|

Pay-for-play

Pay-to-play, sometimes pay-for-play or P2P, is a phrase used for a variety of situations in which money is exchanged for services or the privilege to engage in certain activities. The common denominator of all forms of pay-to-play is that one must pay to "get in the game", with the sports analogy frequently arising. In the entertainment industry Broadcasting The term also refers to a growing trend in which individuals or groups may purchase radio or television airtime, much like infomercials, to broadcast content promoting the payer's interests. While these types of shows are typically shows that have little sponsor support and have no substantiated audience, some major program producers do purchase airtime to "clear" their programs in certain major markets. This type of format is particularly common among religious broadcasters (televangelism), where the related term ''pay-for-pray'' is used. Music industry The term also refers to a growing trend, where venue owners charge a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment. Money was historically an emergent market phenomenon that possess intrinsic value as a commodity; nearly all contemporary money systems are based on unbacked fiat money without use value. Its value is consequently derived by social convention, having been declared by a government or regulatory entity to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private", in the case of the United States dollar. Contexts which erode public confidence, such as the circulation of counterfeit money or domestic hyperinflation, can cause good money to lose its value. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RuneScape

''RuneScape'' is a fantasy massively multiplayer online role-playing game (MMORPG) developed and published by Jagex, released in January 2001. ''RuneScape'' was originally a browser game built with the Java programming language; it was largely replaced by a standalone C++ client in 2016. The game has had over 300 million accounts created and was recognised by the Guinness World Records as the largest and most-updated free MMORPG. ''RuneScape'' takes place in the world of Gielinor, a medieval fantasy realm divided into different kingdoms, regions, and cities. Players can travel throughout Gielinor via a number of methods including on foot, magical spells, or charter ships. Each region offers different types of monsters, resources, and quests to challenge players. The game's fictional universe has been explored through a tie-in video game on another of its maker's websites, ''FunOrb'', ''Armies of Gielinor'', and the novels ''Betrayal at Falador'', ''Return to Canifis'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Municipal Securities Rulemaking Board

The Municipal Securities Rulemaking Board (MSRB) writes investor protection rules and other rules regulating broker-dealers and banks in the United States municipal securities market, including tax-exempt and taxable municipal bonds, municipal notes, and other securities issued by states, cities, and counties or their agencies to help finance public projects or for other public policy purposes. Operations Like the Financial Industry Regulatory Authority (FINRA), the MSRB is a self-regulatory organization that is subject to oversight by the Securities and Exchange Commission (SEC). The MSRB is authorized to create rules designed "to prevent fraudulent and manipulative acts and practices, to promote just and equitable principles of trade, to foster cooperation and coordination with persons engaged in regulating, clearing, settling, and processing information with respect to, and facilitating transactions in municipal securities, to remove impediments to and perfect the mechanism ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC). Overview The Financial Industry Regulatory Authority is the largest independent regulator for all securities firms doing business in the United States. FINRA's mission is to protect investors by making sure the United States securities industry operates fairly and honestly. In December 2019, FINRA oversaw 3,517 brokerage firms, 153,907 branch offices and approximately 624,674 registered securities representatives. FINRA has appr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Dilution

Stock dilution, also known as equity dilution, is the decrease in existing shareholders' ownership percentage of a company as a result of the company issuing new equity. New equity increases the total shares outstanding which has a dilutive effect on the ownership percentage of existing shareholders. This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising stock options, or by issuance or conversion of convertible bonds, preferred shares or warrants into stock. This dilution can shift fundamental positions of the stock such as ownership percentage, voting control, earnings per share, and the value of individual shares. Control dilution Control dilution describes the reduction in ownership percentage or loss of a controlling share of an investment's stock. Many venture capital contracts contain an anti-dilution provision in favor of the original investors, to protect their equity inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Preferred Stock

Preferred stock (also called preferred shares, preference shares, or simply preferreds) is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior (i.e., higher ranking) to common stock but subordinate to bonds in terms of claim (or rights to their share of the assets of the company, given that such assets are payable to the returnee stock bond) and may have priority over common stock (ordinary shares) in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Like bonds, preferred stocks are rated by major credit rating agencies. Their ratings are generally lower than those of bonds, because preferred dividends do not carry the same guarantees as interest payments from bonds, and becaus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

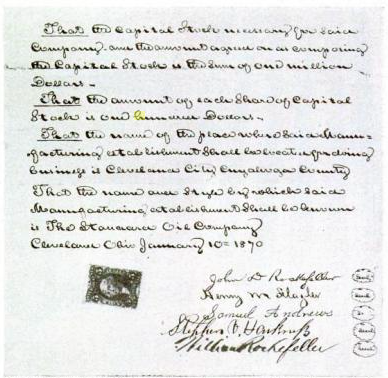

Corporate Charter

In corporate governance, a company's articles of association (AoA, called articles of incorporation in some jurisdictions) is a document which, along with the memorandum of association (in cases where it exists) form the company's constitution, and defines the responsibilities of the Board of directors, directors, the kind of business to be undertaken, and the means by which the shareholders exert control over the board of directors. Articles of association are very critical documents to corporate operations, as they may regulate both internal and external affairs. Articles of incorporation, also referred to as the certificate of incorporation or the corporate charter, is a document or charter that establishes the existence of a corporation in the United States and Canada. They generally are filed with the Secretary of State in the U.S. State where the company is incorporated, or other list of company registers, company registrar. An equivalent term for limited liability comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Larceny

Larceny is a crime involving the unlawful taking or theft of the personal property of another person or business. It was an offence under the common law of England and became an offence in jurisdictions which incorporated the common law of England into their own law (also statutory law), where in many cases it remains in force. The crime of larceny has been abolished in England, Wales, Ireland, and Northern Ireland, broken up into the specific crimes of burglary, robbery, fraud, theft, and related crimes. However, larceny remains an offence in parts of the United States, Jersey, and in New South Wales, Australia, involving the taking (caption) and carrying away (asportation) of personal property without the owner's consent. Etymology The word "larceny" is a late Middle English word, from the Anglo-Norman word ''larcin'', "theft". Its probable Latin root is ''latrocinium'', a derivative of ''latro'', "robber" (originally mercenary). By nation Australia New South Wales In the st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdictions with varying definitions. It is usually a key operation of organized crime. In US law, money laundering is the practice of engaging in financial transactions to conceal the identity, source, or destination of illegally gained money. In UK law the common law definition is wider. The act is defined as "taking any action with property of any form which is either wholly or in part the proceeds of a crime that will disguise the fact that that property is the proceeds of a crime or obscure the beneficial ownership of said property". In the past, the term "money laundering" was applied only to financial transactions related to organized crime. Today its definition is often expanded by government and international regulators such as the US Offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PricewaterhouseCoopers

PricewaterhouseCoopers is an international professional services brand of firms, operating as partnerships under the PwC brand. It is the second-largest professional services network in the world and is considered one of the Big Four accounting firms, along with Deloitte, EY and KPMG. PwC firms are in 157 countries, across 742 locations, with 284,000 people. As of 2019, 26% of the workforce was based in the Americas, 26% in Asia, 32% in Western Europe and 5% in Middle East and Africa. The company's global revenues were $42.4 billion in FY 2019, of which $17.4 billion was generated by its Assurance practice, $10.7 billion by its Tax and Legal practice and $14.4 billion by its Advisory practice. The firm in its recent actual form was created in 1998 by a merger between two accounting firms: Coopers & Lybrand, and Price Waterhouse. Both firms had histories dating back to the 19th century. The trading name was shortened to PwC (stylized p''w''c) in September 2010 as part of a rebr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-victimization

Victim playing (also known as playing the victim, victim card, or self-victimization) is the fabrication or exaggeration of victimhood for a variety of reasons such as to justify abuse to others, to manipulate others, a coping strategy, attention seeking or diffusion of responsibility. A person who repeatedly does this is known as a "professional victim". For abuse Victim playing by abusers is either: * Dehumanization, diverting attention away from acts of abuse by claiming that the abuse was justified based on another person's bad behavior (typically the victim). * Grooming for abusive power and control by soliciting sympathy from others in order to gain their assistance in supporting or enabling the abuse of a victim (known as proxy abuse). It is common for abusers to engage in victim playing. This serves two purposes: * Justification, to themselves, in transactional analysis known as existential validation, as a way of dealing with the cognitive dissonance that results from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |