers from 20 states and the District of Columbia. According to the ABA website: The purpose of the original organization, as set forth in its first constitution, was "the advancement of the science of jurisprudence, the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forbes

''Forbes'' () is an American business magazine owned by Integrated Whale Media Investments and the Forbes family. Published eight times a year, it features articles on finance, industry, investing, and marketing topics. ''Forbes'' also reports on related subjects such as technology, communications, science, politics, and law. It is based in Jersey City, New Jersey. Competitors in the national business magazine category include '' Fortune'' and '' Bloomberg Businessweek''. ''Forbes'' has an international edition in Asia as well as editions produced under license in 27 countries and regions worldwide. The magazine is well known for its lists and rankings, including of the richest Americans (the Forbes 400), of the America's Wealthiest Celebrities, of the world's top companies (the Forbes Global 2000), Forbes list of the World's Most Powerful People, and The World's Billionaires. The motto of ''Forbes'' magazine is "Change the World". Its chair and editor-in-chief is Stev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Jobs Creation Act Of 2004

The American Jobs Creation Act of 2004 () was a federal tax act that repealed the export tax incentive (ETI), which had been declared illegal by the World Trade Organization several times and sparked retaliatory tariffs by the European Union. It also contained numerous tax credits for agricultural and business institutions as well as the repeal of excise taxes on both fuel and alcohol and the creation of tax credits for biofuels. The bill was introduced by Representative Bill Thomas on June 4, 2004, passed the House June 17, the Senate on July 15, and was signed by President George W. Bush on October 22. Summary of provisions The Office of Tax Analysis of the United States Department of the Treasury summarized the tax changes as follows: * created deduction for income from U.S. production activities * repealed exclusion for extraterritorial income * changed interest expense allocation rules A report by the Tax Policy Center identifies the following main provisions and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expatriation Tax

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. This often takes the form of a capital gains tax against unrealised gain attributable to the period in which the taxpayer was a tax resident of the country in question. In most cases, expatriation tax is assessed upon change of domicile or habitual residence; in the United States, which is one of only three countries (Eritrea and Myanmar are the others) to substantively tax its overseas citizens, the tax is applied upon relinquishment of American citizenship, on top of all taxes previously paid. Canada Canada imposes a "departure tax" on those who cease to be tax resident in Canada. The departure tax is a tax on the capital gains which would have arisen if the emigrant had sold assets after leaving Canada ("deemed disposition"), subject to exceptions. However, in Canada, unlike the U.S., the capital gain is generally based on the difference between the market value on the date ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |